Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Economic Development

Vietnam's remarkable economic expansion, accompanied by the ascent of disposable incomes and the amelioration of living standards, constitutes a driving force behind the surge in healthcare expenditure and pharmaceutical consumption. As Vietnam progresses from a state of low-income to that of a middle-income economy, there emerges an augmented capacity and inclination among its populace to allocate resources towards healthcare and well-being provisions.This propensity extends to a diverse array of healthcare products, spanning from prescription medications to over-the-counter remedies and health supplements, indicative of a burgeoning health-consciousness permeating society. The broadening accessibility of health insurance coverage, coupled with concerted government efforts aimed at fortifying the nation's healthcare infrastructure, synergistically catalyze the expansion of the pharmaceutical sector. Such initiatives not only enhance healthcare accessibility but also instill confidence in consumers, fostering a conducive environment for sustained growth and innovation within the pharmaceutical market of Vietnam.

Government Policies and Regulatory Reforms

Government policies and regulatory reforms exert significant influence on shaping Vietnam's pharmaceutical market dynamics. The government's steadfast dedication to fostering domestic pharmaceutical production, coupled with efforts to refine regulatory frameworks and bolster intellectual property rights protection, fosters an environment conducive to investment and innovation within the pharmaceutical sector. By prioritizing the promotion of domestic pharmaceutical manufacturing, the government aims to reduce reliance on imported drugs, bolster self-sufficiency, and enhance national healthcare resilience.Initiatives aimed at fortifying the healthcare system, such as expanding access to essential medicines and promoting the utilization of generic drugs, serve to bolster the pharmaceutical market's growth and maturation. These initiatives not only enhance medication affordability and availability but also incentivize pharmaceutical companies to invest in research and development, manufacturing capabilities, and market expansion. Overall, government policies and regulatory reforms play a pivotal role in nurturing a vibrant and sustainable pharmaceutical market landscape in Vietnam, fostering growth, innovation, and accessibility within the sector.

Healthcare Infrastructure Development

Vietnam's relentless endeavors to enhance healthcare infrastructure and widen access to healthcare services constitute pivotal drivers propelling growth within the pharmaceutical market. Substantial investments directed towards bolstering healthcare facilities encompassing hospitals, clinics, and pharmacies are pivotal in fostering an environment ripe for pharmaceutical companies to expand their reach across a broader spectrum of patients. In March 2024, Vietnam has committed to upgrading six hospitals to international standards in response to the growing trend of its citizens seeking medical care abroad.These hospitals, located in Hanoi, Ho Chi Minh City, and Thừa Thiên-Huế, will be equipped with advanced technology and will provide “world-class” medical services to both domestic and international patients. The plan aims to achieve an accessibility target of 33 hospital beds, 15 doctors, 3.4 pharmacists, and 25 nurses per 10,000 people by 2025. By 2030, these figures are expected to increase to 35 hospital beds, 19 doctors, 4 pharmacists, and 33 nurses per 10,000 people. Looking ahead to 2050, Vietnam’s healthcare sector aspires to establish several modern facilities meeting international standards, with targets of 45 hospital beds, 35 doctors, 4.5 pharmacists, and 90 nurses per 10,000 people.

Additionally, there are plans to expand private healthcare facilities, with private beds projected to constitute at least 10% of the total by 2025, 15% by 2030, and 25% by 2050. This expansion not only facilitates the distribution of pharmaceutical products but also serves to cater to the burgeoning healthcare needs of an increasingly diverse patient demographic. The integration of cutting-edge healthcare technologies, including electronic medical records and telemedicine solutions, into the healthcare ecosystem serves to optimize healthcare delivery processes.

These advancements not only enhance the efficiency and accuracy of patient care but also augment the demand for pharmaceutical products. The seamless integration of technology into healthcare infrastructure not only streamlines administrative processes but also enables healthcare providers to deliver more personalized and effective treatment regimens, consequently driving the uptake of pharmaceutical products. Thus, Vietnam's sustained focus on enhancing healthcare infrastructure and embracing technological innovations underscores its pivotal role in propelling growth and development within the pharmaceutical market, while simultaneously ensuring improved healthcare outcomes for the population.

Disease Burden and Epidemiological Shifts

The escalating incidence of chronic diseases, infectious ailments, and lifestyle-related disorders is serving as a catalyst for the burgeoning demand for pharmaceutical products across Vietnam. According to the latest available data from the WHO, non-communicable diseases (NCDs) accounted for 81% of deaths in Vietnam in 2019. The leading causes of death that year were stroke, ischemic heart disease, diabetes, chronic obstructive pulmonary disease, and lung cancer.A notable shift in disease patterns, marked by a surge in non-communicable diseases (NCDs) such as diabetes, cardiovascular conditions, and cancer (In 2017, diabetes had a nationwide prevalence of 6.0%, affecting approximately 5 million adults in Vietnam. Additionally, Vietnam experiences an estimated 165,000 new cases of cancer and 115,000 cancer-related deaths annually), presents pharmaceutical companies with lucrative opportunities to innovate and introduce treatments tailored to address these prevalent health concerns. The rising prevalence of these ailments underscores the imperative for effective pharmaceutical interventions to manage and mitigate their impact on public health.

The persistent burden of infectious diseases remains a formidable challenge in Vietnam's healthcare landscape. In 2021, the country reported an estimated 169,000 tuberculosis (TB) cases, with 14,000 related deaths. Vietnam reported 77,657 new TB cases, and 89.2% of those with bacteriologically confirmed TB were tested for rifampicin resistance, identifying 2,640 cases of drug-resistant TB (DR-TB). Of these, 96% were successfully placed on treatment. The Ministry of Health (MOH) approved the National Strategic Plan (NSP) 2021-2025, aiming to eliminate TB by 2030.

This plan introduces new care models and interventions that build on previous successes and align with the National Action Plan to End TB, further driving demand for pharmaceutical solutions. Conditions such as dengue fever, tuberculosis, and HIV/AIDS continue to pose significant public health threats, necessitating the development and distribution of vaccines, antibiotics, and antiviral medications. The demand for these pharmaceutical products is driven by the pressing need to combat infectious diseases, reduce transmission rates, and safeguard public health.

Key Market Challenges

Counterfeit Drugs and Quality Assurance

The prevalence of counterfeit drugs and substandard pharmaceutical products in Vietnam represents a significant threat to public health, as well as a formidable challenge for pharmaceutical companies operating within the market. The proliferation of counterfeit medications not only undermines the efficacy of healthcare interventions but also erodes consumer confidence in the safety and reliability of pharmaceutical products. This poses grave risks to patient health and wellbeing, as individuals may unknowingly consume counterfeit drugs that lack the required active ingredients, contain harmful substances, or fail to meet quality and safety standards.To address this pressing issue, it is imperative to implement robust regulatory oversight mechanisms aimed at monitoring and regulating the pharmaceutical supply chain effectively. Strengthening regulatory frameworks and enforcement mechanisms can help mitigate the influx of counterfeit drugs into the market, deter illicit activities, and hold offenders accountable. Implementing stringent quality control measures throughout the manufacturing, distribution, and dispensing processes is essential to ensure the integrity and authenticity of pharmaceutical products.

Access to Healthcare Services

The widespread presence of counterfeit drugs and substandard pharmaceutical products in Vietnam poses a grave threat to public health, presenting a formidable challenge for pharmaceutical companies operating within the market. Beyond compromising the efficacy of healthcare interventions, the proliferation of counterfeit medications undermines public trust in the safety and reliability of pharmaceutical products. This raises alarming concerns for patient health and well-being, as individuals may unwittingly consume counterfeit drugs that lack essential active ingredients, contain harmful substances, or fail to meet stringent quality and safety standards.Addressing this urgent issue requires the implementation of robust regulatory oversight mechanisms aimed at monitoring and regulating the pharmaceutical supply chain effectively. By bolstering regulatory frameworks and enforcement mechanisms, authorities can mitigate the infiltration of counterfeit drugs into the market, deter illicit activities, and hold offenders accountable for their actions. The introduction of stringent quality control measures throughout the entire pharmaceutical lifecycle - from manufacturing and distribution to dispensing - is imperative to uphold the integrity and authenticity of pharmaceutical products.

Key Market Trends

Technological Advancements and Innovation

Technological advancements within the pharmaceutical sector are instrumental in propelling innovation and catalyzing growth within the Vietnam Pharmaceuticals Market. In October 2024, the draft version of the Pharmacy Law is expected to drive technological advancements and innovation in Vietnam’s pharmaceutical market by encouraging companies to prioritize the country for new drug launches. The revised Pharmacy Law, to be presented in the ongoing National Assembly session, aims to improve public access to new medicines. Over the past decade, only 9% of new drugs were introduced in Vietnam, a figure significantly lower than other Asia-Pacific nations (20%).The draft law seeks to streamline approval processes and introduce a reliance mechanism to speed up pharmaceutical recognition. These changes are designed to enhance efficiency, allowing Vietnamese patients to access new medicines more quickly, supporting innovation and competitiveness in the market. Pioneering research and development initiatives focused on the creation of novel drugs, biologics, and medical devices are driving transformative breakthroughs that revolutionize treatment modalities and therapeutic outcomes. These advancements facilitate the development of cutting-edge pharmaceutical formulations and delivery systems, fostering the creation of safer, more efficacious, and targeted therapies for a diverse array of diseases and medical conditions prevalent in Vietnam.

Investments in biotechnology, genomics, and personalized medicine herald a new era of precision healthcare, offering tailored therapeutic solutions that address unmet medical needs and optimize patient outcomes. The integration of advanced technologies into drug discovery processes enables pharmaceutical companies to expedite the identification and validation of novel drug targets, accelerating the development of innovative therapies. The advent of precision medicine approaches, facilitated by genomic sequencing and biomarker identification, enables healthcare providers to deliver personalized treatment regimens that are tailored to the unique genetic makeup and medical profiles of individual patients.

Medical Tourism and Healthcare Exports

Vietnam's growing reputation as a medical tourism destination and an emerging hub for healthcare exports drives demand for pharmaceutical products. The availability of high-quality healthcare services, skilled healthcare professionals, and affordable medical treatments attracts medical tourists from neighboring countries as well as overseas Vietnamese communities seeking specialized care and treatment options. Vietnam's pharmaceutical industry exports a wide range of products, including generic drugs, active pharmaceutical ingredients (APIs), and medical devices, to international markets, contributing to the growth of the pharmaceutical market.Segmental Insights

Drug Type Insights

Based on Drug Type, the Generic drugs emerged as the fastest growing segment in the Vietnam Pharmaceuticals market during the forecast period. Generic drugs offer a significant cost advantage over branded medications, making them an appealing choice for both patients and healthcare providers in Vietnam’s price-sensitive market. As healthcare costs rise, the affordability of generics plays a crucial role in ensuring broader access to essential treatments. With increasing awareness of healthcare needs, especially in rural areas where access to care is often limited, demand for affordable medications, particularly generics, is growing.The Vietnamese government has supported the use of generic medicines through policies that aim to control costs and improve healthcare access. The expiration of patents for branded drugs has further fueled the demand for generics, ensuring continuity in treatment at lower costs. Additionally, the rising prevalence of chronic conditions like diabetes, hypertension, and cardiovascular diseases has increased the demand for long-term medications, with generics being the preferred, more affordable option for extended management. These factors have positioned generic drugs as the fastest-growing segment in Vietnam’s pharmaceutical market, driven by both cost-efficiency and the country's healthcare needs.

Product Type Insights

Based on product type, Prescription Drugs emerged as the dominating segment in the Vietnam Pharmaceuticals market in 2024. Prescription drugs, which require authorization from a licensed healthcare provider, are predominant in addressing acute and chronic medical conditions that necessitate specialized diagnosis, treatment, and monitoring. As such, they constitute a substantial portion of pharmaceutical sales and revenue, reflecting the prevalence of complex health issues and the importance of professional medical guidance in managing them effectively. Several factors contribute to the dominance of prescription drugs in the Vietnam Pharmaceuticals Market.The country's healthcare system predominantly relies on physician consultations and prescription-based treatments, with patients typically seeking medical advice for both minor ailments and serious health conditions. This healthcare-seeking behavior aligns with cultural norms and societal perceptions that prioritize professional medical expertise in diagnosing and managing illnesses. The regulatory framework in Vietnam mandates strict control over the distribution and dispensing of prescription medications, with licensed healthcare providers playing a pivotal role in prescribing and monitoring their use. This regulatory oversight ensures patient safety, promotes rational drug use, and minimizes the risks associated with self-medication and inappropriate drug use.

Regional Insights

Based on Region, Southern Vietnam emerged as the dominant region in the Vietnam Pharmaceuticals market in 2024. Ho Chi Minh City serves as Vietnam’s economic and commercial hub, driving the demand for healthcare products, including pharmaceuticals. The region's robust economic growth and rapid urbanization have heightened the need for advanced healthcare services and medications. Southern Vietnam is home to the most advanced healthcare infrastructure in the country, with numerous hospitals, clinics, and pharmaceutical distributors. This concentration of facilities improves access to medications and stimulates the growth of the pharmaceutical sector.According to the EU-Vietnam Business Network (EVBN), 80% of Vietnamese individuals purchase drugs from private pharmacies and often self-medicate. The pharmaceutical industry is expanding, with around 250 manufacturing plants, 200 import-export facilities, 4,300 wholesale agents, and over 62,000 retail agents. Leading pharmaceutical companies, both domestic and international, have established their headquarters or production sites in southern Vietnam, benefiting from the region's well-developed infrastructure that supports efficient distribution. The growing population, coupled with the rising prevalence of chronic diseases and an aging demographic, further fuels the demand for pharmaceutical products.

The World Bank reported that 7.6 million Vietnamese people were aged 65 and above in 2020, representing nearly 7.9% of the population, with projections suggesting this will increase to 18.1% by 2049. This demographic shift creates sustained demand for pharmaceuticals. Additionally, southern Vietnam has attracted significant investments in healthcare technologies, boosting innovation in pharmaceutical research, development, and manufacturing, which strengthens the region’s position in the market. These factors combine to make southern Vietnam the dominant player in the country’s pharmaceutical sector, driving both demand and supply.

Key Market Players

- Bayer Vietnam Ltd.

- DHG Pharmaceutical Joint Stock Company

- Traphaco Joint Stock Company

- Pharmaceutical Corporation Ha Tay

- Domesco Medical Import Export Joint Stock Corporation (DOMESCO)

- OPC Pharmaceutical Joint Stock Company

- Sanofi Vietnam

- Mekophar Chemical and Pharmaceutical JSC

- Imexpharm Pharmaceutical Joint Stock Company

- Pymepharco Joint Stock Company

Report Scope:

In this report, the Vietnam Pharmaceuticals Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Pharmaceuticals Market, By Drug Type:

- Generic Drugs

- Branded Drugs

Vietnam Pharmaceuticals Market, By Product Type:

- Prescription Drugs

- Over-The-Counter Drugs

Vietnam Pharmaceuticals Market, By Application:

- Cardiovascular

- Musculoskeletal

- Oncology

- Anti-infective

- Metabolic Disorder

- Others

Vietnam Pharmaceuticals Market, By Distribution Channel:

- Retail Pharmacy

- Hospital Pharmacy

- E-Pharmacy

Vietnam Pharmaceuticals Market, By Region:

- Southern Vietnam

- Northern Vietnam

- Central Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Pharmaceuticals Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bayer Vietnam Ltd.

- DHG Pharmaceutical Joint Stock Company

- Traphaco Joint Stock Company

- Pharmaceutical Corporation Ha Tay

- Domesco Medical Import Export Joint Stock Corporation (DOMESCO)

- OPC Pharmaceutical Joint Stock Company

- Sanofi Vietnam

- Mekophar Chemical and Pharmaceutical JSC

- Imexpharm Pharmaceutical Joint Stock Company

- Pymepharco Joint Stock Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | January 2025 |

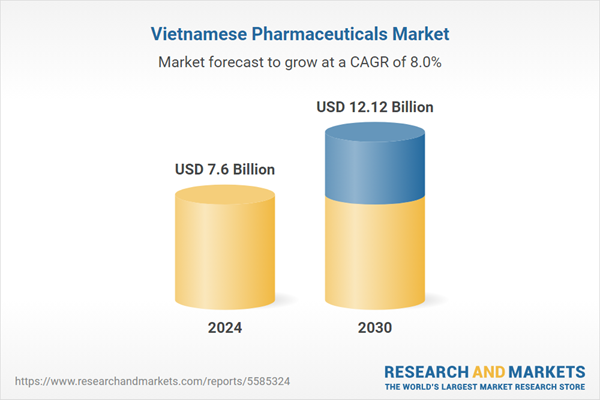

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.6 Billion |

| Forecasted Market Value ( USD | $ 12.12 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |