Nuclear Decommissioning Market Analysis:

- Major Market Drivers: The demand for renewable energy and rising number of ageing nuclear power plants is contributing to the growth of the market.

- Key Market Trends: The nuclear decommissioning market overview highlights the rising focus on environmental remediation, along with the ongoing adoption of innovative technologies, are facilitating the market growth.

- Geographical Trends: Europe holds the largest segment because of stringent regulatory frameworks for nuclear safety.

- Competitive Landscape: Some of the major market players in the nuclear decommissioning industry include Aecom, Babcock International Group PLC, Bechtel Corporation, Électricité de France S.A, EnergySolutions, General Electric Company, James Fisher and Sons plc, Northstar Group Services Inc., Ontario Power Generation Inc., Orano SA, Studsvik AB and Westinghouse Electric Company LLC., among many others.

- Challenges and Opportunities: While the market faces challenges like technical issues, which impacts the market, it also encounters opportunities in the development of effective and safe decommissioning process.

Nuclear Decommissioning Market Trends:

Increasing demand for renewable energy sources

Renewable energy sources like solar, wind, and hydropower are now becoming more cost-competitive with the traditional sources such as nuclear power. Therefore, the trend of renewable energy is increasing, which can directly compete with nuclear power in the energy market. The competition can affect the profitability and viability of the nuclear power plants, which results in their early decommissioning. Besides this, the rising public awareness about environmental issues and nuclear safety and radioactive waste disposal that can affect public opinion and choices on energy sources is supporting the market growth. Renewable energy is usually recognized as cleaner, safer, and more sustainable compared to nuclear power.This, in turn, is increasing the public support and demand for renewable energy initiatives. This change in the public opinion can create a pressure on the policymakers to prioritize the development of renewable energy and at the same time phase out the nuclear power, which is leading to the decommissioning of the nuclear facilities. The dismantlement of nuclear power plants is leading to the adoption of other energy sources like the renewable energy. According to the International Energy Agency report, it is expected that the renewable energy sources will account for over 42% of global electricity generation in 2028, with the share of wind and solar PV doubling to 25%.

Shutting down of nuclear reactors

The World Nuclear Association report of 2024 claims that over the past 20 years, 107 nuclear reactors were shut down across the globe. As nuclear reactors reach the end of their operational lifespans or become economically unviable, they are shut down permanently. Thus the number of nuclear decommissioning projects is rising around the world. With the growing number of reactors being shut down, there is an increasing demand for skilled professionals and firms that can manage the complex decommissioning process safely, efficiently, and cost-effectively.Besides this, the shutdown of nuclear reactors is leading to the development of advanced decommissioning technologies and methods. Companies are spending on research and development (R&D) activities to come up with the safer, more efficient, and cost-effective ways of dismantling, decontamination, waste management, and site remediation, which is anticipated to influence the nuclear decommissioning market growth.

Rising focus on radioactive waste management

As per the Pacific Northwest National Laboratory (PNNL) report of 2022, the total global inventory of solid radioactive waste was approximately 38 million m3, of which 81% of the total waste was disposed of permanently and a further 19% was in storage awaiting for final disposal. Radioactive waste is also generated during decommissioning activities, which is becoming a significant challenge. As a result, there is an increasing demand for innovative waste treatment and disposable methods for radioactive waste. Moreover, regulatory agencies are imposing strict rules for the safe management and disposal of radioactive waste that is produced during decommissioning activities.The compliance with these regulations is vital for getting the permits and the approvals to proceed with the decommissioning projects. As rules are changing to deal with the environmental and safety issues, firms participating in nuclear decommissioning are investing in waste management solutions to comply with these rules. In addition, effective radioactive waste management is the key to the protection of public health and the environment.

Improper handling or throwing away the radioactive waste can cause the pollution of the soil, water, and air, which is leading long-term dangers to human health and the environment. Furthermore, stakeholders, among which regulatory authorities, local communities, and environmental organizations, are closely examining decommissioning projects to make sure that the radioactive waste is handled safely and responsibly.

Nuclear Decommissioning Market Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with nuclear decommissioning market forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on reactor type, strategy, and capacity.Breakup by Reactor Type:

- Pressurized Water Reactor (PWR)

- Boiling Water Reactor (BWR)

- Gas Cooled Reactor (GCR)

- Other.

Pressurized water reactor (PWR) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the reactor type. This includes pressurized water reactor (PWR), boiling water reactor (BWR), gas cooled reactor (GCR), and others. According to the report, pressurized water reactor (PWR) represents the largest segment.Pressure water reactor (PWR) is the most used reactor technology for nuclear power generation around the world. As many of these reactors are approaching the end of their operational life spans, the need for decommissioning services is increasing. Additionally, PWRs are huge in size in comparison to other reactors, which, in turn, causes the decommissioning processes to be complicated and requires a lot of resources and experts. Moreover, PWR decommissioning projects usually involve large amounts of radioactive waste, requiring sophisticated waste management solutions.

Breakup by Strategy:

- Deferred Dismantling

- Entombment

- Immediate Dismantlin.

Immediate dismantling holds the largest share of the industry

A detailed breakup and analysis of the market based on the strategy have also been provided in the report. This includes deferred dismantling, entombment, and immediate dismantling. According to the report, immediate dismantling accounts for the largest market share.The instant removal of the radioactive materials and structures from a decommissioned nuclear facility is the immediate dismantling. This approach allows for the release of the site for potential reuse or redevelopment, minimizing the long-term financial liabilities associated with maintaining a decommissioned facility. Besides this, nuclear decommissioning market recent development of the technology and expertise is making the immediate dismantling feasible and cost-effective, thereby driving its widespread adoption.

Breakup by Capacity:

- Upto 800 MW

- 801 MW-1000 MW

- Above 1000 MW

Upto 800 MW represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes upto 800 MW, 801 MW-1000 MW, and above 1000 MW. According to the report, upto 800 MW represents the largest segment.Smaller reactors within this segment tend to be older and less economically viable to operate compared to larger and more modern plants. Consequently, they are more likely to be decommissioned. Furthermore, regulatory requirements and safety standards for decommissioning are generally similar regardless of plant size, and complexities and challenges associated with decommissioning smaller reactors are often comparable to those of larger ones. As a result, decommissioning projects for reactors up to 800 MW represent a substantial portion of the overall nuclear decommissioning demand.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Europe leads the market, accounting for the largest nuclear decommissioning market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represents the largest regional market for nuclear decommissioning.According to the World Nuclear Association report of 2024, in UK 36 nuclear reactors were shut down by 2024. Europe has a notable number of ageing nuclear power plants that are reaching the end of their operational lifespans. As many of these plants were built several decades ago and decommissioning them are becoming a necessity. Secondly, European countries have stringent regulatory frameworks governing nuclear safety and decommissioning, which necessitate thorough planning and compliance with rigorous standards. These regulations create a robust framework for decommissioning activities, ensuring that they are carried out safely and responsibly.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major nuclear decommissioning companies have also been provided. Some of the major market players in the nuclear decommissioning industry include Aecom, Babcock International Group PLC, Bechtel Corporation, Électricité de France S.A, EnergySolutions, General Electric Company, James Fisher and Sons plc, Northstar Group Services Inc., Ontario Power Generation Inc., Orano SA, Studsvik AB and Westinghouse Electric Company LLC.

- Companies are continuously developing innovative decommissioning solutions, such as advanced robotics and remote handling technologies. They are also manufacturing specialized equipment and processes for handling and treating radioactive waste generated during decommissioning activities to increase the nuclear decommissioning market revenue. Many key players are providing a range of services, including dismantling, decontamination, waste management, and site restoration. In addition, many leading players are offering comprehensive decommissioning solutions, including reactor dismantling, waste packaging, and site restoration. Several companies are shutting down their nuclear plants due to their aging intended operational lifespans. For instance, in 2022, Entergy Corporation shut down its Palisades nuclear plant on Lake Michigan, which was an 800-megawatt facility.

Key Questions Answered in This Report

- How big is the nuclear decommissioning market?

- What is the future outlook of nuclear decommissioning market?

- What are the key factors driving the nuclear decommissioning market?

- Which region accounts for the largest nuclear decommissioning market share?

- Which are the leading companies in the global nuclear decommissioning market?

Table of Contents

Companies Mentioned

- Aecom

- Babcock International Group PLC

- Bechtel Corporation

- Électricité de France S.A

- EnergySolutions

- General Electric Company

- James Fisher and Sons plc

- Northstar Group Services Inc.

- Ontario Power Generation Inc.

- Orano SA

- Studsvik AB

- Westinghouse Electric Company LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | June 2025 |

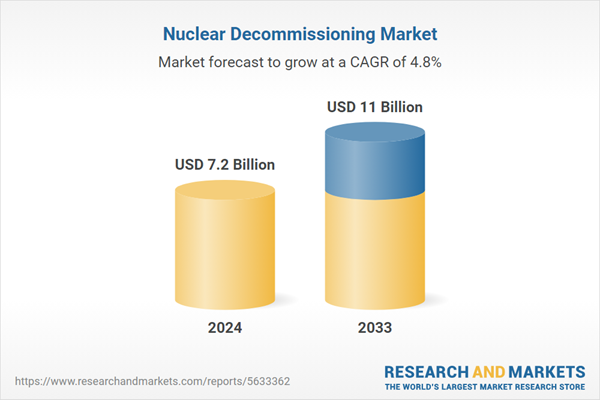

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 7.2 Billion |

| Forecasted Market Value ( USD | $ 11 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |