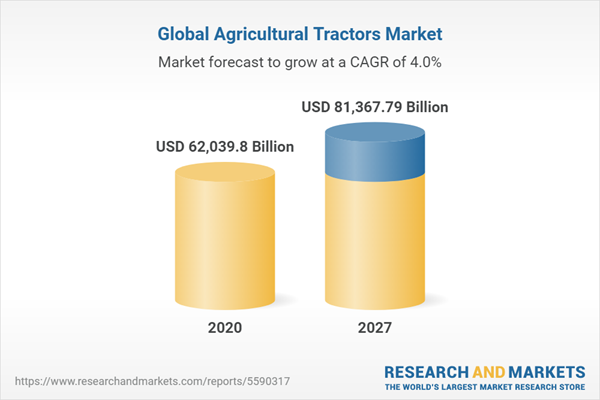

The Global Agricultural Tractors Market size is expected to reach $81.4 billion by 2027, rising at a market growth of 4.2% CAGR during the forecast period.

Tractors are defined as vehicles that are developed to travel at low speeds while producing a large amount of torque. Tractors can haul big agricultural implements behind them due to their high torque. In addition, they are also recognized for delivering massive amounts of power, comparable to that of a semi-truck. Tractors are two-wheel drive in most cases. A traditional farm tractor is a straightforward open vehicle with two huge wheels on one axle. Moreover, the agricultural tractor is designed for a variety of agricultural works, including ploughing, tilling, panning, harrowing, planting, and insecticide spraying, as well as pulling or pushing agricultural machinery or trailers. A rise in the demand for productivity and an increase in the deployment of smart farming is driving the agricultural tractors industry.

Some of the major industry trends are the growing demand for compact tractors on small farms and technical developments like the integration of telematics with agricultural tractors. Moreover, the agricultural industry has been witnessing higher adoption of mechanization in the last couple of years. Additionally, the market is expected to rise as farm laborers are migrating to cities, resulting in a labor shortage in the rural areas.

Row crop tractors are the most popular type of agricultural tractor in the world. Several key market companies are investing much in R&D in order to generate cutting-edge technology and maintain a strong market position. Deere & Company introduced the 8 Family Tractor series in 2020, which includes 8R wheel tractors, 8RT two-track tractors, and the first fixed-frame four-track tractors in the industry. In addition, customers can choose the machine configuration, extras, and horsepower that best suit their operation with these new tractors, which come loaded with the latest precision agriculture technologies.

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Deere & Company is the forerunners in the Agricultural Tractors Market. Companies such as AGCO Corporation, CNH Industrial N.V., Kubota Corp. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AGCO Corporation, CNH Industrial N.V., Deere & Company, CLAAS KGaA mbH, Escorts Ltd., International Tractors Ltd., Yanmar Co., Ltd., Kubota Corp., Mahindra & Mahindra Ltd., and Tractors and Farm Equipment Ltd.

Tractors are defined as vehicles that are developed to travel at low speeds while producing a large amount of torque. Tractors can haul big agricultural implements behind them due to their high torque. In addition, they are also recognized for delivering massive amounts of power, comparable to that of a semi-truck. Tractors are two-wheel drive in most cases. A traditional farm tractor is a straightforward open vehicle with two huge wheels on one axle. Moreover, the agricultural tractor is designed for a variety of agricultural works, including ploughing, tilling, panning, harrowing, planting, and insecticide spraying, as well as pulling or pushing agricultural machinery or trailers. A rise in the demand for productivity and an increase in the deployment of smart farming is driving the agricultural tractors industry.

Some of the major industry trends are the growing demand for compact tractors on small farms and technical developments like the integration of telematics with agricultural tractors. Moreover, the agricultural industry has been witnessing higher adoption of mechanization in the last couple of years. Additionally, the market is expected to rise as farm laborers are migrating to cities, resulting in a labor shortage in the rural areas.

Row crop tractors are the most popular type of agricultural tractor in the world. Several key market companies are investing much in R&D in order to generate cutting-edge technology and maintain a strong market position. Deere & Company introduced the 8 Family Tractor series in 2020, which includes 8R wheel tractors, 8RT two-track tractors, and the first fixed-frame four-track tractors in the industry. In addition, customers can choose the machine configuration, extras, and horsepower that best suit their operation with these new tractors, which come loaded with the latest precision agriculture technologies.

COVID-19 Impact Analysis

OEMs are presently facing a semiconductor shortage, as well as supply chain interruptions and market uncertainty, as a result of the consistently increasing COVID-19 cases, which may cause manufacturing delays. In addition, an increase in steel and aluminum costs is predicted to raise tractor prices, which is expected to slow market development in the coming quarters. The United States Department of Agricultural (USDA) introduced the Precision Agriculture Loan (PAL) Act on September 15, 2021, to allow farmers and ranchers to obtain loans to buy precision agriculture equipment. Tractor demand rebounded considerably in H1 2021, in major economies such as the United States, Canada, the United Kingdom, Germany, China, and India. In addition, in 2021, robust crop output in these areas, as well as the requirement to substitute aged equipment, fuelled the demand and sale of agriculture machines.Market driving Factors:

Farm Mechanization in Emerging Economies

Because their engines have a size of less than 1,500 cc, these tractors take up less space and are more adaptable. Because of the ease of customization, manufacturers are more likely to experiment with novel components and technologies in this category before moving on to higher-powered ones. These tractors are small, with a PTO horsepower of less than 40 and a weight of less than 4,000 pounds. In addition, Schools, landscapers, parks, cemeteries, and hobby farmers all use this high-production, cost-effective, and user-friendly compact tractors. Low horsepower tractors are useful in soft soil conditions, such as river basins. Moreover, horticulture is the primary application for tractors with less than 40 horsepower.Exponential growth in the global population and supportive governments’ policies

Tractor demand is increasing as the world's population grows. Some of the key trends of the market are rapid urbanization, limited labor accessibility, rising food consumption, and technological innovation. When simple demand-supply economics and the flow of labor from urban to rural areas are taken into account, the cost of farm labor has a direct link with the percentage of a country's entire population employed in agriculture. In addition, farmers are expected to boost their yields as the population and demand for food grow. Moreover, agricultural tractors play a vital role in raising agricultural output in India. In recent years, the rising preference for lower-power output tractors, as well as the greater penetration of self-driving tractors, has been witnessed.Marketing Restraining Factor:

The highly thriving rental industry

Tractors and harvesters, for example, constitute a big investment in agricultural activities and are responsible for a significant portion of the global rental business. The cost of the machinery available to farmers reflects all of the procedures involved in designing, producing, and distributing the equipment. Farm equipment penetration in emerging countries is low due to small farmers' incapacity to invest a large sum of money. Farmers choose to hire farm machinery to boost output and turnaround time, which boosts the overall efficiency and profitability. When compared to purchasing agricultural equipment with a traditional loan from a financial institution, renting farm equipment is more cost-effective.Driveline Type Outlook

Based on Driveline Type, the market is segmented into Two-wheel Drive, and Four-wheel Drive. In 2020, the 2WD segment procured the maximum revenue share of the Agricultural Tractors Market. This is because long-term considerations such as lower upfront costs and improved mobility are projected to promote demand in the 2WD segment, particularly in the Asia Pacific market. In India, 2WD tractors are the most popular among middle-income farmers. Hence, these factors are anticipated to drive the growth of this segment over the forecast years.Engine Power Outlook

Based on Engine Power, the market is segmented into Less than 40 HP, 41 to 100 HP, and More than 100 HP. The 41 to 100 HP segment held a significant revenue share of the Agricultural Tractors Market in 2020. This is because of an increase in demand for these tractors in developed markets like the United States, Japan, and Germany. In addition, factors such as greater disposable income, tech-savvy farmers, and well-established after-sales services are expected to boost the growth of this segment. Moreover, long-term factors such as increased demand for high-power tractors for farms larger than 10 hectares are likely to drive the segment growth during the forecasting period.Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, the APAC emerged as the leading region in the overall Agricultural Tractors Market. This is because of the countries like India, where more than 70% population is still employed in agricultural and related activities. In addition, product sales in India are estimated to exceed 900,000 units. In 2022, the regional market is predicted to develop due to easy loan availability, a favorable Minimum Support Price (MSP), and a better monsoon.The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Deere & Company is the forerunners in the Agricultural Tractors Market. Companies such as AGCO Corporation, CNH Industrial N.V., Kubota Corp. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AGCO Corporation, CNH Industrial N.V., Deere & Company, CLAAS KGaA mbH, Escorts Ltd., International Tractors Ltd., Yanmar Co., Ltd., Kubota Corp., Mahindra & Mahindra Ltd., and Tractors and Farm Equipment Ltd.

Partnerships, Collaborations and Agreements:

- Feb 2022: CLAAS extended its partnership with Carraro Group, an international group, a leader in transmission systems for off-road vehicles and specialized tractors. Following this extended partnership, the two companies is expected to focus on the development and production of special and compact tractors, and the supply of axles and gears for tractors.

- Nov 2021: CNH Industrial N.V. signed a multi-year licensing agreement for electrification technologies with Monarch Tractor, a US-based AgTech company specializing in completely electric autonomous tractors. Under this agreement, the two companies is expected to introduce a scalable, modular electrification platform focusing on low horsepower tractors. Moreover, these is expected to be designed across various product families in the forthcoming years, utilizing an agile process that constantly collects farmers' input to ensure that the company develops best-in-class, innovative solutions aligned to customer requirements.

- Jul 2021: AGCO formed a partnership with DEUTZ, a German internal combustion engine manufacturer. The partnership is expected to focus on supply security, predictability, and reliability for both companies and their customers. In addition, the partnership covers a supply agreement for updated 6.1 liters and 4.1-liter engines to be utilized in some Fendt tractors.

- Mar 2021: Mitsubishi Mahindra Agricultural Machinery Company, a Mahindra & Mahindra (M&M)'s Japanese subsidiary, teamed up with Kubota, a Japanese multinational corporation. Under this partnership, the two companies is expected to pursue Japanese domestic operations. Moreover, the two entities is expected to fulfill a wide range of customer requirements and add to the sustainable growth of Japanese agriculture by expanding mutual OEM supply and using products compatible with Kubota's IoT platform 'KSAS', which is the basis of smart agriculture.

- Feb 2020: Mahindra & Mahindra joined hands with Mitsubishi, a Japanese multinational automobile manufacturer. Through this partnership, the two companies aimed to enhance their position in the domestic as well as overseas markets.

Acquisitions and Mergers:

- Dec 2021: AGCO signed an agreement to acquire Appareo Systems, a leader in software engineering, hardware development, and electronic manufacturing. This acquisition aimed to expand the company's offerings and talent as it implements its vision to offer modern technology solutions to farmers globally.

- Nov 2021: CNH Industrial N.V. took over Raven Industries, a U.S.-based leader in precision agriculture technology. This acquisition is expected to add strong innovation capabilities to expedite the company's precision and digital strategy.

- Aug 2021: John Deere completed the acquisition of Bear Flag Robotics, an agriculture technology startup based in Silicon Valley. Following the acquisition, the technology of Bear Flag is expected to support Deere's own technology initiatives and objectives to assist farmers to get the optimum outcomes and solve emerging challenges with the help of modern technology, including autonomy.

Product Launches and Product Expansions:

- Feb 2022: AGCO Corporation rolled out Massey Ferguson 6S Series tractor in North America. Moreover, the versatile Massey Ferguson 6S Series is developed to provide concentrated power with a straightforward, user-friendly operation for excellent performance in various applications.

- Feb 2022: International Tractors Limited expanded has expanded its footprint under the Solis Yanmar brand portfolio with the launch of the YM 342A and YM 348A, its new YM3 tractor series. Moreover, the new tractors are well-suited to provide higher productivity and unparalleled performance.

- Nov 2021: Escorts introduced India's first autonomous model electric tractor on its annual innovation site. Through this launch, the company made its entry into the autonomous farming solutions market.

- Oct 2021: Mahindra & Mahindra's Farm Equipment Sector, part of the Mahindra Group and the world's largest manufacturer of tractors by volume, rolled out Yuvo Tech+ 275 (27.6 kW-37 HP), Yuvo Tech+ 405 (29.1kW 39 HP) & Yuvo Tech+ 415 (31.33 kW-42 HP), a next-generation tractor range called the Yuvo Tech+. Featuring high precision control valves, and a superior lift capacity of up to 1700 kgs, these tractors can manage heavy implements with ease & precision.

- Feb 2021: Tractors and Farm Equipment Limited (TAFE) introduced its new Dynatrack Series - a series of advanced tractors for agriculture as well as haulage. Moreover, the new Dynatrack series is developed to offer higher productivity while ensuring good mileage, durability, and comfort.

- Dec 2020: AGCO Corporation rolled out all-new Challenger MT800 Series track tractors. The new tractors are based on proven innovations from AGCO's 30 years of experience in track tractors, these machines feature new engine and transmission combinations, an improved track and chassis system, more hydraulic and hitch options, and a redesigned operator-friendly cab. Moreover, MT800 Series tractors are integrated with the AccuDrive powertrain and are the most powerful two-track tractors available with a step-less transmission.

- Oct 2020: CLAAS India, a 100 percent subsidiary of German agri-machinery conglomerate CLAAS KGaA, virtually introduced the new version of CROP TIGER TERRA TRAC combine harvester. The new product features high performance and durability and gained massive adoption in various overseas markets.

Scope of the Study

Market Segments Covered in the Report:

By Driveline Type

- Two-wheel Drive

- Four-wheel Drive

By Engine Power

- Less than 40 HP

- 41 to 100 HP

- More than 100 HP

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- AGCO Corporation

- CNH Industrial N.V.

- Deere & Company

- CLAAS KGaA mbH

- Escorts Ltd.

- International Tractors Ltd.

- Yanmar Co., Ltd.

- Kubota Corp.

- Mahindra & Mahindra Ltd.

- Tractors and Farm Equipment Ltd.

Unique Offerings from the publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Agricultural Tractors Market by Driveline Type

Chapter 5. Global Agricultural Tractors Market by Engine Power

Chapter 6. Global Agricultural Tractors Market by Region

Chapter 7. Company Profiles

Companies Mentioned

- AGCO Corporation

- CNH Industrial N.V.

- Deere & Company

- CLAAS KGaA mbH

- Escorts Ltd.

- International Tractors Ltd.

- Yanmar Co., Ltd.

- Kubota Corp.

- Mahindra & Mahindra Ltd.

- Tractors and Farm Equipment Ltd.

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 164 |

| Published | March 2022 |

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 62039.8 Billion |

| Forecasted Market Value ( USD | $ 81367.79 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |