In the automotive sector, digitization has become a critical driver of innovation. With automobiles generating massive amounts of data in seconds, the chance to provide exceptional customer experiences and business operations is more important than ever. At the moment, automobiles have at least 50 sensors meant to capture more comprehensive data such as speed, emissions, distance, resource utilization, driving behavior, and fuel consumption. The data generated enables stakeholders in the automotive industry to use it for additional research, relationship analysis, and improved usage.

Factors such as an increase in the trend of networking solutions in automotive, an increase in the usage of cloud-based technology for smart fleet management solutions, and an increase in concern for vehicle safety and security are likely to fuel market expansion. However, the high installation costs and security issues associated with data transfer are impeding industry expansion. Market participants forming strategic alliances with OEMs, insurers, and fleet operators to obtain a competitive edge, increasing development in semi-autonomous and autonomous cars, and increased demand from emerging nations are some of the reasons predicted to drive market expansion.

Due to the rising dominance of connected and autonomous cars, Asia-Pacific is the fastest-growing region. Furthermore, the increased penetration of new technology firms finding their way into the automotive sector is projected to give rise to a new era of automotive analytics. China announced a target of at least 30 million autonomous vehicles by 2028, which is likely to boost demand for automobile analytics. The government has been highly active in embracing technology to assist with policy execution. China also intends to relax quotas meant to encourage the production of electric vehicles in order to assist automakers in reviving sales.

Ping An Insurance announced in April 2020 that the "Ping An Auto Owner" app has reached 100 million registered users. The app has 25 million monthly active users and is one of the top-ranked automotive service applications in China. Ping An Property & Casualty automobile insurance clients account for almost half of the app's users. The app makes use of Ping An's artificial intelligence (AI) and big data analytics technologies on a platform to link automobile owners to dealers and other automotive service providers. The app has served roughly 12.3 million users since the outbreak of COVID-19 in January 2020, with online self-service insurance claims accounting for 40% of the services.

Growth Factors

Advancements in technology:

The growth of predictive analytics is a significant element driving the industry. This technology is used as a collision-avoidance system in automobiles by utilizing sophisticated sensors, massive and fast data, and car-to-car connections. The increasing implementation of such technology, particularly with the expansion of the autonomous vehicle industry, will be a significant driver for Automotive Data Analytics. Furthermore, automobile malfunctioning is a major cause of accidents. These malfunctions are frequently caused by human negligence in the timely servicing and maintenance of vehicles. Predictive analytics systems notify the owner of the possible need for maintenance before a malfunction occurs. Data obtained from different sensors installed in automobiles aids in the performance of predictive maintenance chores. As the demand for electric cars grows, the market has the potential to expand. Variations in voltages during charging in EVs might damage the battery. Predictive analytics combined with artificial intelligence (AI) improves the feedback and monitoring system for batteries in order to reduce unnecessary damage and thus increase battery life.

Restraints:

Concerns regarding data privacy:

The most severe challenge with data analytics is dealing with the delicate subject of data privacy and security, which most automobile businesses are dealing with. Security and privacy concerns are rising as corporations feed more and more customer and supplier data into powerful, AI-powered algorithms, resulting in the creation of additional sensitive information about unknown consumers and workers. This is especially true in the insurance industry, where collecting customer data has been at the forefront of big data challenges. Since a data breach or security failure may be devastating, the insurance industry is controlled by stringent adherence to rules and governance. These concerns about data privacy and security will actually hinder the adoption of automotive data analytics, particularly in the insurance industry.

The Impact of COVID-19 on the Automotive Data Analytics Market:

The COVID-19 pandemic has caused market uncertainty by delaying supply chains, impeding company growth, and raising concerns among customers. End users, such as automotive OEMs, dealers, insurers, and fleet operators, are anticipated to prioritize working capital management, with little room for substantial investment in sophisticated technology. However, due to the high installation cost and other infrastructure needs, there is a significant likelihood of sales momentum for automotive analytics technology. Automotive analytics market participants are using specific methods to manage operations to overcome the financial slump, such as reduced budgets, longer equipment life cycles, reduced employee numbers, and lower pay.

Key Developments

Epicor expanded its automotive data analytics portfolio in September 2021 through an exclusive partnership with SideKick360, a prominent web-based reporting tool that enables tyre dealers and other similar businesses to generate more profit from each service opportunity.

Ford launched the new "RoadSafe" concept in September 2021, in collaboration with a partnership co-funded by the UK's innovation agency, Innovate the UK, to predict traffic accident locations based on data from connected vehicles, roadside sensors, and traffic collision reports.

Market Segmentation

By Deployment

- On-premise

- Cloud

By Application

- Driver Performance Analysis

- Predictive Maintenance

- Safety and Security Management

- Traffic Management

- Others

By End-User

- Original Equipment Manufacturers (OEMs)

- Insurers

- Fleet Owners

- Regulatory Bodies

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

1. Introduction1.1. Market Definition1.2. Market Segmentation

2. Research Methodology2.1. Research Data

2.2. Assumptions

3. Executive Summary3.1. Research Highlights

4. Market Dynamics4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of End-Users

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. Automotive Data Analytics Market Analysis, by Deployment5.1. Introduction

5.2. On-premise

5.3. Cloud

6. Automotive Data Analytics Market Analysis, by Application6.1. Introduction

6.2. Driver Performance Analysis

6.3. Predictive Maintenance

6.4. Safety and Security Management

6.5. Traffic Management

6.6. Others

7. Automotive Data Analytics Market Analysis, by End-User7.1. Introduction

7.2. Original Equipment Manufacturers (OEMs)

7.3. Insurers

7.4. Fleet Owners

7.5. Regulatory Bodies

7.6. Others

8. Automotive Data Analytics Market Analysis, by Geography8.1. Introduction

8.2. North America

8.2.1. USA

8.2.2. Canada

8.2.3. Mexico

8.3. South America

8.3.1. Brazil

8.3.2. Argentina

8.3.3. Others

8.4. Europe

8.4.1. Germany

8.4.2. France

8.4.3. UK

8.4.4. Italy

8.4.5. Others

8.5. Middle East and Africa

8.5.1. Saudi Arabia

8.5.2. UAE

8.5.3. South Africa

8.5.4. Others

8.6. Asia Pacific

8.6.1. China

8.6.2. India

8.6.3. Japan

8.6.4. South Korea

8.6.5. Taiwan

8.6.6. Thailand

8.6.7. Indonesia

8.6.8. Others

9. Competitive Environment and Analysis9.1. Major Players and Strategy Analysis

9.2. Emerging Players and Market Lucrativeness

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Vendor Competitiveness Matrix

10. Company Profiles 10.1. Microsoft

10.2. Agnik LLC

10.3. Harman International Industries Inc. (Samsung Electronics Co. Ltd)

10.4. SAP SE

10.5. IBM Corporation

10.6. Genetec Inc.

10.7. Teletrac Navman US Ltd.

10.8. Inquiron Ltd

10.9. Cloudmade Ltd

10.10. Intelligent Mechatronic Systems Inc.

Companies Mentioned

- Microsoft

- Agnik LLC

- Harman International Industries Inc. (Samsung Electronics Co. Ltd)

- SAP SE

- IBM Corporation

- Genetec Inc.

- Teletrac Navman US Ltd.

- Inquiron Ltd

- Cloudmade Ltd

- Intelligent Mechatronic Systems Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 102 |

| Published | March 2022 |

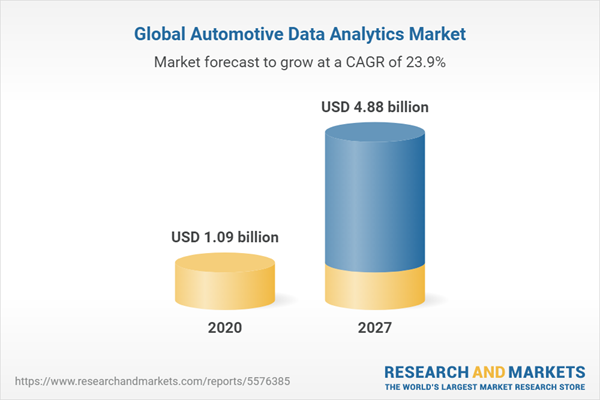

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 1.09 billion |

| Forecasted Market Value ( USD | $ 4.88 billion |

| Compound Annual Growth Rate | 23.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |