One of the key reasons driving the global electrostatic precipitator market during the forecast period is the rising awareness of air quality control and growing industrialization in both developing and developed nations. Because of toxic pollutants emitted by automobiles, industrial manufacturing, power plants, and other industries, air quality is degrading regularly. Electrostatic precipitators, which remove soot and ash from exhaust fumes, are an excellent solution for a variety of end-use sectors looking to reduce particulate matter in the exhaust air and thus stay within environmental limitations. In addition, countries like the United States, China, and India are seeing tremendous industrialization. Sectors including public transit, autos, and energy (power plants) all contribute significantly to the economy's growth. All of these factors combine to boost demand for electrostatic precipitators, boosting the global market’s growth.

Increased awareness of the need for air quality control and the negative consequences of hazardous emissions has resulted in a rapid transition away from non-renewable energy sources and toward renewable energy sources for energy generation. Renewable energy sources such as wind, solar, geothermal, and hydropower generate electricity without emitting any pollutants. Furthermore, due to the instability of crude oil prices, geopolitical difficulties, and significant investment risks, many power plants are turning toward using renewable energy sources for energy production. During the forecast period, these issues are anticipated to limit the electrostatic precipitator market's growth.

Key Developments

In August 2021, the Italian company Ecospray will introduce the Wet Electrostatic Precipitator (WESP), a novel technology for removing particulate matter and black smoke created by passenger ships and other boats. At Lafarge Egypt's cement facility, Redecam successfully started project one line two in 2020, with the aim of converting the electrostatic precipitator in the main kiln to a bag filter, including a partial ESP refit, improving the cooling system for the clinker cooler, and rebuilding the bypass for the gas conditioning tower and dust transport system.

Bars

By type, the global electrostatic precipitator market is segmented into wet, two-stage, plate wire, and flat plate. The plate wire segment accounts for a larger market share in 2020. The wet segment, on the other hand, is expected to grow at the quickest rate. The growing demand for paper-based products for packaging, printing, advertising, and other applications has prompted the paper industry's major players to expand their production capacities in areas where plate-wire type electrostatic precipitators are used to remove harmful soot and ash from the exhaust gas.

Based on end-users, the global electrostatic precipitator market can be segmented into manufacturing, chemicals, metals, power generation, cement, and others.Power generation has the largest market share in 2020. The growing population, combined with rising per capita energy consumption, has fueled the expansion of power facilities, where electrostatic precipitators are frequently utilised to reduce particulate matter from furnace and boiler exhaust gases. The India Brands Equity Foundation predicts that power consumption in India will reach 1,897.4 terawatt-hours (TWh) by 2022. This will lead to the growth of the electrostatic precipitator market in the power generating industry. This will lead to the growth of the electrostatic precipitator market in the power generating industry.

By geography, the global electrostatic precipitator market is segmented into five regions: North America, Europe, South America, the Middle East, Africa, and Asia-Pacific regions.During the projection period, the Asia-Pacific electrostatic precipitator market is expected to develop at the fastest rate. This rise is expected to be fueled by China's improved economic performance, large investments in research and development, and increased technical assistance. For example, according to a report published in the academic journal Paper and Biomaterials, China's household paper output and consumption in 2019 were 10.05 million tonnes and 9.30 million tonnes, respectively, up 3.61 percent and 3.22 percent from 2018. Germany, Russia, the United Kingdom, Spain, Italy, and other Eastern and Central European countries are all part of the electrostatic precipitator market in Europe. Due to considerable demand for pollution control equipment from numerous key end-use sectors, Europe was the second-largest area in terms of revenue.

The use of ESPs was reduced as a result of the lockdown of oil refineries, chemical and manufacturing industries, especially in the early stages. This aspect had a negative impact on the worldwide electrostatic precipitator industry. In addition, a drop in worldwide electricity usage due to the closure of large-scale businesses, offices, and malls lowered the demand for electrostatic precipitators. The market, on the other hand, is expected to recover quickly. According to the Energy and Economic Growth Survey, the oil and gas industry will be among the hardest hit in 2020, with an average decrease of -2.8 percent. Furthermore, more than 100 nations have closed their international borders for transportation and non-essential trade, causing the demand-supply chain in the electrostatic precipitator market to be impeded. In the COVID-19 scenario, this had a significant impact on the demand for electrostatic precipitators among oil refineries.

Key Market Segments

Key Developments

In August 2021, the Italian company Ecospray will introduce the Wet Electrostatic Precipitator (WESP), a novel technology for removing particulate matter and black smoke created by passenger ships and other boats. At Lafarge Egypt's cement facility, Redecam successfully started project one line two in 2020, with the aim of converting the electrostatic precipitator in the main kiln to a bag filter, including a partial ESP refit, improving the cooling system for the clinker cooler, and rebuilding the bypass for the gas conditioning tower and dust transport system.

Bars

By type, the global electrostatic precipitator market is segmented into wet, two-stage, plate wire, and flat plate. The plate wire segment accounts for a larger market share in 2020. The wet segment, on the other hand, is expected to grow at the quickest rate. The growing demand for paper-based products for packaging, printing, advertising, and other applications has prompted the paper industry's major players to expand their production capacities in areas where plate-wire type electrostatic precipitators are used to remove harmful soot and ash from the exhaust gas.

Based on end-users, the global electrostatic precipitator market can be segmented into manufacturing, chemicals, metals, power generation, cement, and others.Power generation has the largest market share in 2020. The growing population, combined with rising per capita energy consumption, has fueled the expansion of power facilities, where electrostatic precipitators are frequently utilised to reduce particulate matter from furnace and boiler exhaust gases. The India Brands Equity Foundation predicts that power consumption in India will reach 1,897.4 terawatt-hours (TWh) by 2022. This will lead to the growth of the electrostatic precipitator market in the power generating industry. This will lead to the growth of the electrostatic precipitator market in the power generating industry.

By geography, the global electrostatic precipitator market is segmented into five regions: North America, Europe, South America, the Middle East, Africa, and Asia-Pacific regions.During the projection period, the Asia-Pacific electrostatic precipitator market is expected to develop at the fastest rate. This rise is expected to be fueled by China's improved economic performance, large investments in research and development, and increased technical assistance. For example, according to a report published in the academic journal Paper and Biomaterials, China's household paper output and consumption in 2019 were 10.05 million tonnes and 9.30 million tonnes, respectively, up 3.61 percent and 3.22 percent from 2018. Germany, Russia, the United Kingdom, Spain, Italy, and other Eastern and Central European countries are all part of the electrostatic precipitator market in Europe. Due to considerable demand for pollution control equipment from numerous key end-use sectors, Europe was the second-largest area in terms of revenue.

The use of ESPs was reduced as a result of the lockdown of oil refineries, chemical and manufacturing industries, especially in the early stages. This aspect had a negative impact on the worldwide electrostatic precipitator industry. In addition, a drop in worldwide electricity usage due to the closure of large-scale businesses, offices, and malls lowered the demand for electrostatic precipitators. The market, on the other hand, is expected to recover quickly. According to the Energy and Economic Growth Survey, the oil and gas industry will be among the hardest hit in 2020, with an average decrease of -2.8 percent. Furthermore, more than 100 nations have closed their international borders for transportation and non-essential trade, causing the demand-supply chain in the electrostatic precipitator market to be impeded. In the COVID-19 scenario, this had a significant impact on the demand for electrostatic precipitators among oil refineries.

Key Market Segments

By geography, the global electrostatic precipitator market is segmented into five regions: North America, Europe, South America, the Middle East, Africa, and Asia-Pacific regions.During the projection period, the Asia-Pacific electrostatic precipitator market is expected to develop at the fastest rate. This rise is expected to be fueled by China's improved economic performance, large investments in research and development, and increased technical assistance. For example, according to a report published in the academic journal Paper and Biomaterials, China's household paper output and consumption in 2019 were 10.05 million tonnes and 9.30 million tonnes, respectively, up 3.61 percent and 3.22 percent from 2018. Germany, Russia, the United Kingdom, Spain, Italy, and other Eastern and Central European countries are all part of the electrostatic precipitator market in Europe. Due to considerable demand for pollution control equipment from numerous key end-use sectors, Europe was the second-largest area in terms of revenue.

