Medical cameras capture images and videos for several life science applications that require visual documentation. They are widely used in microscopy, ophthalmology, pathology, endoscopy, lab automation, biomedical research, rheumatology, and other disciplines. They help doctors make precise and suitable interpretations by ensuring correct diagnosis.

Private funding and investments in healthcare facilities and infrastructure are raising performance benchmarks ensuring better healthcare delivery. Consistent technological advancements, combined with increased use and application of visual technology in surgical procedures, are expected drive robust market growth.

Market Trends:

- Advances in Medical Imaging Technology: Technological progress in medical imaging is propelling the growth of the global medical camera market. The use of visual tools in surgical and medical procedures has elevated treatment quality, as recorded visuals offer superior insights for diagnosing diseases, ultimately leading to better patient outcomes. The shift toward early disease detection and increased investments in technologies improve treatment precision have opened up new opportunities for medical camera applications.

- Rise in Minimally Invasive Surgeries: The increasing prevalence of minimally invasive surgical procedures has broadened the market’s reach. Medical cameras enhance disease detection and diagnosis, playing a crucial role in decision-making processes. Additionally, they provide magnification of small cavities during complex surgeries, aiding surgeons in performing intricate procedures. The growing incidence of chronic diseases has further driven the demand for minimally invasive surgeries, boosting the market.

- North America’s MarketDominance: North America is projected capture a substantial portion of the global medical camera market throughout the forecast period. The market is segmented geographically into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. North America stands out due tits significant growth potential, supported by a strong presence of medical device manufacturers and advanced healthcare infrastructure in key economies like the United States and Canada.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies, and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights exercise strategic decisions uncover new business streams and revenues in a dynamic environment.

- Caters to Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 t2024 & forecast data from 2025 t2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions, including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

Medical Camera Market Segmentation:

By Type

- Endoscopic Cameras

- Surgical Cameras

- Ophthalmology Cameras

- Microscopy Cameras

- Others

By Application

- Surgery and Minimally Invasive Procedures

- Endoscopy

- Dermatology

- Ophthalmology

- Pathology and Research

- Others

By Sensor Type

- Charge-Coupled Device

- Complementary Metal Oxide Semiconductor (CMOS)

- Infrared (IR) & Thermal Sensors

- 3D Depth-Sensing Sensors

- Others

By End-User

- Hospitals

- Clinics

- Ambulatory Surgery Centers (ASC)

- Diagnostic Centers

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Taiwan

- Thailand

- Others

Table of Contents

Companies Mentioned

- Olympus Corporation

- Canon Inc.

- Medigus Ltd.

- Sony Corporation

- Imperx, Inc.

- Leica Microsystems GmbH (Danaher Corporation)

- Basler AG

- KARL STORZ SE & Co. KG

- Carl Zeiss Meditec AG

- 3D MediVision, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | April 2025 |

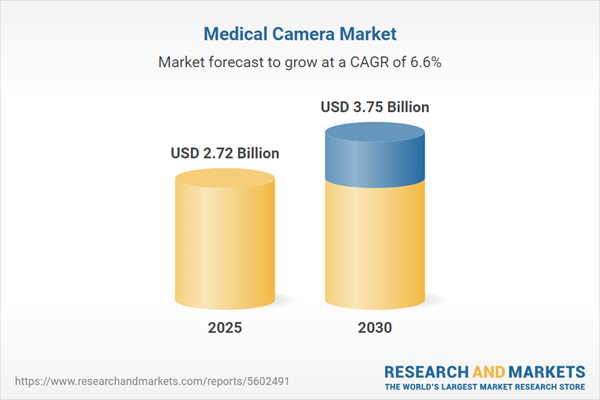

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 2.72 Billion |

| Forecasted Market Value ( USD | $ 3.75 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |