A total station is an electronic/optical tool that is used in construction and surveying. It is an electronic transit theodolite with electronic distance measurement (EDM) for measuring vertical and horizontal angles, as well as the slope distance from the instrument to a specific point, along with an on-board computer for collecting data and triangulation computations.

In topographic and geodetic operations, a total station counts distances, horizontal & vertical angles, and elevations. Topographic surveys, road and corridor surveys, general land surveys, volumetric surveys, infrastructure surveys, power/pipeline line inspections, utility design surveys, and forensic investigations are all examples of places where a total station is employed. The total station's internal memory stores the measurement findings, which can then be downloaded to a personal computer interface for analysis using surveying/construction software tools. Construction, transportation, utilities, mining, agriculture, and oil and gas are a few of the industries that use total stations.

The reflector is the most basic function of the Total station. This is due to the capacity of the total station or the estimations made by the machine using reflected beams. The reflector is emitted from a specially designed reflecting crystal made up of shapes, squares, or reflecting glasses. It also includes a data collector, which plays a vital role in the survey. The information or impressions are collected and stored by the data collector. The information gatherer controls the complete process of taking information in, storing it and excluding it from the process.

Total stations that are robotic or motorized allow the user to control the device from a distance via a remote controller. It eliminates the requirement of any assistance staff member as the operator can control the retroreflector and operate the total station from the observed point. These motorized total stations can also be utilized in automated total station installations, which are referred as Automated Motorized Total Stations.

COVID-19 Impact Analysis

The COVID-19 pandemic led the world economy to severe harm. Along with the increased mortality rate of people, industries across the world also suffered a steep downfall. In order to prevent the diffusion of the novel coronavirus, governments across the world enforced stringent regulations and guidelines on various industrial activities. Manufacturing of the total station devices was restricted due to the lockdown. Moreover, the COVID-19 pandemic had a significant impact on the worldwide construction sector in 2020. Construction projects around the world were temporarily closed due to a shortage of raw materials, a lack of finances, and a shrinking workforce.

Due to the closure of construction projects and sites, the demand for total station devices considerably decreased. Also, with the shutdown of other industries, such as mining and transportation, the utilization of total station devices was substantially reduced.

Market Growth Factors:

Increasing demand from the construction industry

Contractors are struggling to meet rising demand due to low productivity and significant unplanned rework and modification orders. Building structures are more sophisticated nowadays, and they are required to be low-cost, have a quick turnaround, and be of exceptional quality. As a result, new techniques such as advanced equipment, building information modeling solutions, and digital workflows must be implemented. Total stations aid contractors in accurately measuring angles and distances when laying out new construction and constructing existing structures with distinct points.

Modular construction, improved safety, 3D printing, remote/connected technologies, and sustainable building are the latest home construction trends that have boosted residential renovations and reconstruction activities all over the world. This is expected to further create more demand and growth of the total station market in the coming years.

Increase in the demand for renewable energy resources

There is a growing need for renewable energy sources because of the increased focus on sustainable development. Renewable energy provides consistent power and fuel diversification, enhancing energy security and minimizing the risk of fuel leaks while also reducing the requirement for imported fuels. As a result, various kinds of energies, such as wind, solar, and thermal energy, are being generated to fulfill the constantly rising energy demand. Due to this, total stations are being utilized in order to obtain the accurate measurement for building the infrastructure that is required for the generation of these energies.

For instance, when it comes to constructing wind turbines for wind farms, a total station can facilitate the mapping of the infrastructure that is expected to be utilized for the construction. Without adequate knowledge of the coordinates that are required for the construction, building a wind turbine can become a very challenging task.

Marketing Restraining Factor:

High initial and maintenance cost along with the availability of alternates

Total stations, particularly robotic total stations, are much more expensive than theodolites and traditional total stations, which are more common surveying devices. Moreover, when consumers' demand for additional features increases, the cost of total stations rises even more. Additionally, when working on a total station, measures must be taken due to harsh environmental conditions that can impair its performance. In addition, the hardware that is deployed while manufacturing a total station device is also very costly. It makes the initial cost of the device even higher. Hence, the higher cost of the equipment is reducing the demand for total station devices.

Moreover, there is a wide availability of surveying instruments such as Dioptra, Geodimeter, and Graphometer. Due to the prevalence of various alternatives of the product, the demand for the device is estimated to be hampered.

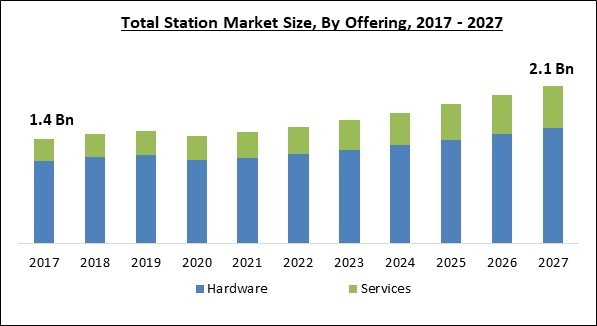

Offering Outlook

Based on Offering, the market is segmented into Hardware and Services. In 2020, the services segment recorded a substantial revenue share of the total station market. There is a large number of market players that are offering total station services on site. Total station services are being highly demanded due to the fact that these services are more affordable. In addition, these services are executed by professionals that are provided by the service-providing company. It reduces the risk of error in management due to lesser knowledge about the operation of the total station devices.

Type Outlook

Based on Type, the market is segmented into Manual and Robotic. In 2020, the Manual Total Station segment acquired the largest revenue share of the total station market. The growth of the segment is attributed to the fact that manual total station allows the user to manually mark impressions of coordinates. In addition, manual total stations also allow the user to choose the preferred tool for conducting the survey. Moreover, due to the manual adjustment setup, manual total stations offer more customized measurements to the user.

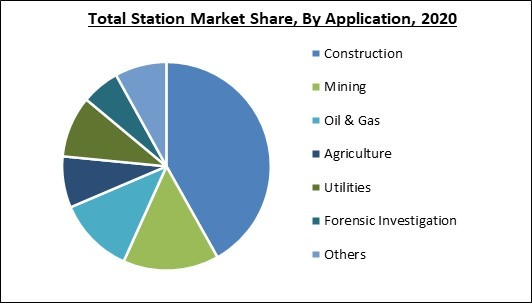

Application Outlook

Based on Application, the market is segmented into Construction, Mining, Oil & Gas, Agriculture, Utilities, Forensic Investigation, and Others. In 2020, the construction segment procured the highest revenue share of the total station market. Total stations are widely being utilized due to their attribute of saving time while delivering measurements. With the advent of automated measuring technology across the construction industry, the time that was being consumed in measuring the coordinates with the conventional scaling method is significantly reduced.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, Europe witnessed a substantial revenue share of the total station market. The growing demand for total station devices across this region is attributed to the expanded agriculture sector across this region. Farmers are increasingly adopting technologies in agriculture in order to increase their productivity. In the agriculture sector, total stations are used in order to measure the dimensions of farms for the deployment of machinery across the field.

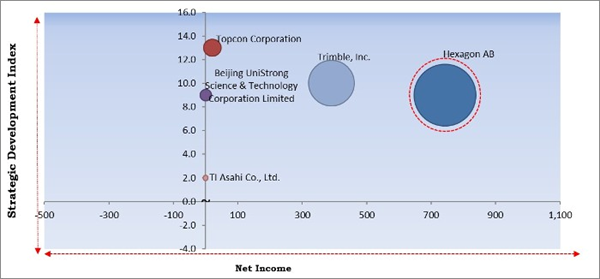

Cardinal Matrix - Total Station Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Hexagon AB is the major forerunner in the Total Station Market. Companies such as Topcon Corporation, Trimble, Inc. and Beijing UniStrong Science & Technology Corporation Limited are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Beijing UniStrong Science & Technology Corporation Limited, Laser Technology, Inc., Hexagon AB, Topcon Corporation, Trimble, Inc., South Surveying & Mapping Technology Co., Ltd., Guangdong Kolida Instrument Co., Ltd., TI Asahi Co., Ltd., Horizon SG, and Hi-Target Global.

Recent Strategy Deployed in Total Station Market

Partnerships, Collaborations and Agreements:

- Apr-2021: Trimble and Amberg Technologies, a global market leader in the area of railway and tunnel surveying, announced today a collaboration to provide a tunnel survey solution. The combined hardware and software solution will enable construction, mining professionals and surveying service providers in underground environments to utilize a complete field-to-office workflow for increased efficiency and productivity.

- Oct-2020: Trimble and Boston Dynamics are entering a strategic alliance to integrate a variety of construction data collection technologies with Boston Dynamics’ Spot robot platform. The relationship gives Trimble exclusivity to sell and support the Spot robot with integrated scanning, total station and GNSS technologies for the construction market.

Product Launches and Product Expansions:

- Jan-2022: Topcon Positioning Group has announced its latest scanning robotic total station - the GTL-1200. The GTL-1200 solution combines the power of a robotic total station with a best-in-class laser scanner, enabling users to perform digital layout and capture high-resolution 3D scans, all with a single setup

- Mar-2021: Stonex announced the launch of R20 Total Station. Stonex R20 combines functionality and reliability. Optimal measure performances up to 5000 m with prism, 600 m reflectorless and 2” as angular accuracy. The high-performance telescope, with illuminated reticle, provides the best sighting quality at any environmental condition.

- Feb-2021: Trimble introduced today the Trimble® SX12 Scanning Total Station, the next iteration of its breakthrough 3D scanning total station that provides fast and efficient data capture for surveying, engineering and geospatial professionals. New features, including a high-power laser pointer and high-resolution camera system, expand capabilities in surveying and complex 3D modeling and enable new workflows in tunneling and underground mining.

- Nov-2020: Leica Geosystems, part of Hexagon, has enhanced the entire automated total stations portfolio in 2020. Starting with the new Leica Nova MS60 MultiStation and TS60 total station, now the new Leica TS16 and TS13 total stations and the new TM60 monitoring total station are introduced. Leica Geosystems’ automated total stations range is designed to help surveyors achieve the highest measurement accuracy and reliability.

- Oct-2020: Topcon Positioning Group announces new flagship GT Series robotic total stations are available for survey, construction, and machine control applications. The GT-1200 and GT-600 total stations are available in multiple accuracy levels. The new total stations are part of a full workflow solution, including a new field computer, a full-version update to Topcon field and office software, as well as GNSS receivers. The system is designed to work in sync for improved performance and better data handling with built-in, field-to-office connectivity.

- Sep-2020: Trimble has announced the new Trimble TCU5 onboard controller for boosting Trimble S Series Total Stations to complete systems that allow surveyors to get total control over how they work. Using the Trimble TCU5 with their Trimble S Series Total Station, surveyors can boost productivity and accommodate how they work in the field with a new, modern workflow that’s adaptable, whether on a pole, onboard or in the office with a docking station.

- Feb-2020: Leica Geosystems, part of Hexagon, announced today the new Leica Nova TS60, the world’s most accurate total station, with newly integrated DynamicLock and AutoHeight features. The new version of theTS60 total station is now equipped with DynamicLock, allowing the instrument to lock onto a moving prism, and devised with AutoHeight, enabling users to get the instrument’s height with a simple button press.

- Feb-2020: Stonex announce the launch of Stonex RS0 Motorized Total Station. RS0 combines the power of a Total Station and the capabilities of a remote control. Stonex RS0 is a Motorized Total Station for classic jobs for survey and stakeout and perfect for monitoring.

Scope of the Study

Market Segments Covered in the Report:

By Offering

- Hardware

- Services

By Type

- Manual

- Robotic

By Application

- Construction

- Mining

- Oil & Gas

- Agriculture

- Utilities

- Forensic Investigation

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Beijing UniStrong Science & Technology Corporation Limited

- Laser Technology, Inc.

- Hexagon AB

- Topcon Corporation

- Trimble, Inc.

- South Surveying & Mapping Technology Co., Ltd.

- Guangdong Kolida Instrument Co., Ltd.

- TI Asahi Co., Ltd.

- Horizon SG

- Hi-Target Global

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Beijing UniStrong Science & Technology Corporation Limited

- Laser Technology, Inc.

- Hexagon AB

- Topcon Corporation

- Trimble, Inc.

- South Surveying & Mapping Technology Co., Ltd.

- Guangdong Kolida Instrument Co., Ltd.

- TI Asahi Co., Ltd.

- Horizon SG

- Hi-Target Global