LED stands for abbreviation Light-emitting diode. A LED is a semiconductor device that emits light whenever an electric current run through it. LEDs are considered cutting-edge technology and are used in energy-saving lighting. In comparison to halogen or incandescent lights, LED lighting helps in minimizing electricity expenses by reducing energy consumption by approximately 85%. In addition, they also comprise a longer lifespan, greater light quality, and are more durable, which makes them popular in industrial and residential applications including modular lighting, task lighting, kitchen under-cabinet lighting, refrigerated case lighting, as well as recessed downlights.

Over the last few years, LED lights have been established as a potent lighting source. These lights have rapidly acquired prominence in the lighting sector across numerous industries due to their multiple advantages over traditional lighting technologies.

Although, the LED lighting industry is rapidly becoming popular all over the world and it has significant opportunities for growth over the upcoming decades. For instance, India is one of the largest lighting markets in the world, which makes it a lucrative hub for LED producers to set up their businesses. A sustainable atmosphere for the LED industry is provided by skilled labor, the convenience of doing business, and geographical advantages.

The development of the LED light industry is continuously being supported by various businesses of all sizes, namely large-sized enterprises, small-sized enterprises, and medium-sized enterprises. For instance, massive displays, such as CLEDIS, micro-displays, and the Apple Watch are rapidly becoming popular among people across the world. However, the diffusion of application development is trending across the world, due to which, there is a cut-throat competition among key market players.

COVID-19 Impact Analysis

The COVID-19 outbreak caused a major impact on various economies across the world. A significant number of businesses were completely demolished due to the sudden outburst of the infection. Moreover, supply chains across the world were significantly disturbed, which led various industries to a shortage of raw inputs or materials. In addition, governments all over the world had to impose lockdown over their countries for the containment of the novel coronavirus. Also, the COVID-19 pandemic had a severe impact on the worldwide micro-LED business. Various new projects were delayed due to the lockdown, as well as stringent travel restrictions on national and international transportation services.

Market Growth Factors:

The rising trend for smart wearables

The popularity of virtual reality and augmented reality, as well as breakthroughs in ultra-high definition micro-display panels, is constantly increasing. The adoption of extended reality and the development of virtual reality glasses, which significantly improved micro displays to offer users an enhanced experience, is expected to continue to drive micro display adoption in wearable devices in the forecasting years. In addition, the desire for thin, efficient displays made of OLED materials is propelling the micro displays industry forward. Micro displays are more compact than regular displays and offer good quality, high resolution, and low power consumption. It's great for consumer electronics, aerospace & defense, as well as healthcare applications, gadgets, and equipment because of these characteristics.

Rising demand for efficient and brighter display panels

A micro-LED display is the latest technology that comprises a cluster of tiny LEDs that forms a single pixel element. In comparison to typical LED and OLED display technologies, it provides better contrast. Additionally, as compared to other technologies like LEDs and OLEDs, the power consumption of micro-LED displays is lower. As a result, the penetration of this technology is increasing due to the high demand for brighter and more energy-efficient devices.

In addition, micro-LEDs are light-emitting diodes with a diameter of a few micrometers that can be used to make self-emitting displays. As a result, micro-LEDs do not require a backlight panel, making them brighter and more energy-efficient. Micro-LEDs are a new technology that can be used in lighting and display applications.

Marketing Restraining Factor:

Fragile supply chain along with limited patents

The three key supply chain steps required for mass production of micro-LED displays are micro-LED manufacture, mass transferring, and panel manufacturing. These three processes should be well-aligned for large-scale display production. Micro-LED displays have a more difficult and lengthy supply chain than LCD or OLED panels. As the technology improves, the LCD supply chain, which includes a variety of materials and components, becomes more established. The OLED supply chain is changing, yet, because there are lesser components in the display panel, a lesser number of market players can control the supply chain. Every operation in the micro-LED supply chain is crucial, and managing each stage of the supply chain by one or two parties is expected to be difficult.

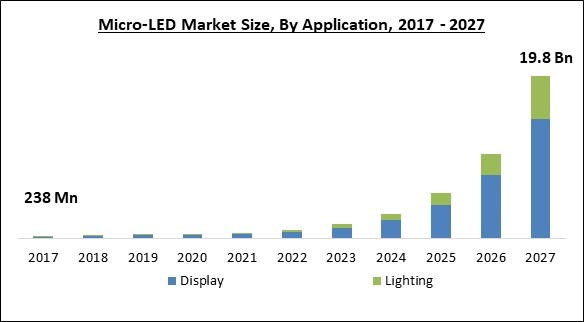

Application Outlook

Based on Application, the market is segmented into Display and Lighting. In 2020, the display segment acquired the largest revenue share of the Micro-LED market. The growth of the market is attributed to the increasing employment of LED displays in numerous digital devices. Nowadays, there are various types of devices that are comprised of micro-Led displays, for instance, smartwatches and smartphones.

Display Type Outlook

Based on Display Type, the market is segmented into Smartphones & Tablets, Smartwatch, Television, Near-to-Eye Devices, Head-up-displays, Digital Signage, and Others. The Television segment under the display segment garnered a substantial revenue share of the Micro-LED market. The increasing growth of this segment is owing to the reducing prices of LED screen televisions. In comparison to the conventional era, LED-comprised smart televisions are increasingly becoming affordable for people. Due to this, the number of people purchasing LED screen television is increasing.

Lighting Type

Based on Lighting Type, the market is segmented into General Lighting and Automotive Lighting. The automotive lighting segment garnered a substantial revenue share of the market. This is owing to the increasing adoption of Micro-LED lights in several applications of a variety of vehicles. For instance, micro-LED lights can be installed as headlights, bottom lights, and interior lights of a vehicle.

Panel Size Outlook

Based on Panel Size, the market is segmented into Small & Medium-sized Panel, Large Panels and Micro Display. In 2020, the large panel segment procured a significant revenue share of the Micro-LED market. The adaptability of micro-LED technology to broad areas is likely to increase the utilization of large displays significantly. In addition, various market players across the micro-LED industry also provide the large screen industry with the ability to integrate other functions and compatibility with transparent and flexible display designs. Moreover, the rising interest of people toward movies and pictures is expected to also increase the deployment of large panel displays in various movie theatres. Therefore, this segment is anticipated to observe a substantial growth over the forecast period.

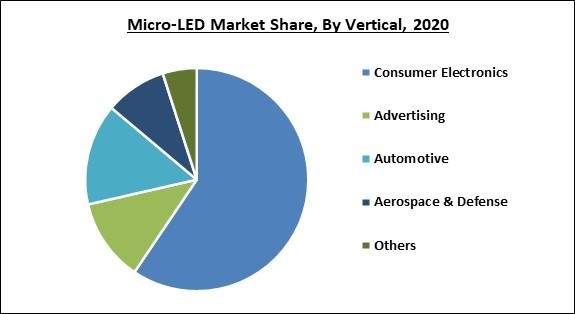

Vertical Outlook

Based on Vertical, the market is segmented into Consumer Electronics, Advertising, Automotive, Aerospace & Defense and Others. In 2020, the Consumer Electronics segment witnessed the largest revenue share of the Micro-LED market. The disposable income of people across the world is rapidly increasing, due to which, people are becoming able to purchase various entertainment goods such as televisions, smartphones, and several others. Hence, the rising disposable income of people is expected to fuel the growth of this segment of the market.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, Asia-Pacific emerged as the leading region in the Micro-LED market with the maximum revenue share. The major electronic giants, such as Samsung, across this region, are increasingly employing micro-LEDs in their products. Moreover, the significant market of quantum dots in this region is expected to also propel the growth of the micro-LED market in this region.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Samsung Electronics Co., Ltd. (Samsung Group), Sony Corporation, Apple, Inc., Ostendo Technologies, Inc., Lumens.com, Konka Group Co., Ltd., Tianma Microelectronics Co., Ltd., X-Celeprint Limited (Xtrion N.V.), Nanosys, Inc., and Visionox Technology, Inc.

Recent Strategies Deployed in Micro-LED Market

- Jan-2022: Samsung Electronics unveiled micro-LED Neo QLED and lifestyle TVs. The product delivers consumers a customizable alluring video and audio experience.

- Dec-2021: Tianma introduced new Transparent, Spliced, Rigid, and Flexible Micro-LED displays. Through this launch, the company aimed to expand the lineup of innovative and leading display technologies.

- May-2021: Nanosys took over glo, the leading technology company for microLED displays. Following the acquisition, the company aimed to boost up development and progress toward the worldwide adoption of microLED and nanoLED display technology.

- Feb-2021: Apple formed a partnership with TSMC, Taiwan Semiconductor Manufacturing Company. Under this partnership, the companies aimed to produce micro-LED displays for Apple VR glasses in the future.

- Jan-2021: Sony Electronics launched its premium LED, the modular Crystal LED C-series, and B-series. The product delivers long-lasting, easy-to-install, and flexible display designs. Moreover, each display embraces seamless, modular, and bezel-free tiles according to layouts, resolutions, and range of sizes.

- Dec-2020: Samsung Electronics introduced 110” Samsung MicroLED in Korea. The product offers a traditional TV experience, installed and calibrated with audio, video, and smart capabilities.

- Dec-2020: KONKA launched the first Micro-LED watch, the APHAEA. The product delivers P0.12AM-LTPS Micro LED screen, which reduces pixel pitch to just 0.12mm. Additionally, HMT technology is used to develop a variety of product forms, innovating watch displays and opening up more opportunities for Micro LED's applications across clients.

- Mar-2020: Samsung came into a partnership with Epister, the largest manufacturer of light-emitting diodes. Under this partnership, Epistar is expected to provide Micro LED chips to different supply chains.

- Feb-2020: Nanosys signed a partnership agreement with SmartKem, design, development, industrialization, and technology transfer of low temp, solution-deposited organic semiconductors. Under this agreement, the companies aimed to work together on a new generation of low-cost solution printed microLED and quantum dot materials for advanced displays.

- May-2019: X-Cleprinte collaborated with BluGlass, a developer of semiconductor manufacturing technology. Following the collaboration, X-Cleprinte adopted Remote Plasma Chemical Vapour Deposition p-GaN technology to produce active-matrix Micro LED displays for good luminance, quantum efficiency, color uniformity, and forward voltage that equal high-performance applications of 2000 nits.

Scope of the Study

Market Segments Covered in the Report:

By Application

- Display and

- Lighting

By Display Type

- Smartphones & Tablets

- Smartwatch

- Television

- Near-to-Eye Devices

- Head-up-displays

- Digital Signage, and

- Others

By Lighting Type

- General Lighting and

- Automotive Lighting

By Panel Size

- Small & Medium-sized Panel

- Large Panels

- Micro Display

By Vertical

- Consumer Electronics

- Advertising

- Automotive

- Aerospace & Defense

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Samsung Electronics Co., Ltd. (Samsung Group)

- Sony Corporation

- Apple, Inc.

- Ostendo Technologies, Inc.

- Lumens.com

- Konka Group Co., Ltd.

- Tianma Microelectronics Co., Ltd.

- X-Celeprint Limited (Xtrion N.V.)

- Nanosys, Inc.

- Visionox Technology, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Samsung Electronics Co., Ltd. (Samsung Group)

- Sony Corporation

- Apple, Inc.

- Ostendo Technologies, Inc.

- Lumens.com

- Konka Group Co., Ltd.

- Tianma Microelectronics Co., Ltd.

- X-Celeprint Limited (Xtrion N.V.)

- Nanosys, Inc.

- Visionox Technology, Inc.