The use of ESPs was reduced as a result of the lockdown of oil refineries, chemical and manufacturing industries, especially in the early stages. This aspect had a negative impact on the worldwide electrostatic precipitator industry. In addition, a drop in worldwide electricity usage due to the closure of large-scale businesses, offices, and malls lowered the demand for electrostatic precipitators. The market, on the other hand, is expected to recover quickly. According to the Energy and Economic Growth Survey, the oil and gas industry will be among the hardest hit in 2020, with an average decrease of -2.8 percent. Furthermore, more than 100 nations have closed their international borders for transportation and non-essential trade, causing the demand-supply chain in the electrostatic precipitator market to be impeded. In the COVID-19 scenario, this had a significant impact on the demand for electrostatic precipitators among oil refineries.

Key Market Segments

By Type

- Plate Wire

- Flat Plate

- Wet

- Two-stage

By End-Users

- Power Generation

- Chemicals

- Metal

- Cement

- Manufacturing

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others

Table of Contents

1. INTRODUCTION1.1. Market Definition1.2. Market Segmentation

2. RESEARCH METHODOLOGY2.1. Research Data

2.2. Assumptions

3. EXECUTIVE SUMMARY3.1. Research Highlights

4. MARKET DYNAMICS4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Powers of Buyers

4.3.3. Threat of Substitutes

4.3.4. The Threat of New Entrants

4.3.5. Competitive Rivalry in Industry

4.4. Industry Value Chain Analysis

5. GLOBAL ELECTROSTATIC PRECIPITATOR MARKET, BY TYPE 5.1. Introduction

5.2. Plate Wire

5.3. Flat Plate

5.4. Wet

5.5. Two-stage

6. GLOBAL ELECTROSTATIC PRECIPITATOR MARKET, BY END-USERS 6.1. Introduction

6.2. Power Generation

6.3. Chemicals

6.4. Metal

6.5. Cement

6.6. Manufacturing

6.7. Others

7. GLOBAL ELECTROSTATIC PRECIPITATOR MARKET, BY GEOGRAPHY7.1. Introduction

7.2. North America

7.2.1. United States

7.2.2. Canada

7.2.3. Mexico

7.3. South America

7.3.1. Brazil

7.3.2. Argentina

7.3.3. Others

7.4. Europe

7.4.1. United Kingdom

7.4.2. Germany

7.4.3. France

7.4.4. Spain

7.4.5. Others

7.5. Middle East and Africa

7.5.1. Saudi Arabia

7.5.2. UAE

7.5.3. Israel

7.5.4. Others

7.6. Asia Pacific

7.6.1. China

7.6.2. Japan

7.6.3. India

7.6.4. South Korea

7.6.5. Others

8. COMPETITIVE ENVIRONMENT AND ANALYSIS8.1. Major Players and Strategy Analysis

8.2. Emerging Players and Market Lucrativeness

8.3. Mergers, Acquisition, Agreements, and Collaborations

8.4. Vendor Competitiveness Matrix

9. COMPANY PROFILES 9.1. Hamon group

9.2. Mitsubishi Hitachi Power Systems

9.3. Envitech

9.4. General Electric

9.5. Trion IAQ

9.6. Sumitomo Heavy Industries

9.7. Babcock & Wilcox Enterprises

9.8. John Wood Group PLC

9.9. Thermax Limited

9.10. Beltran Technologies Inc.

Companies Mentioned

- Hamon group

- Mitsubishi Hitachi Power Systems

- Envitech

- General Electric

- Trion IAQ

- Sumitomo Heavy Industries

- Babcock & Wilcox Enterprises

- John Wood Group PLC

- Thermax Limited

- Beltran Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | March 2022 |

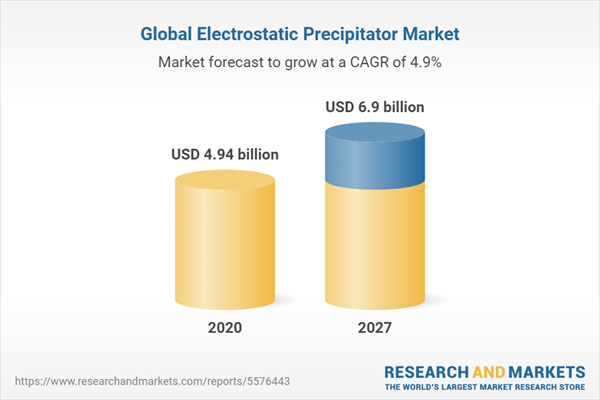

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 4.94 billion |

| Forecasted Market Value ( USD | $ 6.9 billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |