Key Highlights

- The increasing demand for bromine in water treatment applications is expected to fuel market growth during the forecast period.

- On the other hand, non-halogenated flame retardants are likely to slow the growth of the market.

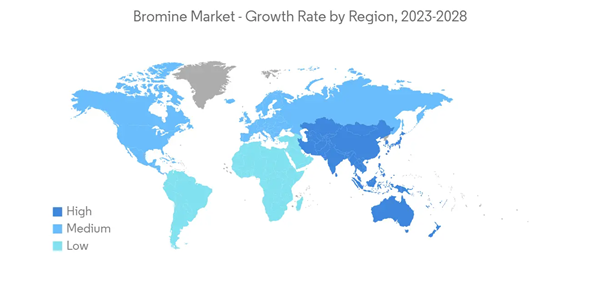

During the forecast period, the Asia-Pacific region is expected to have the most market share. This is because India, China, and Japan are all growing and becoming more developed.

Bromine Market Trends

Increasing Demand for Flame Retardants

- Bromine is a common ingredient in flame retardants because it works well to stop fires.

- Around 80 different types of brominated flame retardants (BFRs) with widely varying chemical properties are available on the market. Some of these are brominated bisphenols, diphenyl ethers, cyclododecanes, biphmanufacturing enyls, phenols, phenoxy ethanes, and phthalic acid derivatives.

- BFRs are commonly used to prevent fires in electronics and electrical equipment. For instance, these flame retardants are extensively used in the outer housings of TV sets and computer monitors, as the internal circuitry of such devices can heat up and, over time, collect dust.

- Also, brominated flame retardants are used in commercial and industrial settings, like in furniture, textiles, construction, electrical, etc., to stop or slow down the spread of fire.

- Rising construction activities across the world are, in turn, boosting the demand for bromine compounds in the aforementioned applications. For example, China is one of the leading countries with respect to the construction of shopping centers. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- In India, according to the Ministry of Statistics and Program Implementation's Infrastructure and Project Monitoring Division, the government had 1,559 projects in the pipeline valued at INR 26.7 trillion (USD 314.22 billion) as of May 2022. Also, the Indian construction industry is expected to grow at a rate of 6.2% per year from 2023 to 2026, thanks to a strong pipeline of infrastructure projects in many sectors.

- All of these things are driving up the demand for brominated flame retardants over the next few years.

High Demand of Bromine from China

- China is one of the leading producers of bromine among Israel, Jordan, and the United States. Flame retardants are the largest application of bromine in China. The expected bromine production in China amounted to 75,000 tons in 2021, according to the latest report published by the US Geological Survey (USGS) in January 2022.

- Brominated flame retardants are used in the construction sector, the electrical industry, etc. to hinder or suppress combustion.

- China's construction sector generated around 6.9% of the country's GDP in 2022. Further, according to the Ministry of Housing and Urban-Rural Development in China, the construction industry intends to maintain a 6% share of the country's GDP by 2025 under the 14th Five-Year Plan period (2021-2025).

- Moreover, China has the world’s largest electronics production base. Electronic products, such as wires, cables, computing devices, and other personal electronic devices, recorded the highest growth in the electronics segment. The country serves the domestic demand for electronics and exports electronic output to other countries, thus providing a huge market for bromine.

- China is one of the major markets for zinc-bromine flow batteries due to the region's growing electric vehicle market. The China Association of Automobile Manufacturing says that the number of new energy vehicles made in the country rose by 96.9% from December 2021 to December 2022.

Because of this, the above factors are likely to increase China's demand for bromine over the next few years.

Competitive Landscape

The bromine market is consolidated by nature. Some of the major players in the market include ICL, Lanxess, Albemarle Corporation, Gulf Resources, Inc., and Jordan Bromine Company, among others (in no particular order).Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Albemarle Corporation

- Gulf Resources Inc.

- Honeywell International Inc.

- ICL

- Jordan Bromine Company

- Lanxess

- Tata Chemicals Ltd.

- TETRA Technologies Inc.

- Tosoh Corporation

- Sujay Chemicals

- Shandong Haiwang Chemical Co.

- Neogen Chemicals Ltd.