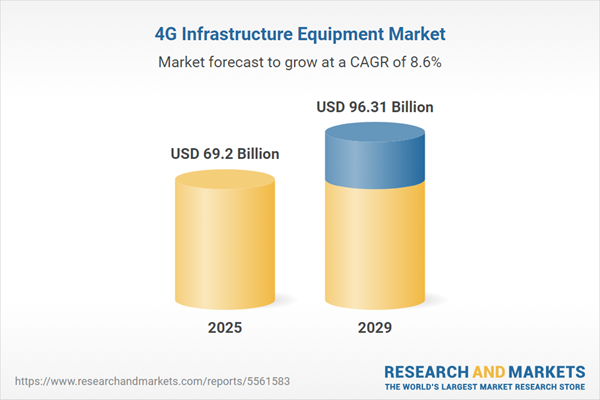

The 4G infrastructure equipment market size has grown strongly in recent years. It will grow from $65.3 billion in 2024 to $69.2 billion in 2025 at a compound annual growth rate (CAGR) of 6%. The growth in the historic period can be attributed to increased mobile data usage, internet proliferation, smartphone revolution, consumer demand for speed, telecom industry growth.

The 4G infrastructure equipment market size is expected to see strong growth in the next few years. It will grow to $96.31 billion in 2029 at a compound annual growth rate (CAGR) of 8.6%. The growth in the forecast period can be attributed to transition to 5g, rising data demands, network upgrades and expansion, iot integration, enhanced coverage and connectivity. Major trends in the forecast period include network virtualization, small cell deployments, network security upgrades, increased carrier aggregation, advanced antenna technologies.

The substantial growth in network traffic stands out as a primary driver for the expansion of the 4G infrastructure equipment market. Network traffic refers to the volume of data transmitted over the internet at any given moment. This surge in network traffic can be attributed to the remarkable increase in internet users, accounting for nearly 57% of the global population, alongside the proliferation of smartphones and mobile devices, which now serve 4.68 billion users. The global count of internet users is projected to reach 4.8 billion individuals by 2022, further fueling the escalation of network traffic. According to data from Telefonaktiebolaget LM Ericsson, mobile network data traffic witnessed a substantial 36% growth between Q1 2022 and Q1 2023. Moreover, the emergence of new social media platforms and applications, including Augmented Reality (AR) and Virtual Reality (VR), is expected to contribute to the continued upswing in network traffic during the forecast period. To effectively manage this escalating network traffic and provide robust network bandwidth, telecom operators are actively expanding their 4G infrastructure equipment, thereby driving growth in the 4G infrastructure equipment market.

The proliferation of smart cities is anticipated to play a significant role in propelling the growth of the 4G infrastructure equipment market. Smart cities represent urban areas that leverage technology and data-driven solutions to enhance efficiency, sustainability, and the overall quality of life for their residents. In this context, 4G infrastructure equipment plays a crucial role by providing reliable high-speed connectivity for Internet of Things (IoT) devices, enabling real-time data analysis and efficient communication networks. This, in turn, supports better urban management and leads to an improved quality of life for city dwellers. For instance, as of April 2023, the IMD Smart City Index Report from a Switzerland-based business school reveals that the coverage of smart cities in the SCI index and report has increased by nearly 20%, bringing the total count of smart cities to 141. This growth in smart cities is a driving force behind the expansion of the 4G infrastructure equipment market.

A Digital Distributed Antenna System (DAS) is a network of interconnected antennas linked to a central source. Digital DAS leverages advanced digital signal processing techniques to enhance voice and data connectivity for end-users. It is a versatile solution that can be deployed both indoors and outdoors to provide wireless coverage in a variety of settings such as hotels, subways, airports, hospitals, businesses, and roadway tunnels. The combination of wireless capabilities and advanced signal processing has positioned Digital DAS as a dependable system for supporting public safety radio communication operations. Nonetheless, ensuring robust public safety coverage indoors has been a persistent challenge. Addressing this challenge necessitates the deployment of specialized in-building infrastructure to support two-way or trunked radio systems. As a result, Digital DAS is poised to play a vital role in boosting the growth of the 4G infrastructure equipment market.

Leading companies in the 4G infrastructure equipment market are dedicated to the development of cutting-edge connectivity solutions, exemplified by offerings like Paytm Music Soundbox and Pocket Soundbox. These solutions are designed to ensure their competitive edge in the market. Paytm Music Soundbox is a product that not only facilitates music management but also streamlines payment processes. On the other hand, the Pocket Soundbox is tailored to provide swift audio payment notifications, catering to the needs of professionals who are frequently on the move. A recent example of this innovative approach comes from Paytm, a prominent multinational financial technology company based in India. In July 2023, Paytm unveiled two 4G-enabled payment devices, the Paytm Pocket Soundbox, and the Paytm Music Soundbox. The Pocket Soundbox is conveniently compact, fitting into a pocket with ease, making it an ideal choice for professionals on the go, such as drivers, electricians, and delivery agents. The Paytm Music Soundbox, on the other hand, is a pioneering portable device that is pocket-sized, as small as a debit card, and designed to deliver rapid audio payment alerts. This innovation caters to the needs of merchants who are constantly on the move and require efficient payment solutions.

In January 2023, Semtech Corporation, a US-based semiconductor manufacturing company, completed its acquisition of Sierra Wireless Inc., a Canada-based communication equipment company, for a total of $1.2 billion. This strategic acquisition has paved the way for the creation of an all-encompassing IoT platform, which is poised to support the global transition towards a smarter and more sustainable world. The merger is not only expected to significantly expand Semtech's addressable market but also to approximately double the company's annual revenue. Furthermore, it has resulted in the development of a robust and diverse portfolio of connectivity solutions for the burgeoning IoT market. This, in turn, simplifies the process for customers to access innovative end-to-end solutions tailored to various segments of the IoT landscape.

4G infrastructure equipment comprises a network of both macro and small cell base stations that are equipped with advanced computing capabilities necessary for the operation of the 4th generation cellular network technology standard.

The primary categories of 4G infrastructure equipment include small cells, macro cells, distributed antenna systems (DAS), and other related components. Distributed Antenna Systems (DAS) are particularly noteworthy as they utilize multiple antennas, rather than a single one, to offer wireless coverage within the same area, while simultaneously conserving power and enhancing reliability. Various product offerings include time-division (TD) LTE, frequency-division duplexing LTE, and LTE Advanced (LTE-A). These products find applications across various sectors, including logistics, e-commerce, virtual presence, crisis management, telemedicine, geoprocessing, and other related fields.

The 4G infrastructure equipment market research report is one of a series of new reports that provides 4G infrastructure equipment market statistics, including 4G infrastructure equipment industry global market size, regional shares, competitors with a 4G infrastructure equipment market share, detailed 4G infrastructure equipment market segments, market trends and opportunities, and any further data you may need to thrive in the 4G infrastructure equipment industry. This 4G infrastructure equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the 4G infrastructure equipment market include Airspan Networks Inc., Cisco Systems Inc., Fujitsu Limited, Huawei Technologies Co. Ltd., Motorola Solutions Inc., Nokia Corporation, ZTE Corporation, Nortel Networks Corporation, Alvarion Technologies Ltd., Telefonaktiebolaget LM Ericsson, Datang Mobile Communications Equipment Co. Ltd., Nokia Siemens Networks GmbH & Co. KG, Samsung Electronics Co. Ltd., Altiostar Networks Inc., Altran Technologies SA, Check Point Software Technologies Ltd., Ciena Corporation, Lumentum Operations LLC, Acacia Communications Inc., Ciena Communications Inc., Finisar Corporation, Juniper Networks Inc., Infinera Corporation, NEC Corporation, Qualcomm Technologies Inc., Telit Communications PLC, T-Mobile US Inc., Verizon Communications Inc., AT&T Inc., China Mobile Limited, China Telecom Corporation Limited, China United Network Communications Group Co. Ltd., Deutsche Telekom AG, Orange S.A., Vodafone Group Plc, Bharti Airtel Limited, Reliance Jio Infocomm Limited, SK Telecom Co. Ltd., KT Corporation, LG Uplus Corp.

Asia-Pacific was the largest region in the 4G infrastructure equipment market in 2024. Western Europe was the second largest region in the 4G infrastructure equipment market. The regions covered in the 4g infrastructure equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the 4g infrastructure equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The 4G infrastructure equipment market consists of sales of equipment such as macrocell, small cell, and distributed antenna systems (DAS) that are used to facilitate people`s communication by increasing network capacity and faster data transmission rates using 4G services. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

4G Infrastructure Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on 4g infrastructure equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for 4g infrastructure equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The 4g infrastructure equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Small Cell; Macro Cell; Distributed Antenna System (DAS); Other Types2) By Product: Time division (TD) LTE; Frequency-Division Duplexing LTE; LTE a

3) By Application: Logistics; E-Commerce; Virtual Presence; Crisis Management; Tele Medicine and Geo Processing; Other Applications

Subsegments:

1) By Small Cell: Femtocells; Picocells; Microcells2) By Macro Cell: Cell Towers; Base Stations; Antennas

3) By Distributed Antenna System (DAS): Active DAS; Passive DAS; Hybrid DAS

4) By Other Types: Remote Radio Units (RRUs); Backhaul Equipment; Repeater Systems

Key Companies Mentioned: Airspan Networks Inc.; Cisco Systems Inc.; Fujitsu Limited; Huawei Technologies Co. Ltd.; Motorola Solutions Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this 4G Infrastructure Equipment market report include:- Airspan Networks Inc.

- Cisco Systems Inc.

- Fujitsu Limited

- Huawei Technologies Co. Ltd.

- Motorola Solutions Inc.

- Nokia Corporation

- ZTE Corporation

- Nortel Networks Corporation

- Alvarion Technologies Ltd.

- Telefonaktiebolaget LM Ericsson

- Datang Mobile Communications Equipment Co. Ltd.

- Nokia Siemens Networks GmbH & Co. KG

- Samsung Electronics Co. Ltd.

- Altiostar Networks Inc.

- Altran Technologies SA

- Check Point Software Technologies Ltd.

- Ciena Corporation

- Lumentum Operations LLC

- Acacia Communications Inc.

- Ciena Communications Inc.

- Finisar Corporation

- Juniper Networks Inc.

- Infinera Corporation

- NEC Corporation

- Qualcomm Technologies Inc.

- Telit Communications PLC

- T-Mobile US Inc.

- Verizon Communications Inc.

- AT&T Inc.

- China Mobile Limited

- China Telecom Corporation Limited

- China United Network Communications Group Co. Ltd.

- Deutsche Telekom AG

- Orange S.A.

- Vodafone Group Plc

- Bharti Airtel Limited

- Reliance Jio Infocomm Limited

- SK Telecom Co. Ltd.

- KT Corporation

- LG Uplus Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 69.2 Billion |

| Forecasted Market Value ( USD | $ 96.31 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 41 |