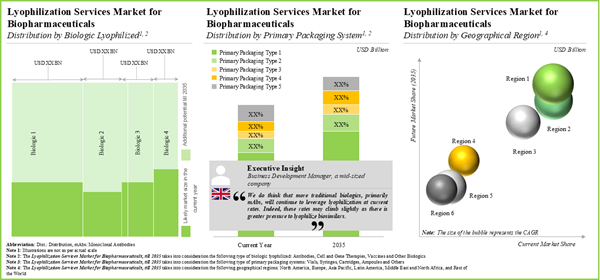

The global lyophilization services market is estimated to grow from USD 2.6 billion in 2025 to USD 4.9 billion by 2035, at a CAGR of 6.3% during the forecast period to 2035.

Lyophilization Services Market: Growth and Trends

Lyophilization is a drug stabilization technique that involves removing excess solvents, such as water, through freeze-drying while preserving the chemical properties of the substance. Notably, lyophilization utilizes specialized equipment, including laboratory freeze dryers, non-sterile freeze dryers, and sterilizable lyophilizers. It is worth highlighting that over the years, lyophilization has emerged as the preferred approach to achieve longer and commercially viable shelf lives, enabling stable and dry biopharmaceutical formulations. However, characterized by a rapidly growing pipeline of biosimilars and novel biologics, and the existing challenges associated with lyophilization of biotherapeutics, stakeholders are increasingly relying on service providers that offer multidisciplinary expertise in this domain.

In addition, several market leaders are accelerating their research for lyophilization technology advancements and innovations to improve working efficiency and achieve process control during the drying process. This has resulted in improved productivity and efficiency of the overall process. For instance, latest technologies, such as continuous freeze-drying systems and automated lyophilization systems, are encouraging industrial leaders to adopt these technologies and meet the customized lyophilization services requirements of clients.

Lyophilization Services Market: Key Insights

The report delves into the current state of the lyophilization services market and identifies potential growth opportunities within industry.

Some key findings from the report include:

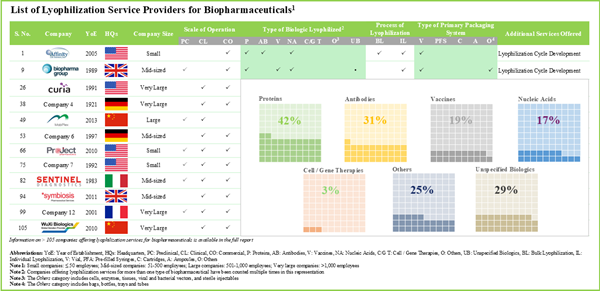

- Presently, over 105 service providers claim to have the required expertise to offer lyophilization services for a variety of biotherapeutics, including proteins, antibodies, nucleic acids and cell / gene therapies.

- The current market landscape is highly fragmented, featuring the presence of both new entrants and established players based in key geographical regions.

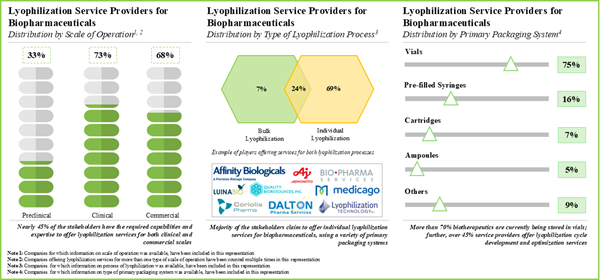

- Leveraging their expertise, stakeholders are offering lyophilization services at different scales of operation; further, vials emerged as the preferred choice of primary packaging system for storing biologics.

- In order to successfully navigate the evolving regulatory landscape, service providers are expanding their portfolios to cater to customized requests of their clients.

- The growing interest in this domain is evident from the rise in partnership activity; in fact, the maximum number of collaborations related to lyophilization of biopharmaceuticals were signed in the past two years.

- To keep pace with the growing demand, many companies have undertaken expansion initiatives, such as establishing new facilities or expanding their existing capabilities, to strengthen their service portfolio.

- The market is expected to grow at a steady rate till 2035; the projected opportunity is anticipated to be well distributed across various types of biologic lyophilized, primary packaging systems and geographical regions.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Biologic Lyophilized

- Antibodies

- Cells and Gene Therapies

- Vaccines

- Other Biologics

Type of Primary Packaging System

- Vials

- Syringes

- Cartridges

- Ampoules

- Others

Key Geographies

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

Lyophilization Services Market: Key Segments

Antibodies Segment holds the Largest Share of the Lyophilization Services Market

Based on the type of biologics lyophilized, the market is segmented into antibodies, cell and gene therapies, vaccines, and other biologics. At present, the antibodies segment holds the maximum share of the global lyophilization services market. This trend is likely to remain the same in the coming years owing to the increasing demand for target-specific drugs for the treatment of a myriad of diseases.

By Type of Primary Packaging System, Syringes is the Fastest Growing Segment of the Global Lyophilization Services Market

Based on the type of primary packaging system, the market is segmented into vials, syringes, cartridges, ampoules, and others. At present, the vials segment holds the maximum share of the global lyophilization services market. However, the market for syringes segment is expected to grow at a higher CAGR during the forecast period owing to the growing demand for automated drug delivery injections and prefilled syringes.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East and North Africa and Latin America. Currently, North America dominates the global lyophilization services market and accounts for the largest revenue share. Further, the market in Asia-Pacific is likely to grow at a higher CAGR in the coming future.

Example Players in the Lyophilization Services Market Include:

- Baxter BioPharma Solutions

- CordenPharma

- Coriolis Pharma

- Curia

- Emergent BioSolutions

- LSNE Contract Manufacturing

- Lyophilization Technology

- Northway Biotech

- ProJect Pharmaceutics

- Vetter Pharma

Lyophilization Services Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global lyophilization services market, focusing on key market segments, including type of biologic lyophilized, type of primary packaging system and key geographies.

- Market Landscape: A comprehensive evaluation of the companies offering lyophilization services, based on several relevant parameters, such as year of establishment, company size, location of headquarters, the scale of operation, regulatory certification / accreditation, type of biologic lyophilized, the process of lyophilization, type of primary packaging system and additional services offered by the firms.

- Benchmark Analysis: A comprehensive benchmark analysis of various service providers segregated into three peer groups based on the location of their headquarters. Additionally, the companies were further distributed across key geographies, based on their employee count, into three categories, namely small, mid-sized and large / very large, highlighting the top players in the lyophilization services market, based on their respective capabilities.

- Company Profiles: In-depth profiles of key players that are currently engaged in offering lyophilization services for biopharmaceuticals, focusing on overview of the company, lyophilization service offerings for biopharmaceuticals, dedicated facilities and recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in this domain, based on several parameters, such as year of partnership, type of partnership, most active players (in terms of the number of partnerships signed) and geographical distribution.

- Recent Expansions: In-depth analysis of the various expansion initiatives undertaken by lyophilization service providers for biopharmaceuticals, based on several parameters, such as year of expansion, type of expansion, company size, location of headquarters, location of expanded facility, most active players (in terms of number of recent expansions) and geographical distribution.

- Survey Analysis: An insightful analysis presenting additional insights on lyophilization services offered for biopharmaceuticals, based on several parameters, such as type of biologic lyophilized, type of primary packaging system, scale of operation, availability of lyophilization cycle development / optimization capabilities and location of a dedicated manufacturing facility for lyophilization.

- Case Study 1: A detailed discussion on lyophilization cycle development and optimization services, highlighting the important parameters and techniques required for these processes.

- Case Study 2: A comprehensive discussion on the alternative approaches to the lyophilization process, such as spray drying, spray freeze dryer, atmospheric spray freeze dryer, and vacuum foam drying.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Baxter BioPharma Solutions

- CordenPharma

- Coriolis Pharma

- Curia

- Emergent BioSolutions

- LSNE Contract Manufacturing

- Lyophilization Technology

- Northway Biotech

- ProJect Pharmaceutics

- Vetter Pharma

Methodology

LOADING...