Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key technologies driving the crop monitoring market include Internet of Things (IoT) devices, remote sensing technologies (such as satellite imagery and drones), and artificial intelligence (AI). These tools help farmers monitor their fields with precision, offering insights that can lead to improved crop management, efficient irrigation, optimized fertilization, and better pest control. The integration of AI and machine learning also allows for predictive analytics, enabling farmers to anticipate potential issues before they become critical, leading to better crop management and higher yields.

Key Market Drivers

Advancements in Technology Such as Machine Learning & AI

Advancements in technology, notably Machine Learning (ML) and Artificial Intelligence (AI), are anticipated to significantly boost the global demand for crop monitoring. These innovative technologies enable real-time tracking, predictive analytics, and nuanced data interpretation, thereby revolutionizing agricultural practices. ML and AI can analyze vast amounts of data from various sources such as drones, satellites, and IoT devices, facilitating precise crop monitoring. By identifying patterns in the data, they can predict weather conditions, identify disease outbreaks, and suggest appropriate interventions, ultimately optimizing crop yield and quality.In addition, these technologies can provide detailed soil analysis, recommending personalized crop treatment strategies based on individual field characteristics. Such precision farming methods, enabled by ML and AI, are expected to reduce resource wastage, increase cost-effectiveness, and promote sustainable agricultural practices. Hence, as the world grapples with the challenges of food security and environmental sustainability, the role of ML and AI in agriculture becomes increasingly pivotal. Their ability to transform data into actionable insights is expected to drive a surge in global demand for their application in crop monitoring.

Key Market Challenges

Lack of Highly Skilled Workers to Operate Digital Tools

The global demand for crop monitoring, though potentially transformative in the field of agriculture, is expected to face a decline due to the glaring lack of highly skilled workers capable of operating advanced digital tools. Technological advancements in crop monitoring have undoubtedly revolutionized farming practices, but the shortage of skilled labor is creating a bottleneck in the adoption and effective use of this technology.Crop monitoring involves intricate tasks such as interpreting data from satellite imagery, handling drones for field scouting, and managing complex software systems for crop health assessment. These tasks require a specialized skill set that is currently scarce in the labor market, which could hamper the global demand for crop monitoring. Furthermore, the cost and time associated with training workers to acquire these skills are significant, which only exacerbates the problem. Hence, until the gap between the complexity of digital tools and the skill set of the labor force is bridged, the global demand for crop monitoring is anticipated to witness a downward trend.

Key Market Trends

Integration of Smartphones with Agricultural Hardware & Software Applications

The integration of smartphones with agricultural hardware and software applications is projected to skyrocket the demand for crop monitoring globally. Smartphones, as accessible, multi-functional tools, are becoming increasingly intertwined with agriculture, offering the ability to control high-tech hardware and interact with sophisticated software applications. This advancement heralds a new era in precision agriculture. Through apps and hardware integrations, farmers can now monitor crop health, track weather patterns, and manage pests directly from their handheld device, making real-time decisions that enhance crop productivity and reduce waste.The ubiquity and ease-of-use of smartphones make them an ideal platform for widespread adoption of these technologies. In developing countries, where large-scale, costly monitoring systems are out of reach for many farmers, this could revolutionize agricultural practices, leading to increased yields and sustainability. Moreover, the leveraging of smartphone technology facilitates the collection and analysis of big data, driving forward the research and implementation of best agricultural practices on a global scale. Thus, the convergence of smartphones with agricultural hardware and software is poised to dramatically escalate the uptake of crop monitoring worldwide.

Key Market Players

Trimble Inc.Topcon Corporation

Yara International ASA

The Climate Corporation

CropX Technologies Ltd.Deere & Company

Syngenta Group

Precision Hawk, Inc.Ag Leader Technology Inc.

AAA Taranis Visual Ltd.

Report Scope:

In this report, the Global Crop Monitoring Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Crop Monitoring Market, By Offering:

- Hardware

- Software

- Services

Crop Monitoring Market, By Technology:

- Sensing & Imagery

- Variable Rate Technology

- Automation & Robotics

Crop Monitoring Market, By Farm Type:

- Small

- Medium

- Large

Crop Monitoring Market, By Application:

- Field Mapping

- Crop Scouting & Monitoring

- Soil Monitoring

- Yield Mapping & Monitoring

- Others

Crop Monitoring Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Crop Monitoring Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Trimble Inc.

- Topcon Corporation

- Yara International ASA

- The Climate Corporation

- CropX Technologies Ltd.

- Deere & Company

- Syngenta Group

- Precision Hawk, Inc.

- Ag Leader Technology Inc.

- AAA Taranis Visual Ltd.

Table Information

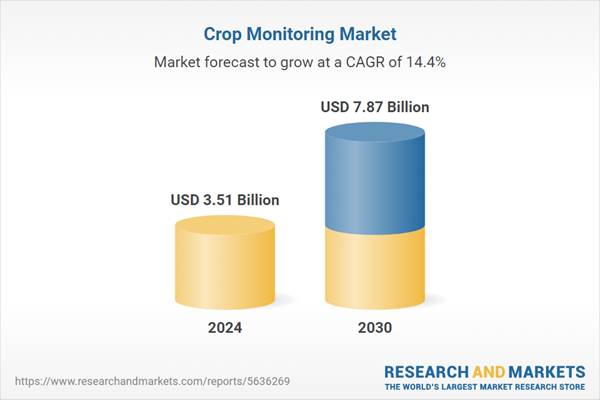

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.51 Billion |

| Forecasted Market Value ( USD | $ 7.87 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |