Technology has changed the way people communicate and travel and stay across the globe. With evolving technology and the increase in the use of mobiles, easy and efficient methods are being used for booking a comfortable stay, thus increasing the growth of the online accommodation market.

The growing interest of tourists in more travel has been the major driver. Inbound tourism has been offering a major share to the market owing to the growing number of youngsters and middle-aged people in the country who are highly interested in travel and tourist activities. Inbound tourism helped the market to expand further in 2020 when the whole world was under lockdown during the COVID-19 pandemic.

China's Online accommodation market saw a huge setback due to Covid-19 being the first country hammered by the health crisis and China's Accommodation Industry was the first to see the outcome. The Pandemic hit hard in the hospitality sector but with large-scale vaccination, the country has entered a normalization stage and is gradually recovering.

Growing China’s economy is encouraging more internal business travel, and travelers need a hotel for their accommodation.They have also boosted holiday travel by releasing travel restrictions andintroducing five day work week, which offers generous vacation time.

The increase in tourists and business travelers and online sales channel expansion of the accommodation sector including hotels fueled the growth of the accommodation online booking market in China. The growing internet utilization in the country is helping the market studied to expand rapidly in China.

With an estimated nearly 130 million annual tourists arrival, China will be the world’s number one tourist destination. Meanwhile, the number of Chinese inbound visitors also has grown affluent.

China Hotel Market is expected to be driven by holidays, business travel, and the country’s increasing popularity and Being the best destination for business meetings, conferences, and Exhibitions.

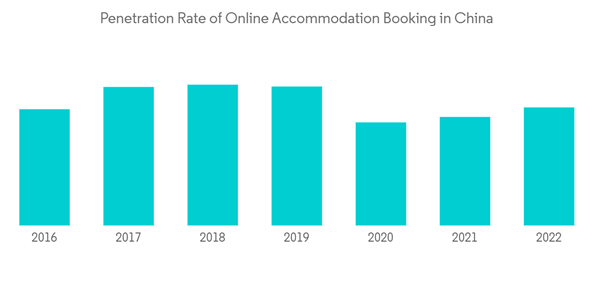

The penetration rate of online accommodation booking stood at 38.5 percent with 397 million internet users have used the services by the end of 2021. Ctrip.com was the largest online holiday booking platform in the country.

After the Covid-19 more offline hotels will accelerate the development of online booking services, which will raise the penetration rate of the accommodation sector in the online market.

Accommodation providers in China are now actively upgrading their management system to connect the offline room resources with their self-developed online booking systems or other OTA channels. For Middle- and low-end hotels having a low client base online services provide an opportunity to reach a wider range of people and thus acquire more clients.

China's Online Accommodation Market is expected to be consolidated with Ctrip, Meituan, Qunar, and Fliggy being significant players. Domestic competition is growing with the increasing international interest. The major players in the accommodation industry are Meituan.com, Qunar.com, Ctrip (Trip.com), Fliggy, and eLong.

This product will be delivered within 2 business days.

The growing interest of tourists in more travel has been the major driver. Inbound tourism has been offering a major share to the market owing to the growing number of youngsters and middle-aged people in the country who are highly interested in travel and tourist activities. Inbound tourism helped the market to expand further in 2020 when the whole world was under lockdown during the COVID-19 pandemic.

China's Online accommodation market saw a huge setback due to Covid-19 being the first country hammered by the health crisis and China's Accommodation Industry was the first to see the outcome. The Pandemic hit hard in the hospitality sector but with large-scale vaccination, the country has entered a normalization stage and is gradually recovering.

Growing China’s economy is encouraging more internal business travel, and travelers need a hotel for their accommodation.They have also boosted holiday travel by releasing travel restrictions andintroducing five day work week, which offers generous vacation time.

Key Market Trends

Tourist and Inbound Travelers promoting growth of Online Accommodation Market

The increase in tourists and business travelers and online sales channel expansion of the accommodation sector including hotels fueled the growth of the accommodation online booking market in China. The growing internet utilization in the country is helping the market studied to expand rapidly in China.

With an estimated nearly 130 million annual tourists arrival, China will be the world’s number one tourist destination. Meanwhile, the number of Chinese inbound visitors also has grown affluent.

China Hotel Market is expected to be driven by holidays, business travel, and the country’s increasing popularity and Being the best destination for business meetings, conferences, and Exhibitions.

Increasing Penetration Rate of Online Accommodation Market

The penetration rate of online accommodation booking stood at 38.5 percent with 397 million internet users have used the services by the end of 2021. Ctrip.com was the largest online holiday booking platform in the country.

After the Covid-19 more offline hotels will accelerate the development of online booking services, which will raise the penetration rate of the accommodation sector in the online market.

Accommodation providers in China are now actively upgrading their management system to connect the offline room resources with their self-developed online booking systems or other OTA channels. For Middle- and low-end hotels having a low client base online services provide an opportunity to reach a wider range of people and thus acquire more clients.

Competitive Landscape

China's Online Accommodation Market is expected to be consolidated with Ctrip, Meituan, Qunar, and Fliggy being significant players. Domestic competition is growing with the increasing international interest. The major players in the accommodation industry are Meituan.com, Qunar.com, Ctrip (Trip.com), Fliggy, and eLong.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET DYNAMICS AND INSIGHTS

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Meituan.com

- Qunar.com

- Ctrip (Trip.com)

- Fliggy

- eLong

- Aoyou.com

- Hotels.com

- Trivago

- Expedia

- IHG Hotel Booking

Methodology

LOADING...