Over the long term, the market is driven by the demand increase in demand for commercial vehicles and an increased demand for vehicle comfort. Furthermore, the significant development of the e-commerce industry across the globe is likely to foster the demand for light commercial vehicles to cater to the demand of vehicle manufacturers, increasing worldwide demand for automobile leaf springs. Furthermore, the growing culture of sports utility vehicles in countries like India, China, and the United States will drive the market growth.

For example, according to premium car Manufacturer Mercedes Benz, the share of SUVs in the overall Indian passenger cars market grew to 47% in 2022, which was 22% five years back.

However, the springs tend to lose structure and sag over time. When the sag is uneven, it might change the vehicle's cross weight, which can impair the handling slightly. It can also affect the angle of the axle to the mount. Acceleration and braking torque can generate wind-up and vibration. It might hamper the market growth during the forecast period.

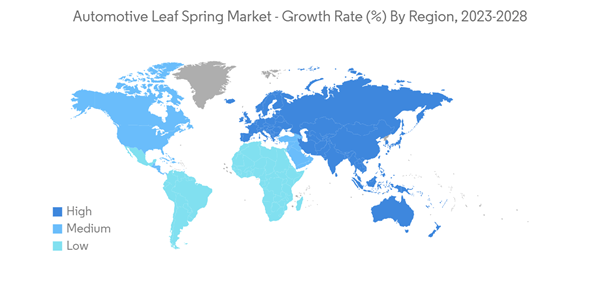

Asia-Pacific dominates the automotive leaf spring market owing to China's highest passenger car sales in 2022, followed by India and Japan.

Key Highlights

- For instance, According to the International Organisation of Motor Vehicle Manufacturers, China contains the highest no sales of passenger vehicles at 23 million units in 2022. Moreover, the majority of suppliers in the region seek to produce lightweight solutions utilizing superior materials as it allows them to adhere to the set standards.

Automotive Leaf Spring Market Trends

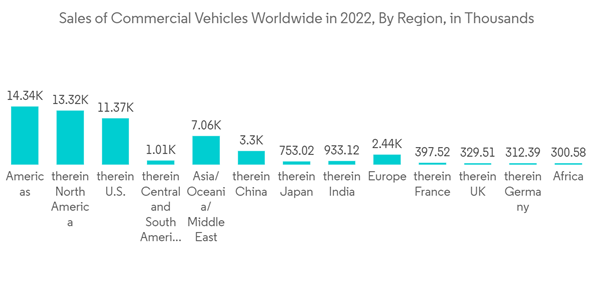

Increasing sales of Commercial Vehicles boost the market growth

The rise in disposable incomes in both developing and developed countries and growing construction activities and urbanization are also projected to drive the adoption of commercial vehicles, which will result in the growth of the market. Considering the scenario, manufacturers are working on innovating vehicle design and customizing vehicles according to weight regulations.Moreover, the logistics market shifted to offering customer-centric solutions, making the growing need for commercial vehicles. Supportive policies and initiatives by governments raised the demand for commercial electric vehicles. Electric buses and heavy-duty truck registrations increased in North America and Asia Pacific.

For instance, in August 2023, the Indian Government approved USD 7 billion to run 10,000 electric buses in 169 cities.

Due to rising MHCV (Medium and Heavy Commercial Vehicle), production is growing in regions like the Asia-Pacific, and automotive giants such as Tata Motors are focusing on new technologies for the production of commercial vehicles. Many companies are also focusing on developing composite leaf springs for electric vehicles and LCVs since composite leaf springs may minimize noise, vibration, and harshness. Furthermore, the composite leaf springs are 40% lighter, with a 76.39% lower stress concentration, and deform 50% less than steel-graded leaf springs.

The Society of Indian Automobile Manufacturers states that sales of medium and heavy commercial vehicles increased from 2,40,577 to 3,59,003 units, and light commercial vehicles increased from 4,75,989 to 6,03,465 units in FY-2022-23, compared to the previous year.

Thus, with the rise in adoption of commercial sales and production, demand for leaf springs will continue to grow and contribute to market growth.

Asia-Pacific is Anticipated to Play a Significant Role in the Market

In the Asia-Pacific region, the increasing e-commerce businesses are fueling the expansion of the transportation industry. According to our analysis, with the largest population in the world and only 6% of India's retail market coming from e-commerce, the market is one of the fastest growing in the world.With expanding vehicle manufacturing in India and China, the Asia-Pacific region is likely to experience considerable development in the global market. For instance, according to the International Organisation of Motor Vehicle Manufacturers, the top 5 car production countries in the world are dominated by Asia-Pacific, with China being the first, followed by Japan and India.

Seeing the growth in production and sales of vehicles in the Asia-Pacific region, companies are focusing on making investments in R&D activities to develop new technologies and cater to the demand.

For instance, in December 2022, THACO Chu Lai Industrial Park announced the establishment of THACO INDUSTRIES in Vietnam. The corporation sets the strategy for the development and manufacturing of products like leaf springs on a large scale. It invests in diversifying its products and services by the construction of a new R&D center and mechanical center.

The above factors, coupled with high sales of vehicles and major investments, will fuel the market growth.

Automotive Leaf Spring Industry Overview

The Automotive Leaf Spring market in the region is fairly consolidated, with major players like EATON Detroit Spring, Inc., Sogefi SpA, and MITSUBISHI STEEL MFG. CO., LTD., NHK SPRING Co., Ltd., and Jamna Auto Industries Ltd., capturing the major market share amongst others.Many players are investing in new technologies to gain the upper hand over their competition and focusing on new launches.

- In May 2022, Dongfeng Motor RUS announced the launch of the DF6 pickup truck in Russia. It is a frame pickup with robust and dependable construction, as well as comfort and off-road capability. The strong undercarriage, with double-wishbone front suspension and a rear-dependent leaf spring, is suitable for Russian roads.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- EATON Detroit Spring, Inc.

- Sogefi SpA

- Mitsubishi Steel Mfg. Co., Ltd.

- NHK SPRING Co.,Ltd.

- Jamna Auto Industiries Ltd.

- Rassini

- Mack Springs Pvt. Ltd.

- EMCO INDUSTRIES

- Roc Springs

- Dendoff Springs Ltd.