Veterinary Healthcare Market Analysis:

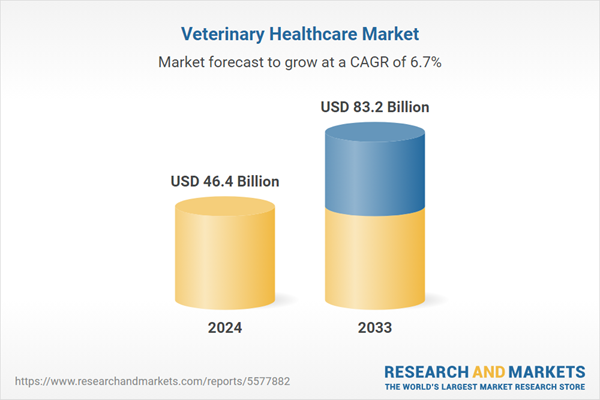

Market Growth and Size: The domain of veterinary healthcare is currently undergoing a substantial phase of growth, attributed to the increasing trend of pet ownership and a heightened collective consciousness regarding animal health. This sector's expansion is significantly propelled by innovative strides in veterinary diagnostics and therapeutic interventions, establishing it as an appealing avenue for investment and entrepreneurial ventures.Major Market Drivers: Central to the market's momentum are the escalating incidences of zoonotic diseases, which amplify the necessity for comprehensive animal healthcare services. Moreover, the expansion of the pet insurance industry alongside a surge in expenditures on pet care underscores an evolving societal valorization of animal welfare.

Key Market Trends: Emerging trends within this market are notably characterized by the integration of telemedicine and mobile technologies, which are redefining the accessibility and efficiency of veterinary care through remote consultation capabilities and continuous health monitoring. The industry is also witnessing a gradual pivot towards individualized pet nutrition and preemptive healthcare solutions, reflecting an overarching shift towards more tailored and all-encompassing animal health care strategies.

Geographical Trends: Geographically, the landscape of the market is intensely competitive, with key entities focusing on strategic mergers, acquisitions, and collaborations to broaden their operational scope and enrich their portfolio of offerings. Innovations in pharmaceuticals and vaccines, coupled with advancements in diagnostic technologies, are crucial strategies employed by these corporations to secure a competitive stance and adapt to the dynamic requisites of animal healthcare.

Competitive Landscape: The competitive milieu is delineated by the strategic initiatives of prominent firms, including substantial investments in research and development, strategic partnerships, and ventures into new markets, all aimed at augmenting their product arrays and fortifying their market dominance.

Challenges and Opportunities: Notwithstanding, the sector is confronted with challenges such as the prohibitive costs associated with veterinary services and the inconsistency in global animal health regulations, which could potentially restrict market growth. Conversely, the escalating prevalence of animal ailments and the unexplored markets in burgeoning economies present significant prospects for the sector's enlargement and the advent of innovative veterinary healthcare solutions.

Veterinary Healthcare Market Trends:

Increasing prevalence of various zoonotic, food-borne, and chronic diseases

As zoonotic diseases (those that can be transmitted from animals to humans) continue to be a global health concern, pet owners and livestock farmers are increasingly seeking veterinary services. This surge in demand includes routine check-ups, vaccinations, and the diagnosis and treatment of illnesses in animals, both for the health of the animals themselves and to mitigate the risk of disease transmission to humans. Moreover, the rising incidence of chronic diseases, such as cancer in pets, has fueled the demand for advanced diagnostics and therapeutic treatments. Veterinary healthcare providers are increasingly using advanced medical technologies and pharmaceuticals to diagnose and manage these diseases effectively. This, in turn, drives growth in the market for veterinary diagnostics and therapeutics.Rising concerns of pet owners toward animal health

Pet owners who are more concerned about their animals' health are more likely to seek preventive veterinary care. This includes regular check-ups, vaccinations, dental care, and parasite control. The heightened awareness of the importance of preventive measures has led to a rise in the utilization of veterinary services, driving revenue in the industry. Moreover, concerned pet owners may seek out specialized veterinary services such as cardiology, dermatology, and oncology to address specific health issues in their pets. This trend has led to the expansion of veterinary specialties, creating additional revenue streams within the market. Besides, the rising concern for animal health has also led to an increase in the adoption of pet insurance. Pet owners are more likely to invest in insurance policies that cover veterinary expenses. This provides financial security and allows pet owners to pursue necessary healthcare without hesitation, further boosting the veterinary healthcare market.Introduction of veterinary health information systems

VHIS enables veterinarians to access comprehensive and up-to-date medical records for individual animals quickly. This means better-informed diagnoses and treatment plans. By having a complete history of an animal's health readily available, veterinarians can make more accurate decisions, leading to improved patient outcomes. Moreover, VHIS allows for the collection and analysis of health data in real-time. This capability is especially valuable for tracking disease outbreaks and patterns. By identifying health issues early and monitoring disease trends, veterinarians and public health officials can respond more effectively to emerging threats, including zoonotic diseases that can affect both animals and humans. Besides, VHIS facilitates communication and collaboration among veterinary professionals. It enables sharing of patient data, images, and test results securely, which can be invaluable for consulting with specialists or seeking second opinions. This interconnectedness among professionals can lead to more comprehensive and effective care for animals, thus propelling the market.Veterinary Healthcare Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global veterinary healthcare market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, animal type, and end user.Breakup by Product:

- Therapeutics

- Vaccines

- Parasiticides

- Anti-Infectives

- Medical Feed Additives

- Others

- Diagnostics

- Immunodiagnostic Tests

- Molecular Diagnostics

- Diagnostic Imaging

- Clinical Chemistry

- Others

Therapeutics represent the most used products

The report has provided a detailed breakup and analysis of the market based on the product. This includes therapeutics (vaccines, parasiticides, anti-infectives, medical feed additives, and others) and diagnostics (immunodiagnostic tests, molecular diagnostics, diagnostic imaging, clinical chemistry, and others). According to the report, therapeutics represented the largest segment.Therapeutics are primarily used to treat various health conditions in animals. This includes medications and treatments for infectious diseases, chronic illnesses, injuries, and other medical issues. Veterinary therapeutics are essential for alleviating suffering and improving the quality of life for animals in need of medical care. Moreover, therapeutics also encompass preventive treatments such as vaccines and parasite control products. These are administered to animals to prevent diseases and health problems from occurring in the first place. Preventive therapeutics play a crucial role in maintaining the overall health of animals and reducing the spread of diseases. Besides, certain health issues in animals are quite common and require ongoing treatment. For instance, conditions like arthritis, allergies, and dental problems are frequently encountered in pets. Therapeutic products provide ongoing relief and management for these common ailments.

Breakup by Animal Type:

- Dogs and Cats

- Horses

- Ruminants

- Swine

- Poultry

- Others

Dogs and cats category includes veterinary healthcare services, treatments, and products specifically designed for dogs and cats, which are among the most common domestic pets. It encompasses routine check-ups, vaccinations, surgeries, medications, and preventive care for these beloved companion animals.

Ruminants are a group of mammals that includes animals like cattle, sheep, and goats. Veterinary healthcare for ruminants involves herd health management, reproductive services, nutrition assessment, and treatment of diseases and conditions affecting these animals, which are often raised for meat, milk, and wool.

Swine veterinary healthcare is directed at the health and well-being of pigs, which are primarily raised for pork production. Services in this category include disease prevention, vaccination programs, nutrition analysis, and treatment of swine-specific health issues.

Poultry healthcare focuses on the health and management of birds raised for meat and egg production. This category includes services like disease control, vaccination, nutritional guidance, and addressing various poultry-related health concerns to ensure the quality and safety of poultry products.

Breakup by End User:

- Veterinary Hospitals

- Veterinary Clinics

- Veterinary Laboratory Testing Services

- Others

Veterinary hospitals accounts for the majority of market share

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes veterinary hospitals, veterinary clinics, veterinary laboratory testing services, and others. According to the report, veterinary hospitals accounted for the largest market share.Veterinary hospitals are equipped to provide a wide range of services under one roof. This includes routine check-ups, surgeries, diagnostic imaging, laboratory testing, dental care, and emergency services. The ability to offer comprehensive care makes veterinary hospitals a one-stop solution for pet owners, which is convenient and reassuring. Moreover, many veterinary hospitals have specialists on staff, such as surgeons, dermatologists, and cardiologists. This enables them to handle complex cases and offer specialized treatments that may not be available in smaller clinics. Pet owners are often willing to seek out veterinary hospitals for access to these specialized services.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America has one of the highest rates of pet ownership in the world. Dogs, cats, and other companion animals are integral parts of many households in the region. This large pet population drives the demand for veterinary services and healthcare products. The veterinary healthcare infrastructure in North America is highly developed. It boasts a vast network of veterinary hospitals, clinics, and specialized centers equipped with state-of-the-art medical technology and highly trained professionals. This advanced infrastructure attracts pet owners seeking the best care for their animals. Besides, pet owners in North America tend to prioritize the wellness and health of their animals. This includes preventive care, routine check-ups, vaccinations, and nutritional guidance. The emphasis on proactive healthcare contributes to a steady demand for veterinary services.

Leading Key Players in the Veterinary Healthcare Industry:

The competitive landscape of the market is characterized by the presence of multiple players that include established brands, emerging startups, and specialty manufacturers. Presently, leading companies are investing in research and development to create innovative veterinary healthcare products. This includes the development of new pharmaceuticals, vaccines, diagnostic tools, and medical devices that offer improved efficacy, safety, and convenience for both veterinarians and pet owners. They are also forming strategic alliances and collaborations with other organizations, including veterinary hospitals, research institutions, and pharmaceutical manufacturers for the development of new products, joint research projects, and expanded distribution networks. Besides, some companies are investing in training and educational programs for veterinarians and veterinary technicians to build relationships with the veterinary community and ensure that professionals are well-versed in using their products and technologies.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Animalcare Group plc

- Boehringer Ingelheim International GmbH (C. H. Boehringer Sohn AG & Co. KG)

- Ceva Animal Health LLC

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Heska Corporation

- IDEXX Laboratories Inc.

- INDICAL Bioscience GmbH (Vimian Group)

- Merck & Co. Inc.

- Norbrook Laboratories Ltd

- Vetoquinol India Animal Health Pvt Ltd (Vétoquinol S.A.)

- Virbac

- Zoetis Inc.

Key Questions Answered in This Report

1. How big is the global veterinary healthcare market?2. What is the expected growth rate of the global veterinary healthcare market during 2025-2033?

3. What are the key factors driving the global veterinary healthcare market?

4. Which region accounts for the largest veterinary healthcare market share?

5. Who are the key players/companies in the global veterinary healthcare market?

Table of Contents

Companies Mentioned

- Animalcare Group plc

- Boehringer Ingelheim International GmbH (C. H. Boehringer Sohn AG & Co. KG)

- Ceva Animal Health LLC

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Heska Corporation

- IDEXX Laboratories Inc.

- INDICAL Bioscience GmbH (Vimian Group)

- Merck & Co. Inc.

- Norbrook Laboratories Ltd

- Vetoquinol India Animal Health Pvt Ltd (Vétoquinol S.A.)

- Virbac

- Zoetis Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 46.4 Billion |

| Forecasted Market Value ( USD | $ 83.2 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |