Speak directly to the analyst to clarify any post sales queries you may have.

MARKET OPPORTUNITIES & TRENDS

Growth of Edge Computing Facilities Along with 5G Network

- The rapid rollout of 5G across Latin America, led by countries including Brazil, Mexico, Argentina, Colombia, and Chile, drives the demand for edge computing facilities that can process data closer to end-users. Edge data centers are essential to support ultra-low latency and real-time applications such as autonomous vehicles, IoT, and AI workloads.

- Agência Nacional de Telecommunications (ANATEL), the Brazilian telecom regulatory authority, was formed in 1997. Telecom operators, including Claro, Telefonica, and TIM, are the prominent players that were the first to launch 5G in Brazil. As per ANATEL, all Brazilian cities are likely to have 5G coverage by the end of 2029. The country expects the number of 5G subscribers to reach 179 million by 2030, with a penetration rate of 77% of the total population.

- The Federal Telecommunications Institute (IFT), formed in 2013, oversees and promotes competition in telecommunications in Mexico. Telcel by America Movil is the largest mobile operator in Mexico, accounting for a total of over 10 million 5G subscribers nationwide. According to the Mobility Report by Ericsson, Mexico accounted for 6.6 million subscribers to the 5G network across 125 cities in 2024.

- Edge data centers are being deployed across Latin America - especially in Brazil, Chile, Colombia, and Mexico, as telecoms expand 5G services to deeper-tier cities and rural regions, pushing demand for localized, low-latency compute.

- Providers like Scala Data Centers, EdgeConneX, Mexico Telecom Partners, KIO Networks, HostDime, and others offer colocation services and support various edge computing solutions across the LATAM region.

- Grupo ZFB, EdgeUno, and Tecto Data Centers support edge computing by offering managed hosting, CDN, and cloud services in Colombia.

Adoption of Artificial Intelligence

- The adoption of AI is on the rise across Latin America with the increased trend of automation and smart operations. The government has launched several artificial strategies. For instance, in May 2025, the government of Argentina promoted Argentina to become a global AI hub, aiming to be the "world’s fourth AI center" by offering minimal regulation, abundant land, and low energy costs to international tech firms

- Several data center operators have started developing AI-ready data centers in Latin America to accommodate AI workloads being rapidly generated by customers of different industry sectors. For instance, in June 2025, TECfusions announced a 100MW AI-ready data center campus in Puente Alto, Chile, starting with 10MW and scaling to meet high-density AI workloads.

- Organizations across Latin America are placing a strong emphasis on strategic data management to accelerate AI adoption, acknowledging that data quality and accessibility are critical to the success of AI and machine learning applications. In Rio Grande do Sul, Scala Data Centers is building AI City, which involves an investment of over $50 billion over time toward the development of data centers. Also, Elea Data Centers focuses on developing its AI-based data center campus in Rio de Janeiro.

SEGMENTATION INSIGHTS

- The electrical infrastructure is witnessing several innovations in the UPS systems, generators, transfer switches & switchgears and other electrical equipment. Some of such innovations include HVO fuel for generator sets, which reduces emissions as a measure to curb emissions.

- Additionally, several innovative UPS batteries, such as Nickel-Zinc (NiZn) and Sodium-Ion batteries, are gaining traction in the market due to their high power density, safety, sustainability, and other factors.

- Liquid cooling is becoming a significant trend that major colocation operators are implementing in their data center facilities. It is emerging as a key differentiator for colocation providers as AI and compute-intensive workloads continue to grow. Companies like Equinix, Ascenty (Digital Realty), ODATA (Aligned Data Centers), Scala Data Centers and others are leading the way by offering scalable and energy-efficient solutions that can support the increasing demands of high-performance computing.

- ODATA (Aligned Data Centers)’s Data Centers feature flexible cooling technology, the Delta cube, that optimizes high-density cooling and space utilization while improving energy efficiency

REGIONAL ANALYSIS

- Cumulatively, data center operators in Latin America are expected to add over 1,831 MW of core & shell power capacity between 2025 and 2030. Brazil is likely to lead the market by contributing more than 858 MW of this capacity, followed by Mexico with over 431 MW.

- Brazil at present dominates the data center market in Latin America, followed by Mexico, Chile, Colombia and Argentina. It accounts for around 60% of the overall data center investments, which highlights its stronghold in the sector. The country witnesses billions in investments from several operators.

- Argentina is emerging as a growing data center market in Latin America due to a combination of untapped demand, its location, and improving digital infrastructure. The country has historically been underserved in terms of data center capacity, creating significant room for expansion as cloud adoption, e-commerce, and digital services accelerate. Compared to saturated markets like Brazil and Chile, Argentina offers competitive advantages, including lower land and power costs, which are critical for large-scale data center operations.

VENDOR LANDSCAPE

- The Latin America data center colocation market has the presence of prominent operators such as Ascenty (Digital Realty), Cirion Technologies, Elea Data Centers, Equinix, KIO Networks, NextStream (Actis), ODATA (Aligned Data Centers) and Scala Data Centers

- The market has a presence of several other prominent colocation operators, such as Angola Cables, Ava Telecom, Blue Nap Americas, Claro, DHAmericas, EdgeConneX, EVEO, Gtd, HostDime, Internexa, IPXON Networks, Mexico Telecom Partners (MTP), Millicom (Tigo), OneX Data Center, Oxygen, Quântico Data Center, SONDA, Takoda Data Centers, Telecom Italia Sparkle, Tecto Data Centers (V.tal), Win Empresas and others.

- New Entrants include 247 Data Centers, Ada Infrastructure, Atlantic Data Centers, CloudHQ, Layer 9 Data Centers, MDC Data Centers, OMNIA Data Centers, Surfix Data Centers, TECfusions and several others.

- In 2024, Ascenty (Digital Realty) held the largest share of colocation revenue in the U.S. data center market, accounting for approximately 18.7% of total revenue. Equinix followed closely, capturing around 13.9% of the market share, reflecting its strong presence and competitive positioning in the Latin America colocation landscape.

Key Data Center Colocation Operators

- Ascenty (Digital Realty)

- Cirion Technologies

- Elea Data Centers

- Equinix

- KIO Networks

- NextStream (Actis)

- ODATA (Aligned Data Centers)

- Scala Data Centers

Other Data Center Colocation Operators

- Angola Cables

- Ava Telecom

- Blue Nap Americas

- Claro

- DHAmericas

- EdgeConneX

- EVEO

- Gtd

- HostDime

- Internexa

- IPXON Networks

- Mexico Telecom Partners (MTP)

- Millicom (Tigo)

- OneX Data Center

- Oxygen

- Quântico Data Center

- SONDA

- Takoda Data Centers

- Telecom Italia Sparkle

- Tecto Data Centers (V.tal)

- Win Empresas

New Entrants

- 247 Data Centers

- Ada Infrastructure

- Atlantic Data Centers

- CloudHQ

- Layer 9 Data Centers

- MDC Data Centers

- OMNIA Data Centers

- Surfix Data Center

- TECfusions

Segmentation by Colocation Type

- Retail Colocation

- Wholesale Colocation

Segmentation by Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

Segmentation by Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgear

- PDUs

- Other Electrical Infrastructure

Segmentation by Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

Segmentation by Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Economizers & Evaporative Coolers

- Other Cooling Units

Segmentation by Cooling Techniques

- Air-based Cooling

- Liquid-based Cooling

Segmentation by General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- DCIM/BMS Solutions

Segmentation by Tier Standard

- Tier I & II

- Tier III

- Tier IV

Segmentation by Geography

- Latin America

- Mexico

- Chile

- Colombia

- Argentina

- Rest of Latin America

KEY QUESTIONS ANSWERED:

1. How big is the Latin America data center colocation market?2. How many MW of power capacity is expected to reach the Latin America data center colocation market by 2030?

3. What is the estimated market size in terms of area in the Latin America data center colocation market by 2030?

4. What is the growth rate of the Latin America data center colocation market?

5. What are the key trends in the Latin America data center colocation market?

Table of Contents

Companies Mentioned

- Ascenty (Digital Realty)

- Cirion Technologies

- Elea Data Centers

- Equinix

- KIO Networks

- NextStream (Actis)

- ODATA (Aligned Data Centers)

- Scala Data Centers

- Angola Cables

- Ava Telecom

- Blue Nap Americas

- Claro

- DHAmericas

- EdgeConneX

- EVEO

- Gtd

- HostDime

- Internexa

- IPXON Networks

- Mexico Telecom Partners (MTP)

- Millicom (Tigo)

- OneX Data Center

- Oxygen

- Quântico Data Center

- SONDA

- Takoda Data Centers

- Telecom Italia Sparkle

- Tecto Data Centers (V.tal)

- Win Empresas

- 247 Data Centers

- Ada Infrastructure

- Atlantic Data Centers

- CloudHQ

- Layer 9 Data Centers

- MDC Data Centers

- OMNIA Data Centers

- Surfix Data Center

- TECfusions

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

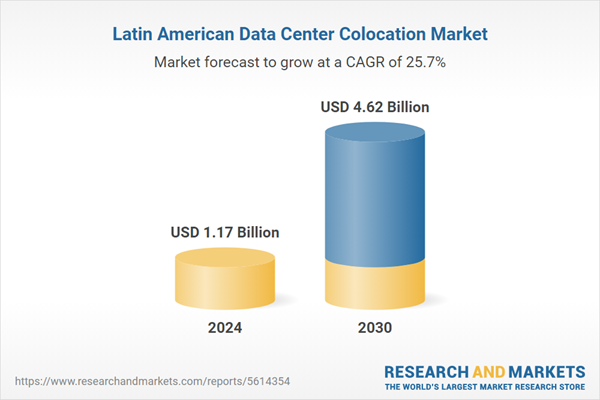

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | October 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.17 Billion |

| Forecasted Market Value ( USD | $ 4.62 Billion |

| Compound Annual Growth Rate | 25.7% |

| Regions Covered | Latin America |

| No. of Companies Mentioned | 38 |