Analgesics, or painkillers, are drugs that are used to cure and relieve pain in the body. They are utilized when the suffering is extreme and the patient can no longer take it. Opioids, non-opioids, and compound analgesics (a mix of opioids and non-opioids) are the most often used topical analgesics worldwide. The most powerful painkillers are opioid medicines, which are developed from opium. They're only available with a prescription and are usually utilized to treat moderate to severe pain. Non-opioid drugs, on the other hand, are made out of acetaminophen rather than opium. NSAIDs (non-steroidal anti-inflammatory medicines) are another class of treatments often used to relieve mild to moderate pain.

Increased rates of chronic diseases, such as tuberculosis, cardiovascular disorders, cancer, and arthritis are driving the expansion of the analgesics market. In addition, infectious disorders, such as respiratory, gastrointestinal, and neurological disorders are causing a significant increase in the number of patients. As the prevalence of these disorders rises, so does the demand for painkillers, which is predicted to drive the analgesics market share even higher. Additionally, an increase in investment from commercial and government organizations for the production of drug manufacturing segments, as well as an increase in R&D activities for the innovation of analgesic goods, has boosted the growth of the analgesics market. According to the World Health Organization, AIDS and malaria cost the lives of nearly 1.5 million people worldwide in 2020. Tuberculosis affects ten million people each year. Despite the fact that tuberculosis is a preventable and treatable infection, 1.5 million people die from it each year, making it the leading infectious killer on the planet. Analgesics, which primarily contain opioid medications, are also in high demand due to cardiovascular illnesses and cancer.

Furthermore, the analgesics market is expected to develop due to an increase in the number of clinical tests being conducted to assess the safety and efficacy of a vast variety of therapeutic medications. Furthermore, an increase in the elderly population, as well as cardiovascular disorders, cancer, and arthritis, is a crucial component driving analgesics market trends. The aging population also has more regular concerns with pain and aches, which helps the industry grow. Furthermore, technical advancements in the pharma companies to create advanced analgesic pharmaceuticals are likely to provide lucrative prospects for the analgesic market in the coming years. Furthermore, the prevalence of major manufacturing businesses that manufacture and sell analgesic pharmaceuticals, rising demand for over-the-counter drugs, and rising healthcare spending all contribute to the market's growth.

COVID-19 Impact Analysis

The COVID-19 pandemic had a severe impact on various economies all over the world. Numerous businesses across the world were significantly demolished by the effect of the pandemic. In addition, governments all over the world were compelled to impose lockdown in their nations in order to regulate the diffusion of the COVID-19 infection. This lockdown scenario not only devastated various industries but also disrupted the worldwide supply chain of all the products and services. However, the healthcare sector observed a significant incline in the demand for its services during the COVID-19 outbreak. There was a substantial patient pool in hospitals amid the pandemic. Moreover, a considerable number of people suffered chronic pain in their chest as a result of the side effects of the virus.

Market Growth Factors

Rising incidences of chronic pain across the world

Physical pain is a prevalent problem all around the world. According to NCBI5, 20% of people all over the world suffer from some form of physical pain, with 10% of those identified with chronic pain for the first time each year. However, the issue of pain has been mostly considered as a medical problem, with public health paying little attention to it. The prevalence, frequency, and broad-ranging social and health consequences of pain mandate that the public health system pays particular attention to it. As a result, healthcare providers, as well as public health practitioners, is expected to have an increased understanding of pain along with the most effective public health as well as social policy solutions.

Rising demand for strong agonists

A pharmaceutical substance that activates certain brain receptors is known as an agonist. These agonists induce a robust physiological/pharmacological response even when just a limited number of receptors are activated, indicating that the medicine has high intrinsic activity. Strong agonist analgesics, including opioids, like encompass fentanyl, morphine, dihydromorphinone, oxycodone, and oxymorphone. The global health system was wrought havoc by COVID-19. During the pandemic, health organizations all over the world were aimed at regulating infection and addressing COVID-19 patients, which resulted in the suspension of elective surgeries and consultations, putting a strain on hospital and pain clinic pain services.

Market Restraining Factors

Risk of overdose and addiction

Due to the prevalence of deaths caused by drug overdose involving opioids and other analgesics remains high, researchers and governments around various countries continue to monitor opioid overdose deaths. Opioids caused about 50,000 deaths in 2019, more than six times the number of opioid-related fatal overdoses in 1999. It's crucial to determine and identify which substances are implicated in an overdose, how often they're present, and how their presence changes over time. By recognizing drug involvement, practitioners can better identify effective prevention and response activities. Overdose death data has traditionally been analyzed using the National Vital Statistics System mortality data (NVSS-M), with the combined classifications of semi-synthetic, natural, and synthetic opioids

Type Outlook

Based on Type, the market is segmented into Non-opioids and Opioids. In 2021, the opioids segment witnessed a substantia revenue share of the analgesics market. The rising growth of the segment is attributed to the rapidly rising instances of cardiovascular diseases. An increase in the rates of chronic diseases, such as tuberculosis, arthritis, and cancer is likely to fuel the growth of the opioid segment during the forecast period. In addition, the growth of the segment is also surging as opioids have anti-inflammatory, analgesic, and antipyretic properties.

Route of Administration Outlook

Based on Route of Administration, the market is segmented into Oral, Transdermal, Intravenous, Topical, and Rectal. In 2021, the oral segment procured the largest revenue share of the analgesics market. The constantly increasing growth of this segment is attributed to the fact that oral analgesic delivery is simple, non-invasive, and effective in contrast to other methods of administration. Furthermore, the expansion of the oral administration segment is fueled by an increase in the number of FDA drug approvals as well as developments in pharmaceutical R&D activities across several developed nations all over the world.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, North America accounted for the largest revenue share of the analgesics market. The growth of the analgesics market across North America is attributed to the rise in demand for non-opioid medications, the presence of key players, and the expansion of R&D activities across the healthcare sector in the region. The increasing growth of the regional market is also owing to an increase in painkiller use, increased awareness about the utilization of analgesic drugs, increased healthcare expenditures, increased OTC analgesics market growth, and increased analgesics product adoption.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AbbVie, Inc., Reckitt Benckiser Group PLC, Abbott Laboratories, Johnson & Johnson, Bayer AG, Endo International PLC, GlaxoSmithKline PLC, Pfizer, Inc., Sanofi S.A., and Eli Lilly And Company.

- Apr-2022: Abbott introduced a new version of its NeuroSphere myPath, a digital health app. With this launch, the company aimed to facilitate healthcare professionals to more precisely track their patients as they trial Abbott neurostimulation instruments in order to address the chronic pain issue in them. Moreover, this launch is expected to also complement the connected care technology portfolio of the company.

- Jan-2022: Eli Lilly expanded its geographical footprint in North Carolina with the introduction of its new manufacturing facility. With this geographical expansion, the company is expected to manufacture injectable devices and products while also expanding its manufacturing capacity of the company.

- Jun-2021: Bayer expanded its business in India with the establishment of its Consumer Health division. The company aimed to strengthen its footprint across the Indian market while also complementing its Crop Science and Pharmaceuticals divisions. In addition, the company is expected to also utilize digital prospects across the whole value chain in order to scale access to healthcare and customized self-care solutions.

- Jan-2021: Eli Lilli and co. came into a licensing agreement with Asahi Kasei Pharma, a Japanese pharmaceutical company. Through this agreement, the companies aimed to focus on the development and commercialization of a solution to address chronic pain and neuroinflammatory pain conditions.

- Jan-2021: Pfizer partnered with Premier, an American healthcare improvement company. Following this partnership, the companies is expected to offer five essential medications to healthcare practitioners in order to assist them in fulfilling the long-term and immediate demands for medications essential to a range of patient care interventions.

- Nov-2020: Abbott launched IonicRF Generator, a novel US FDA-approved device. The new product aimed to offer non-surgical and minimally invasive treatment to patients with nervous system pain. In addition, the new radiofrequency ablation device leverages heat to target particular nerves and restricts pain signals from reaching the brain.

- Mar-2020: Eli Lilly and Company teamed up with Pfizer, an American multinational pharmaceutical and biotechnology corporation. With this collaboration, the companies aimed to increase their efforts for the US FDA approval for a Biologics License Application for its tanezumab 2.5 administered subcutaneously for patients with chronic pain.

- Sep-2019: Abbott received the US FDA approval for its Proclaim XR, a recharge-free neurostimulation system. The new product is expected to deliver a low dose of proprietary BurstDR of Abbott. The new product aimed to work by utilizing low doses of mild electrical pulses in order to change pain signals while they transmit from the spinal cord to the brain.

- Sep-2019: Reckitt Benckiser unveiled a novel Diclofenac range of Moov with the enhanced formulation. Through this launch, the company aimed to strengthen its footprint in the pain relief OTC products market.

- Nov-2018: Abbott rolled out its new DRG Invisible Trial System, a US FDA and grant of the European CE-Mark approved CPM system. The new product is a non-opioid treatment option, which provides dorsal root ganglion stimulation of the company and allows patients to test before using a device implant.

- Sep-2018: GlaxoSmithKline expanded its geographical footprint in Canada with the introduction of a manufacturing unit. Under this geographical expansion, the company aimed to manufacture an over-the-counter pain reliever.

- Jul-2018: AbbVie along with Neurocrine Biosciences received the US FDA approval of ORILISSA, an oral gonadotropin-releasing hormone antagonist. This approval is expected to complement AbbVie's vision to address critical diseases along with unmet demands.

- Jan-2018: GlaxoSmithKline collaborated with NeuroMetrix, a developer of non-invasive medical devices. Following this collaboration, the companies aimed to focus on GSK Consumer Healthcare to increase access to Quell technology among chronic pain patients around the world.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Non-opioids

- Opioids

By Route of Administration

- Oral

- Transdermal

- Intravenous

- Topical

- Rectal

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- AbbVie, Inc.

- Reckitt Benckiser Group PLC

- Abbott Laboratories

- Johnson & Johnson

- Bayer AG

- Endo International PLC

- GlaxoSmithKline PLC

- Pfizer, Inc.

- Sanofi S.A.

- Eli Lilly And Company

Unique Offerings from KBV Research

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- AbbVie, Inc.

- Reckitt Benckiser Group PLC

- Abbott Laboratories

- Johnson & Johnson

- Bayer AG

- Endo International PLC

- GlaxoSmithKline PLC

- Pfizer, Inc.

- Sanofi S.A.

- Eli Lilly And Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 163 |

| Published | May 2022 |

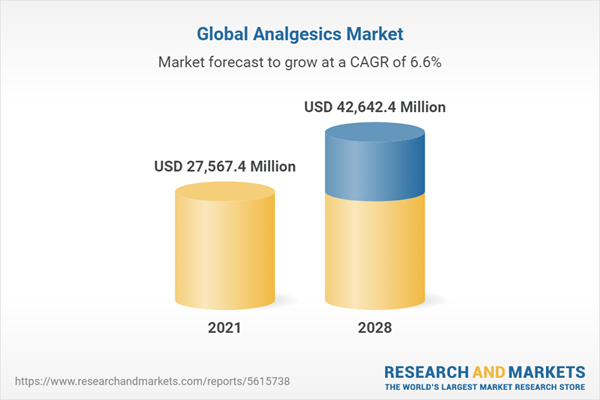

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 27567.4 Million |

| Forecasted Market Value ( USD | $ 42642.4 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |