Nanoparticles is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global nanomedicine market experiences significant impetus from two primary factors: ongoing advancements in nanotechnology innovation and the increasing prevalence of chronic diseases. Technological progress consistently yields novel tools and materials, enabling sophisticated diagnostic and therapeutic applications within healthcare. For instance, according to the National Institutes of Health, in July 2023, the Notice of Funding Opportunity for "Innovative Research in Cancer Nanotechnology (IRCN) R01 Grant" was published, with application deadlines including November 2023 and May 2024, demonstrating sustained investment in fundamental research in this specialized area. Concurrently, the rising global burden of chronic diseases intensifies the demand for more effective medical interventions.Key Market Challenges

A significant challenge impeding the expansion of the Global Nanomedicine Market is the substantial cost associated with the development and complex manufacturing processes of these specialized products. The intricate nature of nanotechnology-based interventions necessitates considerable upfront investment in research, highly specialized equipment, advanced infrastructure, and a workforce with unique expertise. These requirements often lead to protracted development timelines and increased operational expenditures throughout the product lifecycle, from initial synthesis to large-scale production.Key Market Trends

The increasing shift towards personalized nanomedicine stands as a significant factor shaping the global nanomedicine market. This trend emphasizes tailoring medical treatments to individual patient characteristics, leveraging nanotechnology's ability to deliver drugs precisely and enhance diagnostic accuracy. Personalized nanomedicine offers the potential for improved therapeutic efficacy and reduced adverse effects by targeting specific cells or tissues. According to the Personalized Medicine Coalition (PMC), a US-based nonprofit organization, the U. S. Food and Drug Administration (FDA) approved 26 new personalized medicines in 2023, a notable increase from the 12 approved in 2022. This demonstrates a growing regulatory recognition and market adoption of personalized approaches, which nanomedicine profoundly supports.Key Market Players Profiled:

- Pfizer Inc.

- Johnson & Johnson Innovative Medicine

- Sanofi S.A.

- Amgen Inc.

- Moderna, Inc.

- Novo Nordisk A/S

- Genentech, Inc.

- Celgene Corporation

- Vifor Pharma Group

- Teva Pharmaceutical Industries Ltd.

Report Scope:

In this report, the Global Nanomedicine Market has been segmented into the following categories:By Nanomolecule Type:

- Nanoparticles

- Nanoshells

- Nanodevices

- Nanotubes

By Nanoparticles Type:

- Polymer-based

- Lipid-based

- Nanocrystals

- Inorganic

- Others

By Application:

- Drug Delivery

- Vaccines

- Diagnostic Imaging

- Regenerative Medicine

- Others

By Disease Indication:

- Oncological Diseases

- Infectious Diseases

- Orthopedic Disorders

- Cardiovascular Diseases

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Nanomedicine Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Nanomedicine market report include:- Pfizer Inc.

- Johnson & Johnson Innovative Medicine

- Sanofi S.A.

- Amgen Inc.

- Moderna, Inc.

- Novo Nordisk A/S

- Genentech, Inc.

- Celgene Corporation

- Vifor Pharma Group

- Teva Pharmaceutical Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

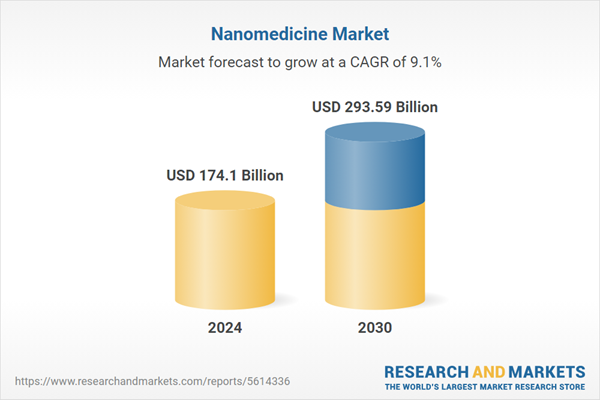

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 174.1 Billion |

| Forecasted Market Value ( USD | $ 293.59 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |