Mining automation is revolutionizing the mining sector by streamlining processes, boosting security, and increasing output. Mining firms may increase productivity and precision in a variety of jobs, such as drilling, blasting, hauling, and material handling, by incorporating automation technologies like autonomous trucks, remote-controlled machinery, and smart sensors. Automation improves worker safety and lowers the likelihood of accidents by eliminating the need for manual labor in repetitive or dangerous jobs.

Automation also makes data-driven decision-making and continuous operation possible, which optimizes resource use and lowers operating expenses. Additionally, by minimizing environmental impact through more accurate and effective extraction procedures, mining automation aids in sustainability initiatives.

MARKET TRENDS:

As technological developments and advancements are increasing, the mining market and industries are compelled to enhance the mining field with the application of automation and technology. Modernizing industrial plants with the latest technology and automation can bring about drastic changes in the mining industry by reducing labor, working hours, and production. The high level of safety offered by automation and digitalization in mining is positively influencing the growth of the mining field.The growth of the market emphasizing digitalization, higher production rates, safety, fewer labor, and working hours is compelling the industrial giants to modernize the mining sector with automation. Their mining automation market is highly valued in the global market. High production, higher safety, less production time, and reduced human resources are the major driving factors, which have a positive impact on the mining automation market.

MARKET DRIVERS:

Increased production with automation is anticipated to drive the market’s growth.

The mining rate and production have tremendously increased with the introduction of automation and technology in the mining industry. The application of software and automation in the important areas of mining makes the process more precise and effective.Automation and technology also took over the role of workers, which reduced workers' pressure and resulted in a smaller number of workers in the mining field. Automation also made the mining process more effective, as the tools and instruments were controlled and carried out with automation and software. The increased production rate with the application of automation increased the market value for mining automation.

The increasing need for worker safety might impact mining automation market growth.

The safety of workers from life hazards is a major factor in the mining industry. The need for worker safety is increasing day by day in the industrial fields. Approval and licenses for large-scale mining can only be attained by maintaining proper worker safety and a working environment. The licensing of governments and health organizations is primarily focused on creating a healthier working environment and conditions in the mining industry.Automated mining makes the process safer and provides better working conditions for the workers engaged in the mining process. Hazardous and high-risk machines can be operated with the use of computers and control panels, which increases the need for automation and technology in the mining field. Ensuring safety in the mining industry by associating with the automation system and technology has a positive impact and hiked the value of the mining automation market.

The cost-effectiveness of mining automation may upsurge market growth.

Replacing human effort with technology and automation in the operation of equipment can achieve a major reduction in the cost of the mining process. The operation cost of large-scale devices and equipment engaged in the mining process is tremendously decreased by the application of automation in the mining industry.Cost-effectiveness in large-scale mining is a major milestone, which can be effectively achieved by relying on and modernizing automation. The market’s growth in automation mining mainly depends on the cost-effectiveness offered by technology and digitalization.

MARKET RESTRAINTS:

Although mining automation has many advantages, several important barriers are preventing its broad use. The significant upfront costs associated with installing automation technology, such as those associated with purchasing and deploying robotic machines, advanced sensing equipment, and autonomous vehicles, represent a significant hurdle. Furthermore, there are logistical issues and a potential need for a large investment of time and money due to the complexity of integrating automation solutions with the current mining infrastructure and processes.Since conventional employment possibilities are important to mining communities, concerns about job loss and workforce transition also limit automation adoption. Furthermore, automated equipment maintenance and servicing is technically challenging due to the distant and sometimes hostile settings in which mining operations are carried out, which might result in downtime and higher maintenance expenses.

Asia Pacific is anticipated to be the major regional market.

The Asia Pacific is predicted to account for the largest market share in the mining automation market. First, As the region becomes more urbanized and industrialized, there will be a greater need for raw materials, which will fuel mining operations. Mining businesses can more effectively fulfill this demand by optimizing processes, increasing productivity, and cutting costs owing to automation technology.Furthermore, mining businesses in the Asia Pacific area are investing in automation solutions to reduce the dangers associated with hazardous mining sites and enhance worker safety as a result of the increased attention on workplace safety and regulatory compliance. North America and South America are anticipated to hold the second and third major market shares in automation mining, followed by Europe and the rest of the world.

Key Developments:

- In December 2023, The new blast support release by Epiroc for safe blasting was launched as a part of the surface mine. A new version of Situational Awareness is included in the package, and it includes a feature that allows alerts to be directed to individuals who are in designated risk areas.

- In July 2023, the purchase of HARD-LINE, a rapidly expanding global leader in mine automation, remote-control technology, and mine production optimization, was announced by Hexagon AB, the world leader in digital reality solutions that combine sensor, software, and autonomous technologies.

- In May 2023, Pega Process Mining was launched by Pegasystems Inc. the low-code platform provider enabling the world's top enterprises to Build for Change®.

- In April 2023, the leading Chinese manufacturer of construction equipment, XCMG Machinery, introduced three new mining machinery products that will better support infrastructure construction projects and global mining operations: the XDE240 mining dump truck, the XDR80TE-AT autonomous electric dump truck, and the XE690DK mining excavator.

Segmentation:

By Technique

- Underground mining

- Surface mining

By Work Flow

- Mining process

- Mine development

- Mine maintenance

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Caterpillar

- RPM Global

- Komatsu

- Sandvik AB

- Atlas Copco

- Hexagon

- Autonomous Solutions Inc.

- Hitachi (Johnson Controls)

- Trimble

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | February 2024 |

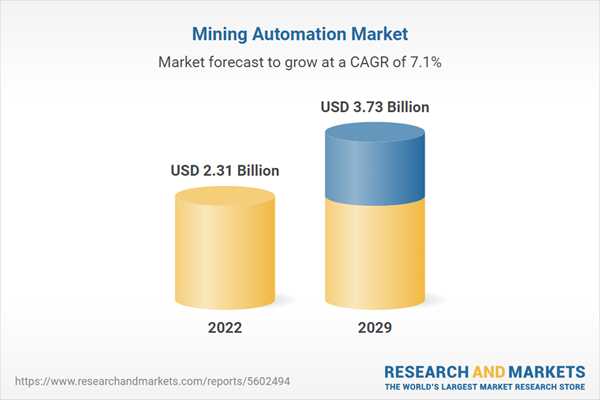

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 2.31 Billion |

| Forecasted Market Value ( USD | $ 3.73 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |