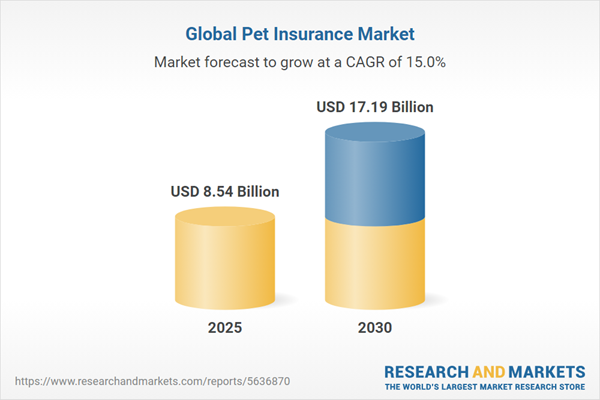

Pet insurance provides financial protection for veterinary healthcare costs, covering treatments for sick or injured pets, and in some cases, expenses related to theft, loss, or death of a pet. The global pet insurance market is poised for growth, driven by rising veterinary healthcare costs and increasing incidents of pet theft, particularly in key regions like Europe and North America.

Market Dynamics

Growth Drivers

Rising Veterinary Healthcare Costs

Escalating costs in the veterinary healthcare sector are a primary driver of pet insurance demand. Advanced treatments, such as knee replacements, allergy testing, cancer therapies, and chiropractic care, previously exclusive to humans, are now available for pets. These sophisticated procedures have significantly increased veterinary expenses, prompting pet owners to seek insurance to mitigate financial burdens. The growing awareness of pet insurance as a solution to manage these costs is expected to fuel market expansion.Increase in Pet Theft

Pet theft, particularly dog theft, has surged, further driving demand for insurance policies covering loss or theft. In the UK, data from 2021 reported a 13% increase in pet thefts, totaling 2,670 cases, the highest in seven years. Despite government efforts to issue protective guidelines, these measures have proven ineffective, leading pet owners to rely on insurance policies to cover the financial impact of losing a pet. This trend is anticipated to bolster the pet insurance market.Market Restraints

Rising Policy Premiums

The cost of pet insurance premiums has risen sharply, largely due to advancements in veterinary treatments that enable more accurate diagnoses and sophisticated care. These high-cost treatments directly impact premium rates, as insurance providers adjust pricing to cover potential claims. Some providers, prioritizing revenue, increase rates aggressively, risking customer retention. Additionally, premiums often rise as pets age, reflecting the higher likelihood of illness, even for pets with no prior claims. The shorter average lifespan of pets compared to humans exacerbates this issue, as ailments tend to manifest more quickly, further elevating insurance costs.Regional Insights

Europe: Holds the largest market share globally, with Sweden leading at approximately 90% pet insurance coverage. The region benefits from high awareness and adoption of pet insurance.North America: Identified as the fastest-growing market, driven by rapid advancements in pet insurance offerings and increasing pet ownership. The region’s growth is supported by rising veterinary costs and consumer awareness of insurance benefits.

Conclusion

The global pet insurance market is set to grow, propelled by increasing veterinary costs and rising pet theft incidents. However, challenges such as escalating premiums may hinder adoption. Europe remains the market leader, while North America shows the strongest growth potential. Industry stakeholders must balance premium pricing with customer retention to capitalize on these growth opportunities.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others).

Market Segments

By Animal Type

- Dog

- Cat

- Others

By Policy Type

- Lifetime Cover

- Non-Lifetime Cover

- Accident-Only Cover

By Coverage Scope

- Comprehensive (Illness + Accident)

- Illness-Only

- Accident-Only

- Preventive Care Only

By End-User

- Individual Pet Owners

- Professional Breeders and Kennels

- Veterinary Clinics

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- South Africa

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Nationwide Mutual Insurance Company

- MetLife Services and Solutions, LLC

- Healthy Paws Pet Insurance, LLC.

- Crum & Foster Pet Insurance Group

- Trupanion, Inc.

- Pet Plan Limited

- Embrace Pet Insurance Agency, LLC

- Animal Friends Insurance Services Limited

- Petsecure Pet Health Insurance

- 24PetWatch Pet Insurance

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | June 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 8.54 Billion |

| Forecasted Market Value ( USD | $ 17.19 Billion |

| Compound Annual Growth Rate | 15.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |