Sales of pet snacks and treats through online distribution channels have surged, reflecting the growing trend towards digital shopping. Online platforms offer convenience, a broad selection, and the ability to compare products and prices easily. This channel appeals to pet owners seeking specific brands, health-oriented options, and unique treats not always available in physical stores. Thus, the Brazilian market registered a volume of 5.91 kilo tonnes in 2023.

The Brazil market dominated the LAMEA Pet Snacks And Treats Market by Country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of $1.45 billion by 2031. The Argentina market is showcasing a CAGR of 14.3% during 2024-2031. Additionally, the UAE market would register a CAGR of 12.5% during 2024-2031.

The growing interest in CBD (cannabidiol) for pets has led to an increase in the availability of CBD-infused snacks and treats. These products are marketed for their potential benefits in reducing anxiety, alleviating pain, and improving overall well-being in pets, particularly dogs. The trend of personalized pet nutrition extends to snacks and treats, with companies offering custom formulations based on a pet’s age, breed, weight, activity level, and health conditions. This trend reflects a broader shift toward tailored, pet-specific products that cater to individual dietary needs.

There is a growing trend towards incorporating superfood ingredients such as turmeric, kale, blueberries, and chia seeds into pet snacks and treats. These ingredients are chosen for their health-boosting properties, such as anti-inflammatory, antioxidant, and immune-supporting benefits. Pet treats made with ancient grains like quinoa, millet, and amaranth, as well as alternative flours like chickpea, sweet potato, and coconut flour, are gaining popularity. These ingredients are perceived as healthier and more digestible options.

The expansion of e-commerce in Brazil is prompting pet snack brands to enhance their investment in digital marketing strategies, including targeted advertisements and social media campaigns. This helps brands reach a broader audience and build stronger connections with consumers. Brazilian e-commerce platforms increasingly integrate with other digital channels, like mobile apps and social media. This multi-platform approach allows pet snack brands to reach consumers through various touchpoints and streamline purchasing. Therefore, the rising e-commerce sector and expansion of the pet care industry in the region are driving the market's growth.

List of Key Companies Profiled

- Archer Daniels Midland Company

- Mars, Inc.

- Nestlé S.A.

- The Colgate Palmolive Company

- General Mills, Inc.

- The Wellness Pet Company (Clearlake Capital Group, L.P.)

- Spectrum Brands Holdings, Inc.

- The J.M. Smucker Company

- Unicharm Corporation

- Diamond Pet Foods, Inc.

Market Report Segmentation

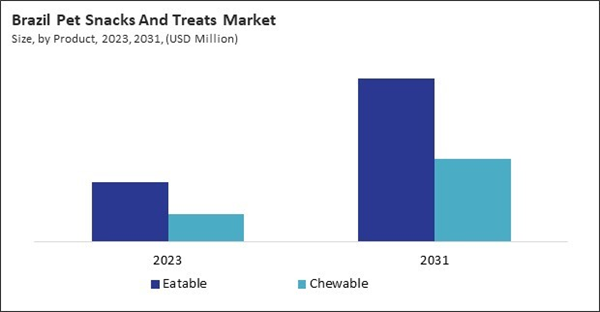

By Product (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Eatable

- Chewable

By Pet Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Dogs

- Cats

- Other Pet Type

By Distribution Channel (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Pet Specialty Stores

- Supermarkets and Hypermarkets

- Online

- Other Distribution Channel

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

Some of the key companies profiled in this LAMEA Pet Snacks and Treats market report include:- Archer Daniels Midland Company

- Mars, Inc.

- Nestlé S.A.

- The Colgate Palmolive Company

- General Mills, Inc.

- The Wellness Pet Company (Clearlake Capital Group, L.P.)

- Spectrum Brands Holdings, Inc.

- The J.M. Smucker Company

- Unicharm Corporation

- Diamond Pet Foods, Inc.