Transparent conductive films, or TCF, are optically transparent thin films made of electrically conductive material. Transparent conductive films are used as transparent electrodes in touch screens and cover electrodes for solar cells, LCDs, organic light-emitting diodes, and other devices. A thin coating of conductive material is deposited on a translucent polymer-based substrate of around 50-150m thick to create TCFs of less than 100 nm thickness. Some of the most common conductive layers include metal oxides (InO2: Sn, SnO2: F), metal meshes (copper, silver, gold), silver nanofibers, graphene, and conductive polymers (PEDOT: PSS), and carbon nanotubes.

Transparent materials have large bandgaps with higher energy values than visible light. As a result, photons with energies lower than the bandgap value are not absorbed, and visible light flows through. To make optimum use of the entire solar spectrum, some applications, such as solar cells, require a larger range of transparency beyond visible light. These transparent-yet-conductive thin films are now essential components of smartphones' high-resolution liquid crystal screens and touch sensor functionalities. Various manufacturers continue to make advancements in the field of transparent conductive films and ITO. Transparent electrodes for the next generation of solar cells, transparent electrodes and anti-static protection in touch screen displays, and even dew condensation, as well as snow accumulation prevention for transparent heaters, can all benefit from ITO and transparent conductive films. The options are limitless. Customers can incorporate the technology into their products for best-in-class outcomes.

Owing to the increasing need for touch-enabled devices and industrial penetration of portable computing devices, the demand for TCF is increasing across several application industries. OPV and DSSC, as well as OLED lighting, are other prospective markets. TCF consumption per unit is substantially higher in smartphones than in tablets as well as tablet PCs. Therefore, due to the increasing deployment in smartphones, the demand for transparent conductive films is rising all over the world.

COVID-19 Impact Analysis

The COVID-19 pandemic had a severe impact on the electronics and semiconductor industries. Due to an increase in the number of COVID-19 cases, business and manufacturing units in several nations were closed during the pandemic. Additionally, the partial or total lockdown has affected the worldwide supply chain, making it difficult for manufacturers to reach their clients. The COVID-19 pandemic majorly damaged society and the global economy. The impact of this pandemic is expanding by the day, and it is disrupting the industry. The crisis is causing uncertainty in the stock market, which is leading to a drop in corporate confidence, a major slowdown in supply chains, and an increase in customer concern.

Market Growth Factors

The rapid adoption of smartphones all over the world

Smartphone usage is increasing as the world becomes more digitalized. Smartphone adoption has increased as a result of the increasing population along with the availability as well as affordability of smartphones across the market. People purchase smartphones in order to streamline their day-to-day tasks. Moreover, with the increasing penetration of smartphones all over the world, consumers are also getting a wide range of choices to buy the best-in-class smartphones. Smartphones can significantly facilitate various tasks. For example, in the modern era, even the most basic smartphone is expected to be comprising an in-built camera, clock, calculator, and various other tools. Smartphones are very handy and can replace various sizeable tools, which requires more space.

An increasing number of government support and subsidiaries

Government subsidies for the manufacture of smartphones are gradually rising. Smartphone imports raise the cost of cell phones, creating a barrier to their broad adoption. Many countries are encouraging indigenous smartphone manufacturing by providing incentives. Many high-quality phones with a wide range of functions have been recently introduced to the market. People are drawn toward purchasing these enticing mobile phones, but security is also a huge concern. The displays on these phones cannot be rebuilt in such a way that they look to be brand new if they crack for any reason. Tempered glass is frequently used to offer protection to these phones.

Market Restraining Factors

Presence of alternatives across the market

Transparent conductive films are being widely utilized across the manufacturing of smartphones, tablets, PCs, and various other smart devices like smart wearables. However, there are a number of alternatives that can be utilized as a replacement for TCF with more advantages. Carbon nanotubes were created as an ITO replacement that could also help to overcome the drawbacks of transparent conductive films. They benefit from the same advantages as transparent conductive films. CNTs are formable, flexible, and inexpensive to the pattern. They also provide better environmental stability, allowing producers to avoid additional expenditures associated with meeting environmental criteria.

Material Outlook

Based on Material, the market is segmented into Indium Tin Oxide (ITO) on Glass, Indium Tin Oxide (ITO) on PET, Silver Nanowire, Carbon Nanotubes, and Others. In 2021, the Indium Tin Oxide (ITO) on PET segment garnered a significant revenue share of the transparent conductive films market. ITO-on-PET is being highly demanded across the market. Many people are considering alternatives due to the uncertainties around the cost of raw indium. The restricted sheet resistance (150-350 ohm/sqr) is expected to likewise fall short of emerging application requirements. ITO-on-PET has some flexibility, but it will break if bent too much or too many times. These factors are augmenting the growth of this segment.

Application Outlook

Based on Application, the market is segmented into Smartphones, Notebooks, Tablets, Personal Computer, Wearables, and Others. In 2021, the smartphones segment acquired the highest revenue share of the transparent conductive films market. The rising growth of this segment is attributed to the growing number of smartphone consumers around the world. Moreover, smartphones have become the necessity of the life as it comprises various useful features, such as alarms and calculator. Therefore, this factor is propelling the growth of this segment.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, Asia-Pacific held the largest revenue share of the transparent conductive films market. The constantly expanding automotive sector in in this region is majorly expediting the growth of the regional transparent conductive films market, owing to rising demand for luxury automotive along with increasing expenditure on advanced technology adoption. In addition, the growing use of transparent conductive films across the regional solar power sector is expected to fuel the growth of the regional market in the forecasting years.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include 3M Company, Fujifilm Holdings Corporation, Dupont Teijin Films, Cambrios Film Solutions Corporation, TDK Corporation, Eastman Kodak Company, Nitto Denko Corporation, Toyobo Co., Ltd., Canatu Oy, and Dontech, Inc.

- Jun-2021: Canatu entered into a major Joint Development Agreement with DENSO, a leader in mobility supplying. With this agreement, the companies aimed to expand the film manufacturing productivity of Canatu CNT by triple in contrast to the present output.

- Oct-2020: Canatu collaborated with TS TECH, a vendor of automotive interiors. Under this collaboration, the companies aimed to introduce a solution that offers an intuitive user experience along with beautiful design. In addition, the Canatu is expected to integrate its unique, bendable, and transparent Carbon NanoBud film with TS TECH's decorative door trim technology to offer this solution.

- Sep-2019: Cambrios partnered with Royole, a manufacturer of flexible displays and sensors. Following this collaboration, the companies is expected to integrate their capabilities in order to offer enhanced customer experience solutions for flexible electronics.

- Sep-2019: Cambrios came into a partnership with Winsky Industry, a company specializing in automobile parts. Following this partnership, the companies is expected to develop optimal and enhanced solutions for electronic materials applications across new technology markets.

Scope of the Study

Market Segments Covered in the Report:

By Material

- Indium Tin Oxide (ITO) on Glass

- Indium Tin Oxide (ITO) on PET

- Silver Nanowire

- Carbon Nanotubes

- Others

By Application

- Smartphones

- Notebooks

- Tablets

- Personal Computer

- Wearables

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- 3M Company

- Fujifilm Holdings Corporation

- Dupont Teijin Films

- Cambrios Film Solutions Corporation

- TDK Corporation

- Eastman Kodak Company

- Nitto Denko Corporation

- Toyobo Co., Ltd.

- Canatu Oy

- Dontech, Inc.

Unique Offerings from KBV Research

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- 3M Company

- Fujifilm Holdings Corporation

- Dupont Teijin Films

- Cambrios Film Solutions Corporation

- TDK Corporation

- Eastman Kodak Company

- Nitto Denko Corporation

- Toyobo Co., Ltd.

- Canatu Oy

- Dontech, Inc.

Table Information

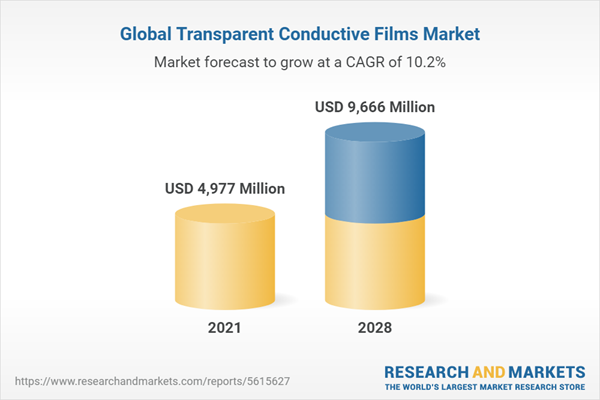

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | May 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 4977 Million |

| Forecasted Market Value ( USD | $ 9666 Million |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |