The Shift from Carpets to Hard Surface Flooring: A Global Market Analysis

Featuring 230 tables and 76 figures, this industry study analyzes the $53 billion global carpets and rugs industry. It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by product (carpet, rug) production process (tufted, woven, other carpets and rugs), market (residential, nonresidential, transportation), application (new, remodeling) and major global region and country. Annual historical data and forecasts are also provided from 2019 to 2026. The study also evaluates company market share and competitive analysis on industry competitors including Mohawk Industries, Shaw, and Engineered Floors.

Global demand for carpets and rugs is forecast to increase 2.3% per year to 5.4 billion square meters in 2027, valued at $63.7 billion. Market advances will be supported by:

- increased construction of new residential and nonresidential buildings, particularly in the Asia/Pacific and Africa/Mideast regions

- rising usage of carpet tile in nonresidential buildings due to their ease of installation and replacement

- a global rebound in motor vehicle production

However, carpets continue to lose share to hard surface flooring, especially in countries where wall-to-wall carpeting has historically been popular, such as the US, Canada, and the UK. Despite this, rugs will continue to see opportunities in these markets as they can be used with hard surface flooring for decorative or utilitarian purposes.

Carpet Losing Share to Hard Surface Flooring, but Carpet Tile Offers Opportunities

Globally, carpets and rugs have lost market share to hard surface flooring over the past decade and will continue to do so through 2027. Products such as luxury vinyl tile have made massive market inroads in the large carpet markets of the US and Western Europe, particularly the residential side. Despite sluggish performance for wall-to-wall carpet in that market, carpet tiles continue to increasingly see use in the nonresidential market, where these products' durability and easier installation when compared to broadloom carpeting make them ideal for buildings that see high levels of foot traffic.

Popularity of Hard Surface Flooring & Cultural Preferences Bolster Rug Sales

As wall-to-wall carpeting continues to fall out of favor in the large US and European markets, the rising use of hard surface flooring is creating opportunities for area rugs and mats in building construction applications. In particular, woven rugs - which can impart a more luxurious atmosphere in corporate headquarters, hotels, and resorts - will benefit from strong growth in nonresidential building construction in the Asia/Pacific and Africa/Mideast regions. Additionally, above average population growth in areas of the latter region that have significant numbers of Muslims will support demand for prayer rugs, particularly in Saudi Arabia.

Rising Motor Vehicle Production Aids Demand for Carpets & Rugs

Although it is the smallest carpet and rug market, transportation will account for sizable share of absolute gains as motor vehicle production improves significantly following difficulty during the pandemic. After weathering a significant drop in production in 2020, a combination of supply chain issues - most notably a semiconductor shortage - and high interest rates in a number of countries restrained greater output growth. With most supply chain issues having either resolved themselves or eased significantly, production is poised to grow at a rate more in line with pre-pandemic periods. As such, demand for needlepunch carpeting, which accounts for the majority of transportation demand, will rebound at a healthy rate.

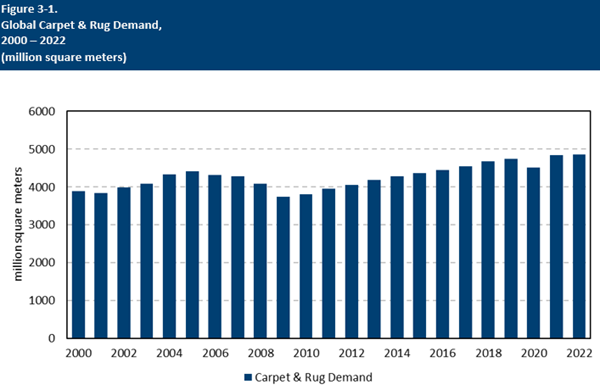

Historical Market Trends

Annual carpet and rug demand is most heavily influenced by trends in the construction industry. Globally, demand for carpets and rugs in volume terms is somewhat insulated from economic variations in new construction activity because of the large replacement demand in residential and nonresidential building applications:

- A large base of installed carpeting exists, much of which is subject to high levels of wear and thus will require replacement at some point as a matter of course

- Carpets and rugs may be damaged before the end of their lifespan by building fires or severe weather, requiring new flooring to be installed.

- Because rugs also serve as a decorative purpose, they may be replaced before the end of the product lifespan if a consumer desires to change the appearance of the structure in which they are installed.

- As economies develop in low-income countries, the number of homes without formal floor coverings decreases, providing more opportunities for carpet and rug suppliers in times of lower construction activity.

However, due to currency and pricing effects, volatility in value terms can be quite significant.

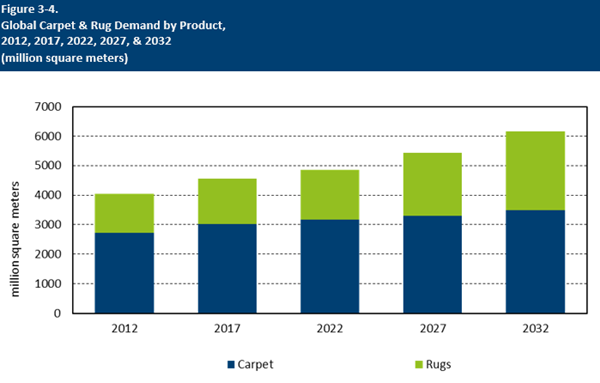

Demand by Product

Through 2027, global demand for carpets and rugs is forecast to increase 2.3% annually to 5.4 billion square meters.

Growth in the rug market is projected to greatly outpace that of the carpet market, primarily due to:

- continued market inroads made by luxury vinyl tile in the US and Europe, which is taking substantial share away from wall-to-wall carpeting in the world’s largest markets for carpet

- hard surface flooring gaining market share worldwide, which increases the likelihood of accent and decorative rugs to cover portions of the existing floor covering product

Production by Region

Through 2027, the Asia/Pacific region will remain the top producer of carpets and rugs globally:

- China will maintain its leading position in machine-made global carpet and rug manufacturing

- Production capacities in India have increased significantly in recent years, as a result, exports have increased at a substantial pace since 2017

- Japan will continue to be a major global producer of automotive carpets and rugs

Due to a recent surge in exports in the Turkish carpet market, the Africa/Mideast region has overtaken both the North American and West European markets and is now the world’s second largest carpet and rug producer on a regional basis.

North America has experienced a consistent decline in carpet production in volume terms over the past five years due to weak domestic demand (as well as in the key export markets of Canada and Western Europe), as preferences for hard surface flooring, particularly luxury vinyl tile, continue to shift at a rapid rate. Given these market conditions, many major carpet manufacturers have responded by expanding their hard surface flooring production capabilities as carpet and rugs continue to lose favor.

Additionally, the mature nature of both the US and West European carpet and rug markets has restrained stronger growth opportunities for producers in these areas.

International Trade

International trade in carpets and rugs is significant due to the light weight of these products, which makes them amenable to shipping.

In recent years, Turkey has surpassed China as the world’s largest net exporter of carpets and rugs. This is due in part to improving diplomatic relations with Saudi Arabia, which has resulted in a surge in exports to the country. Additionally, the continued development of several economies in the Africa/Mideast region has greatly increased export opportunities for Turkish carpet and rug suppliers.

China is expected to remain a leading exporter of carpets and rugs. The country is a major producer of tufted and woven carpets and rugs, which are competitive in developed nations due to their versatility and low cost.

Other notable carpet and rug exporters include:

- Belgium

- Netherlands

- India

Most countries are net importers of carpets and rugs. The US had the largest trade deficit in 2022. Many countries in Western Europe - including the UK, France, and Germany - are major net importers of carpets and rugs, as is Canada.

Pricing Trends

Global average prices for carpets and rugs in US dollar terms are impacted by a variety of factors, including:

- raw materials costs

- energy costs

- currency valuations

- the geographic distribution of demand

Product prices tend to be higher in developed countries, in part due to generally higher income and materials price levels. In addition, the product mix in developed countries includes a greater share of high-end products, while demand in developing countries tends to consist of basic, low cost product types.

Prices for carpets and rugs are expected to see slight growth as labor and materials costs rise. Manufacturer efforts to offer products with enhanced aesthetics and performance properties - such floor as ultra-soft carpeting and rugs with better resistance to wear and staining, which can be sold at higher price points than standard varieties - will support advances.

However, the rising share of global demand held by developing countries, where price levels are generally lower, will moderate global average price gains. Additionally, growth will be restrained by the increasing use of recycled and reclaimed materials in US and European carpet and rug production. Fibers made from recycled materials cost less than those made from virgin resins, supporting their use among manufacturers looking to control costs.

FAQs

How is tufted carpet made?

Tufted carpet is made by punching yarn through a carpet backing material that has been previously woven. The carpet pile may then be left in loop form, cut, or a combination of the two styles. A secondary backing may be added for extra strength. A wide variety of styles and textures are created using various techniques.

What are the main drivers of growth for the carpets & rugs industry?

Demand for carpets and rugs is driven by increased demand for tufted carpets and carpet tiles in nonresidential applications, the need to replace damaged and worn flooring products and global growth in motor vehicle production.

What is the global market size for carpets & rugs?

Demand for carpets and rugs is expected to grow 2.3% annually through 2027 to 5.4 billion square meters.

What is the process for carpet recycling?

Carpet plastics can be recycled into new carpet fiber or plastic resins with a wide range of performance properties and applications, depending on the reclamation process. Plastic components of scrap carpet can also be reclaimed for other purposes, such as depolymerization into feedstock chemicals and incineration to produce energy.

Table of Contents

1. Executive Summary

Companies Mentioned

- Engineered Floors

- Mohawk Industries

- Shaw