The e-commerce market has grown as a result of Covid-19, resulting in a growth in the volume of shipments shipped across the country. Despite the fact that online shopping for product sales is inextricably linked to home delivery, online shopping for product sales grew by 21.7% in 2020, while parcel delivery (trucks) grew by 11.5%. According to the announcement by the Ministry of Land, Infrastructure, Transport, and Tourism, the number of parcel delivery services (trucks) handled in FY2020 was 4.78 billion, an increase of 494.31 million.

As B2C e-commerce demand grows, the role of last-mile logistics has gained prominence in Japan. In recent years, there has been a significant increase in the last mile market due to increased demand for speed of delivery and expanding internet penetration, which has resulted in a greater number of regions active online. Looking at the characteristics of the number of parcels handled by the three major courier companies in FY2020, Yamato Transport increased by 16.5%, Sagawa Express increased by 7.2%, and Japan Post increased by 11.9%.

E-commerce is one of the primary drivers of the Japanese CEP market's expansion. The e-commerce industry's revenue is expected to reach USD 128 billion by 2024, due to growing internet user penetration. The domestic CEP market is likely to witness the growth and hold the major share during the forecast period driven by the B2C e-commerce boom.

Key Market Trends

Increase in Parcel Volumes Fueling the CEP Market Growth

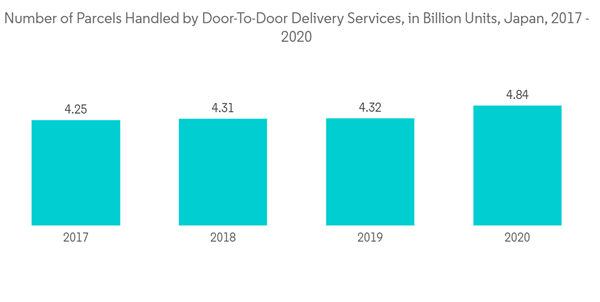

In the fiscal year 2020, the number of parcels handled by door-to-door delivery services in Japan reached a record high of 4.84 billion packages. Three service providers dominated this market, accounting for more than 90% of the traffic.

In the fiscal year 2020, Yamato Transport's TA-Q-BIN parcels were the leading door-to-door parcel delivery service in Japan, accounting for almost 43% of all parcels handled via trucks. Hikyaku Express came in second place, reaching a share of slightly over 28%.

All major carriers in the Japanese parcel market (courier and mail) reported an increase in sales in 2020. According to data from the Ministry of Land, Infrastructure, Transport, and Tourism the total shipment volume of courier and mail service increased by 1% year on year, while that of courier service alone increased by 12% year on year.

The strong growth of courier service is due to the increase in electronic commerce. It was further accelerated by changes in consumer behavior due to the spread of the new Coronavirus worldwide. Global economic uncertainty and supply chain problems are accelerating the surge in online shopping and delivery.

E-commerce Growth Driving the Market

Japan is the world's third-largest economy, with a GDP of USD 5 trillion. GDP per capita in 2021 is USD 42,927, with a projected increase to USD 51,620 by 2026. Japan is the world's fourth-largest e-commerce market, behind the United Kingdom, China, and the United States.

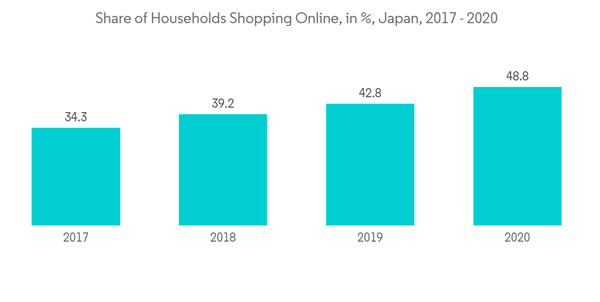

The Ministry of Internal Affairs and Communications conducts monthly surveys of Japanese shoppers' online expenditures and services, with a recent report showing a 13.7% increase from January 2018 to January 2020, and households shopping online increasing from 36.3% to 42.8%.

In Japan, there are 117.4 million internet users, and internet penetration is at 93% as of January 2021. Internet penetration in Japan is highest in the age groups 20-59 (all over 97%), with 60-69-year-olds at 90.5% and dropping slightly to 74% in the next age group (70-79). Smartphone penetration is 82% overall, with 20-29-year-olds having the highest penetration at 93%.

E-commerce growth in the market is estimated to be 6.24% per annum, with a market value of USD 143 billion by 2025. Food and Personal Care is the largest segment, worth USD 28 billion in 2021, followed by Fashion and Beauty (worth USD 25 billion), Toys, DIY and Hobbies (worth USD 21 billion), and Electronics and Media (worth USD18.9 billion).

M-commerce is popular in Japan, with revenue increasing year on year from USD 9 billion in 2010 to USD 41.5 billion in 2019. In 2021, m-commerce accounts for 45.5% of all e-commerce sales.

Competitive Landscape

Japan's domestic CEP market is fragmented in nature with a mix of global and local players, this makes the sector highly competitive. Some of the strong players in the country include Yamato, Sagawa Express, United Parcel Service, Japan Post, TNT Express, etc. The local companies are facing high competition with multinational companies that have a comparatively well-developed infrastructure. To leverage the opportunity of fast growth in the CEP industry, many new start-ups have entered the market. As a result of increasing market activity, the industry observes high competition among the players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Yamato

- Sagawa Express

- United Parcel Service

- Japan Post

- TNT Express

- Schenker-Seino

- Seino Transportation

- DHL

- FedEx

- Takuhai

- Nippon Express Company

- National Air Cargo *