Because of the global pandemic, the Automotive Wiping system market took a beating in 2020-2021, attributed to a halt in manufacturing and reduced demand for automotive components. As a result, the sales of vehicles globally were reduced for the first half of the year. However, in the latter half of the year 2020, the global automotive industry started to rebound, driving the market for automotive parts and components, including wiping systems.

For instance, around the world, 82 million vehicles were produced in 2019, a number that sharply decreased to 78 million in 2020. But sales of cars rose to just over 80 million units in 2021 as a result of a general increase in demand for automobiles. Given the circumstances, it is anticipated that the demand for passenger automobiles would rise as more people opt to purchase their own vehicles during the forecast period.

As the wiping systems are a part of almost all the cars playing on the road, with the increase in the number of new cars sold, the demand for the automotive wiper systems market is expected to grow. However, the semiconductor shortage may affect the production of vehicles in turn hampering the growth of the market.

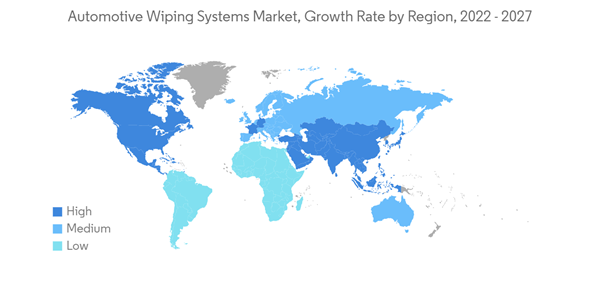

Owing to the number of vehicles sold, the Asia-Pacific region is the largest market and is expected to dominate in the forecast period.

Key Market Trends

Advancing Various Wiper Technologies are Expected to Drive the Market

All the cars plying on the road come with at least a windshield wiper, for which it is a bare necessity. With the advancing technology, many players are coming up with new technology to reduce the drivers' input. For instance, many carmakers have started incorporating automatic wipers or rain-sensing wipers in their vehicles.

With that, many luxury carmakers have developed a new wiper technology that incorporates the water dispensing nozzle into the wiper blades. This aids in the better cleaning of the windshield while eliminating the vision impaired due to the water spray through conventional nozzles on the bonnet.

For Instance, since 2017, many cars from Mercedes Benz come equipped with this new wiper technology which the company calls MAGIC VISION CONTROL.

According to data from the China Automobile Dealers Association, China’s luxury vehicle sales in the first 11 months of the year 2021 exceeded 2 million units with a year-on-year increase of over 5%. This also marked the third consecutive year for luxury brands to register growth in the wake of downward pressure in China's overall automotive market.

Earlier automatic wipers were a feature that was limited to luxury cars, but now many affordable and mainstream cars come equipped with these features. These rain-sensing wipers use a combination of the light sensor and a motor to operate the wipers.

Hence, to have an upper hand over their rivals, many carmakers across the globe offer automatic wipers in their mid to top-tier variants of the vehicles. For instance, In March 2022, Ford launched its compact Hatchback Focus in the United Kingdom. The car features rain-sensing wipers in the mid and the top Titanium trims.

Hence, with the rising demand for passengers cars and luxury vehicles, in many countries, the demand for automatic wipers and other technologies is anticipated to also grow.

Asia-Pacific Region Is Anticipated to Dominate The Market in the Forecast Period

In the Asia-Pacific region, China embraces a significant share in the automotive wiping systems market share due to their higher sales of vehicles. This can be accredited to their growing population which is providing for the growth in vehicle sales.

Due to the high demand for automobiles in China and Japan, these nations are leading the Asia-Pacific automotive airbag market. More than 21 million passenger cars have been sold in China, which currently leads the world in vehicle sales.

Additionally, India being an emerging economy, has significant demand for automotive wiping systems due to the rising sales of passenger cars including electric vehicles. In 2019, 3.8 million units of passenger cars were sold out of which, nearly 6,000 were battery electric passenger cars. Further, when compared to 2020, the number of battery electric cars sold have increased by 110% in 2021.

Hence owing to the rising demand for passenger cars and battery electric vehicles in the entire Asia-Pacific region, the automotive wiping systems market is expected to grow in the forecast period.

Competitive Landscape

The Automotive Wiping Systems Market is fairly fragmented with players like Robert Bosch GmbH, Valeo Group, Denso Corporation, Mitsuba Corp., and Zhejiang Shenghuabo Electric Corporation. Many players in the market are investing in research and development to develop new technologies for wipers to overcome their competition. For instance,

In February 2022, Bosch introduced, two new wipers, the Bosch ENVISION and FOCUS wiper blades. The two blades can withstand the nighttime driving circumstances, assisting drivers in safely reaching their destinations. Also, the wipers also have a SafeCheck indicator that warns customers when it's time to check the effectiveness of their wiper blades, promoting safer nighttime and bad weather driving.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Robert Bosch GmbH

- Denso Corporation

- Valeo Group

- Zhejiang Shenghuabo Electric Corporation

- Mitsuba Corp.

- Syndicate Wiper Systems (P) Ltd.

- Tenneco Inc.

- TRICO

- Korea Wiper Blade Co., Ltd.

- Minda Group

- Lucas TVS Limited