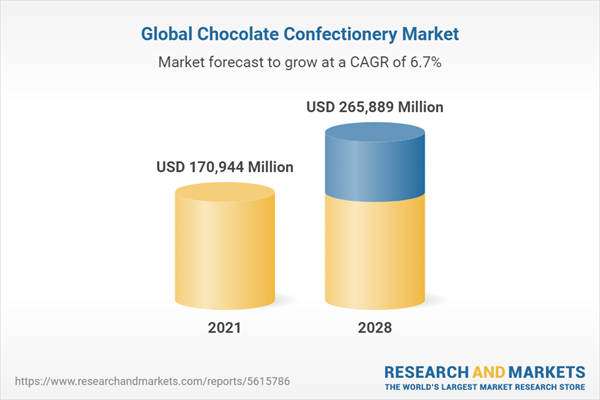

The Global Chocolate Confectionery Market size is expected to reach $265.9 billion by 2028, rising at a market growth of 6.7% CAGR during the forecast period.

The most common options in the chocolate confectionery sector include oranges, citrus fruits, nuts, and especially walnuts.

Chocolate confectionery product innovation is becoming increasingly popular as consumers want more innovative, healthful, and environmentally friendly products. Manufacturers gain from nuts in all three of these areas. Moreover, nuts such as walnuts and almonds, as well as their derivatives, are components that complement chocolate beautifully, delivering a variety of nutritional and sensory benefits. Additionally, a significant proportion of confectionery product customers chose healthier alternatives in the previous year. Consumers are no longer satisfied with any chocolate candy, instead, they seek for products that are good for them as well as the environment.

Vegan and plant-based diets have become increasingly popular in recent years, and this is inspiring new product introductions in the chocolate confectionery business. Chocolate makers are betting on milk-free products, or products created with dairy alternatives, such as milk or beverages based on plants and nuts like almonds or pecans, to cater to the preferences, demands, and requirements of a broad spectrum of consumers. It is important to remember that in several markets, a huge proportion of chocolate consumers still prefer milk chocolate. This fact will continue to augment the launch of new vegan chocolates, along with many of those profiles entering the lactose-free chocolate trend in the next few years.

The COVID-19 pandemic caused severe harm to the worldwide economy with significant damage to various businesses irrespective of their sizes. Due to the rapid spread of the infection, governments all over the world were compelled to impose lockdown in their countries, which lead various companies and manufacturing facilities to a temporary closure. Moreover, governments also enforced several travel restrictions, which caused a major disruption in the worldwide supply chain of various goods and services. The COVID-19 pandemic also impacted the chocolate confectionery market.

Chocolates are primarily consumed and connected with seasonal festive occasions in many countries throughout the world, fueling their global demand. Chocolates have become a favorite dessert at religious gatherings and special occasions like Christmas and Easter. Every year, consumers demand more inventive chocolate flavors. Seasonal launches have increased significantly in developed countries around the world in recent years. To capitalize on the expanding demand, the leading market players are heavily investing in research and development facilities, distribution networks, and appealing packaging. Millennials' increasing demand for craft, customized, and luxury chocolates are propelling the chocolate confectioneries industry forward.

In recent years, there has been a tremendous increase in the demand for a premium or specialty chocolates, particularly in developed markets with an increasing trend anticipated in the coming years. Consumer demand for information about the origins of ingredients used in chocolate confectioneries is encouraging manufacturers to provide the complete detail for the product on its packaging. The growing popularity of clean-label and organic products for general health and wellness has boosted the demand for dark and sugar-free chocolate treats with higher cocoa content. In the coming years, surging public awareness about labor rights is projected to increase demand for fair-trade chocolate.

The chocolate confectionary market is being impacted by the rising prevalence of lifestyle-related health disorders, such as obesity and diabetes, linked to excessive sugar consumption. A considerable number of people all over the world are being diagnosed with diabetes every year. In addition, there is a huge proportion of people that are also being diagnosed with obesity, which can give the emergence to various other diseases further. The majority of confectionary items are high in calories. A modest treat can supply the body of a consumer with a lot of energy. As a result, eating sweets lead to the consumption of more calories per day resulting in obesity.

Based on Type, the market is segmented into Milk, Dark, and White. In 2021, the milk segment acquired the highest revenue share of the chocolate confectionary market. Milk chocolate is being preferred by a considerable number of people all over the world, which is also owing to the growth of this segment. Moreover, many companies are introducing new products along with clean labels like vegan, organic, and certified Kosher to enhance their existing product assortment due to the growing developing preference for milk type categories.

Based on Distribution Channel, the market is segmented into Supermarkets & Hypermarkets, Convenience Stores, Online, and Others. In 2021, the online segment acquired a significant revenue share of the chocolate confectionary market. One of the key elements propelling product sales via online channels is a shift in consumer buying behavior. Companies are increasingly offering products through online platforms as consumers' preferences for them grow. Many firms have been breaking into the worldwide market using online platforms, which have lower entry hurdles and allow products to be supplied by online corporations or third-party distributors like Amazon.

Based on Product, the market is segmented into Molded Bars, Chips & Bites, Boxed, Truffles & Cups, and Others. In 2021, the molded bars segment procured the largest revenue share of the chocolate confectionary market. Molded chocolate bars are the most popular type of chocolate in the world. Because of their convenient size, they are popular among consumers. Product introductions by major manufacturers are propelling the growth of the segment.

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, Europe accounted for the largest revenue share of the chocolate confectionary market. The increasing growth of the segment is attributed to the rising consumption of chocolates in the region. In recent years, France and Belgium have experienced significant growth. Increased supply of artisanal chocolates, ongoing taste improvements, and in-store promotions are driving the regional market growth. Consumers want high-quality products that are both healthy for the environment and their health. During the forecast period, the robust food and beverage industry in Europe is expected to fuel market growth in this region.

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Nestle S.A. is the forerunners in the Chocolate Confectionery Market. Companies such as Mondelez International, Inc., The Barry Callebaut Group, The Hershey Company (Hershey Trust Company) are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Ferrero Group, The Hershey Company (Hershey Trust Company), Lindt & Sprungli AG, Mars, Inc., Mondelez International, Inc., Nestle S.A., The Barry Callebaut Group, Lotte Corporation, Lake Champlain Chocolates, and CÉMOI Group.

The most common options in the chocolate confectionery sector include oranges, citrus fruits, nuts, and especially walnuts.

Chocolate confectionery product innovation is becoming increasingly popular as consumers want more innovative, healthful, and environmentally friendly products. Manufacturers gain from nuts in all three of these areas. Moreover, nuts such as walnuts and almonds, as well as their derivatives, are components that complement chocolate beautifully, delivering a variety of nutritional and sensory benefits. Additionally, a significant proportion of confectionery product customers chose healthier alternatives in the previous year. Consumers are no longer satisfied with any chocolate candy, instead, they seek for products that are good for them as well as the environment.

Vegan and plant-based diets have become increasingly popular in recent years, and this is inspiring new product introductions in the chocolate confectionery business. Chocolate makers are betting on milk-free products, or products created with dairy alternatives, such as milk or beverages based on plants and nuts like almonds or pecans, to cater to the preferences, demands, and requirements of a broad spectrum of consumers. It is important to remember that in several markets, a huge proportion of chocolate consumers still prefer milk chocolate. This fact will continue to augment the launch of new vegan chocolates, along with many of those profiles entering the lactose-free chocolate trend in the next few years.

COVID-19 Impact Analysis

The COVID-19 pandemic caused severe harm to the worldwide economy with significant damage to various businesses irrespective of their sizes. Due to the rapid spread of the infection, governments all over the world were compelled to impose lockdown in their countries, which lead various companies and manufacturing facilities to a temporary closure. Moreover, governments also enforced several travel restrictions, which caused a major disruption in the worldwide supply chain of various goods and services. The COVID-19 pandemic also impacted the chocolate confectionery market.

Market Growth Factors

Emerging demand for chocolates on festivals and occasions

Chocolates are primarily consumed and connected with seasonal festive occasions in many countries throughout the world, fueling their global demand. Chocolates have become a favorite dessert at religious gatherings and special occasions like Christmas and Easter. Every year, consumers demand more inventive chocolate flavors. Seasonal launches have increased significantly in developed countries around the world in recent years. To capitalize on the expanding demand, the leading market players are heavily investing in research and development facilities, distribution networks, and appealing packaging. Millennials' increasing demand for craft, customized, and luxury chocolates are propelling the chocolate confectioneries industry forward.

Rising demand for Specialty Chocolate Products

In recent years, there has been a tremendous increase in the demand for a premium or specialty chocolates, particularly in developed markets with an increasing trend anticipated in the coming years. Consumer demand for information about the origins of ingredients used in chocolate confectioneries is encouraging manufacturers to provide the complete detail for the product on its packaging. The growing popularity of clean-label and organic products for general health and wellness has boosted the demand for dark and sugar-free chocolate treats with higher cocoa content. In the coming years, surging public awareness about labor rights is projected to increase demand for fair-trade chocolate.

Market Restraining Factors

Health concerns regarding chocolates

The chocolate confectionary market is being impacted by the rising prevalence of lifestyle-related health disorders, such as obesity and diabetes, linked to excessive sugar consumption. A considerable number of people all over the world are being diagnosed with diabetes every year. In addition, there is a huge proportion of people that are also being diagnosed with obesity, which can give the emergence to various other diseases further. The majority of confectionary items are high in calories. A modest treat can supply the body of a consumer with a lot of energy. As a result, eating sweets lead to the consumption of more calories per day resulting in obesity.

Type Outlook

Based on Type, the market is segmented into Milk, Dark, and White. In 2021, the milk segment acquired the highest revenue share of the chocolate confectionary market. Milk chocolate is being preferred by a considerable number of people all over the world, which is also owing to the growth of this segment. Moreover, many companies are introducing new products along with clean labels like vegan, organic, and certified Kosher to enhance their existing product assortment due to the growing developing preference for milk type categories.

Distribution Channel Outlook

Based on Distribution Channel, the market is segmented into Supermarkets & Hypermarkets, Convenience Stores, Online, and Others. In 2021, the online segment acquired a significant revenue share of the chocolate confectionary market. One of the key elements propelling product sales via online channels is a shift in consumer buying behavior. Companies are increasingly offering products through online platforms as consumers' preferences for them grow. Many firms have been breaking into the worldwide market using online platforms, which have lower entry hurdles and allow products to be supplied by online corporations or third-party distributors like Amazon.

Product Outlook

Based on Product, the market is segmented into Molded Bars, Chips & Bites, Boxed, Truffles & Cups, and Others. In 2021, the molded bars segment procured the largest revenue share of the chocolate confectionary market. Molded chocolate bars are the most popular type of chocolate in the world. Because of their convenient size, they are popular among consumers. Product introductions by major manufacturers are propelling the growth of the segment.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, Europe accounted for the largest revenue share of the chocolate confectionary market. The increasing growth of the segment is attributed to the rising consumption of chocolates in the region. In recent years, France and Belgium have experienced significant growth. Increased supply of artisanal chocolates, ongoing taste improvements, and in-store promotions are driving the regional market growth. Consumers want high-quality products that are both healthy for the environment and their health. During the forecast period, the robust food and beverage industry in Europe is expected to fuel market growth in this region.

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Nestle S.A. is the forerunners in the Chocolate Confectionery Market. Companies such as Mondelez International, Inc., The Barry Callebaut Group, The Hershey Company (Hershey Trust Company) are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Ferrero Group, The Hershey Company (Hershey Trust Company), Lindt & Sprungli AG, Mars, Inc., Mondelez International, Inc., Nestle S.A., The Barry Callebaut Group, Lotte Corporation, Lake Champlain Chocolates, and CÉMOI Group.

Partnerships, Collaborations and Agreements:

- Sep-2021: Hershey came into an agreement with Barry Callebaut, a Belgian-Swiss cocoa processor, and chocolate manufacturer. This agreement aimed to allow both companies to continue to drive strategic and long-term growth across North America. Moreover, Barry Callebaut is expected to continue to deliver liquid chocolate as well as finished products to Hershey across the region.

- Feb-2021: Barry Callebaut entered into a partnership with PT Sinarniaga Sejahtera, an entity of of Garudafood. Following this partnership, the companies is expected to bring the Van Houten Professional brand's line of compound chocolate to the Indonesian foodservice market.

- May-2020: Lotte partnered with DKSH, a market expansion services vendor. Following this partnership, the company aimed to entrust a complete range of distribution and marketing activities for its products across Singapore to DKSH.

Product Launches and Product Expansions:

- May-2022: Lindt & Sprungli rolled out Lindt Classic Recipe OatMilk bars. the new product is made up of oat milk and is expected to offer the same creamy and smooth experience as the company's vegan Lindt Classic Recipe milk chocolate.

- Jan-2022: Nestle released Aero Melts buttons and Kit Kat Bites, a line of new confectionery products for the spring. With this launch, the company aimed to pull out the stops for the Easter season, which is one of the most lucrative prospects for the market players operating in the confectionery sector.

- Feb-2022: Hershey's brand unveiled SHE. With this launch, the company aimed to highlight the significance of women by creating a simple and robust change to its iconic milk chocolate.

- Oct-2021: Mondelez International launched two new flavors of its plant bar. The new smooth chocolate and smooth chocolate with salted caramel pieces flavor of the plant bar is expected to come in completely plant-based packaging made up of natural resources.

- Jun-2021: Mondelez introduced Cadbury Caramilk, a caramelized white chocolate. With this launch, the company aimed to help retailers in recruiting new shoppers to the range, especially millennials who are seeking sweeter tastes.

- Apr-2021: SNICKERS introduced SNICKERS Almond Brownie. The new product is expected to feature a chewy brownie filling along blended with chopped almonds as well as toppings of a layer of luscious caramel, all coated in dark chocolate.

- Feb-2021: Nestle introduced KitKat V, a vegan version of its KitKat bar. This launch aimed to fulfill the demand for a vegan substitute for KitKat candy. In addition, the new product is made up of a rice-based formula as a milk substitute, crispy wafers, and 100% sustainable cocoa sourced.

- Oct-2020: Ferrero India rolled out Ferrero Rocher Moments, an affordable premium gifting brand. With this launch, the company aimed to expand the prevailing portfolio of Ferrero Rocher with the introduction of an enjoyable, unique, and lighthearted experience for consumers.

- Jan-2020: Hershey India introduced Hershey’s Kisses under its flagship Hershey’s brand. The new product is expected to come in three variants including Almonds and cookies, creme flavor, and creamy milk chocolate.

Acquisitions and Mergers:

- Apr-2022: Mondelez acquired Ricolino, a confectionery business of Grupo Bimbo. Following this acquisition, the company aimed to expand its Mexico business to offer an attractive entry point into the chocolate category and strengthen its position in the snacking sector.

- Sep-2021: The Barry Callebaut Group acquired the Europe Chocolate Company, a B2B manufacturer of chocolate specialties and decorations. With this acquisition, the company aimed to strengthen its manufacturing capabilities in the expanding highly customized chocolate specialties and decorations market.

- Sep-2021: Lindt & Sprüngli S.p.A merged Lindt & Sprüngli S.p.A and Caffarel S.p.A., subsidiaries of the company. With this merger, the company aimed to strengthen the synergies between the two organizations in order to improve them under a unified industrial and business strategy.

- May-2021: The Hershey Company took over Lily's, a confectionery brand. With this acquisition, the company aimed to add Lily's better-for-you confection brand into its portfolio of candy favorites and iconic chocolate in order to offer a range of choices to fulfill the evolving demands of its consumers.

- Jul-2020: The Barry Callebaut Group took over GKC Foods, a manufacturer of chocolate, coatings, and fillings. This acquisition aimed to strengthen the company's position across the industrial chocolate market. Moreover, the company is expected to also leverage the Specialty business and value-adding Gourmet in Australia and New Zealand.

Geographical Expansions:

- Mar-2021: The Barry Callebaut Group expanded its geographical footprint in India with the opening of its new chocolate and compound manufacturing facility in Baramati. With this geographical expansion, the company aimed to fulfill the growing customer demand with the integration of an R&D lab and assembly lines with the ability to manufacture compound and chocolate in different delivery formats.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Milk

- Dark

- White

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

By Product

- Molded Bars

- Chips & Bites

- Boxed

- Truffles & Cups

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Ferrero Group

- The Hershey Company (Hershey Trust Company)

- Lindt & Sprungli AG

- Mars, Inc.

- Mondelez International, Inc.

- Nestle S.A.

- The Barry Callebaut Group

- Lotte Corporation

- Lake Champlain Chocolates

- CÉMOI Group

Unique Offerings from KBV Research

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Chocolate Confectionery Market by Type

Chapter 5. Global Chocolate Confectionery Market by Distribution Channel

Chapter 6. Global Chocolate Confectionery Market by Product

Chapter 7. Global Chocolate Confectionery Market by Region

Chapter 8. Company Profiles

Companies Mentioned

- Ferrero Group

- The Hershey Company (Hershey Trust Company)

- Lindt & Sprungli AG

- Mars, Inc.

- Mondelez International, Inc.

- Nestle S.A.

- The Barry Callebaut Group

- Lotte Corporation

- Lake Champlain Chocolates

- CÉMOI Group

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 219 |

| Published | May 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 170944 Million |

| Forecasted Market Value ( USD | $ 265889 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |