The combined ratio for motor insurers in France fell below 100 for the first time in 2020, which means that they received more in premiums than they paid out in claim. In 2020, the combined ratio for motor insurance amounted to 94.7, down from 102 in 2019. In 2019, the combined ratio of car insurances before reinsurance amounted to 102 percent, and it was the same for the combined ratio after reinsurance, in France. One year later, the combined ratio before reinsurance was marginally lower than the ratio after reinsurance: 94 percent and 95 percent, respectively.

Insurtechs, recently introduced to the market, are impacting the traditional insurance sector. Although the growth of the global market of Insurtechs is moderate, the number of insurance start-ups rose from 203 to 224 in France between January 2020 and January 2021.

Key Market Trends

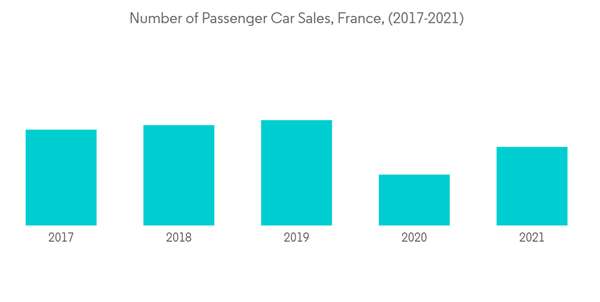

Increase in Number of passenger Car Sales

In 2021, the new car market in France was flat. Market analysis showed an increase in electric vehicles sales while diesel’s share is down to 21%. In full-year 2021, new passenger vehicle registrations in France increased by 0.54% to only 1,659,008 cars, a second crisis year after a very weak 2020. Market analysis of the French new car market showed a continued increase in the popularity of electric cars and plug-in hybrid vehicles while diesel-engined cars made up only a fifth of the market. The Stellantis Group was the largest carmaker in France and Peugeot was the best-selling brand in 2021. The Peugeot 208 and the Renault Clio were the top-selling car models in France in 2021.

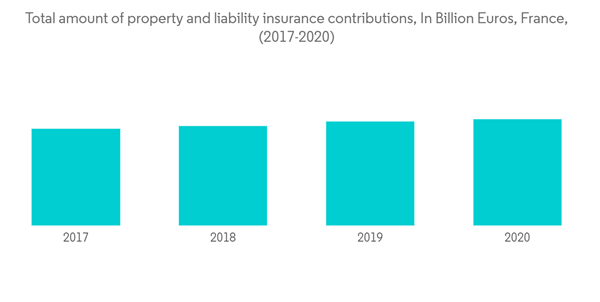

Increase in Premium of Car Insurance

In 2020, contributions of property insurance and liability amounted to EUR 60.1 billion in direct business France which rose by 2.3% year-on-year. This evolution mask contrasting growth. If for the main branches (auto insurance, personal property insurance and damage to professional and agricultural goods) growth of contributions remain close to that of all the branches. Automobile went up by 2.9% in 2020 and automobile held highest share in the non-life segment.

Competitive Landscape

The report covers the major players operating in the France motor insurance market. The market is fragmented in nature and is expected to grow during the forecast period due to increase in automobile sales.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- PREDICA-PREVOYANCE DIALOGUE DU CREDIT AGRICOLE

- ALLIANZ VIE

- GENERALI IARD

- MACIF

- AXA FRANCE IARD

- MAAF VIE

- GMF ASSURANCES

- INTER MUTUELLES ASSISTANCE GIE

- ADREA MUTUELLE*