Immunoassays are bioanalytical methods that employ antigen-antibody affinity to identify and quantify molecules of interest in biological samples. They are quick and accurate tests performed in the lab for the identification of particular substances.

The increase in the cases of chronic illnesses such as cancer, diabetes, cardiovascular, and autoimmune diseases is mostly responsible for the immunoassays market growth as they are important in early diagnosis and monitoring for improved disease management.

The global prevalence of diabetes for the adult (20-79 years) age group is projected to increase to 643 million by 2030, as per the estimates provided by the International Diabetes Federation (IDF). The number is projected to rise to 783 million by 2045, which was around 537 million in 2021. The statistics portray that there will be an increasing need for early diagnosis and apparent detection devices; hence, the requirement for immunoassay will grow in the future.

Additionally, the increasing prevalence and incidence of infectious diseases are fuelling the market growth. As per the World Health Organization data released in May 2024, the burden of healthcare-associated infections and antimicrobial resistance is substantial, with more than 24% of patients with sepsis, 52.3% of patients in the intensive care unit dying every year, and patients with antimicrobial-resistant infections increasing two to three times the death rates.

In addition, public health education campaigns focusing on recognizing the signs of different infectious diseases and how to take precautions against them help in the growing of public awareness and the management of other diseases. This increased patient awareness is expected to lead to high demand for immunoassays.

Immunoassay market growth drivers

Increasing Prevalence of Chronic Diseases

There has been an increase in the number of individuals suffering from chronic diseases such as cancer and diabetes, among others. Due to this, there has been a growth in the necessity of immunoassay devices that are used to detect a particular biomarker in a patient. The International Agency for Research on Cancer (IARC) provided statistics on absolute new cases of cancer and cancer incidence in global regions in 2022. In Asia, there was an incidence of 9.826 million cancers, which accounted for the highest number of cases, which was 49.2% of total incidences. Followed by Europe at 22.4% with 4.471 million cancer cases and Northern America at 13.4%, that is, 2.673 million cases of cancers. Immunoassays are essential in the collection of chronic illness biomarkers to improve the treatment management of patients. These assist in medicine personalization, where patients' treatment plans are designed according to their disease condition, followed by monitoring treatment response and modification of the treatment strategy after the disease diagnosis.Immunoassay market geographical outlook:

The Asia-Pacific region is expected to witness significant growth in the immunoassay market.Asia-Pacific is poised to hold a prominent position in the immunoassay market, particularly due to its growing investment in robust healthcare infrastructure and the increasing prevalence of chronic diseases. The Japanese immunoassay market is displaying stable growth. Its growth has been characterized by an aging population, a high prevalence of chronic diseases, and increased demand for early diagnostic tools. Japan boasts some of the world's best healthcare infrastructure and quality care, with implementations of immunoassay technologies widespread in most of its hospitals, clinics, and research institutions. The proportion of Japan's elderly population, representing a percentage of the total population, witnessed a gradual increase, reaching 28.56% in 2020, 28.86% in 2021, and 29.00% in 2022. The RUO immunoassay is an invaluable tool for research to diagnose and treat this growing chronic disease ailment in the population.

Further major developments such as Sysmex Corporation, headquartered in Kobe, Japan, and Fujirebio Holdings, Inc., headquartered in Tokyo, Japan, agreed on a business collaboration in October 2023. This agreement enhances their collaboration in various areas, including research and development, production, clinical development, and sales-marketing within the immunoassay field. Additionally, they have agreed on a supply agreement for reagents and raw materials specifically for immunoassay applications. Both companies will leverage their expertise and capabilities in immunoassay, which expedites their global growth and contributes significantly to advancing this field of diagnostics.

With the advancement of ultrasensitive technologies, the demand is increasing, particularly in the neurology infectious disease sector and oncology testing. The higher sensitivity enables, the discovery of new markers at lower levels in all fields, detection, and diagnosis. Hence, in the projected period, with the development of new and innovative product launches, the market for immunoassay is expected to propel.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The Immunoassay Market is analyzed into the following segments:

By Type

- Radioimmunoassay (RIA)

- Enzyme Immunoassay or Enzyme-linked Immunosorbent Assays (ELISA)

- Counting Immunoassay (CIA)

- Fluoroimmunoassay (FIA)

- Chemiluminescence Immunoassay (CLIA)

By Therapeutic Area

- Infectious Diseases

- Bone Metabolism

- Immunology

- Neurobiology

- Others

By End-User

- Hospitals & Clinics

- Diagnostics

- Pharmaceutical & Biotechnology Companies

- Research & Academic Laboratories

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- Fujirebio

- QuidelOrtho Corporation

- Roche Diagnostics

- Immunodiagnostic Systems

- Arbor Assays

- Beckman Coulter Inc.

- ImmunoReagents Inc.

- Abbott

- Mercodia AB

- Thermo Fisher Scientific

- Siemens Healthineers

- Bio-Rad Laboratories

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | December 2024 |

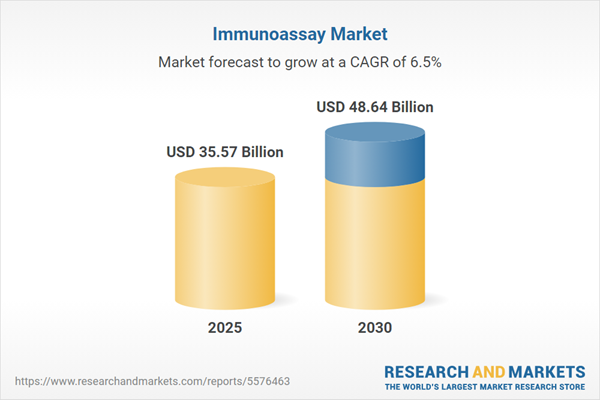

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 35.57 Billion |

| Forecasted Market Value ( USD | $ 48.64 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |