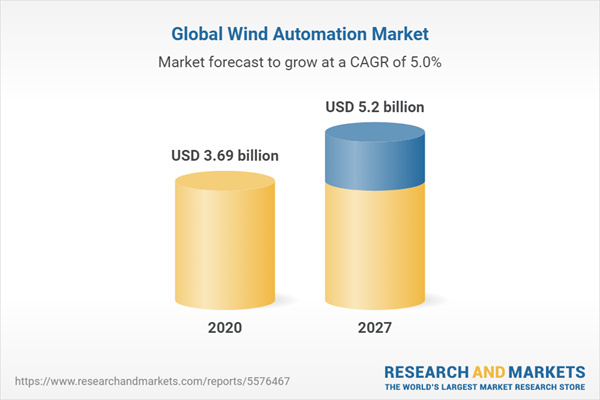

The global wind automation market is expected to grow at a compound annual growth rate of 5.01% over the forecast period to reach a market size of US$5.196 billion in 2027 from US$3.689 billion in 2020.

Wind farms are usually located in harsh environments, where they are subject to shock, vibration, dust, humidity, and extreme temperatures. To efficiently generate, distribute and manage power, Wind automation products include all of the tools needed to build a highly reliable industrial-grade network infrastructure. The strict quality control and fan-less design of the new product launches help prevent system failures and provide convenient installation and maintenance for power plant management, power distribution, and communication control in electrical systems. Human Machine Interface (HMI) systems are used to provide energy analysis and control, allowing users to take actions to better manage energy. In a wind farm, the distance between wind turbine towers may be several miles apart, and wind turbines are susceptible to electrical interference. Wind farms must use robust network equipment with long-distance transmission capabilities for remote monitoring in harsh environments. The remote monitoring system is used to collect and sort data generated by wind turbine towers and substations so that users in the control centre can accurately control the operation of the wind farm. The control centre manages the power state and integrates different types of power plants.

The growing digital transformation trend, along with rising R&D spending, is expected to be the major factor propelling the growth of the global wind automation market. As the demand for renewable energy continues to grow, government authorities around the world have taken steps to increase renewable energy production, contributing greatly to the growth of the global market for wind power automation. Other factors that further drive the demand for wind power automation are stringent low-carbon regulations, a better return on investment, and increased awareness of green energy. The Biden administration’s Department of the Interior announced the expansion of its offshore wind farms in the Atlantic, off the coasts of Massachusetts and the Carolinas, and in the Gulf of Mexico.

On the flip side, high capital requirements along with stringent government regulations regarding offshore installations are expected to act as restraints to this market’s growth.

One of the main factors driving the growth of the global wind energy automation market is the rising demand for renewable energy. According to the IEA, the demand for renewable energy has increased by 3% in 2020. The share of renewable energy in global electricity demand was estimated to be around 27% in 2019, which has increased and jumped to 29% in 2020. Automation in wind turbines helps in detecting the most suitable conditions for energy production, which is expected to increase the demand for automation processes such as AI, IoT, and data analytics in wind turbines. Automated devices help in controlling and detecting the working conditions of the equipment remotely in real-time, which ultimately reduces the operational cost and lowers the dependency on available fossil fuels, which are limited in nature. Efficiency is the major restraint on generating renewable energy, but with the help of smart automated devices, companies are easily implementing automated controls that help in improving efficiency while generating electricity. Amazon, the online retail giant, has announced the development of 18 new wind and solar energy projects in the United States, Germany, Italy, Spain, and the United Kingdom.It has 274 renewable projects around the world and plans to use renewable energy to power 100 percent of its business operations by 2025.

Another factor propelling this growth is the increase in spending for R & D. According to the IEA, in 2019, world government energy R & D spending increased by 3% to the US $ 30 billion, of which approximately 80% was used for low-carbon energy technologies. Although the growth rate in 2019 is lower than in the previous two years, it is still above the annual average since 2014. China's low-carbon energy R&D content increased by 10% in 2019, especially in efficiency energy and hydrogen energy R&D. In Europe and the United States, public energy R & D spending in both economies has increased by 7%, which is higher than the recent annual trend. 24 major countries and the European Commission pledged in 2015 to double public investment in clean energy research and development within five years under the Mission's Innovation Initiative. This is to increase public spending on energy research and development and bring it closer to the need for decarbonization. consistent. Since then, major economies' governments have increased their investment in energy research, and some countries, such as India, have clarified the link between their R&D activities and members of their innovation mission.

The COVID-19 pandemic, however, is expected to act as a restraint to this market’s growth, owing to the pandemic scenario, several countries around the world went into lockdown, which completely disrupted the supply chain. Also, work stoppages, labour shortages, and preventive quarantines to curb the spread of the virus are expected to have a negative impact on the market.

The increasing demand for global wind automation solutions has led to the entry of several new players into the global wind automation market. To increase their clientele as well as increase their market share in the upcoming years, many of these market players have taken various strategic actions like partnerships and the development of novel solutions, which are expected to keep the market competitive and constantly evolving. Major market players like Siemens AG, Rockwell Automation, Inc., and Bachmann Electronic GmbH, among others, have been covered along with their relative competitive strategies. The report also mentions recent deals and investments by different market players over the last few years.

Introduction

Wind farms are usually located in harsh environments, where they are subject to shock, vibration, dust, humidity, and extreme temperatures. To efficiently generate, distribute and manage power, Wind automation products include all of the tools needed to build a highly reliable industrial-grade network infrastructure. The strict quality control and fan-less design of the new product launches help prevent system failures and provide convenient installation and maintenance for power plant management, power distribution, and communication control in electrical systems. Human Machine Interface (HMI) systems are used to provide energy analysis and control, allowing users to take actions to better manage energy. In a wind farm, the distance between wind turbine towers may be several miles apart, and wind turbines are susceptible to electrical interference. Wind farms must use robust network equipment with long-distance transmission capabilities for remote monitoring in harsh environments. The remote monitoring system is used to collect and sort data generated by wind turbine towers and substations so that users in the control centre can accurately control the operation of the wind farm. The control centre manages the power state and integrates different types of power plants.

Market Trends

The growing digital transformation trend, along with rising R&D spending, is expected to be the major factor propelling the growth of the global wind automation market. As the demand for renewable energy continues to grow, government authorities around the world have taken steps to increase renewable energy production, contributing greatly to the growth of the global market for wind power automation. Other factors that further drive the demand for wind power automation are stringent low-carbon regulations, a better return on investment, and increased awareness of green energy. The Biden administration’s Department of the Interior announced the expansion of its offshore wind farms in the Atlantic, off the coasts of Massachusetts and the Carolinas, and in the Gulf of Mexico.

On the flip side, high capital requirements along with stringent government regulations regarding offshore installations are expected to act as restraints to this market’s growth.

Growth Factors

Growing demand for renewable energy

One of the main factors driving the growth of the global wind energy automation market is the rising demand for renewable energy. According to the IEA, the demand for renewable energy has increased by 3% in 2020. The share of renewable energy in global electricity demand was estimated to be around 27% in 2019, which has increased and jumped to 29% in 2020. Automation in wind turbines helps in detecting the most suitable conditions for energy production, which is expected to increase the demand for automation processes such as AI, IoT, and data analytics in wind turbines. Automated devices help in controlling and detecting the working conditions of the equipment remotely in real-time, which ultimately reduces the operational cost and lowers the dependency on available fossil fuels, which are limited in nature. Efficiency is the major restraint on generating renewable energy, but with the help of smart automated devices, companies are easily implementing automated controls that help in improving efficiency while generating electricity. Amazon, the online retail giant, has announced the development of 18 new wind and solar energy projects in the United States, Germany, Italy, Spain, and the United Kingdom.It has 274 renewable projects around the world and plans to use renewable energy to power 100 percent of its business operations by 2025.

Increased spending on R & D

Another factor propelling this growth is the increase in spending for R & D. According to the IEA, in 2019, world government energy R & D spending increased by 3% to the US $ 30 billion, of which approximately 80% was used for low-carbon energy technologies. Although the growth rate in 2019 is lower than in the previous two years, it is still above the annual average since 2014. China's low-carbon energy R&D content increased by 10% in 2019, especially in efficiency energy and hydrogen energy R&D. In Europe and the United States, public energy R & D spending in both economies has increased by 7%, which is higher than the recent annual trend. 24 major countries and the European Commission pledged in 2015 to double public investment in clean energy research and development within five years under the Mission's Innovation Initiative. This is to increase public spending on energy research and development and bring it closer to the need for decarbonization. consistent. Since then, major economies' governments have increased their investment in energy research, and some countries, such as India, have clarified the link between their R&D activities and members of their innovation mission.

COVID-19's Impact on the Wind Automation Market:

The COVID-19 pandemic, however, is expected to act as a restraint to this market’s growth, owing to the pandemic scenario, several countries around the world went into lockdown, which completely disrupted the supply chain. Also, work stoppages, labour shortages, and preventive quarantines to curb the spread of the virus are expected to have a negative impact on the market.

Competitive Insights

The increasing demand for global wind automation solutions has led to the entry of several new players into the global wind automation market. To increase their clientele as well as increase their market share in the upcoming years, many of these market players have taken various strategic actions like partnerships and the development of novel solutions, which are expected to keep the market competitive and constantly evolving. Major market players like Siemens AG, Rockwell Automation, Inc., and Bachmann Electronic GmbH, among others, have been covered along with their relative competitive strategies. The report also mentions recent deals and investments by different market players over the last few years.

Market Segmentation:

By Product

- Synthetic fibres

- Supervisory Control and Data Acquisition (SCADA)

- Programmable Logic Controller (PLC)

- Distributed Control System (DCS)

- Geared Motors & Drives

By Deployment

- Onshore Wind Farms

- Offshore Wind Farms

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- Italy

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

1. Introduction1.1. Market Definition1.2. Market Segmentation

2. Research Methodology2.1. Research Data

2.2. Assumptions

3. Executive Summary3.1. Research Highlights

4. Market Dynamics4.1. Market Drivers

4.2. Market Restraints

4.3. Porters Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. The threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Function

4.4. Function Value Chain Analysis

5. Global Wind Automation Market Analysis, By Product5.1. Introduction

5.2. Synthetic fibres

5.3. Supervisory Control and Data Acquisition (SCADA)

5.4. Programmable Logic Controller (PLC)

5.5. Distributed Control System (DCS)

5.6. Geared Motors & Drives

6. Global Wind Automation Market Analysis, By Deployment6.1. Introduction

6.2. Onshore Wind Farms

6.3. Offshore Wind Farms

7. Global wWind Automation Market Analysis, By Geography 7.1. Introduction

7.2. North America

7.2.1. United States

7.2.2. Canada

7.2.3. Mexico

7.3. South America

7.3.1. Brazil

7.3.2. Argentina

7.3.3. Others

7.4. Europe

7.4.1. UK

7.4.2. Germany

7.4.3. Italy

7.4.4. Spain

7.4.5. Others

7.5. Middle East and Africa

7.5.1. Israel

7.5.2. Saudi Arabia

7.5.3. Others

7.6. Asia Pacific

7.6.1. China

7.6.2. Japan

7.6.3. India

7.6.4. Australia

7.6.5. South Korea

7.6.6. Taiwan

7.6.7. Thailand

7.6.8. Indonesia

7.6.9. Others

8. Competitive Environment and Analysis8.1. Major Players and Strategy Analysis

8.2. Emerging Players and Market Lucrativeness

8.3. Mergers, Acquisitions, Agreements, and Collaborations

8.4. Vendor Competitiveness Matrix

9. Company Profiles.9.1. Siemens AG

9.2. Rockwell Automation, Inc.

9.3. Bachmann Electronic GmbH

9.4. ABB

9.5. Schneider Electric

9.6. Emerson Electric Co.

9.7. Bonfiglioli Riduttori S.P.A.

9.8. Mitsubishi Electric Corporation

9.9. Honeywell Corporation

9.10. Yokogawa Electric Corporation

Companies Mentioned

- Siemens AG

- Rockwell Automation, Inc.

- Bachmann Electronic GmbH

- ABB

- Schneider Electric

- Emerson Electric Co.

- Bonfiglioli Riduttori S.P.A.

- Mitsubishi Electric Corporation

- Honeywell Corporation

- Yokogawa Electric Corporation

- Top of Form

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | March 2022 |

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 3.69 billion |

| Forecasted Market Value ( USD | $ 5.2 billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |