Audio advertising can be broadly defined as the presentation of advertisement content through audio recordings across various internet streaming channels, including podcasts, music streaming applications, and radio stations. The evolution of audio technology and consumer demand has significantly transformed advertising methods, making audio a vital component of modern marketing strategies. Digital audio platforms such as Spotify, Apple Music, and Pandora provide advertisers with new avenues to reach consumers, contributing to the global growth of the audio advertising market. Additionally, the rise in mobile usage has led to the development of audio ads through mobile applications and podcasts. Innovations in programmatic advertising have further enhanced targeting efficiency by improving real-time bidding and campaign performance measurement. Another key driver for the market is the growing demand for targeted advertising. Podcasts are increasingly influential in the audio advertising landscape, as audiences show a preference for this medium. However, the rise of ad-blockers may pose challenges, potentially reducing overall market demand.

Drivers of the Global Audio Advertising Market:

- Advancements in Audio Advertising: New technologies and innovations in audio advertising are expected to accelerate growth in this sector. Programmatic buying automates ad space purchases, making the process more efficient and cost-effective. Data-driven targeting allows advertisers to reach specific audiences at optimal times. Innovative formats such as voice-activated ads enhance engagement levels. Multi-platform measurement provides insights into campaign performance, enabling advertisers to refine their strategies. The integration of artificial intelligence and machine learning further personalizes advertisements and optimizes campaign effectiveness. These advancements by various market players are anticipated to contribute significantly to market expansion.

Geographical Outlook of the Global Audio Advertising Market:

- North America Expected to Hold Significant Market Share: The global audio advertising market is segmented into North America, South America, Europe, the Middle East & Africa, and Asia-Pacific. North America is poised to dominate the market due to its advanced healthcare infrastructure, substantial advertising spending on audio platforms, and robust growth in digital audio consumption. The region has a long history of radio advertising and is home to major industry players that drive innovation.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The global audio advertising market has been segmented as following:

- By Medium

- Radio

- Music-on-demand

- By Device

- Smartphones and Tablets

- Smart TV

- Radio

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Taiwan

- Indonesia

- Thailand

- Others

- North America

Table of Contents

Companies Mentioned

- Spotify AB

- Saavn Media Pvt Ltd.

- Pandora Media, LLC

- Airtel Digital Limited

- Cumulus Media

- iHeartMedia Inc.

- Entercom Communications Corp.

- SBS

- Townsquare HQ

- Music Broadcast Limited

- ENIL

- BAUER CONSUMER MEDIA LTD

- Digital Radio (Delhi) Broadcasting Limited

- Next Radio Ltd (Next Mediaworks Limited)

- SoundCloud

- Southern Cross Media Group Limited

- TBS RADIO, Inc. (Japan)

- ABC Audio

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | January 2025 |

| Forecast Period | 2025 - 2030 |

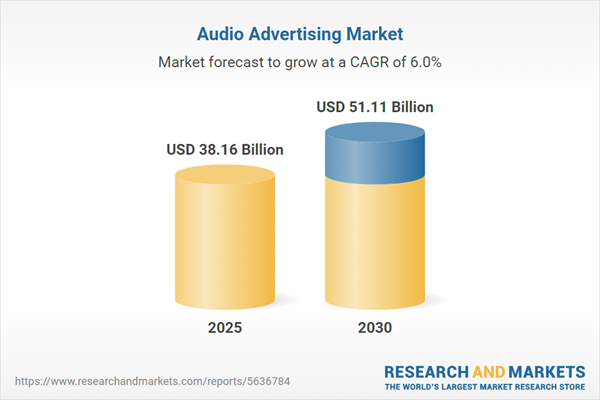

| Estimated Market Value ( USD | $ 38.16 Billion |

| Forecasted Market Value ( USD | $ 51.11 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |