Key Highlights

- The Vietnamese population in 2022 was 100 million and is expected to reach 120 million by 2050. The country is experiencing rapid demographic and social change, which is anticipated to support the effective demand for the residential real estate industry in the coming years.

- Vietnam, across various sectors, including construction and real estate, is rising with great potential among the Southeast Asian economies and is expected to continue its stellar growth in the coming years. The outlook for the Vietnamese residential real estate market is buoyant, mainly due to continued strong economic growth, rapid urbanization growth, and the construction of several mega projects in major cities such as Ho Chi Minh and Hanoi.

- The rising internet penetration and increase in disposable income by the middle-class youth population in Vietnam have surged the demand and sales proportion of residential real estate through online channels. This quick surge in individual wealth has made property affordable for many Vietnamese people, contributing to an increase in new developments and property prices.

- The residential market's focus has shifted from the high-end to the mid-value segments as urbanization has created an ongoing demand for housing in large urban centers. Furthermore, the country is now widely seen as the luxury real estate market hotspot, with a growing economy coupled with laws that have made it easier for foreigners to purchase the property.

- At a conference on August 1, 2022, Vietnam's Prime Minister Pham Minh Chinh set an ambitious goal of building at least one million social housing units, which are affordable state-supported housing, by 2030.

Vietnam Residential Real Estate Market Trends

Rising Government Initiatives and Social Housing Development Policies

The National Assembly and the Government of Vietnam propagated many policies and mechanisms to develop social housing to support disadvantaged and low-income people in urban and rural areas. The Vietnamese government's key initiatives include the housing law and other official directives to provide support and incentive for the development and management of social housing. It also has openness for investment by foreign individuals and organizations in social housing development.HCMC council implemented projects to increase the sources of pure land in urban and suburban areas and retrieved about 200 hectares (initially in 2008) of the site from the inner city to the suburban. The expansion of the availability of clean land is likely to increase the radius of social housing from the central area.

According to the MoC, most social housing projects would be implemented in areas with large industrial parks, including Long An (310,000 units), Bac Giang (285,000), Bac Ninh (96,2 7), and Binh Duong (8,000). Social housing projects are also considered a priority in large urban cities such as Hanoi (136,000 apartments), Ho Chi Minh City (130,000), Haiphong ( 5,355), and Danang (19,360). KM assumed the implementation of the plan in stages, when approximately 700,000 apartments should be completed in the period 2021-2025, i.e. 5 % of the total demand, and 1.1 million apartments in 2025-2030, i.e. 85%

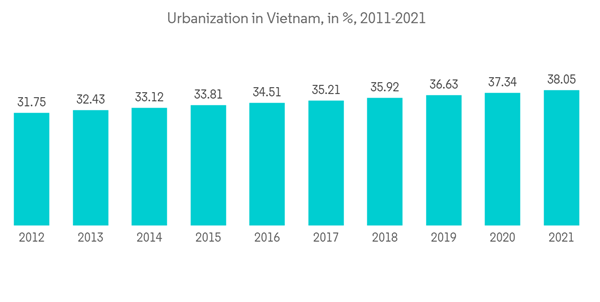

Rapid Urbanization is Supplementing Housing Demand

Urbanization will be an important driving force for rapid and sustainable socio-economic development in the future, and urban areas will make up the largest part of the country's economy in the coming years. All party committees and party members are therefore called to focus on the planning, construction, management, and sustainability of Vietnam's urban areas by 2030.The resolution also sets specific targets, such as the rate of urbanization reaching at least 5 percent by 2025 and more than 50 percent by 2030. in the country by 2025 and around 1.9-2.3 percent by 2030. The nationwide number of built-in areas will reach 950-1000 by 2025 and approximately 1000-1200 by 2030. The share of the urban economy in the gross domestic product will be about 75 percent by 2025. 85 percent by 2030. In addition, the level of urbanization in ASEAN and Asia is estimated to be medium to high by 2045.

Vietnam Residential Real Estate Industry Overview

The Vietnamese residential real estate market is fragmented due to many local and global players' presence. Vietnam residential real estate includes:- Pure Vietnamese capital-based local companies.

- Foreign investment funds from foreign companies.

- Joint venture firms.

Key players in the residential real estate market include Novaland Group, Dat Xanh Group, FLC Group, Hung Thinh Real Estate Business Investment Corporation, and Nam Long Investment Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Novaland Group

- Dat Xanh Group

- FLC Group

- Hung Thinh Real Estate Business Investment Corporation

- Phu My Hung Development Corporation

- Sun Group

- Phat Dat Corporation

- Vinhomes

- Rever

- SonKim Land

- Capital and Limited*