One of the very essential trends seen within this market is the promotion of renewable energy worldwide. Governments across the globe have set high renewable energy targets in light of climate change. Many countries introduce policy frameworks to promote the use of solar power, including feed-in tariffs, net metering, and renewable portfolio standards. The increase in residential and commercial installations has resulted in steady market growth. Rising environmental awareness is also helping in the adoption of solar panels. People and businesses are now opting for green energy solutions to reduce their carbon footprint. With an emphasis on corporate social responsibility (CSR), companies are investing in solar energy as part of their sustainability initiatives.

The United States has emerged as a major region in the solar panel market due to several factors. One of the most prominent trends in the market is the increasing deployment of solar energy across various sectors. Residential installations have grown steadily as homeowners seek to reduce electricity bills and gain energy independence, thereby offering a favorable solar panel market outlook. The operational costs for the commercial and industrial (C&I) sector have decreased by a significant number, coupled with their goals in terms of sustainability. Utility-scale solar projects are drastically on the rise and have been so in response to the decreased prices and the high demand for clean energy. The majority of states allow net metering, meaning homeowners and businesses can sell back their excess energy into the grid. The revenues could thus be drawn not only from selling electricity to the grid but also from Solar Renewable Energy Credits (SRECs). Thus, the financial viability of the solar systems improves. In 2024, the US inaugurated one of the biggest solar projects by putting over 52 Billion solar panels on highways all over the country. This step was taken in order to enhance the employment of clean energy in the country.

Solar Panel Market Trends:

Increasing environmental concerns

The escalating demand for solar panels because of the heightened environmental concerns of individuals is proving to be a positive market aspect. In keeping with this, the increasing necessity to reduce climate change and the carbon emissions present in the environment is supporting the growth of the market. Furthermore, the use of fossil fuels for electricity production leads to a significant amount of GHG emissions, which absorb heat in the atmosphere and warm the Earth. The Global Carbon Budget projects that the total amount of CO2 emissions will be 41.6 Billion Tons by 2024, with an increase from the last year's value of 40.6 Billion Tons. From it, fossil fuel is claimed at 37.4 billion Tons and deforestation accounted for the rest- as reported by the WMO. Another more pristine clean way is that which emanates through Solar Panels - minimizing carbon by tons, aiding and further enhancing globalization in achieving these climatic missions towards having an ecofriendly atmosphere. Furthermore, the increasing adoption of solar panels in organizations to reduce their carbon footprint and environmental impact and maintain sustainability goals is impelling the market growth. Besides this, solar panels provide an accessible means to achieve this goal by harnessing the power of the sun. Additionally, there is a rise in the need for renewable energy sources that promote a greener environment.Favorable government initiatives

Governing agencies of several countries are encouraging the adoption of solar panels by implementing stringent carbon control policies, which are propelling the solar panel market growth. The European Parliament has adopted the European Climate Law, which makes it legally binding to lower net greenhouse gas releases by 55% by 2030 and climate neutrality by 2050. They are also providing tax credits, wherein taxpayers get a percentage of the cost of their solar panel system as a tax deduction. Other than this, these policies and financial incentives motivate people and organizations to invest in solar energy systems. Additionally, it provides rebates or subsidies which immediately decrease the initial cost for the installation and installation costs making them even more cost-effective. Another incentive would be through policies called net metering which help those with installed solar panels generate an opportunity of selling surplus to the grid in turn. And through feed-in tariffs, that assure fixed compensation to be gained on electricity. These incentives not only reduce the financial burden of solar panel installation. Additionally, the rising development of more efficient and cost-effective solar panel technologies is contributing to the growth of the market.Technological Advancements in solar panel design

Technological improvements in solar panels benefit from improved efficiency, durability, and cost-effectiveness. Besides that, monocrystalline and bifacial solar panels are also more efficient than others as they can produce more electricity using the same amount of sunlight. The innovations in the manufacturing process are also reducing the cost of the panels, thus supporting the market growth. In addition, material and design advancements further enhance the panel's durability and lifespan such that these panels are guaranteed to be efficient and reliable in energy generation. Besides being environmentally friendly, these technological advancements benefit the investor by increasing the returns on investment (ROI) for a solar panel purchaser. In line with this, the increasing development of transparent panels that can be integrated into windows, skylights, and building facades while allowing natural light to pass through is impelling the market growth. Moreover, smart panels equipped with integrated sensors and monitoring systems provide real-time data on energy production and system health, thereby driving the solar panel market demand. The global artificial intelligence (AI) market size was valued at USD 115.62 Billion in 2024. AI and machine learning (ML) algorithms are employed in panels to optimize their performance by predicting energy generation, improving tracking systems, and reducing maintenance costs.Solar Panel Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global solar panel market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on type and end use.Analysis by Type:

- Crystal Silicon

- Monocrystalline Silicon

- Polycrystalline Silicon

- Thin Film

- Others

Analysis by End Use:

- Commercial

- Residential

- Industrial

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

Key Regional Takeaways:

United States Solar Panel Market Analysis

The market in the US is expanding, fueled by government support, advancements in technology, and greater awareness of sustainability issues. As of 2024, industry reports indicate that approximately 4.2 million homes in the United States are equipped with solar panels, with each roof having about 25 to 30 panels. Essential policies like the federal Investment Tax Credit (ITC), state-specific rebates, and renewable energy requirements are crucial in lowering installation expenses and enhancing the accessibility of solar energy. Advancements in solar efficiency and energy storage are bolstering the practicality of solar energy, as the increasing trend of energy independence fuels consumer uptake. Additionally, increasing electricity costs and environmental issues are driving both companies and residences to seek cleaner energy options. Major corporations are also pledging to sustainability objectives, thereby boosting solar demand in the commercial and industrial sectors. In general, the synergy of policy backing, technological advancements, and market need is anticipated to drive ongoing expansion in the U.S. solar panel industry.Europe Solar Panel Market Analysis

Europe’s market is thriving, spurred by the European Union's ambitious renewable energy policies. According to EEA, in 2023, renewable energy accounted for 24.1% of the EU's final energy use, reflecting the continent's dedication to reducing carbon emissions. The EU’s Green Deal aims for carbon neutrality by 2050, driving further demand for solar energy. National governments have implemented incentives, tax breaks, and subsidies to support solar installations in residential, commercial, and industrial sectors. Energy security concerns, particularly following geopolitical developments, have reinforced the shift to renewable energy sources. Additionally, technological innovations like bifacial panels and energy storage systems have made solar power more efficient and reliable. Leading markets such as Germany, Spain, and France continue to promote aggressive solar adoption policies, with businesses and consumers alike investing in solar solutions to meet sustainability goals. Public awareness of environmental issues, combined with efforts to reduce energy costs, has made solar energy an increasingly attractive option across Europe. These factors position the European solar market for sustained growth and success in the coming years.Asia Pacific Solar Panel Market Analysis

The Asia Pacific market is seeing swift expansion, propelled by robust government backing and increasing energy needs. As reported by PIB, India has recently exceeded 200 GW in renewable energy capacity, in line with its goal of reaching 500 GW from non-fossil sources by the year 2030. China continues to be a world leader in solar panel manufacturing, driving the growth of solar energy throughout the area. Nations such as Japan, India, and South Korea are vigorously encouraging solar energy use by implementing supportive policies, including subsidies and feed-in tariffs. Moreover, the rising industrialization and urbanization in the region boost the need for sustainable, dependable energy solutions. With rising worries over air pollution and energy security, businesses and governments are increasingly looking to solar energy to satisfy their sustainability targets. Technological innovations, including enhanced solar panels and better storage solutions, further aid in the growth of the market. Solar energy is increasingly seen as a vital answer to fulfill the area's energy requirements and ecological objectives.Latin America Solar Panel Market Analysis

The market in Latin America is being driven by significant growth in Brazil, which leads the region in clean energy investments, accounting for over 80% of the total in 2023. This boom is primarily fueled by the rapid rise of small-scale solar plants, each with a capacity of 5 megawatts or less. As a result, Brazil has become the world’s third-largest solar market, surpassing even Germany and India. The expansion of solar installations in Brazil is not only reshaping the country's energy landscape but also catalyzing wider adoption of solar energy across the region, further boosting the Latin American market.Middle East and Africa Solar Panel Market Analysis

The market in the Middle East and Africa (MEA) is expanding, with the UAE leading the charge. According to industry reports, oil and gas exports now contribute to only about 30% of the UAE’s economic activity, while clean energy is rapidly increasing. The country's renewable energy capacity grew by nearly 70% between 2022 and 2023, underscoring its transition toward sustainable energy. Solar power plays a pivotal role in this shift, supporting the UAE’s strategy to diversify its energy sources, cut carbon emissions, and bolster its position in the global clean energy sector.Competitive Landscape:

One of the primary ways leading solar companies are improving their business is by investing in advanced solar panel technologies. Companies are focusing on enhancing photovoltaic (PV) efficiency through innovations such as passivated emitter and rear cell (PERC) technology, bifacial solar panels, heterojunction (HJT) technology, and tandem solar cells. These advancements allow for higher energy output with reduced material usage, making solar power more cost-effective for consumers and businesses. To meet the growing demand for solar panels, key market players are expanding their production capacity and localizing manufacturing operations. For instance, in 2025, ES Foundry opened its high-volume solar cell production facility in South Carolina. Leading companies are securing long-term contracts for critical materials such as polysilicon, silver, and rare earth elements to ensure a stable supply. Some manufacturers are vertically integrating their operations by investing in in-house wafer, cell, and module production.The report provides a comprehensive analysis of the competitive landscape in the solar panel market with detailed profiles of all major companies, including:

- Jinko Solar

- Trina Solar

- Canadian Solar

- JA Solar

- Hanwha Q-CELLS

- GCL-SI

- LONGi Solar

- Risen Energy

- Shunfeng

- Yingli Green

Key Questions Answered in This Report

1. How big is the solar panel market?2. What is the future outlook of solar panel market?

3. What are the key factors driving the solar panel market?

4. Which region accounts for the largest solar panel market share?

5. Which are the leading companies in the global solar panel market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Solar Panel Industry

5.1 Market Overview

5.2 Market Performance

5.2.1 Volume Trends

5.2.2 Value Trends

5.3 Impact of COVID-19

5.4 Price Trends

5.5 Market Breakup by Type

5.6 Market Breakup by Region

5.7 Market Breakup by End Use

5.8 Market Forecast

5.9 SWOT Analysis

5.9.1 Strengths

5.9.2 Weaknesses

5.9.3 Opportunities

5.9.4 Threats

5.10 Value Chain Analysis

5.11 Porter’s Five Forces Analysis

5.11.1 Overview

5.11.2 Bargaining Power of Buyers

5.11.3 Bargaining Power of Suppliers

5.11.4 Degree of Competition

5.11.5 Threat of New Entrants

5.11.6 Threat of Substitutes

5.12 Key Success Factors and Risk Factors for Solar Panel Manufacturers

6 Market Breakup by Type

6.1 Crystal Silicon

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Monocrystalline Silicon

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Polycrystalline Silicon

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Thin Film

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Others

6.5.1 Market Trends

6.5.2 Market Forecast

7 Performance of Key Regions

7.1 Asia Pacific

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 North America

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Europe

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Latin America

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Middle East and Africa

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by End Use

8.1 Commercial

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Residential

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Industrial

8.3.1 Market Trends

8.3.2 Market Forecast

9 Competitive Landscape

9.1 Market Structure

9.2 Capacities of Key Players

10 Solar Panel Manufacturing Process

10.1 Product Overview

10.2 Detailed Process Flow

10.3 Various Types of Unit Operations Involved

10.4 Mass Balance and Raw Material Requirements

11 Project Details, Requirements and Costs Involved

11.1 Land Requirements and Expenditures

11.2 Construction Requirements and Expenditures

11.3 Plant Machinery

11.4 Raw Material Requirements and Expenditures

11.5 Packaging Requirements and Expenditures

11.6 Transportation Requirements and Expenditures

11.7 Utility Requirements and Expenditures

11.8 Manpower Requirements and Expenditures

11.9 Other Capital Investments

12 Loans and Financial Assistance

13 Project Economics

13.1 Capital Cost of the Project

13.2 Techno-Economic Parameters

13.3 Product Pricing and Margins Across Various Levels of the Supply Chain

13.4 Taxation and Depreciation

13.5 Income Projections

13.6 Expenditure Projections

13.7 Financial Analysis

13.8 Profit Analysis

14 Key Player Profiles

14.1 Jinko Solar

14.2 Trina Solar

14.3 Canadian Solar

14.4 JA Solar

14.5 Hanwha Q-CELLS

14.6 GCL-SI

14.7 LONGi Solar

14.8 Risen Energy

14.9 Shunfeng

14.10 Yingli Green

List of Figures

Figure 1: Global: Solar Panel Market: Major Drivers and Challenges

Figure 2: Global: Solar Panel Market: Volume Trends (in Gigawatt), 2019-2024

Figure 3: Global: Solar Panel Market: Value Trends (in Billion USD), 2019-2024

Figure 4: Global: Solar Panel Market: Price Trends (in USD/Watt), 2019-2024

Figure 5: Global: Solar Panel Market: Breakup by Type (in %), 2024

Figure 6: Global: Solar Panel Market: Breakup by Region (in %), 2024

Figure 7: Global: Solar Panel Market: Breakup by End Use (in %), 2024

Figure 8: Global: Solar Panel Market Forecast: Volume Trends (in Gigawatt), 2025-2033

Figure 9: Global: Solar Panel Market Forecast: Value Trends (in Billion USD), 2025-2033

Figure 10: Global: Solar Panel Industry: SWOT Analysis

Figure 11: Global: Solar Panel Industry: Value Chain Analysis

Figure 12: Global: Solar Panel Industry: Porter’s Five Forces Analysis

Figure 13: Global: Crystalline Silicon Market: Volume Trends (in Megawatt), 2019 & 2024

Figure 14: Global: Crystalline Silicon Market Forecast: Volume Trends (in Megawatt), 2025-2033

Figure 15: Global: Monocrystalline Silicon Market: Volume Trends (in Megawatt), 2019 & 2024

Figure 16: Global: Monocrystalline Silicon Market Forecast: Volume Trends (in Megawatt), 2025-2033

Figure 17: Global: Polycrystalline Silicon Market: Volume Trends (in Megawatt), 2019 & 2024

Figure 18: Global: Polycrystalline Silicon Market Forecast: Volume Trends (in Megawatt), 2025-2033

Figure 19: Global: Thin Film Market: Volume Trends (in Megawatt), 2019 & 2024

Figure 20: Global: Thin Film Market Forecast: Volume Trends (in Megawatt), 2025-2033

Figure 21: Global: Other Type of Solar Panel Market: Volume Trends (in Megawatt), 2019 & 2024

Figure 22: Global: Other Type of Solar Panel Market Forecast: Volume Trends (in Megawatt), 2025-2033

Figure 23: Asia Pacific: Solar Panel Market: Volume Trends (in Megawatt), 2019 & 2024

Figure 24: Asia Pacific: Solar Panel Market Forecast: Volume Trends (in Megawatt), 2025-2033

Figure 25: North America: Solar Panel Market: Volume Trends (in Megawatt), 2019 & 2024

Figure 26: North America: Solar Panel Market Forecast: Volume Trends (in Megawatt), 2025-2033

Figure 27: Europe: Solar Panel Market: Volume Trends (in Megawatt), 2019 & 2024

Figure 28: Europe: Solar Panel Market Forecast: Volume Trends (in Megawatt), 2025-2033

Figure 29: Middle East and Africa Solar Panel Market: Volume Trends (in Megawatt), 2019 & 2024

Figure 30: Middle East and Africa Solar Panel Market Forecast: Volume Trends (in Megawatt), 2025-2033

Figure 31: Latin America: Solar Panel Market: Volume Trends (in Megawatt), 2019 & 2024

Figure 32: Latin America: Solar Panel Market Forecast: Volume Trends (in Megawatt), 2025-2033

Figure 33: Global: Solar Panel Market (Commercial Applications): Volume Trends (in Megawatt), 2019 & 2024

Figure 34: Global: Solar Panel Market Forecast (Commercial Applications): Volume Trends (in Megawatt), 2025-2033

Figure 35: Global: Solar Panel Market (Residential Applications): Volume Trends (in Megawatt), 2019 & 2024

Figure 36: Global: Solar Panel Market Forecast (Residential Applications): Volume Trends (in Megawatt), 2025-2033

Figure 37: Global: Solar Panel Market (Industrial Applications): Volume Trends (in Megawatt), 2019 & 2024

Figure 38: Global: Solar Panel Market Forecast (Industrial Applications): Volume Trends (in Megawatt), 2025-2033

Figure 39: Solar Panel Manufacturing Process: Detailed Process Flow

Figure 40: Solar Panel Manufacturing Plant: Various Unit Operations Involved

Figure 41: Solar Panel Manufacturing Process: Conversion Rate of Products

Figure 42: Solar Panel Manufacturing Plant: Proposed Plant Layout

Figure 43: Solar Panel Manufacturing Plant: Breakup of Capital Costs (in %)

Figure 44: Solar Panel Industry: Breakup of Profit Margins at Various Level of the Value Chain

Figure 45: Solar Panel Manufacturing Plant: Breakup of Operating Costs (in %)

List of Tables

Table 1: Global: Solar Panel Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Solar Panel Market Forecast: Breakup by Type (in Megawatt), 2025-2033

Table 3: Global: Solar Panel Market Forecast: Breakup by Region (in Megawatt), 2025-2033

Table 4: Global: Solar Panel Market Forecast: Breakup by End Use (in Megawatt), 2025-2033

Table 5: Global: Solar Panel Market: Competitive Structure

Table 6: Global: Solar Panel Market: Capacities of Key Players

Table 7: Solar Panel Manufacturing Plant: Raw Material Requirements

Table 8: Solar Panel Manufacturing Plant: Costs Related to Land and Site Development (in USD)

Table 9: Solar Panel Manufacturing Plant: Costs Related to Civil Works (in USD)

Table 10: Solar Panel Manufacturing Plant: Machinery Costs (in USD)

Table 11: Solar Panel Manufacturing Plant: Raw Material Requirements and Expenditure

Table 12: Solar Panel Manufacturing Plant: Costs Related to Utilities

Table 13: Solar Panel Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

Table 14: Solar Panel Manufacturing Plant: Costs Related to Other Capital Investments (in USD)

Table 15: Details of Financial Assistance Offered by Financial Institutions

Table 16: Solar Panel Manufacturing Plant: Capital Costs (in USD)

Table 17: Solar Panel Manufacturing Plant: Techno-Economic Parameters

Table 18: Solar Panel Manufacturing Plant: Income Projections (in USD)

Table 19: Solar Panel Manufacturing Plant: Expenditure Projections (in USD)

Table 20: Solar Panel Manufacturing Plant: Taxation (in USD)

Table 21: Solar Panel Manufacturing Plant: Depreciation (in USD)

Table 22: Solar Panel Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability

Table 23: Solar Panel Manufacturing Plant: Cash Flow Analysis on Considering the Income Tax Liability

Table 24: Solar Panel Manufacturing Plant: Profit and Loss Account (in USD)

Companies Mentioned

- Jinko Solar

- Trina Solar

- Canadian Solar

- JA Solar

- Hanwha Q-CELLS

- GCL-SI

- LONGi Solar

- Risen Energy

- Shunfeng

- Yingli Green

Table Information

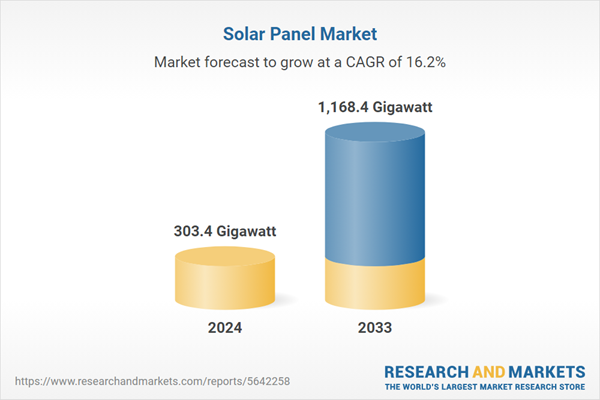

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 303.4 Gigawatt |

| Forecasted Market Value by 2033 | 1168.4 Gigawatt |

| Compound Annual Growth Rate | 16.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |