The unprecedented COVID-19 pandemic had an enormous impact on the organic sector in 2020. The coronavirus pandemic has led to surging demand for organic and sustainable foods. As shoppers search for healthy, clean food to feed their at-home families, organic food, including meat, has proven to be the food of choice for the home.

Rising health consciousness, increasing concerns about meat quality, and instances of meat contamination are some of the major factors driving the global organic meat market. Organic meat, poultry, and fish remained the smallest organic food category in 2019 with USD 1.4 billion in sales, but the segment also saw almost 10% growth, the highest growth of any organic food category as pet Organic Trade Association. Organic poultry remained the organic protein of choice, and the USD 865 million poultry market made up more than half of the sales for the organic meat, poultry, and seafood category.

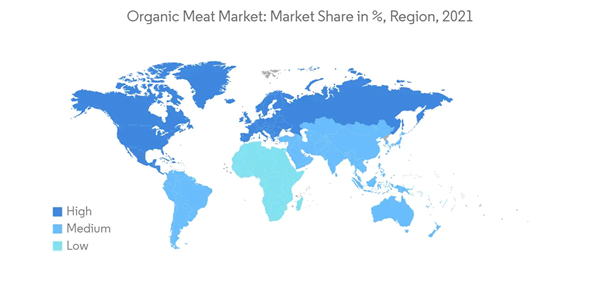

North America accounted for the largest share of the market for organic meat in 2020 globally. The domestic demand is primarily driven by the increasing preference for chemical-free high-quality meat from health-conscious consumers across the region. Asia-Pacific was the fastest-growing region with the expanding per capita income growth and consumer concerns over the defamed meat industry, thus, allowing numerous players to penetrate the market with diversified product portfolios.

Organic Meat Market Trends

Rising Health Awareness Resulted in Increased Meat Consumption

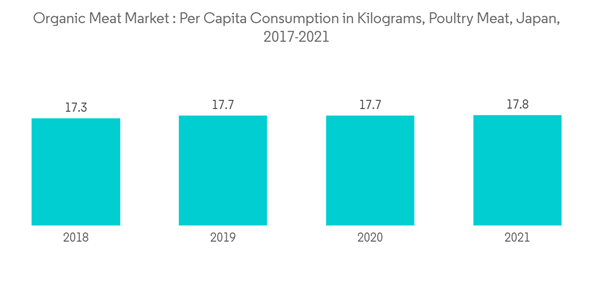

Consumers in the Asia-Pacific region are increasingly opting for organic meat over conventional meat due to the mounting awareness about health, perceived nutritional benefits, and socio-environmental responsibility. According to statistics revealed by Agriculture and Agri-Food Canada, the total retail sales of organic meat in Japan increased severalfold in 2017. Japan's Ministry of Agriculture, Forestry, and Fisheries reported that the per capita consumption of meat has been rising steadily to reach the per capita consumption of 89.7 grams per person per day in 2017, with the organic segment constituting a major portion of the total demand. Moreover, due to increasing food safety concerns, regulatory bodies are imposing bans on potentially harmful antibiotics. For instance, the Government of India proposed a ban on the antibiotic 'colistin' in 2019, which is widely used in the meat and poultry industry in India. The regulatory measure was taken to ensure the cautious use of anti-microbial agents in humans and animals to tackle the issue of anti-microbial resistance. Thus, the growing concerns about food safety and subsequent demand for high-quality meat are expected to boost the organic meat market in the region during the forecast period.Rapidly Expanding Demand in Developed Countries

North America accounted for the largest share of the global organic meat market in 2021. Among all the regions, the United States contributed the largest portion of the total revenue generated in the region. According to the Organic Trade Association (OTA), the retail sales of organic meat, poultry, and fish crossed the 1-billion mark with an increase of 17.2% in 2019. The rising concerns over high-quality meat without the use of growth-enhancing hormones and antibiotics are fuelling the market for organic meat in the country. Though the premium price for organic beef is roughly 67% over its conventional counterpart, the rising per capita income has, in turn, boosted the inclination of the consumers toward organically-produced meat. According to the Canada Organic Trade Association, organic meat and poultry remained the second-most purchased category by Canadian consumers in 2019. The organic regulations in the country, including the Canada Organic Logo, have played a significant role in the transition of the consumption pattern towards organic meat.Organic Meat Industry Overview

The organic meat market is fragmented, with both international players and emerging players striving for higher market shares in the organic meat industry. Some of the major players are Tyson Foods, Inc., Perdue Farms, Inc., Pilgrim's, Foster Farms, Meyer Natural Foods, and JBS SA, among others. These companies are targeting markets in both the developing and developed countries for business expansion, either by investing in a new production unit or acquiring established companies in the organic meat segment.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Tyson Foods Inc.

- JBS SA

- Perdue Farms Inc.

- Foster Farms

- Meyer Natural Foods

- Eversfield Organic

- Verde Farms

- DuBreton

- Swellington Organic Farm

- Leverandørselskabet Danish Crown A.m.b.a