The adoption of house call services by patients not only provides them with optimum care at their home but also has other benefits. A provider of house calls, Heal, estimated that its house call services reduced hospitalization rate by 28% and unnecessary urgent care and emergency room visits by up to 71%, saving around USD 53.7 million annually.

The COVID-19 pandemic further boosted app-based house call services, as it was the only option during the pandemic restrictions and a safe one to avoiding avoid the risk of infection at the hospitals. These services are reducing hospitalization time for patients, and saving costs for them, especially for long-term chronic care.

The competition among market players is very high. Launch of new mobile apps to ease the process of requesting house calls, collaborating with other players to gain access to patient data, and acquisitions to increase market presence are leading to high competition in the market.

U.S. House Calls Market Report Highlights

- The emerging telemedicine & house call services in recent times are a great option for reducing healthcare expenditure, as telehealth saves healthcare costs in multiple ways.

- The primary care segment held the largest market share in 2021 and is expected to witness the fastest growth during the forecast period. The family physicians providing primary care are familiar with the medical history of their patients, and, in certain cases, their family medical history as well, which helps in better medical intervention.

- House call providers are establishing advanced platforms to enable real-time remote patient monitoring parameters, such as blood oxygen concentration, blood pressure, and other biometrics.

- Preventive care, mobile clinical testing, and chronic care management service segments are expected to witness substantial growth in the coming years due to the ongoing COVID-19 pandemic.

- More primary care physicians are opting for home visits as it allows them to provide quality care, reduce administrative burden, and increase revenue for their practice in comparison to providing office visits.

Table of Contents

Companies Mentioned

- Sos Doctor House Call, Inc.

- Heal

- Doctor on Demand, Inc.

- Resurgia Health Solutions LLC.

- Mdlive Inc

- House Call Doctor Los Angeles

- Mount Sinai Visiting Doctors

- Visiting Physicians Association

- Urgent Med Housecalls

- Housecall Doctors Medical Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | April 2022 |

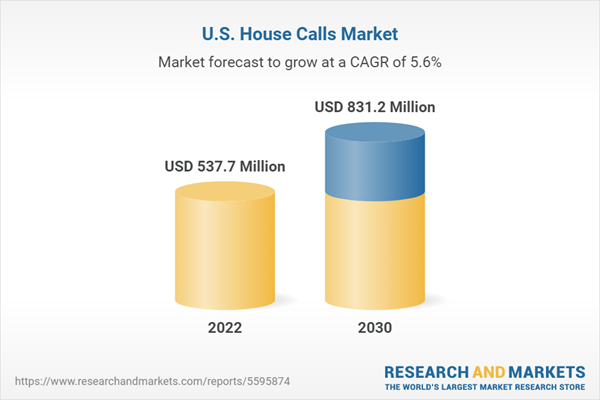

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 537.7 Million |

| Forecasted Market Value ( USD | $ 831.2 Million |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |