The agricultural packaging market is significant as it ensures that food is delivered from farms hygienically and conveniently. The packaging also makes sure the products do not get spoiled on their way to the retail market. Not to forget, it also elongates the shelf life of the products and reduces unnecessary food wastage.

Agriculture packaging includes different kinds of bulk and small packaging. Like bulk bags, pouches, silo bags, trays, containers, films, clamshells, and bottles, to name a few. The material may include plastic, jute, paper, cardboard, and metals, amongst others.

Agriculture packaging has gained prevalence with increasing strict regulations regarding the packaging of food and beverages. Another key factor contributing to the industry is the growing population. Further, with globalization, the demand for importing and exporting agriculture-related products has increased significantly.

Moreover, with the green revolution and further research and development, the production per yield has increased. With advanced packaging technology, it has become easier for farmers and wholesalers to store the products with less wastage, and this has made them convenient for transportation as well.

Market Drivers:

Growth in the population

With the burgeoning global population, there has been a notable surge in the demand for food products. As per the United Nations, the worldwide human population reached 8.0 billion by mid-November 2022, escalating from an estimated 2.5 billion individuals in 1950. This surge translated to an additional 1 billion people since 2010 and 2 billion since 1998, intensifying the need to meet the nutritional requirements of such a vast populace.In addition to the heightened demand for food, there has been a corresponding increase in the demand for crops utilized in various sectors such as feed, fuel, fiber, and feedstocks. Furthermore, the escalating urban population has led to a rise in the utilization of agricultural packaging, facilitating transportation and storage processes.

The growing global market for pesticides and fertilizers:

The market for pesticides and fertilizers has experienced a consistent growth trajectory in recent years. A primary catalyst influencing this market is the escalating demand for crops, driven by the expanding global population. According to data from the United Nations Environmental Program, the consumption of inorganic fertilizers amounted to approximately 190 million tonnes in 2018.Projections indicate that this figure is expected to climb to 197 million tonnes by 2024. The packaging utilized for pesticides varies in form and includes options such as sacks, pouches, bags, containers, and other formats to suit different needs and preferences.

Market Restraint:

Depletion of Arable Land:

A stark decline in agricultural land is evident as urban population figures continue to rise. Data from the United Nations Convention to Combat Desertification (UNCCD) cautions that if present trends persist, the world will be compelled to restore an astounding 1.5 billion hectares of degraded land by 2030 to meet Land Degradation Neutrality (LDN) targets outlined in the Sustainable Development Goals (SDGs).In countries like Georgia, for instance, approximately 60% of agricultural land is categorized as having low or moderate suitability for food production, while 35% is classified as degraded. Moreover, the fertility of the land has plummeted significantly due to escalating crop production and the excessive application of fertilizers and pesticides.

Agricultural packaging market segmentation by material type into plastic, paper and paperboard, composite material (jute), metal, and others.

The agricultural packaging market is segmented based on material type, encompassing plastic, paper and paperboard, composite materials, metal, and other alternatives. Plastic packaging stands out for its lightweight properties, facilitating convenient transportation.Paper and paperboard packaging are favored for their biodegradability and sustainability, addressing growing environmental apprehensions. Composite materials, derived from natural and renewable resources, attract eco-conscious consumers due to their environmentally friendly attributes.

Metal packaging boasts high barrier properties, ensuring effective protection for sensitive agricultural products. Other options in the market include bioplastics, nanomaterials, and glass, each offering distinct advantages and catering to specific needs within the agricultural packaging landscape.

APAC is anticipated to hold a significant share of the Agricultural Packaging Market

The Agricultural Packaging Market is poised to witness a substantial share held by the Asia-Pacific (APAC) region. The burgeoning populations in APAC nations, notably India and China, generate heightened demand for food products, thereby fueling the requirement for effective and safeguarding packaging solutions.The escalating agricultural output across the region underscores the necessity for sophisticated packaging solutions catering to storage, transportation, and export needs. APAC's expansive agricultural sector continues to exert significant influence, solidifying its position as a key driver in the agricultural packaging market.

Market Developments:

- December 2023- TIPA and ATI unveiled a groundbreaking achievement with the introduction of a 'first-of-its-kind' fully compostable lid for coffee capsules. The innovative lid was designed to meet forthcoming compostability regulations while enhancing barrier protection, sealing properties, and guarding against material migration, among other benefits.

- October 2023- CP Foods collaborated with SCGP and SCGC to introduce eco-friendly food packaging. This tri-party collaboration was formalized with the signing of a memorandum of understanding (MoU). The partnership centered on pioneering advancements in pulp and polymer-based packaging with SCGP, as well as the development of green polymer-based plastic solutions with SCGC.

Market Segmentation

By Material Type

- Plastic

- Paper and Paperboard

- Composite Material (Jute)

- Metal

- Others

By Product Type

- Trays

- Pouches Bags and Sacks

- Containers

- Films

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others

Table of Contents

Companies Mentioned

- Sonoco Products Company

- Mondi Group

- BAG corporation

- LC Packaging International BV

- NNZ Group

- Tetra Pak International S.A.

- Amcor plc

- Flex – Pack

- Western Packaging

- Greif, Inc.

- Proampac LLC

- Creative Agricultural Packaging, Inc.

Table Information

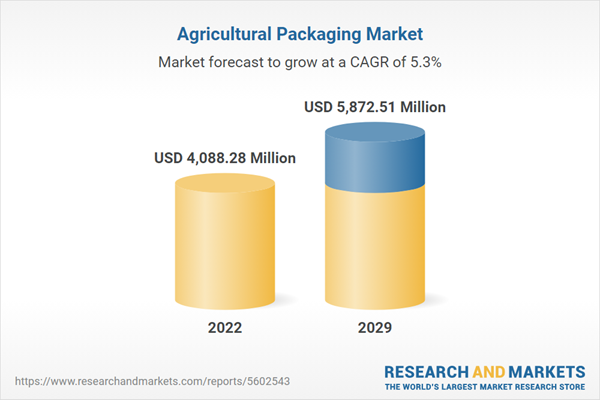

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | February 2024 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 4088.28 Million |

| Forecasted Market Value ( USD | $ 5872.51 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |