Personal care and cosmetics are routinely utilized in large quantities all around the world. As a result, personal hygiene, as well as cosmetics products or chemicals, are continuously released into the environment in an unnoticed manner. As these bioactive are extremely persistent in the environment and may also bioaccumulate, they have an overall impact on the lives of living beings. Personal care and cosmetics refer to any product that is applied to the outside of the body, such as the skin, nails, lips, hair, and external genital organs, or oral hygiene, such as the teeth and mucous membrane of the oral cavity, in order to clean, protect from germs, prevent bad odor, change appearance, and maintain good health. Personal care and cosmetic items, unlike medicinal medications, can only be administered for external use.

As a result, they are more likely to infiltrate the environment in large amounts as a result of human activities, such as bathing or washing, causing more problems for ecological systems. Daily use personal care and cosmetic items include soaps, hair colors, nail paints, scents, emulsifiers, UV absorbers, preservatives, acrylates, and antioxidants. Some of these are harmful to one's health, and prolonged exposure to them can lead to cancer, endocrine disruption, allergies, mutation, and reproductive toxicity. Therefore, the preference of people all over the world is rapidly being shifted toward organic and sustainable personal care products. Sustainability has evolved from a novelty to a requirement in the personal care industry. Raw material sourcing, product compositions, manufacturing processes, distribution, packaging, and marketing, along with product end-of-life considerations, are all becoming more sustainable. The surge in client demand for ethical products is one of the main reasons behind this.

In recent years, the concept of sustainable personal care has become one of the most popular in the industry. It began as a modest movement centered on environmentally friendly companies and has grown into a rapidly expanding and dynamic personal care market in the modern era. There has been a drive for improvement in skincare, haircare, makeup, and scent as customers become more aware of the dangers of excess plastic and non-recyclable packaging, as well as substances that damage ecosystems and their personal health.

COVID-19 Impact Analysis

The COVID-19 pandemic affected the sustainable personal care market. The supply of sustainable personal care products was reduced. As a result, the demands of a significant number of customers remained unfulfilled. Furthermore, consumer focus has migrated to internet enterprises at an unprecedented rate as a result of the COVID-19 pandemic. As a result of these recent developments, market players are spending to provide their customers with a unique digital experience. COVID-19 introduced several new issues, the severity of which was determined by the portfolio as well as regional exposure. As a result, the sustainable personal care market is coping with a very different client and retail environment.Market Growth Factors

Good for health and skin nourishment

Cosmetics is one of the least regulated industries across the world. In reality, harmful compounds can be found in the ingredient lists of various beauty products, including toothpaste, shampoos, and bubble baths. According to some research, human bodies absorb up to 5 kilos of hazardous compounds each year from beauty products. Petrochemicals and parabens, which are used in traditional cosmetics to extend their shelf life, are among the most harmful ingredients. Parabens, according to several scientific research, cause the body to stop manufacturing estrogens and may be the cause of a variety of ailments, including cancer, a weakened immune system, and allergies.Environment friendly and better-quality products

One of the most prominent advantages of utilizing sustainable personal care products is that it contributes to a clean and better environment. The cosmetics industry's unsustainable practices have resulted in considerable amounts of deforestation, pollution, and water scarcity. Using sustainable personal care instead of harmful cosmetics in daily life can majorly help in minimizing the amount of pollution and trash produced each year. This results in a cleaner as well as a healthier environment for people to live in.Market Restraining Factors

Lack of exact particular substances

One of the drawbacks of natural cosmetics is that they do not always include the exact ingredients that are required for a particular skin type. This could be because the manufacturers are unable to obtain the compounds they require for the manufacturing of any specific sustainable personal care product, or because they do not include those ingredients in their product. Many companies, for example, do not employ parabens in their products because they have been proven to be hazardous even at little levels. Organic cosmetics makers need to conduct more studies to identify the ingredients that is expected to provide the best outcomes for their customers.Nature Outlook

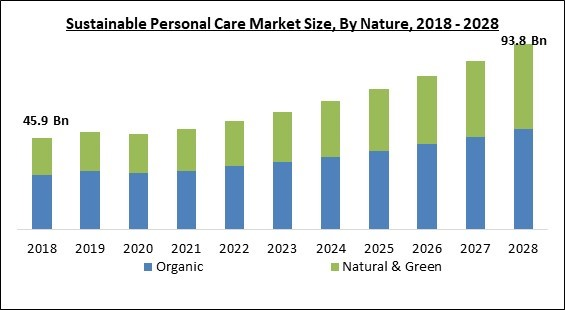

Based on Nature, the market is segmented into Organic and Natural & Green. In 2021, the organic segment acquired the largest revenue share of the sustainable personal care market. The rapidly increasing growth of this segment is majorly owing to the rising consumer demand for pesticide-free, clean-label, and natural products. Organic sustainable personal care products are created from plant materials grown in soil free of pesticides, herbicides, fungicides, and synthetic fertilizers, and contain no GMOs.Sales Channel Outlook

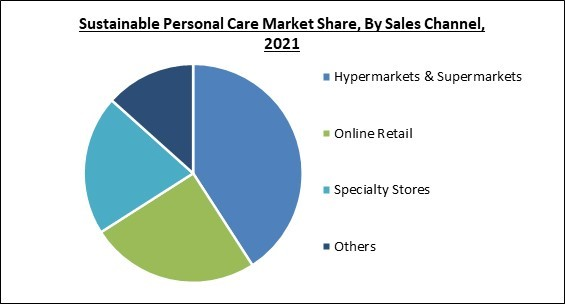

Based on Sales Channel, the market is segmented into Hypermarkets & Supermarkets, Online Retail, Specialty Stores, and Others. In 2021, the online retail segment acquired significant revenue share of the sustainable personal care market. An increase in the use of e-commerce portals in emerging regions, as well as an increase in the number of deals or discounts made available by these E-commerce platforms, is attracting end-users, such as home consumers and institutions, to buy sustainable personal care through these platforms. Moreover, e-commerce platforms have increased client reach, making them a substantial source of revenue for many enterprises.Type Outlook

Based on Type, the market is segmented into Skin Care, Hair Care, Oral Care, Hygiene Products, and Others. In 2021, the skin care segment registered the largest revenue share of the sustainable personal care market. The increasing growth of this segment is attributed to the increasing focus of people all over the world on enhancing the quality of their skin. Human behavior is influenced by skincare products. Everyone strives to have healthy, bright skin in order to appear appealing. Serums, body lotions, moisturizers, exfoliators, and eye creams are examples of skincare products that aid in the maintenance of healthy and bright skin. Furthermore, sustainable skincare products are created with natural and organic components that have minimal or no negative effects on human skin or the environment, which is likely to drive market growth over the forecast period.Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, North America accounted for the highest revenue share of the sustainable personal care market. This is highly due to the region's vast awareness of sustainable ingredients and products. The demand for environmentally friendly personal care is growing in the United States and Canada, boosting the regional market growth. Moreover, the prevalence of a significant number of major market players operating in the sustainable personal care market is also driving the growth of the regional market.Cardinal Matrix-Sustainable Personal Care Market Competition Analysis

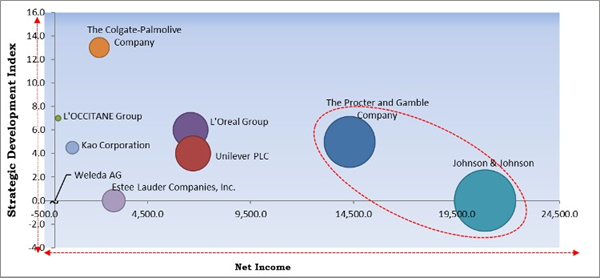

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Johnson & Johnson, The Procter and Gamble Company are the forerunners in the Sustainable Personal Care Market. Companies such as L'Oreal Group, Unilever PLC and The Colgate-Palmolive Company are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include L'Oreal Group, Johnson & Johnson, The Procter and Gamble Company, Unilever PLC, Kao Corporation, The Colgate-Palmolive Company, Estee Lauder Companies, Inc., Coty, Inc., L'OCCITANE Group, and Weleda AG.

Strategies deployed in Sustainable Personal Care Market

- Mar-2022: L’Occitane completed its acquisition of Grown Alchemist, an Australian skincare brand. Through this acquisition, the company aimed to expand its international consumer profile along with its market reach.

- Jan-2022: Colgate Palmolive Company teamed up with 3Shape, a developer and manufacturer of 3D scanners. Following this collaboration, the companies aimed to launch Colgate Illuminator to deliver more precise consultations and enhanced patient experience.

- Jan-2022: L'Oréal came into a partnership with Verily, an Alphabet precision health company. Following this partnership, the companies aimed to bring advancement in the skin health sector with the development of new technologies along with telehealth solutions.

- Jan-2022: L’OCCITANE rolled out the Solid range, a lineup of soaps and shampoos. With this launch, the company aimed to offer a minimal-waste substitute crafted with at least 98% biodegradable components for conscious consumers. In addition, the 250g soap range is available in Lavender, Shea, and Verbena fragrances while 60g solid shampoos comprise Ylang-Ylang, Sweet Orange, Geranium, Angelica, and Lavender essential oils.

- Dec-2021: L’Oréal took over Youth to the People, a US-based superfood skin care specialist. With this acquisition, the company aimed to strengthen its ethical portfolio within the highly competitive market.

- Nov-2021: Colgate-Palmolive rolled out Colgate RecyClean, a 100% recycled plastic handle toothbrush. With this launch, the company aimed to complement its vision to bring sustainability and reduce carbon footprint along with focusing on water conservation and waste management.

- Aug-2021: Unilever took over Paula’s Choice, a digital skincare brand. Through this acquisition, the company aimed to expand the portfolio of Unilever within the high-growth premium skincare sector.

- Apr-2021: Kao Corporation expanded its geographical footprint with the launch of Oribe, a hair salon brand, in Japan. With this launch, the company aimed to complement its strategy of expanding its salon business across Asia.

- Jan-2021: Procter & Gamble joined hands with A.S. Watson Group, the world's largest international health and beauty retailer. Under this collaboration, the companies is expected to introduce aio, a new skincare brand. In addition, the new product line is expected to be available online as well as in brick-and-mortar stores of A.S. Watson Group across Greater China.

- Feb-2020: Procter & Gamble rolled out Microban 24, a range of antibacterial surface cleaning products. With this launch, the company aimed to offer a range of products with the ability to kill bacteria for 24 hours. Moreover, the new products are available in sanitizing cleanser and spray forms as well as a bathroom cleaner.

- Jan-2020: Colgate-Palmolive completed its acquisition of Hello, an oral care products provider. Through this acquisition, the company aimed to integrate Hello's capabilities and products into its portfolio in order to accelerate its growth across the market.

- Jul-2019: Colgate-Palmolive acquired Laboratoires Filorga Cosmétiques, a skin care business. This acquisition aimed to integrate a high-growth and profitable skincare asset into Colgate's offerings in order to drive its growth through an increased distribution range.

- Aug-2018: Kao Corporation took over Washing Systems, the leading provider of innovative products and services. Through this acquisition, the company aimed to expand its chemical solution portfolio for commercial laundry all over the world.

Scope of the Study

Market Segments Covered in the Report:

By Nature

- Organic

- Natural & Green

- Hypermarkets & Supermarkets

- Online Retail

- Specialty Stores

- Others

- Skin Care

- Hair Care

- Oral Care

- Hygiene Products

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- L'Oreal Group

- Johnson & Johnson

- The Procter and Gamble Company

- Unilever PLC

- Kao Corporation

- The Colgate-Palmolive Company

- Estee Lauder Companies, Inc.

- Coty, Inc.

- L'OCCITANE Group

- Weleda AG

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- L'Oreal Group

- Johnson & Johnson

- The Procter and Gamble Company

- Unilever PLC

- Kao Corporation

- The Colgate-Palmolive Company

- Estee Lauder Companies, Inc.

- Coty, Inc.

- L'OCCITANE Group

- Weleda AG