Human Capital Management is a set of strategies for attracting, supervising, developing, refining, and maximizing the value of personnel within a business. Payroll, workforce planning, training, compliance, onboarding, compensation planning, and performance management are just a few of the basic administrative and strategic practices and activities covered. Benefits administration, time and attendance, workflow management, reporting and analytics, employee service and self-service, and retirement services are all part of the package. Organizations all over the world are now implementing HCM systems that give specialized competencies for effectively managing personnel and increasing overall productivity.

In addition, it comprises not only the hiring, job & position management, HR compliance, and reporting activities, but also workforce rewards & talent, as well as workforce management. Furthermore, cloud-based HCM is becoming increasingly popular as a result of benefits such as remote data access, unlimited storage capacity, lower costs and maintenance fees, and access via mobile & web from any place and at any time. As a result, the interest in HCM is rapidly increasing.

Incorporation of developing technologies with HCM software, such as Machine Learning (ML) and Artificial Intelligence (AI), has emerged as one of the most important variables in HCM software and service acceptance across geographies. HCM vendors are projected to benefit from factors such as growing cloud adoption among small and medium businesses to better manage field and office staff.

HCM solutions include a variety of features that assist businesses in attracting, developing, retaining, and engaging their staff. Along with that, through workflow routing and notifications, HCM helps to boost overall organizational productivity while ensuring data integrity. Due to benefits such as remote access to data, infinite storing capacity, cheaper cost & maintenance charges, and access via web and mobile from any location and at any time, cloud-based HCM use is on the rise.

COVID-19 Impact Analysis

Due to the COVID-19 pandemic, businesses around the world are adopting a remote work culture, posing new problems for HCM software and service providers. The main problem is keeping offers up to date with changing organizational cultures. During the pandemic, HCM providers can improve their software by introducing additional features, such as tracking employee health and location. This is expected to increase HCM software adoption. Cost-cutting and project delays by businesses, on the other hand, may limit the use of HCM software. Due to the distributed workforce and the COVID-19 pandemic, the demand for performance management and workforce management solutions is likely to increase.Market Growth Factors

Use of Latest Technologies like AI, ML, and Cloud in HCM Suites Leading to Reduced Costs

Since business operations are becoming increasingly complicated as a result of the adoption of new technologies and innovations, the majority of organizations across verticals are experiencing a scarcity of highly trained workers. As a result, HR managers around the world are having difficulty finding the appropriate people for the right jobs. HCM suites can assist HR managers in discovering skilled workers by utilizing Artificial Intelligence (AI) and Machine Learning (ML) technology. AI and machine learning can help to automate the recruitment process and provide more filters to help locate the ideal candidate.The amalgamation of Robot Process Automation (RPA) with HR Tools

The use of robotic process automation (RPA) improves the efficiency and effectiveness of human capital management. Compensation management, onboarding new staff, payroll management, and compliance reporting are just a few of the repetitive HR operational chores that robotic process automation may help with. RPA improves data management and processing accuracy and speed while lowering IT costs associated with manual and repetitive processes. RPA technology is used by businesses to automate processes and boost employee satisfaction in HR. To meet the needs of clients, market participants are delivering RPA integrated products.Marketing Restraining Factor:

Threats of Security Breaches and Data Leaks on Cloud-Based Deployment

Since most HCM software is hosted in the cloud and controlled by a third party, businesses are concerned about security. The majority of manufacturers are now selling HCM software in the cloud to take advantage of cloud technology benefits like security, scalability, and lower IT infrastructure costs. Security protections are frequently built-in to cloud-based software. This eliminates the risk of data leaks or hackers. Despite this, many firms are apprehensive to migrate HR data and systems to the cloud, which typically contain sensitive employee information. As a result, businesses are hesitant to shift their personnel data, payroll, and administrative data to the cloud.Component Outlook

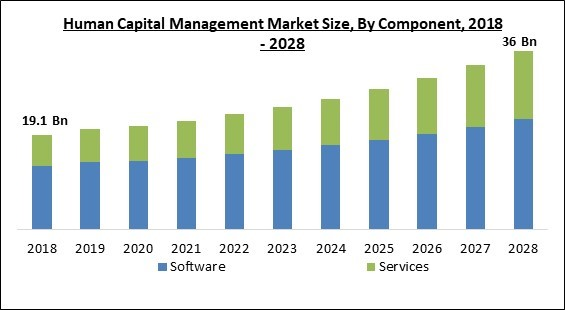

Based on Component, the market is segmented into Software and Services. Based on Software Type, the market is segmented into Core HR, HR Analytics, Workforce Management, and Applicant Tracking System. The services segment obtained a significant revenue share in the human capital management market in 2021. This is due to the growing diversity of the workforce; it is necessary for an HR professional to keep track of employees in order to manage the workforce, and as a result, the use of HCM services is increasing.Deployment Mode Outlook

Based on Deployment Mode, the market is segmented into On-premise and Cloud. The on-premises segment acquired the highest revenue share in the human capital management market in 2021. HCM software adoption is now high, and this trend is projected to continue, with the majority of end-users having their software on-premises, as it provides greater data protection and helps businesses comply with numerous requirements. Due to security rules, current hardware concerns, and upgrade requirements, on-premise solutions are anticipated to witness moderate growth. The advantages of an on-premise deployment strategy, such as security and maximum customization are what makes this mode of deployment a safe and reliable choice. On-premise deployment is used in high-regulatory businesses since it provides more security than cloud deployment because it does not require the use of the internet. The data is stored on private servers and not on public clouds.Organization size Outlook

Based on Organization size, the market is segmented into Large Enterprises and Small & Medium-sized Enterprises (SMEs). The SMEs segment observed a substantial revenue share in the human capital management market in 2021. HCM is likely to gain more widespread adoption by SMEs with the popularization of the cloud mode of deployment. SMEs operate on a tight budget and hence human capital management services on cloud is likely to appeal to them due to very low initial costs involved.Vertical Outlook

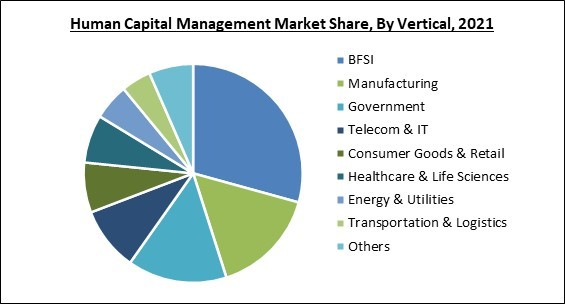

Based on Vertical, the market is segmented into BFSI, Manufacturing, Government, Telecom & IT, Consumer Goods & Retail, Healthcare & Life Sciences, Energy & Utilities, Transportation & Logistics, and Others. The telecom and IT segment acquired a promising revenue share in the human capital management market in 2021. During the forecast period, core HR, talent management, and workforce management solutions are expected to be widely adopted in IT and telecommunications. HR software is being used by businesses of all sizes to successfully administer employee benefits and manage HR operations.Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia-Pacific region observed a significant revenue share in the human capital management market in 2021. Due to the existence of a large number of HCM suppliers and the increasing acceptance of cloud-native technologies, Asia Pacific is estimated to account for the maximum revenue share in the market during the forecast period. Large investments in verticals such as BFSI, manufacturing, retail, healthcare, telecommunications, and IT are being made in key countries such as China and Japan, resulting in the development and economic expansion in APAC countries.Human Capital Management Market Competition Analysis

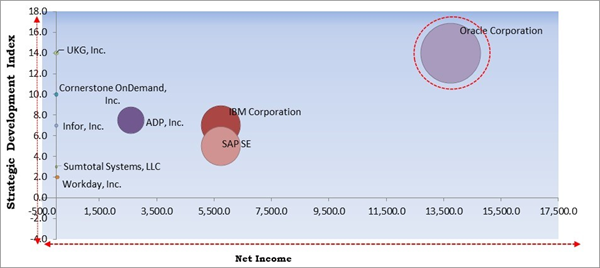

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Oracle Corporation are the forerunners in the Human Capital Management Market. Companies such as IBM Corporation, SAP SE and ADP, Inc. are some of the key innovators in Human Capital Management Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ADP, Inc., Cornerstone OnDemand, Inc. (Clearlake Capital Group), Epicor Software Corporation, IBM Corporation, Infor, Inc., Workday, Inc., Oracle Corporation, SAP SE, Sumtotal Systems, LLC (Skillsoft), and UKG, Inc.

Recent Strategies Deployed in Human Capital Management Market

Partnerships, Collaborations and Acquisitions:

- Feb-2022: Infor formed a partnership with iCIMS, a company developing talent cloud. The partnership aimed to provide next-gen talent capacities across North America to important services industries, such as healthcare organizations. These two are powerful teams, which is expected to support employers across the whole employee lifecycle and enable them to achieve business success.

- Dec-2021: UKG (Ultimate Kronos Group) formed a partnership with Visier, a globally renowned company developing people analytics and planning. The partnership aimed to accelerate workforce management capacities across the employee journey. UKG Pro customers can leverage people data and insights to make well-informed business decisions using Visier"s improved analytics.

- Dec-2021: UKG signed a partnership agreement with Rain India, an earned wage access (EWA) and financial wellness provider to the Indian market. The partnership is expected to permit organizations leveraging UKG dimensions to authorize their employees with real-time visibility into hours worked and on-demand earned wage access reducing the stress employees go through while waiting for salary to cover unplanned or emergency expenditures and enhancing overall employee experience and retention.

- Jun-2021: UKG collaborated with 2nd.MD, a provider of convenient virtual access to top national clinicians. In this collaboration, 2nd.MD is utilizing UKG Pro to boost HR agility, empower its people, and gain a significant ROI.

- May-2021: UKG came into collaboration with WayUp, a US-based job site and mobile app for college students and recent graduates. This collaboration aimed to provide UKG users to effortlessly connect UKG Pro with the WayUp platform, using WayUp"s marketplace of more than 6 million candidates, where 71% of whom have self-identified as a part of underrepresented groups.

- May-2021: UKG partnered with Emburse, a global leader in expense management. This partnership aimed to enable employee records developed for new hires in UKG Ready, UKG Pro, and UKG Dimensions and is expected to automatically sync with Emburse Certify Expense and Emburse Chrome River Expense. This combination removes an important but highly manual part of the employee onboarding process, enabling HR teams to increase their focus on people instead of processes.

- Apr-2021: Oracle collaborated with Ramco Systems, a software company. Under this collaboration, Ramco Systems" Global Payroll solution is expected to be available on the Oracle Cloud Marketplace. Along with that, Ramco is expected to effortlessly combine its payroll platform in almost 50 nations with the Oracle Fusion Cloud Human Capital Management, thus, ensuring Human Resources and payroll transformation for large enterprises.

- Jan-2021: SAP extended its partnership with Microsoft for offering public cloud services for the SAP SuccessFactors Human Capital Management (HCM) suite. Through this expansion, SAP is expected to have a crucial added capacity to run operational workloads of SAP SuccessFactors solutions on Azure, starting with demo environments, for supporting its continuing client user growth.

- Oct-2020: IBM Services came into collaboration with Burger King Brazil. This collaboration intended to develop a new virtual assistant, which is expected to be based on IBM Watson Assistant, called TOP (Technology Orienting People) to assist Burger King Brazil"s 16,000 employees, working in more than 800 restaurants, to be connected.

- Aug-2020: IBM entered into a partnership with Workday, on-demand financial management, and human capital management software providing company. The partnership aimed to aid community leaders and businesses plan, scheduling, and tracking a safe return for the employees to their offices.

- May-2020: Workday entered into a partnership with Microsoft, a multinational company based in the United States. The partnership aimed to prioritize enterprise planning in the cloud and increase the business solutions customers can use to make their everyday work efficient. Workday users is expected to be enabled to run Workday Adaptive Planning on the Microsoft Azure cloud via this partnership.

Product Launches and Product Expansions:

- Mar-2022: Oracle launched Oracle Advanced HCM Controls. This product is expected to aid HR professionals and leaders in improving their vision into possible compliance and fraud-related concerns within their systems as well as detecting suspicious activities as they occur. Oracle Advanced HCM Controls is a component of Oracle Fusion Cloud Human Capital Management (HCM), the company"s AI-powered tracking solution that makes sure only authorized personnel can access sensitive data.

- Sep-2021: Oracle released Oracle Payroll Core, an adaptable payroll management solution. The solution is a part of Oracle Fusion Cloud Human Capital Management (HCM) and is expected to aid both intergovernmental and non-governmental organizations in steering through complicated pay rules and policies to optimally pay any employee, anywhere, in any currency.

- Jun-2021: SAP made enhancements to its HR"s ability for planning the workforce requirements by combining SuccessFactors with the SAP Analytics Cloud, its main planning tool. The SAP Analytics Cloud helps ERP users in linking operational and financial plans for improving workforce planning and analytics.

- May-2021: International Business Machines (IBM) launched Watson Orchestrate. This new product is expected to help companies automate tasks, capitalizing on the growth of chatbots & virtual assistants in the pandemic and also taking one step ahead in its pivot toward cloud services & AI. This tool utilizes AI to choose and sequence the prepackaged skills required to function a task over human resources, sales, or operations functions.

- Feb-2021: ADP released Roll, an application developed to provide small enterprises more adaptability in running payroll while remaining secure and compliant. The app emphasizes ease of use by using a conversational interface to usher business owners through the full process utilizing straightforward prompts like "run my payroll" while removing steps that consume more time.

- Sep-2020: Oracle introduced major updates to Oracle Cloud Human Capital Management (HCM). These new products and features provide customized journeys and growth opportunities for employees and also enhance data precision for HR teams. Due to this, such latest updates enhance both the employee and HR experience.

- Jul-2020: Infor launched a new Payroll program for Infor Global Human Resources (Global HR). Infor Payroll offers in-house payroll processing capacities with numerous alternatives for service partners to aid handle back-end payroll procedures, such as salary payments, employment tax filing, wage garnishments, and other value-added services.

- May-2020: Oracle unveiled Oracle Analytics for Cloud HCM. This solution is built on Oracle Analytics Cloud and powered by Oracle Autonomous Database, which provides HR executives, analysts, and line-of-business leaders with more actionable insights into workforce management by helping a complete view of data from across the company. The latest self-service analytics offerings enable users to optimize the value of Oracle Cloud HCM.

Acquisitions and Mergers:

- Nov-2021: ADP acquired Integrated Design (IDI), a leading software corporation. This acquisition is the result of the 20-year long partnership between the two companies. Clients is expected to gain access to an improved payroll and HR expertise, which is expected to permit them to grow and scale up their business, due to the further integration of IDI"s expertise with DP's global reach and comprehensive HCM and Workforce Management solutions.

- Jun-2021: UKG announced the acquisition of EverythingBenefits, a developer of cloud-based business software used to help businesses increase profits. This acquisition is aimed to expand UKG"s footprint in the benefits technology space. This acquisition will also enable UKG to include EverythingBenefits’ end-to-end tech solutions into the HCM platform's portfolio of payroll, workforce management, and HR service delivery tools.

- Apr-2020: Cornerstone On Demand acquired Saba Software, a world-renowned company involved in talent experience solutions and a portfolio company of Vector Capital. With this acquisition, Cornerstone is expected to increase the reach and capacity to aid a bigger, diverse bunch of clients conceive the potential of their people with the correct learning and development opportunities.

- Jan-2020: Cornerstone OnDemand completed the acquisition of Clustree, a technology company. The acquisition aimed to hasten the development of the world"s biggest skills engine to aid organizations in detecting, developing, and implementing their talent for the positions needed today and in the future.

Geographical Expansions:

- Mar-2020: ADP expanded its geographical presence by expanding ADP iHCM 2 in the Asia Pacific market. Under this expansion, ADP launched the product in Hong Kong. In addition, ADP iHCM 2 is a comprehensive human capital management system in the cloud, developed to assist organizations to reduce costs, boost talent engagement and unify operations. It also integrates ADP"s deep payroll expertise with an expanded portfolio of HR technologies.

Scope of the Study

Market Segments Covered in the Report:

By Component

- Software

- Core HR

- HR Analytics

- Workforce Management

- Applicant Tracking System

- Services

- On-premise

- Cloud

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

- BFSI

- Manufacturing

- Government

- Telecom & IT

- Consumer Goods & Retail

- Healthcare & Life Sciences

- Energy & Utilities

- Transportation & Logistics

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- ADP, Inc.

- Cornerstone OnDemand, Inc. (Clearlake Capital Group)

- Epicor Software Corporation

- IBM Corporation

- Infor, Inc.

- Workday, Inc.

- Oracle Corporation

- SAP SE

- Sumtotal Systems, LLC (Skillsoft)

- UKG, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- ADP, Inc.

- Cornerstone OnDemand, Inc. (Clearlake Capital Group)

- Epicor Software Corporation

- IBM Corporation

- Infor, Inc.

- Workday, Inc.

- Oracle Corporation

- SAP SE

- Sumtotal Systems, LLC (Skillsoft)

- UKG, Inc.