Enzymes are specialized proteins that facilitate and accelerate biochemical reactions in living organisms. Through a process known as catalysis, enzymes work by lowering the activation energy required for a reaction to occur, thereby expediting chemical transformations without being consumed themselves. This ability to enhance the rate of reactions has numerous practical applications across various industries. Enzymes find extensive use in sectors such as food and beverages, pharmaceuticals, and bioenergy, where they play a pivotal role in enhancing production processes, improving product quality, and reducing environmental impact. Enzymes offer several advantages, including high specificity, enabling them to target specific substrates, resulting in efficient and controlled reactions. They operate under mild conditions of temperature and pH, reducing the need for harsh chemicals and extreme conditions. They also contribute to cost-effectiveness, as they can be reused and require minimal quantities to catalyze reactions. Different types of enzymes, such as amylases, proteases, and lipases, serve diverse functions based on their substrate specificity.

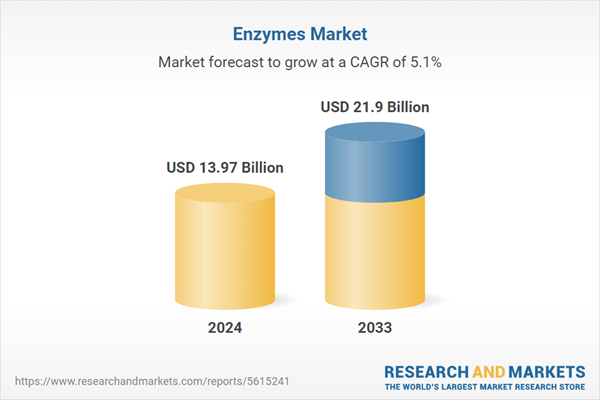

The global enzymes market is influenced by the increasing product demand from various industries, including food and beverages, healthcare, and biofuels. Moreover, the growing awareness of environmentally friendly solutions fuels the adoption of enzymes in various applications, further supporting market growth. Additionally, rapid advancements in biotechnology and genetic engineering have facilitated the development of novel enzymes with diverse functionalities, boosting market growth. In line with this, the pharmaceutical sector's escalating requirement for enzymes in drug development and manufacturing and the expanding research efforts to unlock enzymes' potential in addressing complex industrial challenges are augmenting the market growth.

Enzymes Market Trends/Drivers:

Increasing demand for enzymes across industries

The enzymes market experiences a robust impetus driven by heightened demand across diverse industries. Notably, the food and beverages sector extensively utilizes enzymes to enhance processing efficiency, improve product quality, and develop innovative products. Enzymes play a pivotal role in enhancing the texture, taste, and nutritional value of food items. Similarly, enzymes find substantial application in the healthcare domain, aiding in diagnostic procedures, drug development, and therapeutic treatments. In the biofuels industry, enzymes catalyze the conversion of organic matter into biofuels, contributing to the pursuit of sustainable energy sources. This escalating demand underscores the vital role enzymes play in streamlining industrial processes and driving innovation across sectors.Sustainability and environmentally friendly solutions

A significant driver of the enzymes market is the escalating global emphasis on sustainable practices and environmentally friendly solutions. Enzymes offer a greener alternative to traditional chemical processes, reducing the reliance on harsh chemicals and minimizing waste production. This aligns with the increasing consumer and regulatory demands for eco-friendly products and manufacturing processes. Enzymes enable industries to meet stringent environmental regulations while maintaining product quality and process efficiency. This heightened awareness of sustainability fosters the adoption of enzymes in various applications, bolstering their market demand and positioning them as a key component of the sustainable industrial landscape.Advances in biotechnology and genetic engineering

Rapid strides in biotechnology and genetic engineering have ushered in a new era of enzyme development and utilization. Scientists can now engineer enzymes with precise functionalities, tailoring them to specific industrial applications. This advancement has expanded the range of enzymes available and their potential applications. Enzymes engineered for enhanced stability, activity, and specificity have unlocked opportunities in industries previously untouched by enzymatic processes. Furthermore, the ability to produce enzymes through recombinant DNA technology has improved scalability and cost-effectiveness. This convergence of biotechnology and enzymes not only enriches industrial processes but also underscores the adaptability of enzymes to modern technological advancements, driving their integration into diverse sectors.Enzymes Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global enzymes market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on the type, source, reaction type, and application.Breakup by Type:

- Protease

- Carbohydrase

- Lipase

- Polymerase and Nuclease

- Others

Carbohydrase dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes protease, carbohydrase, lipase, polymerase and nuclease, and others. According to the report, carbohydrase represented the largest segment.The carbohydrase segment is propelled by the burgeoning demand for healthier and nutritious food options. These enzymes play a critical role in breaking down complex carbohydrates into simpler sugars, enhancing digestibility and nutrient absorption. Additionally, the rising prevalence of dietary restrictions, such as gluten intolerance, fuels the need for carbohydrase to facilitate the production of gluten-free products In line with this, the biofuel and bioenergy sectors leverage carbohydrase to convert lignocellulosic biomass into fermentable sugars, which are subsequently transformed into biofuels. This alignment with sustainable practices and the pursuit of renewable energy sources underscores the significance of carbohydrase in these industries. Furthermore, advancements in enzyme engineering and biotechnology enable the customization of carbohydrase for specific applications, boosting their efficiency and effectiveness.

Breakup by Source:

- Microorganisms

- Plants

- Animals

Microorganisms dominate the market

The report has provided a detailed breakup and analysis of the market based on the source. This includes microorganisms, plants, and animals. According to the report, microorganisms represented the largest segment.The microorganisms’ segment is propelled by several pivotal factors, including the burgeoning demand for sustainable solutions across industries, including agriculture, food and beverages, and waste management. They offer eco-friendly alternatives, aiding in crop protection, enhancing soil fertility, and promoting efficient waste decomposition. Furthermore, advancements in biotechnology and genetic engineering empower scientists to harness the potential of microorganisms for diverse applications, from biopesticides to probiotics. This trend amplifies their utilization and market demand. Apart from this, the emphasis on clean energy sources fuels the incorporation of microorganisms in biofuel production, showcasing their role in the renewable energy landscape. Additionally, collaborations between research institutions and industries foster innovation, resulting in novel applications and products that leverage microorganisms' unique properties. In line with this, the growing awareness of the microbiome's impact on human health and the environment underscores the need for microorganism-based solutions, solidifying their position as key drivers in the market's expansion.

Breakup by Reaction Type:

- Hydrolase

- Oxidoreductase

- Transferase

- Lyase

- Others

Hydrolase dominates the market

The report has provided a detailed breakup and analysis of the market based on the reaction type. This includes hydrolase, oxidoreductase, transferase, lyase, and others. According to the report, hydrolase represented the largest segment.The hydrolase segment is propelled by the ubiquity of hydrolases across various industries, such as food and beverages, detergents, and pharmaceuticals. Their ability to catalyze the hydrolysis of substrates into simpler compounds enhances process efficiency and product quality. In line with this, the increasing consumer preference for eco-friendly solutions aligns with hydrolases' environmentally benign nature, as they facilitate biodegradation and reduce waste. Moreover, ongoing advancements in biotechnology and protein engineering have paved the way for the development of engineered hydrolases with improved efficiency and specificity, further expanding their applications. Cross-industry collaborations foster innovation, enabling the customization of hydrolases for diverse processes. Additionally, the surging demand for enzyme-based products, such as biofuels and biopharmaceuticals, reinforces the importance of hydrolases.

Breakup by Application:

- Food and Beverages

- Household Care

- Bioenergy

- Pharmaceutical and Biotechnology

- Feed

- Others

Food and beverages dominate the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, household care, bioenergy, pharmaceutical and biotechnology, feed, and others. According to the report, food and beverages represented the largest segment.The food and beverage segment is propelled by several pivotal factors that shape its growth trajectory. Enzymes play a crucial role in this sector by enhancing product quality, taste, and nutritional value. They facilitate the breakdown of complex molecules, aiding in the production of items like cheese, bread, and beverages. The demand for clean labels and natural ingredients in food products drives the adoption of enzymes as they offer a sustainable alternative to chemical additives. Enzymes also aid in reducing processing time and energy consumption, aligning with the industry's focus on efficiency. Moreover, the rising trend of personalized nutrition and functional foods has spurred the development of enzymes that enhance nutrient absorption and digestion. As consumers become increasingly health-conscious, enzymes contribute to the production of products with improved nutritional profiles. This convergence of consumer preferences, efficiency enhancements, and nutritional advancements collectively drive the use of enzymes in the food and beverage segment, underpinning its sustained growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest enzymes market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The North American enzymes market is influenced by several key factors, including the region's robust industrial landscape, which drives demand across sectors such as food and beverages, pharmaceuticals, and biofuels. Enzymes play a pivotal role in optimizing processes, enhancing product quality, and promoting innovation in these industries. Furthermore, the increasing consumer awareness of sustainable practices fosters the adoption of enzymes as eco-friendly solutions, aligning with stringent environmental regulations. In line with this, advancements in biotechnology and genetic engineering enable the development of tailored enzymes with precise functionalities, expanding their applications and market penetration. Additionally, collaborations between industries and research institutions fuel enzyme innovation and commercialization. The expanding biopharmaceutical sector further amplifies enzyme demand for drug development and manufacturing. Moreover, the growth of enzyme-related research and development activities solidifies North America's position as a key market player.

Competitive Landscape:

The competitive landscape of the enzymes market is characterized by dynamic interactions among industry players vying for market share and innovation. Companies in this landscape focus on research and development to engineer specialized enzymes for diverse applications, ensuring optimal process efficiency and quality enhancement. Collaboration and partnerships between key stakeholders facilitate knowledge exchange and foster advancements in enzyme technology.Moreover, the emphasis on sustainability and environmentally friendly solutions drives companies to develop greener enzyme-based alternatives, aligning with evolving consumer preferences and stringent regulations. As the market continues to expand, companies seek to differentiate themselves through product diversification, technological advancements, and a strong commitment to adhering to regulatory standards. This landscape's evolution is further driven by the increasing demand for enzymes across industries and regions, compelling players to navigate competitive terrain while striving for continuous innovation and market leadership.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Advanced Enzyme Technologies Limited

- Amano Enzyme Inc.

- Associated British Foods plc

- Aumgene Biosciences

- BASF SE

- Chr. Hansen Holding A/S

- Codexis Inc.

- DuPont de Nemours Inc.

- Koninklijke DSM N.V.

- Novozymes A/S

- Novus International Inc. (Mitsui & Co. Ltd.)

- Thermo Fisher Scientific Inc.

Notable Developments:

In July 2023, Codexis, Inc announced that, in alignment with its previously announced strategy to focus resources on programs with the strongest probability of creating significant value in the near-term and beyond, the company intends to prioritize the advancement and commercialization of its Enzyme-Catalyzed Oligonucleotide (ECO) Synthesis™ platform and its complementary pharmaceutical manufacturing business.In July 2023, Associated British Foods (ABF.L acquired the dairy technology company, National Milk Records, for 48 million pounds ($59.7 million) to boost its agri-food unit.

In January 2023, Advanced Enzyme Technologies Limited completed the acquisition of a 50% stake in Saiganesh Enzytech Solutions Private Limited.

Key Questions Answered in This Report

1. What is enzymes?2. How big is the global enzymes market?

3. What is the expected growth rate of the global enzymes market during 2025-2033?

4. What are the key factors driving the global enzymes market?

5. What is the leading segment of the global enzymes market based on the type?

6. What is the leading segment of the global enzymes market based on source?

7. What is the leading segment of the global enzymes market based on the reaction type?

8. What is the leading segment of the global enzymes market based on application?

9. What are the key regions in the global enzymes market?

10. Who are the key players/companies in the global enzymes market?

Table of Contents

Companies Mentioned

- Advanced Enzyme Technologies Limited

- Amano Enzyme Inc.

- Associated British Foods plc

- Aumgene Biosciences

- BASF SE

- Chr. Hansen Holding A/S

- Codexis Inc.

- DuPont de Nemours Inc.

- Koninklijke DSM N.V.

- Novozymes A/S

- Novus International Inc. (Mitsui & Co. Ltd.)

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 13.97 Billion |

| Forecasted Market Value ( USD | $ 21.9 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |