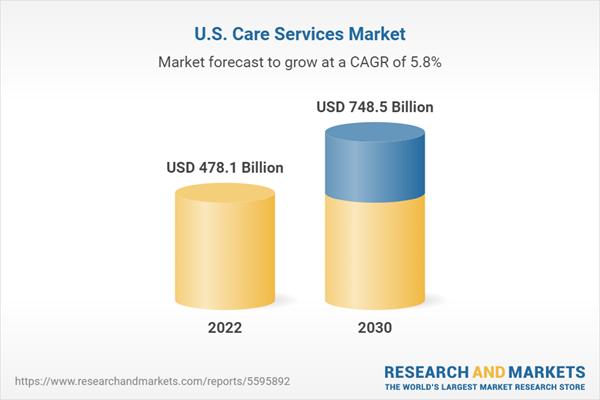

The U.S. care services market size is expected to reach USD 748.5 billion by 2030 expanding at a CAGR of 5.76%. Growing geriatric population and rising incidence of target diseases such as dementia and Alzheimer’s as well as orthopedic diseases are factors expected to fuel the industry growth in the times to come. Increasing treatment cost is one of the prime concerns for governments and health organizations and hence they are striving to curb healthcare costs. Care services are cost-efficient alternatives to expensive hospital stays and thus are economic for a longer time duration.

The federal government is playing an active role in financing the care services. SNFs, hospice, and home healthcare are financed by the government. The U.S. government introduced the COVID-19 relief fund and provided funding of USD 175 billion to SNFs, USD 30 billion to hospice care, and USD 20 billion to assisted living facilities, as per the Department of Health and Human Services. From 2016 up to 2021, the government provided USD 184 million to hospice areas in the Office of the Parliamentary Budget Officer.

The COVID-19 pandemic has positively impacted home healthcare services & the growth of technology in care services. Telehealth services at home & house calls have been the main option for residents, with inpatient hospital facilities being busy with handling COVID-19 cases. Since the onset of the pandemic, the growth in telehealth use has increased significantly.

The federal government is playing an active role in financing the care services. SNFs, hospice, and home healthcare are financed by the government. The U.S. government introduced the COVID-19 relief fund and provided funding of USD 175 billion to SNFs, USD 30 billion to hospice care, and USD 20 billion to assisted living facilities, as per the Department of Health and Human Services. From 2016 up to 2021, the government provided USD 184 million to hospice areas in the Office of the Parliamentary Budget Officer.

The COVID-19 pandemic has positively impacted home healthcare services & the growth of technology in care services. Telehealth services at home & house calls have been the main option for residents, with inpatient hospital facilities being busy with handling COVID-19 cases. Since the onset of the pandemic, the growth in telehealth use has increased significantly.

U.S. Care Services Market Report Highlights

- The skilled nursing facility segment dominated the market in terms of revenue in 2019. SNFs provide high-quality care services at a much lower cost as compared to hospitals, generating tremendous demand among investors. Reimbursement rate pressures or the introduction of new payment systems are also impacting the business size.

- Remote patient monitoring is projected to be one of the fastest-growing segments during the forecast period. This can be attributed to the rising demand for home healthcare. Rapid advancement in technology and the majority of chronic patients in the U.S. have shown an inclination toward home healthcare due to convenience, cost-effectiveness, and availability of top-class service in the comfort and safety of home has driven the dependence on these services over the years.

- The COVID-19 pandemic propelled the demand for home healthcare due to the restriction on healthcare facilities resulting in-home healthcare solutions being the only option. Acute care facilities assisted living facilities, hospice care, and SNF, among others, witnessed improvement in new residents at facilities since the latter half of 2020.

- The U.S. care services market has been witnessing several mergers and acquisitions and partnerships resulting in the integration of various services and maximizing revenue. For Instance, In July 2021, Brookdale Senior Living, Inc. sold a significant stake in its outpatient therapy, hospice, and home health business to HCA Healthcare.

Table of Contents

Chapter 1 Methodology and Scope

Chapter 2 Research Methodology

Chapter 3 Executive Summary

Chapter 4 Market Variables, Trends & Scope

Chapter 5 U.S. Care Services Market: Service Analysis

Chapter 6 Competitive Analysis

Companies Mentioned

- Kindred Healthcare, LLC

- Amedisys, Inc.

- Sunrise Senior Living, LLC

- National Healthcare Corporation

- Brookdale Senior Living Inc.

- Capital Senior Living Corporation

- Home Instead, Inc.

- Genesis Healthcare

- Diversicare Healthcare Services, Inc.

- Lhc Group, Inc.

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 74 |

| Published | April 2022 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 478.1 Billion |

| Forecasted Market Value ( USD | $ 748.5 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |