Covid-19 has significantly impacted the patient positioning devices market growth. For instance, according to the study published in IEEE Transactions on Medical Imaging in May 2020, to solve the high risk of getting infections, companies have designed and developed a contactless patient positioning system that allows for entirely remote and contactless scanning of patients. Such systems of the contactless patient position will bolster the market growth due to the rise in adopting such systems during the pandemic.

The major factors driving the market growth include the rise in the number of surgeries, the rise in hospitals and hospital investments, and the rise in the burden of the geriatric population, among others.

According to the Organisation for Economic Co-operation and Development updated in May 2022, the number of surgical procedures taking place in Norway and Denmark in 2020 were 19,201 and 54,836. Such a huge number of surgeries in the developed countries of Europe will lead to a rise in the adoption of patient positioning devices needed for surgeries, driving the market growth.

In addition, the rise in the geriatric population will lead to increased hospitalization due to various diseases in the elderly population, driving the market growth. For instance, according to the World Ageing Population 2020 highlights, in 2020, there were 727 million people aged 65 and up on the planet. Women, on average, live longer than men. Hence they make up the bulk of the elderly population, particularly at advanced ages. Such a huge burden on the elderly population will lead to increased hospitalization, thereby lead to drive the demand for patient positioning systems. Driving the market growth significantly.

Rising product launches for patient positioning are further expected to drive market growth over the forecast period. For instance, in April 2020, ExacTrac Dynamic, the next-generation patient positioning and monitoring system from Brainlab, received CE Mark (Conformité Européenne) clearance. The new system provides increased capabilities by combining never-before-seen high-speed thermal surface tracking technology with an update of ExacTrac X-ray monitoring. The launch of such systems will lead to increased adoption in radiology, driving the market growth.

However, the high cost of these systems and the availability of refurbished patient positioning systems in the market are expected to hinder the market growth.

Patient Positioning Devices Market Trends

Surgical Table Segment is Expected to Hold a Major Share in the Studied Market Over the Forecast Period

The surgical table segment is expected to hold a significant share in the patient positioning devices market, and it is expected to do the same over the forecast period.The key players in the market are implementing their strategies to launch their innovative surgical tables in the market, thereby driving this segment growth. For instance, in March 2021, SIMEON Medical collaborated with skilled practitioners to create the Sim.MOVE 800. It is an operating room table that is adaptable to all conditions and thus universally applicable to all typical applications. Sim.MOVE 800 is also suitable for hybrid operating rooms as well. Such launch of surgical tables that are applicable for versatile applications will therefore lead to drive this segment growth.

In addition, in October 2021, Stille AB entered an exclusive collaboration with GE Healthcare for a new general surgery table in the United States. The new GS2 general surgery table was created to meet the growing need for a premium general surgery table that meets the needs of multi-disciplinary surgery units like Ambulatory Surgery Centers (ASC) while also being a cost-effective, high-value solution. Such collaborations to market surgical tables will lead to rising in the adoption of surgical tables, driving the market growth.

Furthermore, according to the news published in December 2021, due to increased demand and improved access to surgical care in Asia, surgical procedure volume and the equipment market are likely to grow rapidly. China, as well as other growing markets such as India and Southeast Asia, are viewed as the most promising growth areas in Asia. The rise in demand and rise in surgical procedure volumes in highly populous countries such as India and China will therefore lead to increased adoption of surgical tables for patient positioning, thereby propelling the market growth of this segment.

Therefore, owing to the above-mentioned factors, this segment is expected to show significant growth over the forecast period.

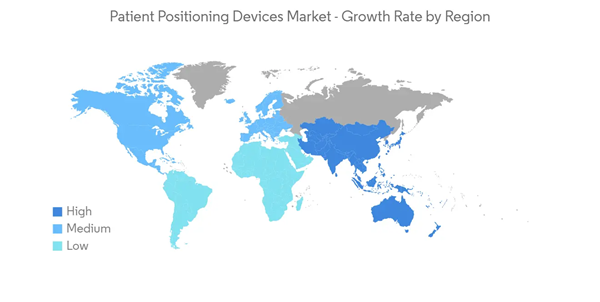

North America Holds a Significant Market Share and Expected to do the Same in the Forecast Period

North America holds a significant market share and it is expected to do the same over the forecast period. The factors driving the growth of market in this region includes developed infrastructure, the rise in healthcare spending, the strong foothold of key market players, among others.According to the study published in the Journal of the American Medical Association, titled 'Trends in US Surgical Procedures and Health Care System Response to Policies Curtailing Elective Surgical Operations During the COVID-19 Pandemic' in December 2021, the rate of surgical procedures rebounded in 2019 levels after the reopening in the late pandemic era. These findings suggest that health systems were able to self-regulate and function at pre-pandemic capacity after initial adaptation. Such recovery will drive the market growth due to the rise in the adoption of patient positioning devices in surgical procedures.

In addition, according to the article published by the Marquette University, titled 'Modeling of a Patient Positioning System for use in MRI Machines' in May 2021, patient positioning systems must be able to manage unknown weights of up to 225 kilogrammes, accommodate friction disturbances, travel vast distances quickly, travel short distances in less than 1 second, and achieve sub millimetre bidirectional precision during an MRI. Such applications of patient positioning systems will lead to drive the market growth in this region due to higher adoption in medical imaging.

Moreover, according to the America's Health Rankings Senior Report 2022 , more than 54 million adults aged 65 and older live in the United States and the total number of adults ages 65 and older is projected to rise to an estimated 85.7 million, roughly 20% of the overall the United States population. Such a high burden of geriatric population will drive the growth of the market studied in this region due to increased hospitalization of elderly population.

Furthermore, rise in product launches in the United States for patient positioning will also boost the market growth due to rise in adoption of these products. For instance, in July 2020, Hillrom launched the PST 500, a precision surgical table, as well as Yellofins Apex, a highly sophisticated addition to the Yellofins Stirrups portfolio.

Therefore, owing to the afore mentioned factors, the market is expected to drive in North America.

Patient Positioning Devices Industry Overview

The market for patient positioning devices is moderately competitive. The market is expected to drive due to the rise in collaborations between key market players, rise in product launches, rise in the number of surgeries, and rise in healthcare infrastructure, among others. Some of the key market players in this market include Getinge AB, Hill-Rom, Inc., Stryker Corporation, Steris Plc, Span-America Medical Systems, Inc, and Smith & Nephew, among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALVO

- Getinge AB

- Hill-Rom, Inc.

- Stryker Corporation

- Steris Plc

- Span America

- Skytron, LLC

- C-RAD

- LEONI AG

- Mizuho OSI

- OPT SurgiSystems

- Smith & Nephew