As the global frequency of chronic diseases rises, the demand for diagnostic imaging procedures also increases and, as a result, contrast materials. Chronic disease costs $3.5 trillion in annual health care costs, according to the National Center for Chronic Disease Prevention and Health Promotion. The Arthritis Foundation estimates that 55 million people have been diagnosed with arthritis. Moreover, about 305,000 newborns and toddlers suffer from arthritis or rheumatic disorders. Osteoarthritis affects approximately 55 million people worldwide. According to the International Osteoporosis Foundation, 220 million women worldwide were affected by osteoporosis in 2019.

Due to the growing demand for imaging operations, contrast media manufacturers have invested much in R & D in order to bring new products to market and gain approval for new indications. Bracco, for example, received FDA approval in 2021 for Lumason, an ultrasound contrast agent, in a 20-vial pack design. According to a report to the Center for Medicare and Medicaid Services (CMS) by the Medicare Payment Advisory Commission (MedPAC), the increase in the volume of imaging services per Medicare beneficiary is the largest among all other services offered by physicians. Imaging techniques like computed tomography (CT), magnetic resonance imaging (MRI), and X-rays have become a standard aspect of most disease diagnoses. Diagnostic imaging modalities are becoming more widely employed as a result of developments in the underlying technology, which includes everything from equipment to administration. Novel solutions, such as syringeless injectors and innovative packaging, aid in the delivery of the correct dose of contrast agents while also reducing waste. The Gadavist Imaging Bulk Package with transfer spike, for example, was authorised by the US FDA in August 2020, allowing for weight-based and multi-patient dosing as well as addressing hospital vial waste issues. It is expected that the approval of such innovative packaging will raise demand for the chemical agent.

Contrast materials are usually regarded as safe for use in MRI and CT scans, among other diagnostic techniques. However, some of the adverse effects and allergic responses associated with its use may limit market expansion. Their side effects range from mild to severe; severe reactions are extremely rare, as are major allergic reactions to contrast materials. In addition, handling complex and sophisticated diagnostic imaging technologies necessitates a high level of technical ability and expertise. According to the US Bureau of Labor Statistics, the employment of radiology technologists is expected to expand by roughly 7% between 2019 and 2029. Despite this, a scarcity of specialists and radiologists will pose a hindrance to industry expansion.

The existence of prominent players in the region, the high prevalence of chronic illnesses, the growing elderly population, and the increasing use of minimally invasive procedures all contribute to the region's significant share of the market. In the United States, the first gadolinium-based contrast agent was approved. Four agents have been certified in the United States in the last decade, indicating a clear trend in the industry to identify more efficient, accurate, and safe agents. In the future, sales of contrast materials are likely to rise in the United States. Contrast material sales for ultrasound may have a significant growth rate among the various imaging modalities. In the United States, the rise in chronic conditions such as cardiovascular and neurological diseases is the primary driver of market growth.

During the predicted period, Asia Pacific is also expected to increase significantly. This is because the region is home to a number of well-known local and worldwide manufacturers. For example, General Electric Pharmaceuticals (Shanghai) Co., Ltd., is a GE Healthcare subsidiary that manufactures diagnostic pharmaceuticals (CT/MR contrast media) in China and is one of the world's largest contrast material manufacturing facilities. This aspect is expected to continue to drive regional market expansion.

Due to fewer patient visits to hospitals, the COVID-19 outbreak had a detrimental influence on the contrast materials industry. As a result of the epidemic, healthcare systems have been severely stressed. To prevent the spread of the disease and conserve healthcare resources for COVID-19 patients, healthcare institutes and providers were told to halt performing elective surgical operations and medical evaluations. As a result, the volume of imaging cases in many radiology departments dropped dramatically.

Due to a fall in the volume of optional and non-essential procedures, lower utilisation of routine testing, decreased capital spending by customers, and a slowdown in research activity owing to laboratory closures and decreased clinical testing, the worldwide contrast materials market has been impacted.

Due to the growing demand for imaging operations, contrast media manufacturers have invested much in R & D in order to bring new products to market and gain approval for new indications. Bracco, for example, received FDA approval in 2021 for Lumason, an ultrasound contrast agent, in a 20-vial pack design. According to a report to the Center for Medicare and Medicaid Services (CMS) by the Medicare Payment Advisory Commission (MedPAC), the increase in the volume of imaging services per Medicare beneficiary is the largest among all other services offered by physicians. Imaging techniques like computed tomography (CT), magnetic resonance imaging (MRI), and X-rays have become a standard aspect of most disease diagnoses. Diagnostic imaging modalities are becoming more widely employed as a result of developments in the underlying technology, which includes everything from equipment to administration. Novel solutions, such as syringeless injectors and innovative packaging, aid in the delivery of the correct dose of contrast agents while also reducing waste. The Gadavist Imaging Bulk Package with transfer spike, for example, was authorised by the US FDA in August 2020, allowing for weight-based and multi-patient dosing as well as addressing hospital vial waste issues. It is expected that the approval of such innovative packaging will raise demand for the chemical agent.

Contrast materials are usually regarded as safe for use in MRI and CT scans, among other diagnostic techniques. However, some of the adverse effects and allergic responses associated with its use may limit market expansion. Their side effects range from mild to severe; severe reactions are extremely rare, as are major allergic reactions to contrast materials. In addition, handling complex and sophisticated diagnostic imaging technologies necessitates a high level of technical ability and expertise. According to the US Bureau of Labor Statistics, the employment of radiology technologists is expected to expand by roughly 7% between 2019 and 2029. Despite this, a scarcity of specialists and radiologists will pose a hindrance to industry expansion.

By region, North America is expected to drive the growth of the global contrast materials market during the forecast period.

The existence of prominent players in the region, the high prevalence of chronic illnesses, the growing elderly population, and the increasing use of minimally invasive procedures all contribute to the region's significant share of the market. In the United States, the first gadolinium-based contrast agent was approved. Four agents have been certified in the United States in the last decade, indicating a clear trend in the industry to identify more efficient, accurate, and safe agents. In the future, sales of contrast materials are likely to rise in the United States. Contrast material sales for ultrasound may have a significant growth rate among the various imaging modalities. In the United States, the rise in chronic conditions such as cardiovascular and neurological diseases is the primary driver of market growth.

During the predicted period, Asia Pacific is also expected to increase significantly. This is because the region is home to a number of well-known local and worldwide manufacturers. For example, General Electric Pharmaceuticals (Shanghai) Co., Ltd., is a GE Healthcare subsidiary that manufactures diagnostic pharmaceuticals (CT/MR contrast media) in China and is one of the world's largest contrast material manufacturing facilities. This aspect is expected to continue to drive regional market expansion.

Covid-19 Insights

Due to fewer patient visits to hospitals, the COVID-19 outbreak had a detrimental influence on the contrast materials industry. As a result of the epidemic, healthcare systems have been severely stressed. To prevent the spread of the disease and conserve healthcare resources for COVID-19 patients, healthcare institutes and providers were told to halt performing elective surgical operations and medical evaluations. As a result, the volume of imaging cases in many radiology departments dropped dramatically.

Due to a fall in the volume of optional and non-essential procedures, lower utilisation of routine testing, decreased capital spending by customers, and a slowdown in research activity owing to laboratory closures and decreased clinical testing, the worldwide contrast materials market has been impacted.

Market Segmentation:

By Product Type

- Iodine-based

- Barium-Sulphate

- Gadolinium

- Saline and Gas

- Others

By Route of Administration

- Oral

- Rectal

- Blood Vessel

By Medical Procedure

- X-Ray/CT

- MRI

- Ultrasound

By Indication

- Cardiovascular Disease

- Oncology

- Gastrointestinal Disorders

- Neurological Disorders

- Other Indications

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

Table of Contents

1. INTRODUCTION

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

5. GLOBAL CONTRAST MATERIALS MARKET, BY PRODUCT TYPE

6. GLOBAL CONTRAST MATERIALS MARKET, BY ROUTE OF ADMINISTRATION

7. GLOBAL CONTRAST MATERIALS MARKET, BY MEDICAL PROCEDURE

8. GLOBAL CONTRAST MATERIALS MARKET, BY INDICATION

9. GLOBAL CONTRAST MATERIALS MARKET, BY GEOGRAPHY

10. COMPETITIVE ENVIRONMENT AND ANALYSIS

11. COMPANY PROFILES

Companies Mentioned

- Bayer AG

- General Electric Company

- Guerbet

- Bracco Diagnostic, Inc.

- Nano Therapeutics Pvt. Ltd.

- Lantheus Medical Imaging, Inc.

- iMax

- Trivitron Healthcare

- Spago Nanomedical AB

- Jodas Expoim

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | June 2022 |

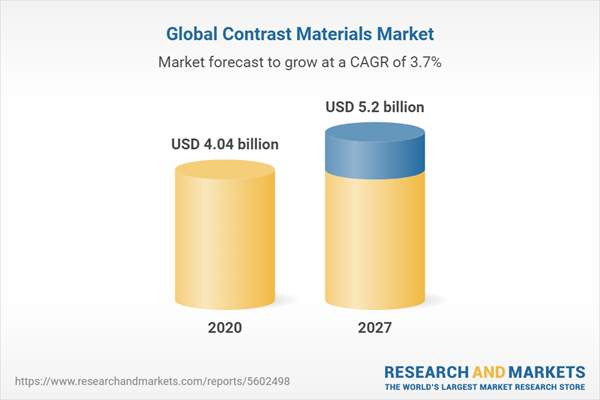

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 4.04 billion |

| Forecasted Market Value ( USD | $ 5.2 billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |