Genomics Market Analysis:

- Major Market Drivers: The genomics market size 2025 is experiencing growth driven by advancements in genetic sequencing technologies and an increasing interest in personalized medicine. Investments in R&D are pivotal, pushing the genomics market value upwards.

- Key Market Trends: Artificial intelligence (AI) and machine learning (ML) integration in genomics refer to the key genomics market trends, enhancing genomics market research capabilities. This trend aids in refining predictive modeling, leading to precise genomics market forecasts. The adoption of CRISPR gene editing technology highlights a significant shift in therapeutic applications, directly influencing genomics market demand.

- Geographical Trends: North America dominates in terms of genomics market revenue, due to its advanced healthcare infrastructure and a strong focus on research and innovation. The Asia-Pacific region shows the fastest genomics market growth rate, propelled by increasing government initiatives and a burgeoning focus on genomics research. This expansion offers a diverse genomics market overview, signaling varied growth prospects across different regions.

- Competitive Landscape: Notable market players in the genomics sector include Illumina, Inc., Thermo Fisher Scientific, QIAGEN, Agilent Technologies, Oxford Nanopore Technologies, and CRISPR Therapeutics, among others. These entities are crucial in determining the genomics market outlook, with their competitive strategies and innovations significantly contributing to the market revenue.

- Challenges and Opportunities: Ethical concerns related to genetic data and the high costs associated with genomic sequencing pose challenges in the genomics market. Yet, these challenges also unveil opportunities for innovation to meet the increasing genomics market demand. Developing cost-effective sequencing methods and establishing ethical guidelines could further bolster the genomics market value and facilitate genomics market growth.

Genomics Market Trends:

Technological innovations in sequencing technologies

According to the genomics market analysis, the fast pace of innovative advancements, especially in next-generation sequencing (NGS) and CRISPR-Cas9 genome altering innovations, serves as an essential driver for the genomics showcase. The emergence of startups providing sequencing services for diverse uses, such as diagnostics, personalized medicine, and research. Sophisticated technologies like NGS have greatly improved genomic analysis, ensuring it is quicker, more precise, and economical. Government and industry funding are also vital in growing the market, aiding research efforts and the commercialization of innovative technologies. Examples like 23andMe, a prominent player in consumer genetic testing, and Genome Medical, which recently obtained $14 million in funding to enhance its telehealth genetic consultations, underscore the growing fusion of genomics and healthcare services. These advancements contribute to making genomics more attainable and usable, thereby making the global genomics market size 2025 experience significant growth.Growing demand for personalized medicine

Another important driver of the market is the rising across the globe need for personalized medicine, which customizes medical care according to each patient's unique characteristics. Customized medical treatment depends greatly on genetic data to inform the creation of specific therapies tailored to an individual's genetic composition, moving away from the generalized approach of traditional medicine to more accurate and efficient treatments. This also facilitates enhanced awareness among consumers that helps them find an answer for the “what is the genomics market?” question. Along with this, the increasing need is fueled by the expanding recognition and knowledge of the genetic causes of diseases, the increasing frequency of genetic conditions, and the limitations of conventional therapies for various illnesses. Using genomics in personalized medicine aims to enhance patient results and provides a cost-effective healthcare approach by prioritizing prevention and accurate treatment, which drives more investments and research in genomics.Expansion in clinical applications and diagnostics

The market is also growing due to genomics technologies being utilized more for clinical applications and diagnostics, such as identifying genetic disorders, cancer screening, and monitoring infectious diseases. Improved understanding of the genetic basis of diseases has allowed for the incorporation of genomics into clinical care, resulting in the creation of novel diagnostic tools and genetic tests that can anticipate an individual's risk for specific conditions, guide treatment choices, and track disease advancement. A question arises, what is the demand for genomics, particularly in the field of clinical applications and diagnostics? Advancements in genomics technologies are anticipated to keep driving demand in this field, expanding their potential in diagnostics such as liquid biopsies and NIPT, highlighting the critical role genomics plays in revolutionizing healthcare and diagnostics.Genomics Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, application, technology, and end-user.Breakup by Component:

- Products

- Instruments and Software

- Consumables and Reagents

- Services

- Core Genomics Services

- NGS-Based Services

- Biomarker Translation Services

- Computational Services

- Others

Consumables and reagents account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the component. This includes products (instruments and software, consumables and reagents), services (core genomics services, NGS-based services, biomarker translation services, computational services, and others). According to the report, consumables and reagents represented the largest segment.The consumables and reagents sector dominates the market due to their essential role in a variety of genomic procedures including DNA sequencing, gene editing, and sample preparation. With the increased use of genomics in sectors such as healthcare, agriculture, and biotechnology, there is a rising need for specific consumables and reagents, leading manufacturers to enhance and extend their product range. This is promoting the development of the consumables industry, emphasizing its crucial role in driving and applying genomics technologies, making a substantial contribution to the market's overall growth. Moreover, the strong demand for these products, which are essential for ensuring the accuracy and reliability of genomic analyses in research and clinical diagnostics, further solidifies the dominance of this industry sector.

Breakup by Application:

- Functional Genomics

- Epigenomics

- Biomarkers Discovery

- Pathway Analysis

- Others

Functional genomics holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes functional genomics, epigenomics, biomarkers discovery, pathway analysis, and others. According to the report, functional genomics accounted for the largest market share.Functional genomics, which focuses on gene functions and interactions, has become the dominant area in the market, showcasing its crucial importance in comprehending intricate biological processes and disease mechanisms. Utilizing high-throughput technologies including RNA sequencing and CRISPR-Cas9 in functional genomics enables in-depth study of gene expression and regulation, leading to progress in biomedical research and healthcare. Moreover, the growing emphasis on exploring the functional characteristics of the genome, along with the quick advancements in technology, positions functional genomics as a major force driving growth and innovation in the overall market.

Breakup by Technology:

- Sequencing

- Microarray

- Polymerase Chain Reaction

- Nucleic Acid Extraction and Purification

- Others

Sequencing represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the technology. This includes sequencing, microarray, polymerase chain reaction, nucleic acid extraction and purification, and others. According to the report, sequencing represented the largest segment.Sequencing technology is the main component of the market due to its crucial role in deciphering the genetic information found in DNA and RNA, making it the largest technological segment. The critical insights provided by sequencing drive this prominence in personalized medicine, genetic research, and diagnostic applications by uncovering genetic variations and mutations. Furthermore, the rise of NGS technologies is changing this field by offering unparalleled speed, accuracy, and cost-efficiency compared to traditional techniques. NGS enables a detailed analysis of genomes, exomes, and transcriptomes, allowing for progress in comprehending complex diseases, evolutionary biology, and microbial genomics.

Breakup by End-User:

- Research Centers

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Others

Pharmaceutical and biotechnology companies exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes research centers, hospitals and clinics, pharmaceutical and, biotechnology companies, and others. According to the report, pharmaceutical and, biotechnology companies accounted for the largest market share.Pharmaceutical and biotechnology companies are playing a major role in the market, emphasizing their significance in driving drug development and personalized medicine forward. These areas apply genomic data to identify novel targets for drugs, understand the genetic origins of diseases, and develop tailored treatments using individuals' genetic data. For instance, Illumina Inc., a top company in DNA sequencing and array-based technologies worldwide, partnered with Nashville Biosciences, LLC, a prominent clinical and genomic data company that is a subsidiary of Vanderbilt University Medical Center (VUMC), to reveal the five original members of the Alliance for Genomic Discovery (AGD). The extended agreement aims to quicken the treatment development process by conducting thorough genomics research and establishing a high-quality clinical genomics database. AbbVie, Amgen, AstraZeneca, Bayer, and Merck will pool their resources to fund the sequencing of 250,000 samples and can use the data for developing drugs and improving therapies.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest genomics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for genomics.North America holds the largest market share due to its advanced healthcare system, significant investment in research and development, and the presence of top pharmaceutical and biotechnology companies. Additionally, the region's advanced technology in genomics and bioinformatics, along with these factors, is fostering a favorable environment for the development and advancement of the genomics field. North America's strong position in the global market is supported by the close collaboration between academic and research institutions with the industry, leading to innovation and setting trends that impact global genomics practices and policies.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the genomics industry include

- 23andMe, Inc

- Agilent Technologies, Inc.

- Bayer AG

- BGI Group

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Illumina, Inc.

- Oxford Nanopore Technologies

- PerkinElmer, Inc.

- Myriad Genetics, Inc.

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

Key Questions Answered in This Report

1. What is the genomics market?2. How big is the genomics market?

3. What is the market forecast for genomics?

4. What are the key factors driving the global genomics market?

5. What has been the impact of COVID-19 on the global genomics market?

6. What is the breakup of the global genomics market based on the component?

7. What is the breakup of the global genomics market based on the application?

8. What is the breakup of the global genomics market based on the technology?

9. What is the breakup of the global genomics market based on the end-user?

10. What are the key regions in the global genomics market?

11. Who are the key players/companies in the global genomics market?

Table of Contents

Companies Mentioned

- 23andMe Inc.

- Agilent Technologies Inc.

- Bayer Aktiengesellschaft

- BGI Genomics Co. Ltd.

- Bio-RAD Laboratories Inc.

- Danaher Corporation

- Illumina Inc.

- Oxford Nanopore Technologies

- PerkinElmer Inc.

- Myriad Genetics Inc.

- Roche Holding AG

- Thermo Fisher Scientific Inc.

Table Information

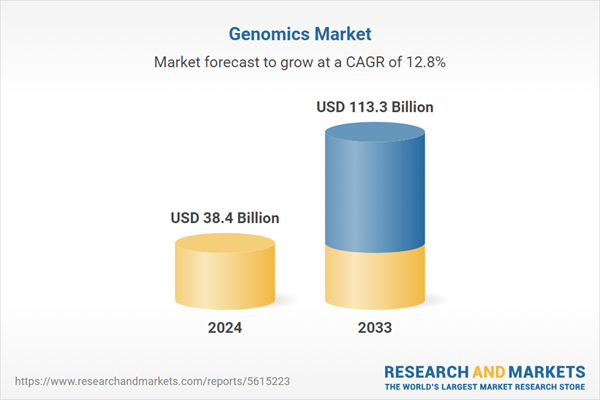

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 38.4 Billion |

| Forecasted Market Value ( USD | $ 113.3 Billion |

| Compound Annual Growth Rate | 12.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |