Mammography is a type of medical imaging approach that involves using a low-dose x-ray device to observe and identify malfunctions in the breasts. Breast cancer as well as other breast-related disorders can be detected more easily with mammography. Females can use these tests to detect and diagnose breast cancer.

Breast cancer is one of the most serious health problems that women face around the world. In the United States, for example, a significant number of new instances of invasive breast cancer is expected to be identified in women in 2022, compared to fewer new cases of non-invasive breast cancer. Throughout their life, few of American women will get invasive breast cancer. The need for mammography systems is expected to rise as a result of this. Because of an increase in the prevalence of breast cancer, the increase in the geriatric population, and proactive measures by healthcare institutions to spread awareness about early diagnosis of breast cancer, this Market is likely to develop significantly over the forecast period.

Breast cancer was the most common type of cancer in 2020, according to a Globocan analysis, with a prevalence incidence of 11.7 percent. As per the same research, Asia had the highest prevalence rate for both sexes, followed by Europe, and North America. The increasing frequency of breast cancer is one of the key reasons for the predicted rise in demand for mammography systems, which can be utilized for diagnostic purposes.

As per data from the Centers for Disease Control and Prevention (CDC), breast cancer is amongst the most common cancers among women, irrespective of race or ethnicity. In women all over the world, it's also the third-leading cause of cancer death. Mammography makes it easier to diagnose breast cancer and other breast-related illnesses. Patients are only exposed to a little quantity of ionizing radiation because mammography uses x-rays to take images of the breast, as per the National Institute of Biomedical Imaging and Bioengineering (NIBIB). Patients are only exposed to a little quantity of ionizing radiation because mammography uses rays to take images of the breast, as per the National Institute of Biomedical Imaging and Bioengineering (NBIB).

COVID-19 Impact Analysis

Because of social distancing measures imposed by governments around the world, the COVID-19 pandemic had a tremendous impact on Mammography Companies. Hospital and healthcare services were radically reduced. Moreover, the COVID-19 pandemic had a substantial impact not only on the global economy but also on the operation of general hospital treatment for non-COVID-19 patients in hospitals all over the world. Because many hospitals & screening institutions were closed owing to lockdowns, it reduced the delivery of the mammography procedures. Cancer screening, cancer management visits, and cancer operations have all decreased significantly as a result of the COVID-19 pandemic.

Market driving Factors:

Increasing Breast Cancer Incidence

The developments in female healthcare have contributed to the growth of the mammography systems Market. Women are predisposed to several diseases that are unique to the female gender. This has increased the medical industry's concerns about delivering high-quality care & analysis of diseases that affect women. For more than a decade, mammography systems are being used in the healthcare industry. Their technology and systems, on the other hand, have advanced dramatically in recent years. These evident developments in the construction, operation, and configuration of mammography systems are the result of evolving demands for diagnosing disorders of the breast. As a result, the mammography systems Market is expected to grow rapidly in the coming years.Increasing demand for digital mammography

They also have the benefit of soft-copy visual displays & soft-copy reading, both of which are easily transferable. Digital mammography screening is now available in many nations, including the United Kingdom, and provides greater accuracy, improved quality, and efficiency. As a result, even though digital mammography is six times more expensive than traditional methods, it is becoming the primarily preferred method of screening. When compared to analog systems, radiation exposure is drastically reduced. The most prevalent type of digital mammography is full-field digital mammography. It has the potential to lead to major improvements in breast cancer diagnostics, such as lower radiation doses, lowered breast compression pressure, and improved detection.Market ing Restraining Factor:

Risks from Radiation and Other Hazards

A modest amount of radiation is used in mammography. Based on the scale & compression of the breasts, the individual dose may vary. However, due to contemporary mammography techniques, particularly full-field digital mammography, the glandular dose has reduced dramatically over the last few decades and continues to do so. The risk of radiation can also be seen in people with aging 40 or above. In nowadays, a 50-year-old woman's natural lifetime risk of developing breast cancer is approximately 8.8%. A certain percentage of this risk may increase to 8.9% if a woman has biennial screening mammography between the ages of 50 and 69.Product Type Outlook

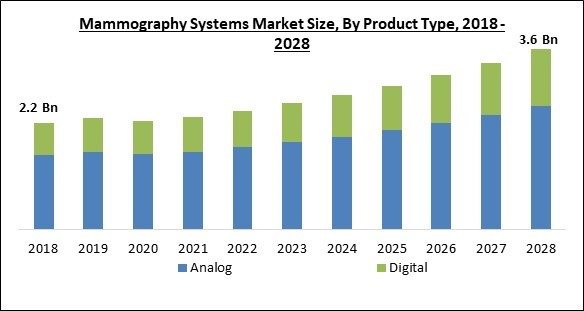

Based on Product Type, the Market is segmented into Analog and Digital. The Analog Mammography segment acquired highest revenue share in the mammography systems Market in 2021. Analog Mammography Devices are classic mammography systems that use film to capture x-ray pictures. Before viewing these films/detectors for a precise diagnosis of breast cancer, they must first be developed. An X-ray unit's analogue image detector is made up of three parts: an intensifying screen, X-ray film, and a light-proof container (cassette). This imaging system includes the developing apparatus, as well as reagents for photochemical processing of X-ray films (fixing agent, developer, water) and the dryer. X-ray film is made consisting of a thin, translucent, flexible polyester film (the X-ray film's base material) and a thin coating of photographic emulsion. The emulsion is coated with protective polymer layers & a dulling agent. Photosensitive elements are silver halide microcrystals. Quanta of X-ray or visible light radiation energy emitted by intensifying screens immediately transfer their energy to silver halide crystals.Modality Outlook

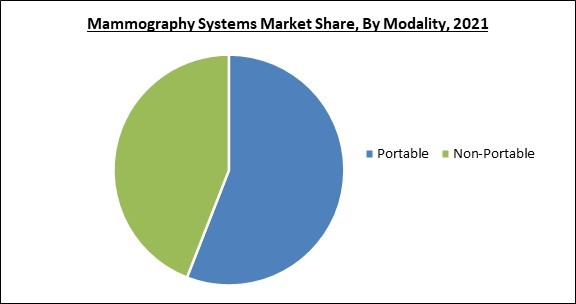

Based on Modality, the Market is segmented into Portable and Non-Portable. The Non-Portable Mammography system segment procured significant revenue share in the mammography systems in 2021. If the practice is being performed in-house and there is a lack of space, a fixed unit may be more cost-effective because they include extra features like larger detectors & better compression mechanisms.End User Outlook

Based on End User, the Market is segmented into In-patient Settings and Ambulatory Surgical Centers. The Inpatient settings segment acquired highest revenue share in the mammography systems Market in 2021. Inpatient care is used to address conditions that necessitate the patient staying in a care facility for at least one night. Rehabilitation centres, acute care facilities, addiction treatment facilities, mental hospitals, and long-term care facilities are all included in this category. Additional facility-based fees apply to inpatient care. According to the most recent cost statistics from the Agency for Healthcare Research and Quality's Cost and Utilization Project, median national inpatient fees vary substantially depending on the length of stay & the therapy offered.Regional Outlook

Based on Regions, the Market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, North America procured the largest revenue share of the mammography system Market. Because of its well-established healthcare facilities, presence of top Market players, rising focus on developed healthcare infrastructure, preventive care, aging population, and an increasing number of product launches, the mammography systems Market in the United States is predicted to develop. In addition, advancements in imaging technology, rising breast cancer prevalence, and rising need for enhanced patient diagnostics in the United States & Canada are increasing the usage of mammography systems, resulting in increased demand for these goods. Hence, the regional Market is flourishing.Mammography Systems Market Competition Analysis

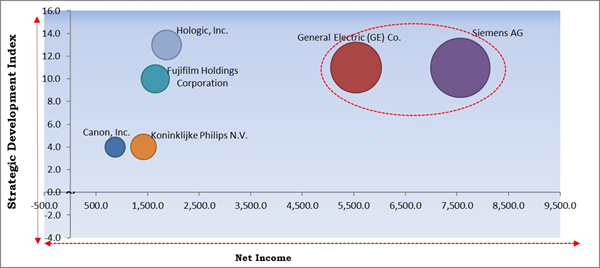

The major strategies followed by the Market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; General Electric (GE) Co. and Siemens AG are the forerunners in the Mammography Systems Market. Companies such as Fujifilm Holdings Corporation, Canon, Inc., Hologic, Inc. are some of the key innovators in the Market.

The Market research report covers the analysis of key stake holders of the Market. Key companies profiled in the report include Siemens AG, Fujifilm Holdings Corporation, Canon, Inc., General Electric (GE) Co., Hologic, Inc., Koninklijke Philips N.V., Metaltronica S.p.A., Allengers Medical Systems Ltd., Planmed Oy, and Konica Minolta, Inc.

Recent Strategies Deployed in Mammography Systems Market

Partnerships, Collaborations and Agreements:

- Jun-2021: Royal Philips teamed up with Akumin, a top provider of outpatient diagnostic imaging services in the U.S. The collaboration aimed to incorporate Philips" NEW Radiology Operations Command Center all over Akumin's outpatient imaging centers & amp; co-create clinical standards for MR and CT imaging modalities of Akumin.

- Oct-2020: The Fujifilm Medical Systems extended its partnership with Volpara Solutions. This partnership aimed to deliver facilities of mammography & amp; clinicians with solutions for breast imaging created to enhance the quality of image, precise assessment of a patient's breast density, and streamline workflow.

- Sep-2020: Candelis teamed up with General Electric Healthcare to improve the image management, mammography workflow, and storage capabilities for Senographe Pristina Mammography Systems. This collaboration aimed to improve the mammography workflow, image management, and storage capabilities for the Senographe Pristina Mammography System.

- Aug-2020: Hologic joined hands with RadNet, a provider of fixed-site outpatient diagnostics imaging services. This collaboration aimed to advance the use of artificial intelligence (A.I) in breast health.

- Aug-2020: Canon Medical Systems USA formed a partnership with Zebra Medical Vision, a computer vision startup focused on health care. This partnership aimed to deliver its AI1 automated imaging analysis solutions to assist clinicians in the U.S to deliver quicker, precise diagnoses for optimized patient care.

Acquisitions and Mergers:

- Jul-2021: Siemens Healthineers took over Varian Medical Systems, an American radiation oncology treatments & amp; software maker located in Palo Alto, California. This acquisition aimed to incorporate a robust & amp; trusted partner capable of supporting patients & amp; customers with the whole cancer care continuum and also all major clinical pathways.

- May-2021: General Electric Healthcare signed an agreement to acquire ZIONEXA, a top innovator of neurology biomarkers and in-vivo oncology, that assists in more customized healthcare. This acquisition aimed to create and bring ZIONEXA's pipeline biomarkers, and even Cerianna which is FDA approved PET imaging agent to the Market. This product is utilized as an adjunct to biopsy for the detection of estrogen receptor (ER) positive lesions to assist in informing the treatment selection for patients with metastatic breast cancer or recurrent breast cancer.

- Jan-2021: Hologic completed the acquisition of Somatex Medical Technologies, a biopsy site markers & amp; localization technologies provider. This acquisition aimed to support the medical technology company's strategy to offer innovative solutions all over the continuum of breast health care. This acquisition deal is expected to assist the company to expand its growing biopsy portfolio.

Product Launches and Product Expansions:

- Apr-2021: The Fujifilm Holding Corporation unveiled the new "Harmony" version of its existing Amulet Innovality mammography system. This version makes the combination of bettered diagnostic performance and innovative design themes light up the mammography system, which makes the patient feel at home and comfortable.

- Mar-2021: Siemens Healthineers expanded its product line with the introduction of Mammovista B.smart, a new software solution. This solution is expected to fasten up the whole reading workflow for breast imaging and another new tool named Teamplay Mammo Dashboard for dashboard-based visualization of key performance indicators process of breast imaging that serves to a better workflow. These new solutions is expected to expand its digital offerings for breast care.

- Oct-2020: The Hologics introduced the new product 3DQuorum Imaging Technology for commercial use. The purpose behind the introduction of this product is to assist in improving mammography efficiency & amp; workflow. In addition, this product is as critical as clinics seek to manage the backlog of women whose regular breast screening was delayed because of the COVID-19 lockdown.

Approvals and Trials:

- Nov-2021: Siemens Healthineers received approval from U.S Food & amp; Drug Administration (FDA) for two new mammography reading and workflow optimization solutions. This approval is expected to widen the company's offering for breast health.

- Aug-2021: The Fujifilm Holding Corporation received FDA approval for ScreenPoint Medical's new, Transpara powered by Fusion AI 2D & amp; 3D mammography in the United States. This approval shows breast screening results at the reading workstation of a doctor or PACS system.

- Dec-2020: Hologics's Genius AI software received approval from the U.S Food & amp; Drug Administration. This Genius AI is software for early breast detection with tomosynthesis, and it is the sole CAD product that assists its Clarity HD & amp; 3DQuorum imaging technology, which are its most developed packages for breast tomosynthesis.

Scope of the Study

Market Segments Covered in the Report:

By Product Type

- Analog

- Digital

- Portable

- Non-Portable

- In-patient Settings

- Ambulatory Surgical Centers

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Siemens AG

- Fujifilm Holdings Corporation

- Canon, Inc.

- General Electric (GE) Co.

- Hologic, Inc.

- Koninklijke Philips N.V.

- Metaltronica S.p.A.

- Allengers Medical Systems Ltd.

- Planmed Oy

- Konica Minolta, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Siemens AG

- Fujifilm Holdings Corporation

- Canon, Inc.

- General Electric (GE) Co.

- Hologic, Inc.

- Koninklijke Philips N.V.

- Metaltronica S.p.A.

- Allengers Medical Systems Ltd.

- Planmed Oy

- Konica Minolta, Inc.