One of the major drivers of the industry’s growth is the boom in the construction industry over recent years.The main sales channels are multi-brand shopping centers, mono-brand stores, and small independent retailers.

Online shopping is becoming more popular day by day in Russia. One of the main reasons for the growth of the e-commerce channel is the opportunity to choose among different brands from all over the world.The improvement in the logistic services is helping the growth of the channel.One of the reasons for the growing demand for furniture in Russia is the import of high-quality furniture from China at a low price.

Key Market Trends

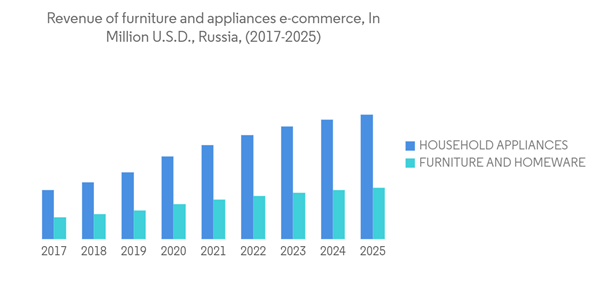

E-Commerce in Furniture and Appliances Market of Russia

Russia has a very large, fast growing and quite open furniture market, consisting of about 142 million inhabitants.Revenue from the furniture and homeware market in Russia stood at one billion U.S. dollars in 2020. By 2025 estimates the revenue from this segment will reach 1.5 billion dollars. With an increase of 16%, the Russian eCommerce market contributed to the worldwide growth rate of 29% in 2021. Revenues for eCommerce continue to increase. New markets are emerging, and existing markets also have the potential for further development.

Increase in Disposable Income is Driving the Market

A key driver fueling the growth of the market is the rising standard of living, which is leading to the increased introduction of premium products. Both developed and developing areas in the country are witnessing growth in the population of high net-worth individuals, and a gradual increase in the preference for a luxurious lifestyle. With an increase in disposable income, the consumers spending capacity and their expenditure on luxury goods and services are increasing.In Russia, the furniture market generated approximately 29.4 billion U.S. dollars of revenue in 2020. According to the Consumer Market Outlook, revenue of this market will increase to roughly 41.8 billion U.S. dollars by 2025.

Competitive Landscape

The report covers major international players operating in the Russian home furniture market. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BOROVICHI-MEBEL CJSC

- MIAS Furniture

- IKEA

- Furniture Factory Shatura OJSC

- Stolplit-Rus OOO

- Maria Furniture Factory

- KARE Voronezh

- Kuchenberg

- Herman Miller

- MK Shatura AO

- Lazurit furniture*