The shared mobility market, encompassing rental and sharing services for scooters, motorcycles, cars, and other vehicles, is experiencing robust growth driven by rising internet and mobile app penetration, cost-effectiveness, zero maintenance costs, and user convenience. Key factors such as escalating fuel prices, traffic congestion, limited parking availability, and environmental concerns are pushing consumers toward shared mobility as a viable alternative to traditional vehicle ownership. Additionally, the increase in global business and leisure travel is expected to further expand the market.

Market Drivers

The primary drivers of the shared mobility market include rising fuel and maintenance costs, traffic congestion, and parking shortages, which collectively make vehicle ownership less appealing. Shared mobility services offer autonomy, affordability, flexibility, and ease of use, addressing these pain points effectively. The rapid adoption of smartphones and innovative technologies, such as GPS and mobile app platforms, further accelerates market growth by enabling seamless access to services from companies like Ola, Uber, and Sixt. Government initiatives promoting eco-friendly transportation, such as electric vehicle integration, also contribute significantly to market expansion.Strategic Investments and Partnerships

Key industry players are leveraging strategic investments and partnerships to capitalize on growing consumer demand. For instance, in February 2022, Yamaha Motor’s shared mobility arm, Moto Business Services India (MBSI), invested in Royal Brothers, a bike rental company, to enter India’s two-wheeler services market. In March 2022, MBSI further expanded into the four-wheeler electric vehicle segment through a collaboration with Malbork Technologies, aiming to transform India’s shared mobility landscape by leveraging its financial and strategic expertise in a market of 1.4 billion people.Similarly, in April 2022, Dubai-based Swvl signed a deal to acquire Zeelo, a UK-based smart bus platform, to expand its presence across 21 countries and enhance its sustainable business model. This acquisition aims to deliver safe, affordable, and eco-friendly transportation solutions, strengthening Swvl’s global footprint.

Emerging Players and Technological Advancements

Emerging shared mobility firms are also driving market growth through innovative strategies. The rapid penetration of electric vehicles into the shared mobility sector, driven by their eco-friendly attributes, is a significant growth factor. Companies are increasingly integrating advanced technologies to enhance service delivery and user experience, further propelling the market forward.Government Initiatives

Government-led initiatives are playing a pivotal role in market expansion. For example, efforts to promote cleaner transportation, such as electric taxi pilot projects, underscore the public sector’s commitment to sustainable mobility. These initiatives align with broader environmental goals, such as reducing carbon emissions, and are expected to bolster the shared mobility market during the forecast period.In summary, the shared mobility market is poised for continued growth, fueled by consumer demand for cost-effective, flexible, and eco-friendly transportation solutions, strategic industry moves, and supportive government policies. Key players’ focus on innovation, partnerships, and sustainable practices will likely shape the market’s trajectory in the coming years.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others).

Market Segments

By Business Model

- Ride-hailing

- Ride-sharing

By Vehicle Type

- Two Wheelers

- Cars

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Others

- Middle East & Africa

- Israel

- Saudi Arabia

- Others

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Others

Table of Contents

Companies Mentioned

- Uber

- Lyft

- DiDi Chuxing

- Grab

- BlaBlaCar

- Car2go

- Hellobike

- Ola

- Zipcar

- Rapido

Table Information

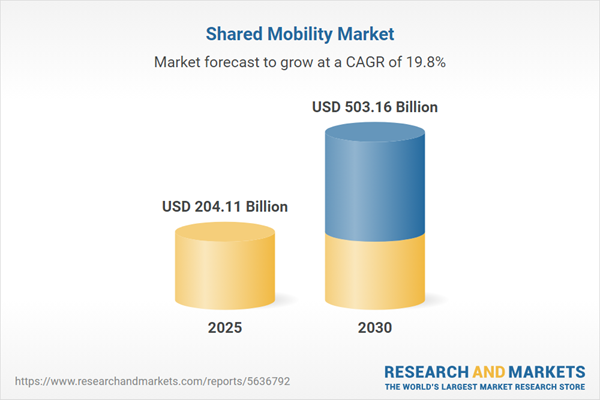

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | June 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 204.11 Billion |

| Forecasted Market Value ( USD | $ 503.16 Billion |

| Compound Annual Growth Rate | 19.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |