Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

These techniques integrate cultural practices, along with prevention and a range of pest controls - mechanical, physical, biological, and chemical - to prevent and suppress various pests, including weeds, insects, diseases, and vertebrate pests like ground squirrels and pigeons. IPM pheromones serve as a pivotal pillar for reducing pesticide risks and promoting sustainable crop production intensification. They adhere to key principles, such as thorough pest identification, assessment of host plants and beneficial organisms prior to implementing control measures, establishment of monitoring guidelines for each pest species, development of action thresholds, execution of control tactics, and systematic monitoring, analysis, and documentation of results.

Key Market Drivers

Rapid Growth in The Agriculture Industry

The agriculture industry is witnessing rapid growth globally, primarily driven by the increasing demand to ensure food security for the booming population. This surge has intensified the need for Integrated Pest Management (IPM), a method that combines biological, cultural, physical, and chemical tools in a way that minimizes economic, health, and environmental risks. IPM, with its effectiveness and efficiency, is being widely adopted by farmers globally to combat various pests that damage crops, including mollusks. The growing awareness of IPM's benefits, including cost-effectiveness, long-term pest control, and reduced pesticide use, is propelling its demand.According to Ministry of Finance India, In recent years, the agriculture sector in India has shown robust growth, averaging 5 per cent annually from FY17 to FY23, demonstrating resilience despite challenges. In the second quarter of the 2024-25 fiscal year, the agriculture sector recorded a growth rate of 3.5 per cent. The Gross Value Added (GVA) of agriculture and related sectors, have improved from 24.38 per cent in the fiscal year FY15 to an impressive 30.23 per cent by FY23. Consistent and stable growth of agriculture at around 5 per cent, with a 20 per cent share of overall GVA in the economy, will contribute 1 per cent growth to GVA.

Moreover, the increasing instances of pest resistance to conventional pesticides and the rising environmental concerns associated with their overuse are further accentuating the shift towards IPM. Governing bodies worldwide are focusing on educating farmers about IPM practices and are implementing supportive policies, providing a thrust to its adoption. In the aquaculture sector, IPM methods, including the use of molluscicides, are being employed to maintain healthy species development and control mollusk populations in various facilities, further driving the demand. As the agriculture industry continues to expand, the need for sustainable and effective pest control methods like IPM is expected to grow significantly, underpinning its global demand.

Key Market Challenges

Lack of Awareness

One of the major challenges impeding the adoption of Integrated Pest Management (IPM) globally is a lack of awareness. In many parts of the world, especially in developing nations, farmers and cultivators are often ill-informed about the benefits of IPM, including the use of molluscicides. They continue inheriting traditional, and oftentimes damaging, pest control methods that undermine the ecosystem.Furthermore, the misconception that IPM strategies are complex, labor-intensive, or prohibitively expensive also dissuade potential users. Though IPM strategies like the use of molluscicides can initially seem costlier than conventional methods, they offer longer-term benefits, such as improved soil health, reduced pest resistance, and lower contamination levels in produce and the surrounding environment. Lack of extension services and training programs to enlighten farmers about these benefits further exacerbates the problem. As a result, despite the potential of IPM to revolutionize pest control and contribute to food security, its global adoption is hindered. If this trend continues, it is expected to decrease the demand for IPM, including the use of molluscicides, unless concerted efforts are made for widespread education and awareness campaigns.

Key Market Trends

Cost-Effectiveness of IPM

The cost-effectiveness of Integrated Pest Management (IPM) is projected to significantly boost its global demand. IPM strategies blend various pest control methods, such as biological, physical, and chemical tactics, optimizing their effectiveness while minimizing the ecological footprint. This integrated approach not only curbs the overuse of toxic chemicals, lowering the input costs for farmers, but also mitigates the risks of pests developing resistance. Furthermore, IPM lays emphasis on prevention techniques over reactive ones, such as the cultivation of pest-resistant crop varieties and crop rotation to disrupt pest breeding cycles, which are intrinsically cost-effective in the long run.The potential savings in pesticide costs, coupled with the increased crop yields due to reduced pest damage, render IPM a financially viable solution for farmers globally. Moreover, the increasing governmental support worldwide, aimed at promoting sustainable farming practices and ensuring food security, is likely to fuel the adoption of cost-efficient IPM techniques. Consequently, this cost-effectiveness paired with its environmental and health advantages, positions IPM as an attractive, sustainable, and economic option for tackling global pest issues.

Key Market Players

- Bayer AG

- BASF SE

- Integrated Pest Management, Inc.

- SGS SA

- Ecolab Inc.

- IPM Technologies Pty Ltd.

- Hercon Environmental.

- Semios.

- Bioline Agrosciences Ltd.

- Trécé, Inc.

Report Scope:

In this report, the Global Integrated Pest Management Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Integrated Pest Management Market, By Pest Type:

- Weeds

- Invertebrates

- Pathogens

- Vertebrates

Integrated Pest Management Market, By Control Method:

- Biological Control

- Chemical Control

- Cultural Controls

- Mechanical & Physical Controls

- Others

Integrated Pest Management Market, By Application:

- Agricultural

- Residential

- Commercial

- Industrial

Integrated Pest Management Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Integrated Pest Management Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bayer AG

- BASF SE

- Integrated Pest Management, Inc.

- SGS SA

- Ecolab Inc.

- IPM Technologies Pty Ltd.

- Hercon Environmental.

- Semios.

- Bioline Agrosciences Ltd.

- Trécé, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | March 2025 |

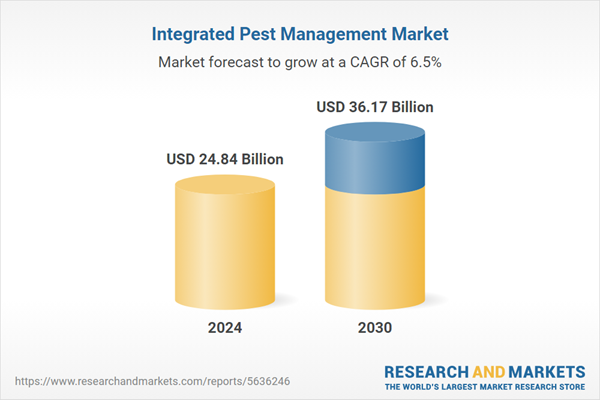

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 24.84 Billion |

| Forecasted Market Value ( USD | $ 36.17 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |