LED street lights are rapidly transforming urban landscapes, owing to their superior energy efficiency and extended lifespan compared to traditional lighting solutions. These modern luminaires often last up to 50,000 hours or more, significantly reducing maintenance and replacement costs. LED street lights offer better illumination, providing a brighter, more uniform light distribution that enhances visibility and safety for both pedestrians and drivers. They are compatible with smart city technologies, including IoT sensors and advanced control systems, allowing for intelligent management of urban lighting. Moreover, they align with environmental sustainability goals, as they are free from hazardous materials like mercury and emit fewer greenhouse gases. These numerous advantages make LED street lights an increasingly popular choice for municipalities.

The rising concern for energy efficiency and reduced carbon emissions represents one of the key factors driving the market growth. In addition to this, innovations like smart grids and IoT are contributing to the LED street light market growth. Moreover, the rising demand for safer, well-lit public spaces and the limited availability of cost-effective, long-lasting lighting solutions are highlighting the indispensability of LED street lights in urban planning. In this vein, these lights are crucial for improving night-time visibility and security, matching growing municipal needs for reliable and sustainable lighting options. Furthermore, the proliferation of online retail for electrical components and government incentives to replace traditional lighting are fueling market expansion. Additional dynamics such as the integration with smart city frameworks, the preference for programmable, adaptive lighting solutions, and an intensified focus on products compliant with international quality standards are propelling the uptake of LED street lights worldwide.

LED Street Light Market Trends/Drivers:

Enhanced Road Safety Measures

The focus on enhanced road safety is actively propelling the LED street light market growth. These lights are becoming essential in ensuring better visibility for both drivers and pedestrians during night-time and in adverse weather conditions. As the incidents of road accidents heighten, municipalities and city planners are increasingly adopting LED street lighting systems for their superior luminosity and directional lighting capabilities. This ongoing transition is not only improving overall road safety but is also supporting governmental initiatives aimed at reducing traffic-related casualties.Integration of Smart Technology

The advent of smart cities is encouraging the incorporation of intelligent LED street lighting solutions. These lights come with features like adaptive brightness levels, real-time monitoring, and remote management. Governments are implementing these technologies to optimize energy use, enhance public safety, and facilitate urban planning. This integration aligns well with the broader objective of converting urban areas into smart cities, equipped with advanced, interconnected technologies for improved quality of life.Sustainability Goals and Cost-Effectiveness

The need for cost-effective and sustainable solutions in public infrastructure is another key driver for the adoption of LED street lights. These lights have a longer lifespan and lower operational costs compared to traditional lighting options, offering long-term economic benefits. Municipalities are acknowledging these advantages and are progressively replacing older lighting systems with LED alternatives. This is not only proving cost-effective but is also resonating with the global shift towards environmentally sustainable practices by reducing energy consumption and waste.LED Street Light Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global LED street light market report along with forecasts at the global, and country levels for 2025-2033. Our report has categorized the market based on application.Breakup by Application:

- Retrofit

- Retail & Hospitality

- Outdoor

- Offices

- Architectural

- Residential

- Industrial

Retrofit dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes retrofit, retail & hospitality, outdoor, offices, architectural, residential and industrial. According to the report, retrofit represented the largest segment.Retrofitting solutions are actively transforming existing infrastructures, offering enhanced efficiency and environmental benefits. These solutions are commonly implemented in HVAC systems, lighting, and insulation, providing avenues for considerable energy savings and improved building functionality. In the realm of lighting, retrofit kits enable easy upgrades from traditional bulbs to LEDs, offering immediate improvements in energy efficiency and lighting quality. Additionally, smart retrofit solutions are integrating seamlessly with existing home automation systems, allowing homeowners to modernize without complete overhauls. These smart systems facilitate remote monitoring and control, providing residents with enhanced convenience and operational ease. Incorporating retrofit solutions into existing structures is proving to be a cost-effective way to modernize and align with sustainable practices. This widespread application establishes retrofitting as an essential component in contemporary building management, mirroring the market research company's expertise in identifying and explaining emerging trends.

Breakup by Region:

- China

- Europe

- United States

- Japan

- Brazil

- Russia

- Other Regions

China holds the largest share in the market

A detailed breakup and analysis of the market based on the country has also been provided in the report. This includes India, China, Europe, United States, Japan, Brazil, Russia and other regions. According to the report, China accounted for the largest market share.The rising commitment to sustainable urban development in China is serving as a major propellant for the LED street light market. Moreover, continuous breakthroughs in optoelectronic engineering are producing LED street lights with advanced features such as adaptive brightness and motion sensing, thereby elevating their market appeal. In addition, the rapid pace of urbanization and infrastructure overhaul is driving the demand for reliable, long-lasting public lighting solutions, positioning LED street lights as a preferred choice. E-commerce giants and B2B platforms are also becoming instrumental in making a diverse range of LED street lighting products accessible to municipalities and contractors, thus energizing the market growth. The government's focus on reducing electricity consumption and lowering greenhouse gas emissions is facilitating the adoption of energy-efficient LED street lights, aligning with national energy conservation goals and thereby fostering a favorable market environment. Furthermore, initiatives like smart city exhibitions, as well as digital workshops on urban planning and sustainability, are collectively shaping an optimistic growth scenario for the LED street light market in China.

Competitive Landscape:

In the LED street light sector, key stakeholders are adeptly employing multiple strategies to fortify their market presence and cater to dynamic consumer needs. These entities are doubling down on R&D initiatives to develop LED street lights with smart controls, enhanced lumens per watt, and better heat dissipation characteristics. To extend their reach, these firms are entering into strategic alliances with local municipalities and contractors to facilitate the widespread adoption of LED street lights in urban and rural areas. Furthermore, these stakeholders are executing comprehensive educational initiatives that inform both government bodies and the general public about the advantages of LED street lights, including their role in enhancing public safety and contributing to smart city solutions. Several of these companies are even setting up localized assembly lines, thus supporting domestic economies and generating employment opportunities. Alongside, collaborations with regulatory agencies and involvement in public-private partnerships underline their commitment to adhering to quality standards and complying with public policies. These key players are also rapidly integrating IoT technology into their LED street light offerings, tapping into the expanding ecosystem of smart urban infrastructure. By astutely amalgamating technological advances, consumer awareness, strategic collaborations, and responsible practices, these entities are continually strengthening their role in the evolution of the LED street light market.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Philips Lighting

- Eaton Corporation PLC

- OSRAM GmbH, Pkk Lighting Inc.

- Pemco Lighting Products LLC

- Hubbell Inc.

- Cree Inc.

- GE Lighting

- XtraLight LED Lighting Solutions

- Niland Company

- NIPSCO Inc.

- Wendel, Acuity Brands

- Nichia Corporation

- Havells India Limited

Key Questions Answered in This Report

1. What is the global LED street lighting market growth ?2. What are the global LED street lighting market drivers?

3. What are the key industry trends in the global LED street lighting market?

4. What is the impact of COVID-19 on the global LED street lighting market?

5. What is the global LED street lighting market breakup by application?

6. What are the major regions in the global LED street lighting market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global LED Lighting Market

5.1 Market Overview

5.2 Market Performance

5.2.1 Volume Trends

5.2.2 Value Trends

5.3 Impact of COVID-19

5.4 LED Street Light Market

5.5 Market Breakup by Region

5.6 Market Breakup by Application

5.7 Market by LED Products: LED Lamps, Modules and Fixtures

5.7.1 Current and Historical Market Trends

5.7.2 Market Forecast

5.8 Market Forecast

5.9 SWOT Analysis

5.9.1 Overview

5.9.2 Strengths

5.9.3 Weaknesses

5.9.4 Opportunities

5.9.5 Threats

5.10 Value Chain Analysis

5.10.1 Primary Raw Materials Suppliers

5.10.2 LED Chip Manufacturers

5.10.3 LED Package and Module Manufacturers

5.10.4 Lighting Products, Electronic Products and Automotive Part Manufacturers

5.10.5 Product Distribution

5.10.6 End Users

5.11 Porter’s Five Forces Analysis

5.11.1 Overview

5.11.2 Bargaining Power of Buyers

5.11.3 Bargaining Power of Suppliers

5.11.4 Degree of Competition

5.11.5 Threat of New Entrants

5.11.6 Threat of Substitutes

5.12 Key Success and Risk Factors for LED Street Light Manufacturers

5.13 Comparative Analysis of CFL and LED

5.14 Price Analysis

5.14.1 Key Price Indicators

5.14.2 Price Structure

6 Performance of Key Regions

6.1 India

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 China

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Europe

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 United States

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Japan

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Brazil

6.6.1 Market Trends

6.6.2 Market Forecast

6.7 Russia

6.7.1 Market Trends

6.7.2 Market Forecast

6.8 Other Regions

6.8.1 Market Trends

6.8.2 Market Forecast

7 Market by Application

7.1 Retrofit

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Retail & Hospitality

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Outdoor

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Offices

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Architectural

7.5.1 Market Trends

7.5.2 Market Forecast

7.6 Residential

7.6.1 Market Trends

7.6.2 Market Forecast

7.7 Industrial

7.7.1 Market Trends

7.7.2 Market Forecast

8 Competitive Landscape

8.1 Market Structure

8.2 Market breakup by Key Players

9 LED Street Light Manufacturing Process

9.1 Product Overview and Specifications

9.2 Key Features and Advantages

9.3 Key Application Areas

9.3.1 Residential Street Lighting

9.3.2 Highways and Interchanges

9.3.3 Railway Crossings

9.3.4 Tunnels

9.3.5 Bridges

9.3.6 Housing Complexes and Warehouses

9.4 Popular Shapes and Sizes

9.5 Design Material Alternatives

9.5.1 Aluminium Die Cast Frame

9.5.2 Aluminium Die Cast Frame with Metallic Silver/Grey Finish

9.5.3 Aluminium Die Cast Frame with UV Treated Coating

9.5.4 Nylon Plastic Material Frame

9.5.5 Plastic Lens or Tempered Glass Lens

9.6 Manufacturing Process

9.7 Raw Material Requirements

9.8 Raw Material Pictures

10 Project Details, Requirements and Costs Involved

10.1 Land Requirements and Expenditures

10.2 Construction Requirements and Expenditures

10.3 Plant Machinery

10.4 Machinery Pictures

10.5 Raw Material Requirements and Expenditures

10.6 Raw Material and Final Product Pictures

10.7 Packaging Requirements and Expenditures

10.8 Transportation Requirements and Expenditures

10.9 Utility Requirements and Expenditures

10.10 Manpower Requirements and Expenditures

10.11 Other Capital Investments

11 Loans and Financial Assistance

12 Project Economics

12.1 Capital Cost of the Project

12.2 Techno-Economic Parameters

12.3 Product Pricing and Margins Across Various Levels of the Supply Chain

12.4 Taxation and Depreciation

12.5 Income Projections

12.6 Expenditure Projections

12.7 Financial Analysis

12.8 Profit Analysis

13 Key Player Profiles

List of Figures

Figure 1: Global: LED Street Light Market: Major Drivers and Challenges

Figure 2: Global: LED Lighting Market: Volume Trends (in Billion Units), 2019-2024

Figure 3: Global: LED Lighting Market: Value Trends (in Billion USD), 2019-2024

Figure 4: Global: LED Street Light Market: Sales Value (in Billion USD), 2019-2024

Figure 5: Global: LED Street Light Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 6: Global: LED Lighting Market: Breakup by Region (in %), 2024

Figure 7: Global: LED Lighting Market: Breakup by Application (in %), 2024

Figure 8: Global: LED Lamps and Modules Market: Sales Volume (in Million Units), 2019-2024

Figure 9: Global: LED Fixtures Market: Sales Volume (in Million Units), 2019-2024

Figure 10: Global: LED Lamps and Modules Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 11: Global: LED Fixtures Market Forecast: Sales Volume (in Million Units), 2025-2033

Figure 12: Global: LED Lighting Market Forecast: Volume Trends (in Billion Units), 2025-2033

Figure 13: Global: LED Lighting Market Forecast: Value Trends (in Billion USD), 2025-2033

Figure 14: LED Street Light Market: Price Structure

Figure 15: Global: LED Lighting Industry: SWOT Analysis

Figure 16: Global: LED Lighting Industry: Value Chain Analysis

Figure 17: Global: LED Lighting Industry: Porter’s Five Forces Analysis

Figure 18: India: LED Lighting Market (in Million USD), 2019-2024

Figure 19: India: LED Lighting Market Forecast (in Million USD), 2025-2033

Figure 20: China: LED Lighting Market (in Million USD), 2019-2024

Figure 21: China: LED Lighting Market Forecast (in Million USD), 2025-2033

Figure 22: Europe: LED Lighting Market (in Million USD), 2019-2024

Figure 23: Europe: LED Lighting Market Forecast (in Million USD), 2025-2033

Figure 24: United States: LED Lighting Market (in Million USD), 2019-2024

Figure 25: United States: LED Lighting Market Forecast (in Million USD), 2025-2033

Figure 26: Japan: LED Lighting Market (in Million USD), 2019-2024

Figure 27: Japan: LED Lighting Market Forecast (in Million USD), 2025-2033

Figure 28: Brazil: LED Lighting Market (in Million USD), 2019-2024

Figure 29: Brazil: LED Lighting Market Forecast (in Million USD), 2025-2033

Figure 30: Russia: LED Lighting Market (in Million USD), 2019-2024

Figure 31: Russia: LED Lighting Market Forecast (in Million USD), 2025-2033

Figure 32: Other Regions: LED Lighting Market (in Million USD), 2019-2024

Figure 33: Other Regions: LED Lighting Market Forecast (in Million USD), 2025-2033

Figure 34: Global: LED Lighting Market: Retrofit Applications (in Million USD), 2019 & 2024

Figure 35: Global: LED Lighting Market Forecast: Retrofit Applications (in Million USD), 2025-2033

Figure 36: Global: LED Lighting Market: Retail & Hospitality Applications (in Million USD), 2019 & 2024

Figure 37: Global: LED Lighting Market Forecast: Retail & Hospitality Applications (in Million USD), 2025-2033

Figure 38: Global: LED Lighting Market: Outdoor Applications (in Million USD), 2019 & 2024

Figure 39: Global: LED Lighting Market Forecast: Outdoor Applications (in Million USD), 2025-2033

Figure 40: Global: LED Lighting Market: Offices Applications (in Million USD), 2019 & 2024

Figure 41: Global: LED Lighting Market Forecast: Offices Applications (in Million USD), 2025-2033

Figure 42: Global: LED Lighting Market: Architectural Applications (in Million USD), 2019 & 2024

Figure 43: Global: LED Lighting Market Forecast: Architectural Applications (in Million USD), 2025-2033

Figure 44: Global: LED Lighting Market: Residential Applications (in Million USD), 2019 & 2024

Figure 45: Global: LED Lighting Market Forecast: Residential Applications (in Million USD), 2025-2033

Figure 46: Global: LED Lighting Market: Industrial Applications (in Million USD), 2019 & 2024

Figure 47: Global: LED Lighting Market Forecast: Industrial Applications (in Million USD), 2025-2033

Figure 48: Global: LED Lighting Market: Breakup by Key Players (in %), 2024

Figure 49: LED Street light Manufacturing Plant: Various Types of Operation Involved

Figure 50: LED Street light Manufacturing Plant: Conversion Rate of Products

Figure 51: LED Street light Manufacturing Plant: Breakup of Capital Costs (in %)

Figure 52: LED Street light Manufacturing Industry: Profit Margins at Various Levels of the Supply Chain

Figure 53: LED Street light Manufacturing Plant: Manufacturing Cost Breakup (in %)

List of Tables

Table 1: Global: LED Lighting Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: LED Lighting Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 3: Global: LED Lighting Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: Global: LED Lighting Market: Competitive Structure

Table 5: Global: LED Lighting Market: Key Players

Table 6: Comparison of LEDs with Compact Fluorescent Lamps (Based on Energy Efficiency and Environmental Impact)

Table 7: Comparison of LEDs and Compact Fluorescent Lamps (Based on Luminous Flux)

Table 8: LED Street Light Manufacturing: Suppliers of Raw Materials and Delivery Timeline

Table 9: LED Street light Manufacturing Plant: Costs Related to Land and Site Development (in USD)

Table 10: LED Street light Manufacturing Plant: Costs Related to Civil Works (in USD)

Table 11: LED Street light Manufacturing Plant: Costs Related to Machinery (in USD)

Table 12: LED Street light Manufacturing Plant: Raw Material Requirements (in Units/Day) and Expenditures (in USD/Unit)

Table 13: LED Street light Manufacturing Plant: Outer Packaging Requirements and Expenditure (in USD/Unit)

Table 14: LED Street light Manufacturing Plant: Inner Packaging Requirements and Expenditure (in USD/Unit)

Table 15: LED Street light Manufacturing Plant: Transportation Expenditure (in USD/Unit)

Table 16: LED Street light Manufacturing Plant: Costs Related to Utilities (in USD)

Table 17: LED Street light Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

Table 18: LED Street light Manufacturing Plant: Costs Related to Other Capital Investments (in USD)

Table 19: Details of Financial Assistance Offered by Financial Institutions

Table 20: LED Street light Manufacturing Plant: Capital Costs (in USD)

Table 21: LED Street light Manufacturing Plant: Taxation and Depreciation (in USD)

Table 22: LED Street light Manufacturing Plant: Income Projections (in USD)

Table 23: LED Street light Manufacturing Plant: Expenditure Projections (in USD)

Table 24: LED Street light Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability (in USD)

Table 25: LED Street light Manufacturing Plant: Cash Flow Analysis on Considering the Income Tax Liability (in USD)

Table 26: LED Street light Manufacturing Plant: Profit and Loss Account (in USD)

Companies Mentioned

- Philips Lighting

- Eaton Corporation PLC.

- OSRAM GmbH

- Pkk Lighting Inc.

- Pemco Lighting Products LLC

- Hubbell Inc.

- Cree Inc.

- GE Lighting

- XtraLight LED Lighting Solutions

- Niland Company

- NIPSCO Inc.

- Wendel

- Acuity Brands.

- Nichia Corporation.

- Havells India Limited etc.

Table Information

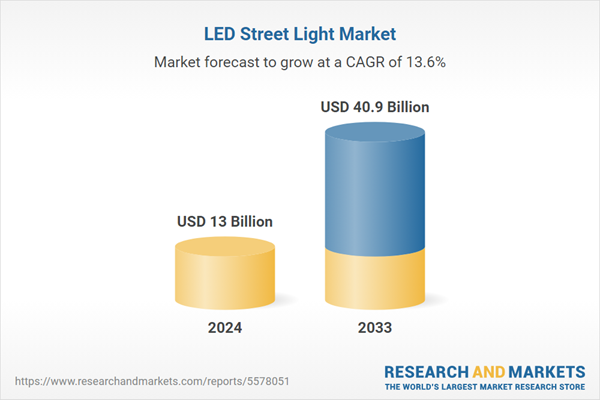

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 13 Billion |

| Forecasted Market Value ( USD | $ 40.9 Billion |

| Compound Annual Growth Rate | 13.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |