According to the analysis, global vehicle production drops below 60 million units in 2021, equivalent to pre-2010 levels, due to a shortage of automotive chips caused by COVID -19. Global car ownership is about 1.5 billion units by the end of 2021. The automotive aftermarket has become a major part of the global tire market demand. Despite the global automotive market downturn, the global tire market continues to grow.

In recent years, Vietnam's auto industry has been developing rapidly. 2021 Vietnam's auto imports will be about 136,000 units, up 24% year on year. 2021 Vietnam's local production will be about 168,000 units, down about 10% year on year. 2021 Vietnam's auto sales will be about 304,100 units, up about 3% year on year. 2020 Vietnam's auto ownership will be 23 units per 1,000 people, far below the global average. With the development of Vietnam's economy, the automotive and auto parts market has great potential for development.

Vietnam has about 830 large and small tire companies, including bicycle tires, motorcycle tires, car tires and truck tires. Bridgestone, Michelin, Yokohama, Kumho, CHENG SHIN, KENDA, Sailun, Guizhou Tire, Jinyu, Goodyear and other global famous tire manufacturers have already established factories in Vietnam, some of them have set up multiple factories. According to this research, some Chinese tire manufacturers, such as Sailun, have plans to expand their tire production capacity in Vietnam. Chinese tire companies have built a semi-steel tire production capacity of 11 million tons/year in Vietnam, and a full-steel tire production capacity of 7.2 million tons/year.

Vietnam exports tires to more than 100 countries, with the highest volume of automotive tires accounting for more than 60% of exports. For car tyres, 80-90% are exported. Vietnam's tire exports have been growing rapidly, with growth in exports to the US being the key driver. In 2021, Vietnam exported 14.06 million passenger car tires to the US, up 6.8% year on year. 2021 Vietnam has more than 200 tire exporters. Among the top ten tire exporters in Vietnam, there are only two Vietnamese companies, namely Southern Rubber JSC (Casumina) and Da Nang Rubber JSC (DRC), while the rest are foreign companies.

According to this analysis, Vietnam has an abundant labor force and low labor costs. Areas with the highest minimum wage levels in Vietnam include Hanoi and Ho Chi Minh City, with a minimum wage of VND4.68 million (about $204) per month in 2021. In the less developed areas of Vietnam, the minimum monthly wage is only VND3.25 million (about $142). At the end of 2021, Vietnam's population reaches about 103 million people, with 45.7% of the working age population between 25-54 years old, Vietnam has an abundant labor force and consumer market.

In addition, Vietnam has certain advantages in the cost of raw materials such as natural rubber, electricity prices, land costs and so on. According to the analysis, Vietnam tire manufacturing industry has the natural advantage of raw materials. Vietnam ranks 3rd in the world in rubber production, with an annual output of 1.2-2 million tons of natural rubber. Vietnam's energy and land prices are also at a low level in East and Southeast Asia.

In terms of policy support, eligible foreign-funded enterprises in Vietnam enjoy tax incentives: the corporate income tax rate is 10% for 15 years, and they are exempt from corporate income tax for 4 years from the date of generating taxable income, and the corporate income tax rate is reduced by 5% for the next 9 years. This translates into a net profit margin of 2.5%-3.5%.

On the export side, Vietnam also has a number of concessions. Since the outbreak of the U.S.-China trade war, Chinese tires exported to the United States are currently subject to a 25% surcharge, as well as a dumping duty rate of up to 87.99%. Vietnam's exports to the United States to enjoy 4% tariff treatment. 2019-2021 the United States imports the largest number of tires is a country and region, Vietnam ranked in the forefront. The EU has signed the Vietnam EU Free Trade Agreement with Vietnam, which will take effect from August 1, 2020. The EU gives Vietnam the highest level of committed free trade partner treatment, and Vietnam and 27 EU countries enjoy mutual tariff preferences.

The low cost of labor as well as other factors of production and favorable export policies are keeping Vietnam's tire industry under the continuous attention of global investors.

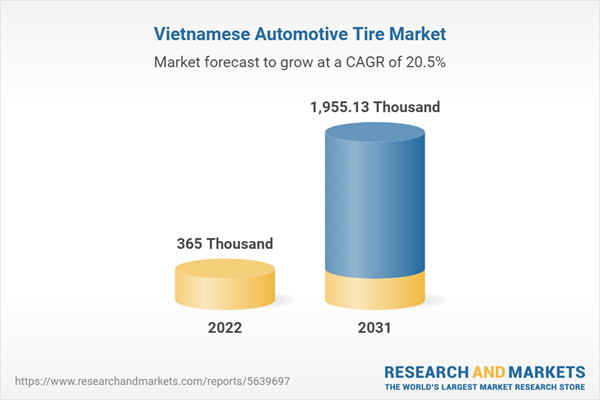

The analyst Vietnam's tire production and exports to continue to rise in the years 2022-2031.

Topics covered:

- Vietnam Tire Industry Overview

- The economic environment and policy environment of Vietnam's tire industry?

- What is the impact of COVID-19 on the Vietnamese tire industry?

- What is the market size of Vietnam's Tire Industry 2016-2021?

- What will be the market size of Vietnam's tire industry in 2022-2031?

- What is the import and export volume of tires in Vietnam?

- What is Vietnam's major trading partners in the tire sector?

- Major tire manufacturing companies in Vietnam?

- What are the key drivers, challenges and opportunities for the Vietnam tire industry in 2022-2031?

- What is the expected revenue of the tire industry in Vietnam from 2022-2031?

- Which segment of the Vietnam Tire Industry market is expected to dominate the market in 2031?

- What are the main unfavorable factors facing the Vietnamese tire industry?

Table of Contents

Companies Mentioned

- Bridgestone

- Michelin

- Yokohama

- Kumho Asiana Group

- Massive New

- Kenda

- Race Wheel

- Solid Platinum

- Guizhou Tire Co.

- The Southern Rubber Industry Joint Stock Company

- Da Nang Rubber JSC

Methodology

Background research defines the range of products and industries, which proposes the key points of the research. Proper classification will help clients understand the industry and products in the report.

Secondhand material research is a necessary way to push the project into fast progress. The analyst always chooses the data source carefully. Most secondhand data they quote is sourced from an authority in a specific industry or public data source from governments, industrial associations, etc. For some new or niche fields, they also "double-check" data sources and logics before they show them to clients.

Primary research is the key to solve questions, which largely influence the research outputs. The analyst may use methods like mathematics, logical reasoning, scenario thinking, to confirm key data and make the data credible.

The data model is an important analysis method. Calculating through data models with different factors weights can guarantee the outputs objective.

The analyst optimizes the following methods and steps in executing research projects and also forms many special information gathering and processing methods.

1. Analyze the life cycle of the industry to understand the development phase and space.

2. Grasp the key indexes evaluating the market to position clients in the market and formulate development plans

3. Economic, political, social and cultural factors

4. Competitors like a mirror that reflects the overall market and also market differences.

5. Inside and outside the industry, upstream and downstream of the industry chain, show inner competitions

6. Proper estimation of the future is good guidance for strategic planning.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 60 |

| Published | July 2022 |

| Forecast Period | 2022 - 2031 |

| Estimated Market Value in 2022 | 365 Thousand |

| Forecasted Market Value by 2031 | 1955.13 Thousand |

| Compound Annual Growth Rate | 20.5% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 11 |