The COVID-19 pandemic significantly impacted the vulvodynia treatment market. As per an article published in February 2022 by Elsevier Public Health Emergency Collection, the COVID-19 pandemic posed significant obstacles to clinical practice, delaying the management of patients with curable conditions, including urogynecological conditions. Such studies indicate that the number of visits for vulvodynia treatment was reduced during the pandemic, thereby depicting a short-term negative impact on the market. However, with the introduction of vaccines and the upliftment of lockdown restrictions, the market is expected to show healthy growth in the coming period.

The market's growth is attributed to the factors such as increasing prevalence pertaining to vulvodynia and new emerging treatments for vulvodynia. For instance, as per an article in June 2021 published by Frontiers Media SA, the prevalence of localized provoked vulvodynia varies between 8-18% in the population. Localized provoked vulvodynia is a poorly recognized condition. 50% of symptomatic women sought care, 30% had three or more physician visits, and 40% remained undiagnosed. Additionally, according to an article published by Sexual Medicine in August 2021, itraconazole therapy is associated with a significant reduction in vulvovaginal pain in patients with negative fungus cultures. Also, according to an article published by National Vestibulodynia Association, in August 2022, Meclon Lenex vulvar emulgel revealed excellent tolerability and compliance, demonstrating to be a safe and effective option in the treatment of provoked vestibulodynia. Thus, new emerging treatments for vulvodynia are expected to drive the growth of the market over the forecast period.

The companies are actively involved in new product launches and approval, developments, and collaborations to expand their footprint. For instance, in April 2022, the US Food and Drug Administration (FDA) approved Mycovia Pharmaceuticals' VIVJOATM (oteseconazole), the first and only treatment for recurrent vaginal candidiasis. Such developments are expected to drive the growth of the market over the forecast period.

The above-mentioned factors are expected to drive the market's growth across the world. However, low awareness pertaining to vulvodynia and the lack of approved products are the major factors hindering the market's growth.

Key Market Trends

Local Anesthetics Segment Expected to Hold a Significant Share in the Vulvodynia Treatment Market

Local anesthetics are expected to hold a significant share of the vulvodynia treatment market. Local anesthetics restrict the transmission of nerve impulses from the targeted region to the spinal cord. In addition, local anesthetics are much safer to use and have fewer side effects than general anesthetics. The major factors contributing to the segment's growth are the growing demand for local anesthetics as well as the implementation of strategic initiatives undertaken by the market players. For instance, as per an April 2022 published article by the National Library of Medicine, therapy with local anesthetics (TLA) successfully reduced vulvodynia in 36 of 45 patients (80% of responders), and the numeric analog scale (NAS) reduction was from 7.9 to 2.4.Furthermore, according to an article published by Sexual Medicine, in April 2022, a symptom-oriented form of therapy with local anesthetics provides a highly effective and easy-to-apply approach to treating vulvodynia, especially if integrating the novel perineal pudendal injection technique. Thus, the advantage of local anesthesia to treat vulvodynia is expected to drive the growth of the segment.

Thus, owing to the above-mentioned factors, the segment is expected to witness significant growth over the forecast period.

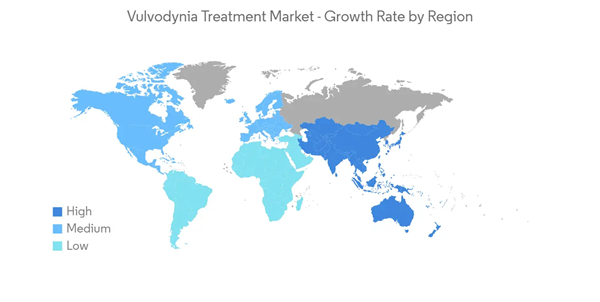

North America Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America is anticipated to account for a significant share of the vulvodynia treatment market during the forecast period. This is attributed to the increasing incidence of females developing vulvodynia, the presence of key market players, substantial R&D, and healthcare spending. Moreover, rising vulvodynia awareness, a surge in novel treatment choices, and vulvodynia's expanding economic and social impact is expected to boost the growth of the market within North America. Within North America, the United States has held a major share of the market. The major factors contributing to the market's growth are the increasing burden of vulvodynia and the increasing demand for vulvodynia treatment. For instance, according to a National Vulvodynia Association article, Harvard research supported by the National Institutes of Health (NIH) found that in 2022, 60% of affected women saw three or more doctors before being diagnosed with vulvodynia. Thus, this indicates the rising demand for vulvodynia treatment in the United States, thereby contributing to market growth.Moreover, in December 2022, SCYNEXIS Inc. announced that the US Food and Drug Administration (FDA) approved a second indication for BREXAFEMME (ibrexafungerp tablets) for the reduction in the incidence of recurrent vulvovaginal candidiasis (RVVC).

Thus, due to the above-mentioned factors, the market is estimated to witness significant growth over the forecast period.

Competitive Landscape

The vulvodynia treatment market is moderate in nature due to the presence of companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold market shares and are well-known, including Upsher-Smith Laboratories, Stada Arzneimittel AG, Bayer AG, Cadila Pharmaceuticals, and Viatris Inc.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Mycovia Pharmaceuticals Inc.

- Scynexis Inc.

- Cadila Pharmaceuticals

- Upsher-Smith Laboratories

- Viatris Inc.

- CordenPharma International

- Bayer AG

- Krosyl Pharmaceuticals Pvt Ltd

- STADA Arzneimittel AG

- Noven Pharmaceuticals