Neurostimulation devices are advanced medical technologies designed to modulate and influence neural activity within the human body. These devices work by delivering electrical or magnetic impulses to specific regions of the nervous system, aiming to alleviate various neurological conditions and chronic disorders. They offer a promising non-invasive or minimally invasive therapeutic approach, enhancing the quality of life for patients and potentially opening up new avenues for treating various neurological disorders. The two primary types of neurostimulation devices are deep brain stimulation and spinal cord stimulation. DBS involves implanting electrodes into targeted brain areas to regulate abnormal neural signals and treat conditions such as Parkinson's disease, essential tremor, and dystonia.

The growing aging population is driving the global market. As the elderly population grows, the demand for neurostimulation devices to manage these conditions is likely to rise. Moreover, the development of non-invasive or minimally invasive neurostimulation technologies has expanded the potential patient pool, as these options often offer reduced risks and quicker recovery times compared to traditional surgical procedures. Besides, improved reimbursement policies by government and private health insurers in some regions have made neurostimulation treatments more accessible to patients, encouraging market growth. Also, ongoing research and clinical trials have provided additional evidence for the safety and efficacy of neurostimulation devices. Positive results from these studies have increased confidence in the technology among medical professionals and patients. Furthermore, the rising healthcare expenditure is supporting the growth of market solutions as neurostimulation devices offer a cost-effective approach to managing chronic conditions, which has driven their adoption.

Neurostimulation Devices Market Trends/Drivers:

Increasing Prevalence of Neurological Disorders

Neurological conditions such as Parkinson's disease, epilepsy, chronic pain, and depression affect millions of people worldwide, leading to significant healthcare burdens. Neurostimulation devices offer a promising solution for patients who are refractory to conventional treatments or experience severe side effects. Deep brain stimulation (DBS) has demonstrated remarkable efficacy in managing movement disorders, such as Parkinson's disease, thereby augmenting the demand for these devices. Additionally, the escalating incidence of chronic pain, particularly due to aging populations and sedentary lifestyles, fuels the need for spinal cord stimulation (SCS) devices to provide pain relief without relying heavily on medications. As governments and healthcare organizations prioritize improved patient outcomes and seek innovative solutions, the demand for neurostimulation devices is expected to grow steadily.Continual Advancements in Neurostimulation Technologies

Continuous research and development efforts have led to the creation of more sophisticated and targeted neurostimulation devices. Innovations include smaller and more precise electrodes, improved battery life, and the integration of closed-loop systems that can automatically adjust stimulation parameters based on real-time patient needs. These advancements translate to enhanced treatment outcomes, reduced side effects, and increased patient comfort. Moreover, the development of minimally invasive procedures for implanting neurostimulation devices has expanded their applicability to a broader patient population, making the treatments more accessible and appealing to both patients and healthcare providers. As technology continues to evolve, neurostimulation devices will likely become even more efficient and adaptable, further impelling their adoption and market penetration.Growing Awareness and Acceptance of Neuromodulation Therapies

As more clinical evidence supports the effectiveness of neurostimulation devices in treating various neurological disorders, medical practitioners increasingly recommend these therapies to their patients. Additionally, patient advocacy groups and awareness campaigns have played a crucial role in educating individuals about the potential benefits of neurostimulation, leading to greater patient acceptance of these treatments. The success stories of patients who have experienced significant improvements in their quality of life through neurostimulation devices have further contributed to the positive perception of these therapies. As trust in neuromodulation grows, the demand for these devices is expected to increase, fuelling the market expansion. Furthermore, collaborations between healthcare organizations, researchers, and device manufacturers to spread awareness and ensure appropriate usage will contribute to the sustained growth of the neurostimulation devices market.Neurostimulation Devices Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global neurostimulation devices market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on stimulation type, device type, application, and end-user.Breakup by Stimulation Type:

- Internal Stimulation

- External Stimulation

Internal stimulation devices form a significant segment within the neurostimulation market, characterized by their implantable nature. These devices are surgically placed within the body to deliver targeted electrical or magnetic stimulation directly to specific neural structures. The demand for internal stimulation devices is driven by their efficacy in managing complex neurological disorders that do not respond adequately to medications or other treatments. The ability to precisely target neural circuits while providing reversible and adjustable stimulation parameters enhances treatment outcomes, leading to improved patient quality of life.

On the other hand, external stimulation devices represent another substantial segment in the neurostimulation market, characterized by their non-invasive or minimally invasive nature. These devices are applied externally to the body's surface, delivering stimulation without the need for surgical implantation.

Breakup by Device Type:

- SCS (Spinal Cord Stimulation) Devices

- DBS (Deep Brain Stimulation) Devices

- SNS (Sacral Nerve Stimulation) Devices

- VNS (Vagus Nerve Stimulation) Devices

- GES (Gastric Electrical Stimulation) Devices

- Transcutaneous Electrical Nerve Stimulation Devices

- Transcranial Magnetic Stimulation Devices

- Others

SCS (spinal cord stimulation) dominates the market

The report has provided a detailed breakup and analysis of the market based on the device type. This includes spinal cord stimulation (SCS) devices, deep brain stimulation (DBS) devices, sacral nerve stimulation (SNS) devices, vagus nerve stimulation (VNS) devices, gastric electrical stimulation (GES) devices, transcutaneous electrical nerve stimulation devices, transcranial magnetic stimulation devices, and other. According to the report, SCS (spinal cord stimulation) devices represented the largest segment.SCS involves the implantation of electrodes along the spinal cord, where electrical impulses are delivered to modulate pain signals and provide relief for chronic pain conditions. The minimally invasive nature of the procedure offers numerous benefits, including shorter recovery times and reduced risks compared to invasive surgeries. Additionally, the customizable nature of SCS allows for individualized programming to target specific pain areas, tailoring treatment to meet each patient's unique needs. Moreover, continual advancements in SCS technology have led to more sophisticated devices with improved battery life, smaller implants, and enhanced programming capabilities, providing greater patient comfort and long-term sustainability. The focus on patient-centered care and shared decision-making has led to an increased emphasis on personalized pain management plans. Spinal cord stimulation, with its individualized programming capabilities, aligns well with this patient-centric approach, fueling its adoption in pain management strategies.

Breakup by Application:

- Pain Management

- Epilepsy

- Essential Tremors

- Urinary and Fecal Incontinence

- Depression

- Dystonia

- Parkinson’s Disease

- Others

Pain management dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes pain management, epilepsy, essential tremors, urinary and fecal incontinence, depression, dystonia, Parkinson’s disease, and others. According to the report, pain management represents the largest segment.Neurostimulation devices designed for pain management offer a promising alternative, particularly spinal cord stimulation (SCS) and peripheral nerve stimulation (PNS). These technologies work by delivering controlled electrical impulses to target nerves, modulating pain signals, and thereby reducing the perception of pain. Pain management through neurostimulation has demonstrated remarkable efficacy in various chronic pain conditions, including neuropathic pain, failed back surgery syndrome (FBSS), and complex regional pain syndrome (CRPS). Additionally, the advancements in neurostimulation technology have led to more personalized and precise pain management solutions, allowing for tailored treatment strategies based on individual patient needs.

Breakup by End-User:

- Rehabilitation Centers

- Hospitals

- Medical Clinics

- Others

Hospitals dominates the market

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes rehabilitation centers, hospitals, medical clinics, and others. According to the report, hospitals represented the largest segment.Hospitals play a central role in the diagnosis, treatment, and management of various neurological and chronic disorders, which often require neurostimulation therapies as part of the treatment plan. Hospitals have access to multidisciplinary teams of medical professionals, including neurologists, neurosurgeons, pain specialists, and anesthesiologists, who collaborate to provide comprehensive care to patients requiring neurostimulation therapies. Additionally, they are equipped with state-of-the-art operating rooms and facilities that meet stringent regulatory standards, ensuring safe and effective implantation procedures. Furthermore, neurostimulation devices often require careful programming and adjustments to optimize treatment outcomes, and hospitals have the resources to support these ongoing patient management needs.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and Others), Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and Others), Latin America (Brazil, Mexico, and Others), and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America has a well-established healthcare infrastructure and is at the forefront of medical research and technological advancements. The presence of leading healthcare facilities, specialized neurology centers, and renowned research institutions fosters innovation and the adoption of cutting-edge neurostimulation technologies. Moreover, the region has a high prevalence of neurological disorders and chronic pain conditions, leading to a substantial demand for neurostimulation devices for effective management and treatment. The region's aging population, coupled with a growing awareness of neurostimulation therapies among patients and healthcare providers, further fuels market growth. Additionally, favorable reimbursement policies and regulatory frameworks in North America support the widespread adoption of neurostimulation devices.

Competitive Landscape:

Neurostimulation device manufacturers are heavily investing in research and development to enhance their existing products and develop new, innovative technologies. This involves conducting clinical trials, exploring new applications for neurostimulation, and improving the safety and efficacy of their devices. Moreover, companies are introducing new neurostimulation devices or release upgraded versions of existing ones. These launches aim to provide patients and healthcare professionals with state-of-the-art solutions that offer better outcomes and user experiences. Furthermore, companies actively seek to expand their market presence, both geographically and in terms of applications. They may pursue regulatory approvals in different regions, explore new therapeutic areas for neurostimulation, or target specific patient populations with unmet needs. Also, collaboration with other companies, research institutions, and healthcare organizations is common in the neurostimulation devices market.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Biocontrol Medical

- Boston Scientific Corporation

- Cyberonics Inc.

- Medtronic Inc.

- Neuronetics Inc.

- Neuropace Inc.

- Neurosigma Inc.

- Nevro Corporation

- ST. Jude Medical Inc.

- Synapse Biomedical Inc.

Key Questions Answered in This Report

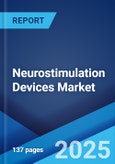

1. What was the size of the global neurostimulation devices market in 2024?2. What is the expected growth rate of the global neurostimulation devices market during 2025-2033?

3. What are the key factors driving the global neurostimulation devices market?

4. What has been the impact of COVID-19 on the global neurostimulation devices market?

5. What is the breakup of the global neurostimulation devices market based on the device type?

6. What is the breakup of the global neurostimulation devices market based on the application?

7. What is the breakup of the global neurostimulation devices market based on the end-user?

8. What are the key regions in the global neurostimulation devices market?

9. Who are the key players/companies in the global neurostimulation devices market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Neurostimulation Devices Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Stimulation Type

6.1 Internal Stimulation

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 External Stimulation

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Device Type

7.1 SCS (Spinal Cord Stimulation) Devices

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 DBS (Deep Brain Stimulation) Devices

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 SNS (Sacral Nerve Stimulation) Devices

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 VNS (Vagus Nerve Stimulation) Devices

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 GES (Gastric Electrical Stimulation) Devices

7.5.1 Market Trends

7.5.2 Market Forecast

7.6 Transcutaneous Electrical Nerve Stimulation Devices

7.6.1 Market Trends

7.6.2 Market Forecast

7.7 Transcranial Magnetic Stimulation Devices

7.7.1 Market Trends

7.7.2 Market Forecast

7.8 Others

7.8.1 Market Trends

7.8.2 Market Forecast

8 Market Breakup by Application

8.1 Pain Management

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Epilepsy

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Essential Tremors

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Urinary and Fecal Incontinence

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Depression

8.5.1 Market Trends

8.5.2 Market Forecast

8.6 Dystonia

8.6.1 Market Trends

8.6.2 Market Forecast

8.7 Parkinson’s Disease

8.7.1 Market Trends

8.7.2 Market Forecast

8.8 Others

8.8.1 Market Trends

8.8.2 Market Forecast

9 Market Breakup by End-User

9.1 Rehabilitation Centers

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Hospitals

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Medical Clinics

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Others

9.4.1 Market Trends

9.4.2 Market Forecast

10 Market Breakup by Region

10.1 North America

10.1.1 United States

10.1.1.1 Market Trends

10.1.1.2 Market Forecast

10.1.2 Canada

10.1.2.1 Market Trends

10.1.2.2 Market Forecast

10.2 Europe

10.2.1 Germany

10.2.1.1 Market Trends

10.2.1.2 Market Forecast

10.2.2 France

10.2.2.1 Market Trends

10.2.2.2 Market Forecast

10.2.3 United Kingdom

10.2.3.1 Market Trends

10.2.3.2 Market Forecast

10.2.4 Italy

10.2.4.1 Market Trends

10.2.4.2 Market Forecast

10.2.5 Spain

10.2.5.1 Market Trends

10.2.5.2 Market Forecast

10.2.6 Russia

10.2.6.1 Market Trends

10.2.6.2 Market Forecast

10.2.7 Others

10.2.7.1 Market Trends

10.2.7.2 Market Forecast

10.3 Asia Pacific

10.3.1 China

10.3.1.1 Market Trends

10.3.1.2 Market Forecast

10.3.2 Japan

10.3.2.1 Market Trends

10.3.2.2 Market Forecast

10.3.3 India

10.3.3.1 Market Trends

10.3.3.2 Market Forecast

10.3.4 South Korea

10.3.4.1 Market Trends

10.3.4.2 Market Forecast

10.3.5 Australia

10.3.5.1 Market Trends

10.3.5.2 Market Forecast

10.3.6 Indonesia

10.3.6.1 Market Trends

10.3.6.2 Market Forecast

10.3.7 Others

10.3.7.1 Market Trends

10.3.7.2 Market Forecast

10.4 Latin America

10.4.1 Brazil

10.4.1.1 Market Trends

10.4.1.2 Market Forecast

10.4.2 Mexico

10.4.2.1 Market Trends

10.4.2.2 Market Forecast

10.4.3 Others

10.4.3.1 Market Trends

10.4.3.2 Market Forecast

10.5 Middle East and Africa

10.5.1 Market Trends

10.5.2 Market Breakup by Country

10.5.3 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

12.1 Overview

12.2 Inbound Logistics

12.3 Operations

12.4 Outbound Logistics

12.5 Marketing and Sales

12.6 Post Sales Services

13 Porters Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Price Indicators

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Biocontrol Medical

15.3.1.1 Company Overview

15.3.1.2 Product Portfolio

15.3.2 Boston Scientific Corporation

15.3.2.1 Company Overview

15.3.2.2 Product Portfolio

15.3.2.3 Financials

15.3.2.4 SWOT Analysis

15.3.3 Cyberonics Inc.

15.3.3.1 Company Overview

15.3.3.2 Product Portfolio

15.3.4 Medtronic Inc.

15.3.4.1 Company Overview

15.3.4.2 Product Portfolio

15.3.5 Neuronetics Inc.

15.3.5.1 Company Overview

15.3.5.2 Product Portfolio

15.3.5.3 Financials

15.3.6 Neuropace Inc.

15.3.6.1 Company Overview

15.3.6.2 Product Portfolio

15.3.7 Neurosigma Inc.

15.3.7.1 Company Overview

15.3.7.2 Product Portfolio

15.3.8 Nevro Corporation

15.3.8.1 Company Overview

15.3.8.2 Product Portfolio

15.3.8.3 Financials

15.3.9 ST. Jude Medical Inc.

15.3.9.1 Company Overview

15.3.9.2 Product Portfolio

15.3.10 Synapse Biomedical Inc.

15.3.10.1 Company Overview

15.3.10.2 Product Portfolio

List of Figures

Figure 1: Global: Neurostimulation Devices Market: Major Drivers and Challenges

Figure 2: Global: Neurostimulation Devices Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Neurostimulation Devices Market: Breakup by Stimulation Type (in %), 2024

Figure 4: Global: Neurostimulation Devices Market: Breakup by Device Type (in %), 2024

Figure 5: Global: Neurostimulation Devices Market: Breakup by Application (in %), 2024

Figure 6: Global: Neurostimulation Devices Market: Breakup by End-User (in %), 2024

Figure 7: Global: Neurostimulation Devices Market: Breakup by Region (in %), 2024

Figure 8: Global: Neurostimulation Devices Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: Global: Neurostimulation Devices (Internal Stimulation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 10: Global: Neurostimulation Devices (Internal Stimulation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 11: Global: Neurostimulation Devices (External Stimulation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Global: Neurostimulation Devices (External Stimulation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Global: Neurostimulation Devices (Spinal Cord Stimulation Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Neurostimulation Devices (Spinal Cord Stimulation Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Neurostimulation Devices (Deep Brain Stimulation Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Neurostimulation Devices (Deep Brain Stimulation Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Neurostimulation Devices (Sacral Nerve Stimulation Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Neurostimulation Devices (Sacral Nerve Stimulation Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: Neurostimulation Devices (Vagus Nerve Stimulation Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: Neurostimulation Devices (Vagus Nerve Stimulation Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: Neurostimulation Devices (Gastric Electrical Stimulation Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: Neurostimulation Devices (Gastric Electrical Stimulation Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Global: Neurostimulation Devices (Transcutaneous Electrical Nerve Stimulation Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Global: Neurostimulation Devices (Transcutaneous Electrical Nerve Stimulation Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Global: Neurostimulation Devices (Transcranial Magnetic Stimulation Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Global: Neurostimulation Devices (Transcranial Magnetic Stimulation Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: Neurostimulation Devices (Other Devices) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: Neurostimulation Devices (Other Devices) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Global: Neurostimulation Devices (Pain Management) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Global: Neurostimulation Devices (Pain Management) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: Global: Neurostimulation Devices (Epilepsy) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: Global: Neurostimulation Devices (Epilepsy) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: Global: Neurostimulation Devices (Essential Tremors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: Global: Neurostimulation Devices (Essential Tremors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: Global: Neurostimulation Devices (Urinary and Fecal Incontinence) Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: Global: Neurostimulation Devices (Urinary and Fecal Incontinence) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Global: Neurostimulation Devices (Depression) Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Global: Neurostimulation Devices (Depression) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Global: Neurostimulation Devices (Dystonia) Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Global: Neurostimulation Devices (Dystonia) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Global: Neurostimulation Devices (Parkinson’s Disease) Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Global: Neurostimulation Devices (Parkinson’s Disease) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Global: Neurostimulation Devices (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Global: Neurostimulation Devices (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Global: Neurostimulation Devices (Rehabilitation Centers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: Global: Neurostimulation Devices (Rehabilitation Centers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: Global: Neurostimulation Devices (Hospitals) Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: Global: Neurostimulation Devices (Hospitals) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: Global: Neurostimulation Devices (Medical Clinics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: Global: Neurostimulation Devices (Medical Clinics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: Global: Neurostimulation Devices (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: Global: Neurostimulation Devices (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: North America: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 54: North America: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 55: United States: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 56: United States: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 57: Canada: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 58: Canada: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 59: Europe: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 60: Europe: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 61: Germany: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 62: Germany: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 63: France: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 64: France: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 65: United Kingdom: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 66: United Kingdom: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 67: Italy: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 68: Italy: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 69: Spain: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 70: Spain: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 71: Russia: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 72: Russia: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 73: Others: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 74: Others: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 75: Asia Pacific: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 76: Asia Pacific: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 77: China: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 78: China: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 79: Japan: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 80: Japan: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 81: India: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 82: India: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 83: South Korea: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 84: South Korea: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 85: Australia: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 86: Australia: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 87: Indonesia: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 88: Indonesia: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 89: Others: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 90: Others: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 91: Latin America: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 92: Latin America: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 93: Brazil: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 94: Brazil: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 95: Mexico: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 96: Mexico: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 97: Others: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 98: Others: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 99: Middle East and Africa: Neurostimulation Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 100: Middle East and Africa: Neurostimulation Devices Market: Breakup by Country (in %), 2024

Figure 101: Middle East and Africa: Neurostimulation Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 102: Global: Neurostimulation Devices Industry: SWOT Analysis

Figure 103: Global: Neurostimulation Devices Industry: Value Chain Analysis

Figure 104: Global: Neurostimulation Devices Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Neurostimulation Devices Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Neurostimulation Devices Market Forecast: Breakup by Stimulation Type (in Million USD), 2025-2033

Table 3: Global: Neurostimulation Devices Market Forecast: Breakup by Device Type (in Million USD), 2025-2033

Table 4: Global: Neurostimulation Devices Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 5: Global: Neurostimulation Devices Market Forecast: Breakup by End-User (in Million USD), 2025-2033

Table 6: Global: Neurostimulation Devices Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 7: Global: Neurostimulation Devices Market: Competitive Structure

Table 8: Global: Neurostimulation Devices Market: Key Players

Companies Mentioned

- Biocontrol Medical

- Boston Scientific Corporation

- Cyberonics Inc.

- Medtronic Inc.

- Neuronetics Inc.

- Neuropace Inc.

- Neurosigma Inc.

- Nevro Corporation

- ST. Jude Medical Inc.

- Synapse Biomedical Inc. etc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 9.6 Billion |

| Forecasted Market Value ( USD | $ 22 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |